JCY was listed on 25 Feb 2010. It's performance since listing (ipo price was 1.60) have been rather dire.

Now UBS AG and CIMB were the joint managing underwriters and bookrunners for the IPO.

And since this is a very 'new' stock, I would refer to CIMB Research IPO notes on JCY.

But there wasn't an IPO research notes on JCY from CIMB Research!

They only began coverage on the stock on 19th April 2010. JCY then was 1.74 and CIMB gave it a very optimistic target price of 2.68.

And mind you... the report.... was 52 pages long!

LOL!

Page 26 of the report..

Hmm.. some might not like that arrowed statement.

- JCY generated RM19m of negative free cash flow in 1QFY10 due largely to the repayment of RM80m owed to its shareholder.

Yes, JCY is in net debt and the very cynical would be fast hand, fast leg and point out that one of the very first thing JCY did as a listed entity was to pay off the debts owed to one of the shareholder. Yo.. it's 80 million bucks hor!

CIMB's valuation of JCY... and the key is 12x fy11 PE.

12x CY11 PE

To give a simple illustration on how to play the funky music.

Say a company's current eps is indicating an annual eps of 13 sen.

Ok, the cynics would say, to make the stock sexy and seductive, the eps is projected to GROW to 22.3 sen by a whopping 71.5%! ( LOL! say only lah... assume. :P )

- Using 12x PE on 13 sen, the stock would be valued at 12x0.13 = 1.56.

- Using 12x PE on 22.3 sen, the stock would value at 12x0.223 = 2.68.

See how the stock is all dressed to look super seductive?

Come on honey... you want me or not?

:P

Yes, I do not doubt future earnings is very important because a company is only worth what it could earn in the future but sometimes they are those insinuating reports that really suggest that a cow could be orbited to the moon so that it could do its nightly moon walking! ( LOL! A moon walker cow! :P ).

Seriously, there are many a times when one is bewildered by the earnings estimates made on a company.

So where is CIMB's key financial tables for JCY?

Ahem...

Here's my flawed interpretations.

JCY earned some 207 million for its fy 2009. CIMB says times are good in 2010, so JCY should earn some 359 million! And 2011, JCY earnings will be even more super. JCY should earn some 441 million by then!

How? Am I reading it wrongly?

So the whole key to CIMB's valuation of JCY is based on an optimistic earnings of 441 million or an eps of around 22.3 sen.

So how has JCY fared so far?

Ok.. I am aware that there are only 3 quarters of earnings posted by JCY and it's seriously too few to pass judgement but for the sake of comparing what JCY earned versus CIMB's estimates...

Ahm... total 3 quarters so far is only 198.944 million.

And to make matters worse, the earnings are declining each quarter.

Would JCY even post a net earnings of 250 million for its fy 2010? I dunno.

And what's CIMB's estimates again? 359 million for 2010 and 441 million for 2011!

oO

Ah... but I have to give CIMB a little credit. :P

Why? Because they have continuously re-adjusted their estimates. ( Cynics would say ... what for? Damages already done!)

7 May 2010.

21 May 2010 - Target price lowered!

CIMB research said:

CIMB research said:- ... we cut our FY10-12 EPS by 13-17% for lower sales and margins after factoring in our new forex forecast of RM3.15:US$1 for FY11 vs. RM3.40 previously.

( Ah... strong RM ( or issit lembik USD) hurting JCY. )

fy 2010 earnings is now lowered to 297.3 million and fy 2011 earnings is now lowered to 370.8 million.

17 Aug 2010 - CIMB acknowledges the possible weakness but it refrains from jumping the gun and held onto their earning estimates and since JCY has fallen to 1.20, CIMB used the classical 'it had already priced in the possible weakness' as their reasoning.

And on this Monday, 23 Aug 2010, CIMB writes again on JCY.

JCY has fallen to just 1.17. (Will it be a penny stock soon? :P )

Earnings estimates are cut once more and the target price is lowered!

But the valuation method remains the same - it's based on 12x CY11 P/E.

- Accordingly, our target price, which is based on 12x CY11 P/E, falls from RM2.28 to RM1.88.

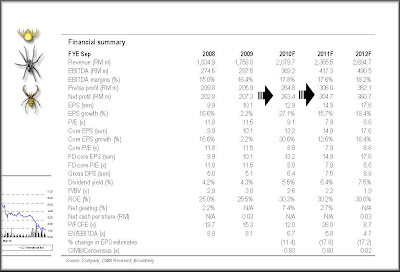

The financial table on JCY from CIMB

JCY is now projected by CIMB to earn some 263 million for its fy 2010.

And ....... for fy 2011, JCY is now projected to earn only 304.7 million or an eps of 14.9 sen.

Hmm... 12x CY11 PE... my calculator for 12 x 0.149 = 1.788.... I wonder how CIMB got 1.88. :P

And there you go.... the story of how JCY's earnings projection went from 441 million to just 304.7 million.

(ps: some are fussy and they would demand that I be more precise. :P

Ok.. the 441 million was projected on 19th April 2010. On 23 August 2010, that projection has been revised down to just 304.7 million. Precise enough? :P )

16 comments:

MY GOODNESS ZE MOOLA.NOW UR MAKING ME NERVOUS.LOOKS LIKE THE INVESTMENT FRATERNITY FROM THE LICENCED PROFESSIONALS TO THE UNLICENCED ARE

ALL MIX UP.ITS LIKE THE GOOD,THE BAD AND THE UGLY.LOL.

