Anon posted these comments on the Update on Maxtral posting.

- 80 mil long term loan, no wonder so geng the cash flow... but debt financing can be good, provided managed properly... lets see what they will do with the financing... irredeemable preference shares not so substantial, need to pay interests only. so dilutions is not that material? am i right?

1. Them preference shares issue. See Maxtral posting.

- At the moment of writing, Maxtral has some 210.099 million shares and it has some 84.415 million shares of ICUL outstanding. (ICP can converted on 1-1 basis)

Which means that if one ass-u-me full conversion of these ICP shares, then Maxtral should have 294.514 million shares. That should the share base you probably should work upon to avoid any shocks from discovering that your earnings per share has been diluted by these ICP shares. Ass-u-me the worse case scenerio. That's what I would have done. Remember this is just a mere second opinion. Some would probably have a different approach depending on one's investing style. For example, some would dare just the current share base (210.099 mil shares) cos they do not reckon that they would be such a long term investor. Which is right or wrong, it depends on your own interpretation.

2. Regarding the term loan.

Have a look at the Q3 pdf attached again.

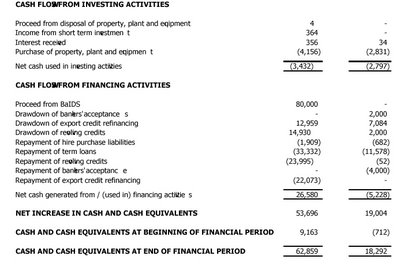

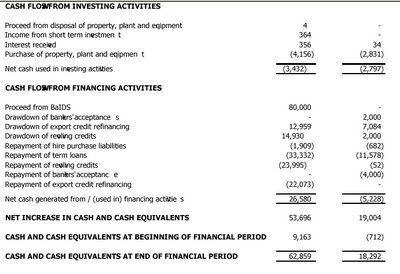

Have a look at page 4. I took 2 screen-shots of that page.

Maxtral had a 80 million Islamic loan (not sure which type). And if you look at the second screen-shot you would see that it used 33.332 million for repayment of term loans and another 23.995 for revolving credits.

It would appear to me that Maxtral is restructuring its term loans here. Am I correct?

Now here is an interesting issue.

Look at the cash and cash equivalents at end of the current financial period.

First compare it to last year same period. Look at the balance sheet. Cash balances was only 9.163 million and loans totalled 56.064 million.

Look at Upadate on Maxtral posting. Look at end of 2nd quarter. Look at the first sreen-shot i posted. Total cash totalled 47.936 million. Loans stood at 80 million.

Look at now. Total loans is still 80 million. Cash balances at end of period? 62.859 million.

How would you interpret such performance?

rgds

*** addum ***

btw.. it all depends so much on what was your main strategy for buying Max.

Did you buy because you wanted to ride the current bullish timber trend? If so, were you disappointed in not getting a blowout quarter from Max?

Or did you buy Max because you think that Maxtral has some qualities in itself?

remember all these are just second opinions. make your own rational decisions. ok?

:D

No comments:

Post a Comment