The Star Bizweek has an article on Scomi Group, To privatise or not? , in which it states the compelling reasons why Scomi Group should be privatised. ( Refer recent blog posting: Privatisation of Scomi? and Update on Scomi )

I find it rather strange the need for this article.

Really.

After all, if you look at the blog posting, Privatisation of Scomi? , you would note that the whole 'story' is based on nothing but speculation and of course the in famous 'according to sources'.

This was what printed by the Business Times article on November 15.

- SPECULATION is rife that major shareholders of Scomi Group Bhd may take the integrated oil services firm private in a bid worth as much as RM1 billion.

Sources said the main shareholders, who include the son of Prime Minister Datuk Seri Abdullah Ahmad Badawi, are considering this as an option as Scomi's market price does not reflect its true value.

SPECULATION is rife and SOURCES said.

Ever wonder why can't our financial report news based on facts and nothing but facts?

Do you want to read news based on SOURCES?

Let me repeat a thousand times again. Anyone can be a source. Anyone. You, me, the makcik or the Ah So cleaning the toilet. The driver. The office boy. They all can be a source.

So today we have an article posted in The Star Bizweek which ATTEMPTS to JUSTIFY this speculation. And they even have TA Securities head airing out his compelling reasons to privatise the stock.

- First off, the timing is right. TA Securities' head Kaladher Govindan is just one of those many who perceive Scomi as being undervalued.

“Going by current prices, it's advisable to take it private,” he says, pointing out that the company is ripe with future growth potential, as evinced by such developments as its recent penetration of the US market. Indeed, Scomi has gone on record as stating that it expects to more than triple its sales to US$1bil by 2009.

The upshot of this is that keeping Scomi listed would mean sharing those future profits with the public. Conversely, privatising the company would largely benefit its major shareholders.

Such a move would also provide the company with a greater deal of flexibility by removing the need to keep up with the regulatory framework, in addition to obtaining shareholders' approval for certain decisions.

Second, Scomi is now susceptible to what is known as holding company discount. Buying into a conglomerate that has a number of subsidiaries engaged in diverse activities under their umbrella is often a bit of a mixed bag, as investors may not want to be exposed to each of these individual companies.

In this instance, especially when a holding company has successfully listed a number of its subsidiaries, buying directly into a subsidiary may represent a better way to get direct exposure. From the perspective of the company itself, analysts feel there is sufficient reason to de-list Scomi as funding for expansion can be raised at the subsidiary company level.

To illustrate the former point, Scomi Engineering Bhd was trading almost 50% higher than its parent two weeks ago. Even after the recent uptrend in Scomi's price, following the recent spate of news, it is still trading 25% lower than its subsidiary.

Financials and elephants

Third, Scomi can afford it. The company's announcement some months ago that it would undertake a restructuring exercise to streamline its subsidiaries was viewed favourably by analysts, along with the proposed listing of KMC Oiltools Bermuda Ltd on the Singapore Stock Exchange under the name Scomi Oilfields Ltd (Oilfields).

With the exercise expected to raise up to half a billion ringgit for Scomi, a privatisation exercise was among the many methods mooted to prevent the cash burning a hole in Scomi's deepened pockets.

As major shareholders, Datuk Kamaludin Abdullah and CEO Shah Hakim Zain own about 34.7% of the company between them. TA Securities reckons they would have to cough out between RM787mil and RM984mil based on the speculated price range of between RM1.20 and RM1.50.

“We believe the major shareholders could obtain part of the funding from the group’s possible capital repayment exercise with the listing of Oilfield Services on the Singapore exchange that could raise up to RM700mil (inclusive of the RM130mil from settlement of inter-company loans),” says the house.

How?

Let's take a look at Scomi Group again.

Here is the link to their last reported quarterly earnings:

Quarterly rpt on consolidated results for the financial period ended 30/6/2006

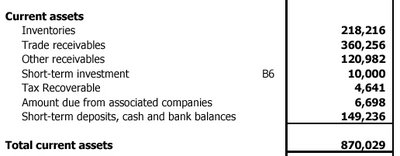

let's look at the balance sheet. It's current assets.

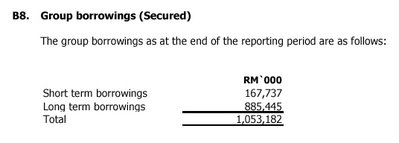

And the below is their group borrowings.

Well, group loans totals 1.053 BILLION. Groups piggy bank cash is only 149.236 million, which gives one a nett debt of ONLY 903. 946 million.

My simple question again.. once Scomi Group is privatised, who owns this debt?

No comments:

Post a Comment