Flashback. April 20th 2005.

Dynaquest iniated research coverage on steel-based products maker, Yung Kong Galavnising Industries Bhd on the Bursa eresearch website (click here for the article). (ps. Dynaquest has been a staunch supporter of Yung Kong since 2003, featuring it on its Sunday Mail write-ups)

Here is a snippet from the report.

- 3. Valuation:

Attractive valuation & well-managed company. There are no local listed comparables for YUNKONG, as the other four major players in the galvanising sector are not listed. However, at the current (as at 15.04.05) price of RM1.29, YUNKONG is trading at a prospective P/E multiple of only 8.1 times and a DY of 2.33% nett. Its current price is also near its 3-year low of RM1.25. Based on both fundamental yardsticks, the current valuation of YUNKONG is considered cheap in view of its relative high EPS growth rate over the long-term (5-Yr: 5.31% & 10-Yr: 11.25%). In addition, YUNKONG is a relatively well-managed company and its long-term prospects remain favourable.

FY2004 in Review

Unable to fully passed on the higher costs to its customers. For FY04, YUNKONG recorded a 9.5% increase in earnings to RM10.11m on the back of almost 23% rise in sales to RM269.19m. The improved sales and earnings performance for FY04 was due to higher selling price of its steel products. However, due to higher cost of raw materials and other inputs which could not be fully passed on to its customers as well as an increase in administrative expenses (+28.4%), the EBITDA margin for FY04 fell to 11.04% from 12.52% in FY03. The FY04 EPS rose to 15.65 sen (1Q: 5.84 sen, 2Q: 4.28 sen, & 3Q: 3.30 sen & 4Q: 2.23 sen) from 14.55 sen (1Q: 5.22 sen, 2Q: 4.51 sen & 3Q: 3.22 sen & 4Q: 1.60 sen) in FY03.

FY2005 Prospects

Double-digit sales growth anticipated. YUNKONG is expected to record double-digit sales growth in the current FY (FY05) as a result of increased selling price of its products as well as increased production following the recent commissioning of its NOF-CGL at its Klang factory.

However, with higher depreciation and continuous pressure on profit margin from the high CRC prices, the bottomline profit of YUNKONG is likely to show only a small improvement. In addition, start-up losses from the new galvanising line are also expected to affect its bottomline profit for the current FY. Hence, we are forecasting only a slightly higher EPS of 16.0 sen for FY05.

Longer-term Prospects

Growth will come from capacity expansion. In spite of the short-term pain, the longer-term outlook of YUNKONG remains bright as its expanded to become an integrated manufacturer of galvanising products. The profit margin of YUNKONG is expected to improve once the prices of its raw materials, particularly CRC, stabilise. It’s the volatile movement of the raw material prices and NOT the high prices that put the pressure on YUNKONG’s profit margin.

During an upswing, there will always be a time lag before YUNKONG can fully passes on the higher cost. On the other hand, during a downswing, the selling price of YUNKONG’s products will be immediately adjusted downward due to competition but it will be a while before its stock of raw materials at relatively higher prices is cleared.

7. Balance Sheet:

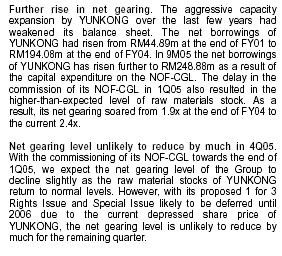

Rising net gearing. The aggressive capacity expansion by YUNKONG over the last few years had weakened its balance sheet. The net borrowings of YUNKONG have risen from RM44.89m at the end of FY01 to RM194.08m at the end of FY04. As a result, its net gearing soared from 0.6x at the end of FY01 to 1.9x at the end of FY04. Net gearing will be reduced after proposed Rights & Special Issues. YUNKONG’s current net gearing of 1.91x at the end of FY04 will be reduced to about 1.77x after the proposed Rights and Restricted Issues.

8. Recommendation:

We are initiating our coverage of the Company with a "LONG-TERM BUY" recommendation at the current market price of RM1.29.

Look at some of the reasonings made by Dynaquest to justify their buy recommendation...

- Low PE multiple 8.1x.

- DIY of 2.33% nett

- Current price of 1.29 at 3-year low

- Growth stock: (5-Yr: 5.31% & 10-Yr: 11.25%).

* Some reasons not to buy?

1. Ze debt issue. See how Dynaquest analyst IGNORED the issue about the massive build-up in debts... debts went from 44.89million to rm194 million? Ah.. remember how some argued that borrowings is needed to finance growth? And that in order to stay on top of the game, further capital expansion and continued spending on research is needed.