ANYWAY,KUDOS AGAIN TO YOUR HIGHLY

XTRAODINARY STYLE OF WRITING.

LOL!

You are welcomed. Article is not finished. I am slow. :P

If I see correctly from google finane site, Western D and Seagate trading at single digit PE in US. Surely their sub-cons don't deserve higher PE right?

David: I see and I understand the justification in your reasoning. :D

How much money do JCY raise in their IPO ?

The total amount due to shareholder is 173mil, and they hav settle it in 9 months.

Total loan 360mil, where 280mil is shortterm loan.

But still able to giv 80mil as dividen and buy equipment for 200mil last quater.

Otak boss JCY rosak ke ?

peng01: Intersting point of view!

Well, JCY had 'hoped' to raise some USD 350 million from its IPO.

See :So Many Cash Calls In Our Market

But JCY was not lucky. :P

It had to scaled back its IPO. ( I wonder why. :P )

JCY to slash IPO size on weak pricing

JCY only managed to raise some 750 million.

And to put your issue in an even better perspective, do refer this news clip JCY set to be Southeast Asia’s largest tech IPO

Quote: "Interestingly, the IPO is expected to give a payout to major shareholder YKY Investment Ltd up to RM1.25bil based on the maximum retail price of RM2.00 per share, assuming it is at 5% discount to the placement price and the full over-allotment option is exercised.

The question floating around is: Why is the IPO an ‘offer for sale’ by 74.1% sole shareholder YKY Investments Ltd?"

you should wrote this article when jcy hit the high of 1.90, 阿弥陀佛。

So, IPO rm750mil, all masuk pocket YKY investment,

And jcy shareholder get rm80mil dividen angpow only, and this 80mil angpow paid is borrow from bank.

peng01: JCY hit the 1.90 highs in early May.

Yes, I could have written and mentioned that CIMB's 'estimates' does have an indication that its seems fairly overly optmistic because from my interpretation of the report CIMB was saying that..

"JCY earned some 207 million for its fy 2009. CIMB says times are good in 2010, so JCY should earn some 359 million! And 2011, JCY earnings will be even more super. JCY should earn some 441 million by then!"

Yes, I could have made a posting based on that... but... do remember....

1. I am a nobody.

2. I am not responsible for anyone's investments.

3. I am not a sotong. :D

4. I am certainly not an independant investment advisor.

5. Most important, I find no motivation to talk about stock price movements. Yeah, I do not induldge in guessing what a stock price will or will not do.

I am sorry.

So how could I be writing then?

And more importantly, JCY only made ONE quarterly announcement. Do I have any data to back what I am saying that CIMB's earnings looked extremely optimistic?

No. I don't.

The second quarter announcement was only announced on 24th May 2010.

u have to admit yong's timing was impeccable. he definitely saw the peak coming and ipo the company at the most opportune moment.

Majority of (stupid) investors complain when Chinese sportswear companies listed on Bursa have so much cash in the kitty. The major shareholder of JCY pocketed a few hundred million from the IPO. Nothing wrong with that but not as good as cash in the bank in the PLCs account.

Ronnie: I just checked on the IPO files from JCY posted on Bursa website>

Page 75 from the pdf file

attached, this amount due to shareholder was actually stated chearly in JCY's balance sheet before JCY was listed.

Since all debts needs to be repaid sooner or later, it's not really a crime that JCY pays the shareholder back.

However.. the interesting point I noted is... for fy ending 30 Sep 2008, amount owing to shareholder is only 5.8 million.

Now... the following year... this amount balloons to 173.20 million.

Err... I am sure there's a reasoning why it ballooned so much...... but... I for one... do not know the reasoning... for now.

Very similar to Mangotone that will

disappear into oblivion !!

The salesmen (Investment bankers) managed to sell the right stock at the right timing, but not the stock buyer kua?

But, just like buying property, u buy at high time, it means u must have the purse to survive the worst time thru. I guess there is some similarity over here, it is about the valuation and risk appetite.

Financial Datas on QL:

https://spreadsheets.google.com/pub?key=0AuRRzs61sKqRdEdtdkItSVFoeWloeUtFcVJlSjVQQnc&authkey=CO_XjeIJ&output=html

QL is yet another company with good revenues (8% annually) and earnings growth (>20% annually). Its ROA was around 9% to 10% and with judicious leverage through debt and borrowings, its ROE was around 21% to 22%.

At its present price, its PE is at its higher end of its historical range. The company has been selling its treasury shares recently. Of course, QL hogs the limelight with its recent purchase of Lay Hong.

Moolah, I look forward to your views on this company.... when you have the time. ;-)

Thank you.

MQTech Mr Chata Singh has deal with JCY, since JCY has problem, what you think about MQTech?

I have summarized table below. Cash position healthy and improve since selling QB to JCY

Hire purchas payable (HP) increases, is it a sell signal?

MQ Tech table (in million)

Cash Debt HP Cash change

19.033 5.548 3.375 Q2 1.198

17.835 4.829 2.721 Q1 0.227

17.608 5.146 2.417 Q4 2009 -1.426

19.034 5.001 1.365 Q3 -2.154

21.188 4.441 1.934 Q2

Comment JCY relationship with MQ tech, please.

Post a Comment