My dearest Ezi,

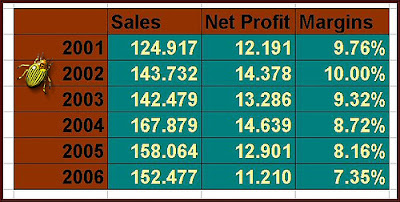

The following table highlights PCCS earnings track record.

TTM stands for trailing twelve months or current 4 quarters.

Here's my interpretation of what PCCS has done.

If I view from what PCCS has done since its fy 2002, I would say that PCCS has done nothing really because if I consider that PCCS made 15.230 million for its fy 2002, then its current earnings or ttm earnings only indicates earnings of around 14.472 million. Which means for me, there simply has was no growth since fy 2002 and considering that the company's nett debt position has increased tremendously, I would normally just call this a investment a pass.

However, I do see some interesting issues.

Now fy 2004 was bad year for PCCS, however, the company has nicely recovered since then. So I guess it would be helpful if one takes a step back and understand what has happened back then.

27th May 2004, PCCS announced its fy 2004 Q4 earnings, Quarterly rpt on consolidated results for the financial period ended 31/3/2004

- Total turnover increased from RM53.1 million recorded in the preceding quarter to RM71.6 million achieved in the current quarter. This was mainly due to increase in orders from the Group’s Apparel and Labelling Division. But the loss incurred by Jusca Garments (Cambodia) Ltd was the main factor attributed to the decline in pre-tax profit from RM1.7 million to a loss of RM7.2 million.

Hm, the losses were due to PCCS's investment in Cambodia. (Here's an issue worth remembering, not all overseas ventures is profitable and in this instance, PCCS's Cambodia investment is perhaps an example!)

Back in Aug 2004, I receieved a copy of iCapital's write-up on PCCS. Do you like iCapital?

This is what the article said. I will add in some comments in blue italic.

- Perusahaan Chan Choo Sing Group (PCCS) was listed on the KLSE on 16 Aug 1995 and its share price has been performing miserably since the 1997 Great Asian Crisis. The group’s core activities span 5 areas; namely, apparel manufacturing, embroidery, fabric knitting, labelling, and marketing and distribution.

Perusahaan Chan Choo Sing S/B (PCCS S/B), PCCS Garments Ltd (PGL) and Jusca Garments (Cambodia) Ltd (Jusca), undertake apparel manufacturing with the latter 2 operating in Cambodia. Approximately 98% of its product are exported overseas to the US, Canada, EU, Japan, Singapore and the Middle East. Among the major clients of this division are Adidas, The Gap, Banana Republic, William Carter, Fila, Nike, Cross Creek, Old Navy and Visage. The operations in Cambodia started in 1999 with the acquisition of a 60% stake in PGL for US$2.1 million and a subsequent 40% for RM5.32 million in 2002. (this details the Cambodian investment by PCCS) This allows it to benefit from the abundant cheap labour available and the Generalised System of Preferences. Jusca was acquired in 2003 for US$0.7 million, representing a 70% interest. Unlike PGL, being new, Jusca has not been profitable and recorded a loss of RM4 mln in fiscal year 2004. (PCCS had invested in a loss making company. Is this advisable? Perhaps their strategy is to invest in a poor company at a cheap price and then attempt to turn it around.. hmm.. it does have some risks in such a strategy, yes? ) The current production capacity of the group’s apparel division is 40,000 dozens of apparels per month for PCCS S/B, 70,000 dozens per month for PGL and 30,000 dozens per month for Jusca. In total, PCCS’s apparel division contributes more than 80% to the group’s revenue.

Although PCCS has an in-house fabric knitting and elastic webbings operation, the main buyers for its fabrics are other garment manufacturers and polymer coating factories that use fabrics as raw material for making carpets or car seats. (interesting! i wonder if PCCS is still active in this business considering the fact that the motor industry is in a slump) The current capacity is 75,000 kg of knitted fabrics and 4,500 kg gross of elastic bands per month. Another complementary activity undertaken by the group is embroidering emblems and logos for garments, towels, handkerchiefs, gifts and souvenirs including appliqué and normal embroidery. (highly diversified PCCS business) Its embroidery division has the capacity to produce 570,000 dozens of apparels per annum. The group also ventured into the labelling business, producing and supplying computer labels, textile labels, barcode labels, security labels and computer imprintable labels. With the current capacity, this division contributes RM1.2 – 1.5 million of sales per month.