On the other hand, the arguement is simply on how prudent the management is. No one has said that capital expansion is bad or said that borrowing is bad... but... there should a limit on how much a company should spend. By being too aggressive capital expansion could be deemed reckless. One cannot use capital expansion as an excuse. There is a saying that one should only buy a hat that fits their head.

Ahh... such classical arguements... anyway... Dynaquest argued that the proposed rights issue by Yung Kong would help lessen this debt issue in the near future.

2. Low PE. I have always argued that the PE only reflects how the stock is trading in the market when gauged against its earnings. It states NOT about the quality of the stock. Simply put.. not all low PE stocks would equate to a great investment.

3. DIY of 2.33%... err.... not terribly exciting isn't it?

4. Trading at a 3 year low? Waahh... does that justifies an investment?

5. Growth stock? The following table highlights Yung Kong track record. Where is the growth? All I see is a very inconsistent company.

6. The inability to pass the cost down to its customers as mentioned by Dynaquest is a worry!

Article was written on April 15th. Few days later Yung Kong announced its quarterly earnings. Yung Kong a net earnings of 1.683 million or an eps of 2.6 sen. It's quarterly earnings improved by some 17% but its year-to-year net earnings dropped an alarming 55%. (see snapshot of Dynaquest's write-up on Yung Kong's earnings )

And the debt issue? Did it improve? Ahem... net borrowings has risen further to rm230.46 million!

And what did Dynaquest conclude in their write-up?

- We are maintaining our "LONG-TERM BUY" recommendation for YUNKONG at the current market price of RM1.27.

Never mind, let's give it a benefit of a doubt for this quarter. Anyway, 3 months later, Yung Kong announced its next quarterly earnings.

Yung Kong announced it made 1.665 million for the quarter or 3.348 million for its first 2 quarters of the year or an eps of 5.15 sen. (ahem.. dynaquest's projected eps was some 16 sen for this fiscal year!)

And here is Dynaquest write-up:

Ahh... Dynaquest is forced to lower the EPS forecast from 16 sen to only 12 sen.

- In view of the weaker-than-expected 1H, we are revising downward our full-year EPS forecast to 12.0 sen from 16.0 sen previously. However, DPS for CY05 is projected to be maintained at 3.00 sen nett.

- We are maintaining our "LONG-TERM BUY" recommendation for YUNKONG at the current market price of RM1.06.

Shocking? When Dynaquest lowered their earnings forecast for Yung Kong from an eps of 16 sen to 12 sen, Dynaquest is effectively downgrading Yung Kong's earnings by some 25%. Now after such a hefty downgrade in earnings, how could Yung Kong still be worth a buy?

3 months later in Nov 2005, Yung Kong announced its 2005 q3 quarterly earnings.

How did Yung Kong do? Well it reported a loss of 1.214 million!

And here is Dynaquest following write-up.

And again, Dynaquest defended the poor result and again it ignored the debt issue.

And what was Dynaquest recommendation?

- The current price of YUNKONG had factored in the bearish outlook for the short term. Hence, we are maintaining our "LONG-TERM BUY" recommendation for YUNKONG at the current market price of 86 sen.

My oh my, still a long term buy at 86 sen? 86 sen??? WOW!!... and Yung Kong was just trading at some 1.29 some 9 months ago!

How?

Current poor price of 86 sen had been factored in the bearish outlook?

Huh?

And the following picture says it all...

Oh.. and a couple of days later... Yung Kong announced the following announcement.

That rights issue thingy that Dynaquest had mentioned so many times b4..

- On behalf of the Board of YKGI, Malaysian International Merchant Bankers Berhad ("MIMB") is pleased to announce that the Securities Commission ("SC") had, via its letter dated 24 November 2005, approved an extension of time of six (6) months from 29 November 2005 up to 29 May 2006 for the implementation of the abovementioned Proposals, subject to the terms and conditions as earlier stipulated in SC's approval letter, dated 30 May 2005.

Hmmm.... seeking extension? Why? Would it be wrong for one to speculate that perhaps Yung Kong is seeking an extension because they could not find a buyer and that perhaps their shares is NOT LAKU?

And the latest development? Yung Kong announced their 2005 Q4 quarterly earnings on Feb 2006.

Yung Kong posted a loss of 1.513 million for the quarter and ended their 2005 fiscal year with a mere profit of 620k.

And this is what Dynaquest had to say in their research write-up and the following is their recommendation:

- The current share price of YUNKONG had factored in the bearish outlook for the short to medium term. While the worse for YUNKONG may be over, earnings recovery to the pre-FY05 level may still be several quarters away. Hence, we are downgrading YUNKONG to a "HOLD" from a "LONGTERM BUY" at the current market price of 83.5 sen.

ahem!

No comments:

Post a Comment