Dedicated to Anon who asked about DCF.

I remembered this Wallstraits write-up on GHL Systems way back in May 2003.

Here is a snippet of what they wrote back then.

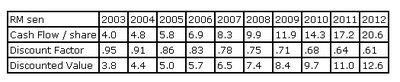

- Valuation Simulation This is not a forecast or recommendation

GHL is likely to experience close to 100% growth again in the current year, 2003, and then growth will slow, we will assume to a sustainable 20% annual rate over the next nine years in this simulation. Current year (2003) full-year net cash flow from operations is estimated at RM 0.04 per share (adding RM 3.5m depreciation back to RM 6.5m net earnings-- RM 10m CF / 250m shares = RM 0.04). We will also assume a 5% discount rate (US Treasury risk free rate) and no terminal value of the business after year 10.

- Given these assumptions (you may want to recalculate this simulation using your own cash flow, growth and discount rate assumptions), GHL’s intrinsic business value based on discounted cash flow expected to be produced from 2003 to 2012 is RM 74.5, which is approximately a 72% discount to the current market share price of around RM 0.21.

PE check: If GHL does achieve cash flow per share of 8.3 sen in 2007 (5-years forward), and at that time GHL is valued by the market at 10-times cash flow, the share price would need to appreciate from 21 sen today to 83 sen, or an appreciation of nearly 300% in 5-years. Of course, GHL has only been listed on Mesdaq for a month, so our assumptions will likely need refinement as the quarters and years pass.

Firstly, do remember that this was a stimulation only done by Wallstraits.com.

Anyway, I reckon that what interests you is how they did the cash flow table. Below is their table again:

Ok let me share with you my understanding of what is being done by Wallstraits.

1. Cash Flow.

First of all, for 2003, that 4.0 sen cash flow is derived from the following manner according to Wallstraits.

- Current year (2003) full-year net cash flow from operations is estimated at RM 0.04 per share (adding RM 3.5m depreciation back to RM 6.5m net earnings-- RM 10m CF / 250m shares = RM 0.04).

So they added the 3.5 million depreciation back to their projected earnings of 6.5 million. Which will equal to 10 million. Divide that by 250 million shares, you would get a cash flow per share of 4 sen for 2003.

(What could go wrong here? The projected earnings of 6.5 million. Just for the record GHL did about 6.0 million (see here ))

2. DF or Discount Factor is assumed at 5%.

So a 5% discount of 1 would equal 0.95

(So far, a 5% discount factor still seems to be fair... but if the interest rates were to increase some more... it would disrupt the whole table)

3. DV or Discounted value

The discounted Value = 4.0 x 0.95 = 3.80

Next column. We need to remember the next assumption made by Wallstraits.

- we will assume to a sustainable 20% annual rate over the next nine years in this simulation.

1. Cash Flow.

In 2003, the calculated cash flow is at 4 sen. A 20% annual growth rate would see the cash flow increase by 4.0 x 20% = 4.8 sen.

2. DF

The discount factor was set at 5%. So the discount factor for 2004 = 0.95 less 5% = 0.91 (rounded up)

3. DV

The DV equals 4.8 * 0.91 = 4.36 (or 4.4 rounded up).

and so on... and so on...

So what could go wrong in these series of calculations?

the starting point of course. The staring point or the initial projected cash flow is utmost important. Put in an optimistic starting value, and you would get a rather optmistic end result.

the annual growth rate. Here Wallstraits assumes a 20% annual growth rate. Try a different growth rate, and you would get a total different value.

the discount rate. here it is assumed to be 5%. what if there is a drastic change in the midst of this time frame?

hope this helps...

cheers!

2 comments:

Thank you for the enlightening article. There is a question I would like to ask you. When do you think DCF is more appropriate to value the company than other method?

Hi,

I do see that you have a nice little blog. :)

I personally do not use DCF at all.. let me post you a new posting using the same stimulation done on GHL by wallstraits...

Post a Comment