The group has a division specifically involved in the local marketing and distribution of its products under PCCS Capital S/B. It also has exclusive distributorship of US upmarket golf apparel, the “Cross Creek” brand under Cross Creek Distribution S/B. On 1st Apr 2002, Jusca Development S/B, formerly a marketing division, entered into a joint venture agreement with Swee Tian Brick Works S/B to develop 17.37 acres of vacant land in Tangkak, Johor.

Both 2003 and 2004 marked significant developments in PCCS with the group actively acquiring new subsidiaries (ah, the acquisition trail. the engineering of new profits) to complement its existing business and diversify into new businesses. Realising it is short of a printing operation to be an integrated garment manufacturer, PCCS acquired Beauty Silk Screen S/B and Beauty Silk Screen Ltd in Mar 2003 and Apr 2003 for RM109,000 and RM190,000 respectively. With extensive testing of the print quality and getting buyers approval in 2003, this new division will start contributing to the group in fiscal year 2004. As an added sweetener to its existing apparel services, PCCS acquired Top Cheer S/B to market and distribute socks.

In Jul 2003, the group also ventured into China with the acquisition of Blopak China P/L (Blopak) for RM4.1 million and China Roots Packaging Pte Ltd (China Roots) for US$1.201 million with an additional investment of US$1.0 million in Jul 2004. Blopak is involved in producing packaging materials and label stickers in China. China Roots is set to take over Blopak’s business in stages to be eligible for investment incentives in China. (Waa.. much more diversification of its business!)

Another major development within PCCS is the disposal of Texline Associates Pte Ltd (TLA), its 60% owned subsidiary acquired in 1994 for RM5.7 million. TLA is engaged in the business of buying and trading textile and apparel, based in Singapore. In 2001, the group sold 15% of its TLA stake for RM10.4 million. The balance 45% was sold in Dec 2003 for RM16.34 million. Even though TLA was profitable, PCCS decided to cash out as the business was deteriorating. Nevertheless, by selling TLA, the group was able to [1]. Focus on its own marketing arm amidst a trend of direct purchasing from customers, [2]. Reduce its debt, and [3]. Eliminate the corporate guarantees of RM50 mln.

Conclusion and Advice

An important point worth noting about PCCS is that although the group recorded a sharp decline in profit for financial year 2004, a closer look will show that the group’s fundamentals were still intact. (but.. the company is really diversifying into so many businesses. Is this a concern to its business fundamentals? Would 'Jack of all trades' be of a concern here?) Taking out the loss of the newly acquired Jusca Garments (Cambodia) Ltd, the RM9.0 mln loss on the disposal of TLA, and TLA’s contribution in fiscal years 2003 (RM4.1 million) and 2004 (RM2.8 million), the pre-tax profit for PCCS would be approximately the same in 2003 and 2004. In addition, despite the plunge in profit, the group also continued to generate positive cash flow from its operations, signifying sound business operations.

However, the most interesting development in PCCS is the group’s new venture in China via China Roots and Blopak. Although the usual advice is for companies not to venture into an unrelated business, the same may not hold true for Blopak. First, Blopak is the 5th largest plastic bottle supplier to Amway (China) Co Ltd. With Amway China a large tax contributor to the Chinese government, the long-term potential of Blopak and China Roots is huge. Secondly, it can be a window to expand the group’s current labelling and stickers operation, with both being able to complement each other. Nevertheless, with the existing net borrowings of around RM33 million, any major capital expenditure by PCCS would add substantially to the gearing of the group.

At RM1.04, PCCS is capitalised at over RM62 mln. Assuming that Jusca reaches breakeven level in fiscal year 2005, assuming no positive or negative contribution from its China expansion and with no exceptional loss expected, PCCS is selling at a PE multiple of only 4 to 5 times. i Capital revises its Hold rating and now rates PCCS Group a Buy for the longer-term.

Ok, I am not keen on such Hold and buy for the longer-term strategy. I would rather wait for a clear confirmation that the business has turned around before investing. Yes, the investor could end up paying more for their investment but at least they are getting a more solid guarantee that their potential investment has turned around.

Consider this, back then in Aug 2004, PCCS was around 1.04. Now if one adopted the safer approach, almost a year later in May 2005, PCCS announced a net profit of around 11 mil for its fiscal year 2005. That was reported on 24th May 2005. If one had used this as a guide, their investment reasoning would have been more justifiable since PCCS had clearly turned around from their 2004 woes. And one could have invested in PCCS after this earnings announcement at a price of under 90 sen. That would have been a much better investment approach, yes?

Anyway, back in Sept 2004, there was this article in Star Biz called "PCCS has big plans for China unit".

