Just how are you doing? Have you been having a go at them weeds yet again?

I do remember your very posting. Yeah, honestly I do. Let me prove it you. Your very last line in that posting you wrote this..

- Oh... comes 2007.... i wonder if any1 will remember this ..

Yes?

See? I do read and I do remember.

Sometimes.

Anyway, you were rambling on and on and o, on how some folks justify by their recommendations by assigning extremely optimistic earnings estimates to the stock. Yeah, some call them as rocket numbers. Hey, but let's not be too critical, shall we?

Here is that said posting again which was posted on Oct 2005: S&P coverage on Mems

Profit & Loss

FY Jul./MYR mln 2004 2005 2006F 2007F

Revenue 33.8 48.3 80.3 223.1

Net Profit 8.2 13.7 17.9 47.6

Well, I just read S&P write-up. What I am interested in is comparing them projection then against their latest report.

Profit & Loss

FY Jul./MYR mln 2004 2005 2006F 2007F

Revenue 33.8 48.3 50.2 88.4

Net Profit 8.2 13.7 14.0 20.9

WOW!

Exactly. (just for info.. rhb research has even more optimistic numbers on MEMs! .. and neither do i have anything against MEMs, yeah i do think they are ok but its just that the market has been too high optimistic about it, so optimistic that MEMS has always performed below expectations due to the high yardstick placed on it!)

Anyway, there is something I do like what S&P reports.

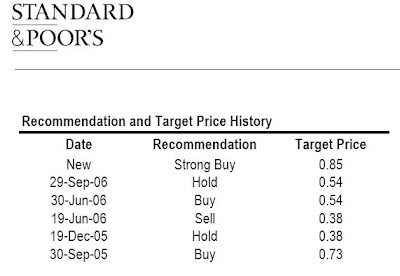

They are prudent enough to disclose their past recommendations and the assigned target prices.

See? S&P even have a SELL on it with a TP of 0.38!!!

Yeah, wow!!!

And rightly put in your posting: It Pays to Read!

- HOW many retail investors take the trouble to fully read research recommendations that brokers issue, especially when these recommendations are on small caps or second liners? From observation and anecdotal accounts from dealers, the answer is: very few. Instead of scrutinising reports to judge if the assumptions or projections are reasonable, there is a strong tendency among small investors to just look at the heading and target price of a research report before jumping in (or out, as the case may be)....

How to achieve this? A good starting point would be for retail players to read critically the dozens of reports issued each week before taking the plunge, especially for companies that have no earnings yet but whose shares have risen to all-time highs. This way, brokers will be forced to be more circumspect in recommendations, while investors may well be spared the pain of large losses in the future. Who knows, if everyone does this, all concerned may actually learn something in the process.

How?

For quick references to the past blog postings on Mems:

No comments:

Post a Comment