Business Times today carried the following article.

- IPO market poised to be slowest in five years

Bursa Malaysia is unfazed by the falling number of IPOs in Malaysia as the Securities Commission's tightening of rules is to boost the quality of companies

The following was mentioned in the article.

- "The exchange's main focus is quality and not quantity to generate greater velocity based on fundamentals. Public listed companies (PLCs) will be delisted if they have been loss-making and fail to turn losses into gains," Bursa chief executive officer Yusli Mohamed Yusoff said in reply to questions from Business Times.

"The Securities Commission (SC), in its efforts to enhance the quality of the market, places a lot of importance on quality PLCs, and has taken rigorous assessments to root out PLCs without good businesses, especially those which are just seeking to cash out," he said.

For once we are hearing the right noises made.

Flashback July 2006.

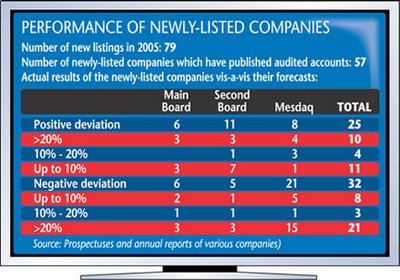

- Over 50% new PLCs fail to meet forecast

By Tamimi Omar, 10 Jul 2006 6 PMMore than half of the companies listed on Bursa Malaysia last year failed to achieve the financial results they had forecasted in their listing prospectus, the Securities Commission said.

The above chart was taken from another Business Times article back in July 2006.

How ironic.

It was only back in December 2005 when Star Business made a huge proclaimation on the impressive performance of them Mess-daq stocks. See past blog posting: Impressive year for MessDaq IPOS.

I would like to reproduce what was blogged then.

- Given the issues mentioned and highlighted in the following two posts:

1. Oh MessDaq

2. Comments on IPO

My fingers were itching when i found out that Star Business today had an article: Impressive year for Mesdaq IPOs

From a business-perspective, it would definately make sense for Bursa Malaysia to highlight these issues. As a business-entity, Bursa is now focused on the Moola itself. This is its responsibility to its shareholders. To make Moola.

However, making moola at all costs?

Is it wise and feasible?

Shouldn't due consideration be made on improving the quality of the newly listed stocks rather than the issue of churning out more business for the exchange?

Anyway, as mentioned in the article, there were simply more new listings in the Messdaq than in the main board or the second board. And the article does shed some light on why is it so.

“For many companies, a listing via Mesdaq was less cumbersome because there were fewer requirements to fulfil,” an analyst with a research house said.. ( EASIER!)

In the case of Mesdaq, companies do not need to show a profit track record. (Lousy company can also list wor!)

“The listing on Mesdaq allows young companies and less-established ones to focus on growth and improving earnings in the early years of listing without having to worry too much about meeting the exchange's stringent rules and regulations, especially on earnings,” he said.

“The cost of entry into Mesdaq is lower (including listing exercise) while allowing companies flexibility to grow globally,” he said.

Those were some of the reasons why the Messdaq seduced more listing...

Now consider some of the following issues mentioned in this blog.

Isn't there one too many companies which lost money after being listed on the Messdaq? (see Oh MessDaq ). For example, Litespeed announced it lost money a few days after being listed!! Or companies like EB Capital and DVM.

Now, why is it such a big deal?

Yeah, yeah, yeah... the Messdaq is a good hunting ground for speculators and punters. A lot of fortune has been made.

What about the losers?

Yeah, they deserve to pay the price for their foolishness... but take the following issue mentioned in Karensoft "Move over who: Part Vii"

When Kenanga first wrote on Karensoft, Kenanga stated that Karensoft some 69.2 million shares then.

Get this... at 0.96 sen, Karensoft then had a market capital of rm65.8 million

Today?

Karensoft (which had a 1-for-2 bonus issue in June 2005) now has some 115.015 million shares.

Now at 0.065 sen, Karensoft market value (market cap) is only some 7.475 million.

Soooooooooooo ...... from 2nd Dec 2004 to 20th Dec 2005, some 58.35 million in market value has simply vanished!

This for me is the huge issue. Huge Issue. Cos most of the messdaq stocks have been trading at a rather high price before crashing. Look at Karensoft, one of them Messdaq stocks had a market value was much as 65.8 million on Dec 2nd 2004. Now, almost a year later some 58.35 million has vanished!!

Think about it.

For a stock like Karensoft, this stock had the means to erase some 58.35 million in market capital from our stock exchange. And this is only one of them troubled Messdaq stock. Aren't the numbers mind boggling?

Do such listings create or ultimately destroy value?

How?

If an investor bought and hold such a share, what would happen to their value of their shareholding?

See the importance of creating value in the market and not quantity?

Yes, yes, yes in this incident, the investor was probably wrong and silly to buy and hold a poor quality stock but let's think in regard to the market itself. Yes, Mr.Market.

Can the market survive without these 'investors'?

Can the market exist without any minority shareholders?

Can the market survive if all there exists is rather poor quality stocks?

Who would want to invest in a poor business?

Shouldn't due consideration be made on improving the quality of the newly listed stocks rather than the issue of churning out more business for the exchange?

Is bigger neccessary better?

Think about it.

And of the most appalling example is Litespeed. ( see LITESPD ) The below table shows Litespeed earnings performance since listing.

And the chart below shows the drastic value destruction done by the listing of a Litespeed.

Yeah, the IPO market has been sluggish. But I would rather prefer a sluggish IPO market than the market churning out garbage listings just for the sake of the market itself.

Oh... and when was the last time Bursa offered a good quality IPO for its investors?

0 comments:

Post a Comment