- “These companies are plagued by high wastage, inferior quality, late delivery and bad sales services,'' Gan told StarBiz in an interview.

PCCS had in July 2003 acquired 100% in a loss making packaging company, Blopak China Private Ltd, for RM4.12mil and turned it around within a year, he said, adding that it broke even in June 2004 and would probably make a profit by the end of the year.

Interesting. Same strategy of buying a loss making company.

May 2006.

- Monday May 22, 2006

PCCS to boost China ops

By Zazali Musa

APPAREL maker PCCS Group Bhd wants to build up and strengthen its labelling and packaging division in China in the coming years.

Group general manager Gan Hoe Lian said the company would focus on three market segments namely consumer goods, electrical items and garments.

He said prospects for the labelling and packaging business in China was bright considering its position as the manufacturing hub of the world.

“The three segments provide us with quantity. In addition, volume is not a problem in China,’’ Gan told StarBiz in an interview recently.

He said with a large number of multinational corporations (MNCs) and international manufacturers having operations in China, the prospect was endless.

The presence of the MNCs and international manufacturers in China offered good business opportunities for many local and foreign companies and businessmen.

The company found that producers of consumer goods, electrical items and garments needed the services of support industries such as those in labelling and packaging.

Gan said demand for labelling and packaging materials in China would grow even higher in future due to the booming manufacturing sector there.

“Our labelling and packaging division in Malaysia is doing well, so we believe we can do the same in China.’’

Although there were many packaging companies in China, a majority of them could not cope with the high standards set up by the MNCs, he said.

Sensing a business opportunity, the company had in July 2003, acquired 100% equity in loss-making packaging company Blopak China Private Ltd for RM4.106mil.

Blopak was already supplying bottles to an international multi level marketing (MLM) company in China.

“Prior to our acquisition of Blopak, there was a lot of wastage where raw materials were not properly controlled during production,’’ Gan said.

The company had successfully reduced the high wastage from 25% to 30% previously to the current 1% and 2%.

Gan said with the improvement in quality, it was able to convince the MLM company to outsource bottle caps from Blopak as well.

In addition to bottles and bottle caps, the company has started supplying toothbrushes and T-shirts to the MLM company.

The supply of T-shirts came under its wholly owned subsidiary PCCS Garments (Shuzou) Ltd, set up in April last year.

Gan said the prospects for apparel manufacturing in China was even brighter with Beijing hosting the Summer Olympics in 2008.

“PCCS managed to turn Blopak around within a year. The company broke even in June 2004 and is now starting to contribute positively. It was a wise decision to acquire Blopak.”

Gan added that several MLM companies and manufacturers in China had expressed interest to outsource packaging materials from the company.

The company was currently providing product samples to five MNCs in China and Gan was confident of securing orders from them.

He added that at present the company would focus on making plastic-based packaging materials before introducing other types of packaging products.

“Demand for plastic-based packaging materials especially bottles in China is high particularly from beverages and consumer goods producers.”

PCCS reported its most recent earnings on Feb 2007. Quarterly rpt on consolidated results for the financial period ended 31/12/2006

I would check out this non-apparels business and see how PCCS is doing.

The following table below is taken from that quarterly earnings announcements.

Non-apparels earnings totals some 1.605 million for the first 3 quarters of current fiscal year. Which kind of pales against 3.611 million achieved the same period last fiscal year.

And there are no geographical segmentation reports. It would have been nice if PCCS included that report since the investor should know what exactly is happening with PCCS's Cambodia business and also its China business.

And its recent developments stated in that earnings report.

- On 26 December 2006, Beauty Electronic Embroidering Centre Sdn. Bhd. (“BEEC”), a wholly-owned subsidiary of PCCS, had invested USD1,000,000/- in JIT Embroidery Limited (“JIT”), which was incorporated in Cambodia, representing 100% of the registered capital of JIT. On 20 January 2007, E.M.I. Embroidery Sdn. Bhd. (“EMI”), A 90% owned subsidiary of BEEC, a wholly-owned subsidiary of PCCS, had completed its voluntary winding-up proceedings.

So as it is, it would appear that PCCS has actively acquired businesses in Cambodia and China the past couple of years. And at this moment of time, PCCS earnings pales in comparison to what it had achieved for its fy 2002.

How would you rate such a business? Would you be concern of PCCS constant acquisitions of new businesses and with it, its nett debt increases? And moving ahead, do you see any catalyst for PCCS earnings to improve?

I hope the opinions posted on this blog posting helps as a second opinion!

Cheers