There is this stock called FimaCorp.

Here is the financial data back in 2004.

Looks like a decent stock to invest in right?

On 8th March I made the following blog posting: ROI on Fima Corporation

Let me reproduce it here again.

~~~~~~~~~~~~~~~~~~~~~~~~~~~

I was asked if an investor could know 'something is wrong before it drops'.

For me, the investor could ALWAYS take some precautionary steps.

Take for example Fima Corp.

Fima Corporation, is the manufacturing arm of Kumpulan Fima. Fima Corp's core business is printing and trading security and confidential documents such as travel documents, permits and licences.

Ok.. little bit background on Fima Corp.

Now, Fima Corp has an interesting track record and if one looks at the historical track record, one would note that this company is enjoying a tremendous turnaround in its fortunes since fy2003. (err.. some might define it as growth too!)

Secondly, since the turnaround of fy 2003, look at the start of 2004 Q1 quarter. It's piggy bank then was 12.106 million. A year later at the start of 2005 Q1, it's piggy bank has now grown to 32.494 million. And come end of fy 2005 q4, its piggy bank now stood at 56.775 million. This is what I think is desired in OUR business isn't it? We want to see our business piggy bank grow! (tiok boh?)

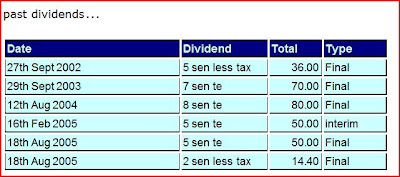

Thirdly, business profit margins is real decent, plus its dividend is on the drastic rise too!

These are some of the criteria that an investor wants, isn't it?

So we have a decent company making big bucks... dividends is on the rise.... and perhaps one could have considered Fima Corp as an investment, rite?

So since we had reasoned that this could be a good investment, we went and purchase this stock as an investment, hoping that this investment could grow forever and ever, right? But as mentioned before, the Review of Investment is an important integral of one's investment. We need to review our investment to make sure that the stocks we are holding is still a good stock. We need to review if the very reasons to invest in the stock remains valid. We need to check if that there is any tell-tale signs that something bad might happen.

In big corporations, when things get too rosy, sometimes it is possible that the company's management could get too big headed for its own good and starts embarking on questionable funky corporate exercises in an attempt to grow the company. Company get rich, starts to lose focus...

So besides looking at the financials, we also need to gauge them corporate exercises too. If it simply gets too funky, should we be dancing and playing that funky music with them ..... ?!! :p

Anyway, back in June 2005, Fima Corp announced that its subsidiary, Percetakan Keselamatan Nasional (PKN) is buying a property for some 15 million. Nothing wrong really. Spending some 15 million in cash for a property that has existing rental income isn't too excessive. So perhaps for this exercise, one would consider this as a mere remark. Nothing more, nothing less.

However, in Aug 2005, the company announced huge plans.

- Security printing-based company, Fima Corporation Bhd, through its associated company, Giesecke & Devrient Malaysia Sdn Bhd, plans to invest about RM150 million to set up a new plant in Shah Alam, Selangor, next year. For the security printing segment, Roslan said Fima planned to spend RM20 million to replace the current machinery in order to increase its efficiency and production capacity

First question that needs to be asked is if this project is too excessive?

Well despite its good recent track record, in fy 2004, Fimacorp made only 13 million and in fy 2005, Fimacorp only made 22 million.

How?

How would you want to rate such capex?

Do you think that such spending is required? Well, if we want Fima Corp to grow more, then the company must spend big to achieve greatness. Aiming big is good mah.

On the other hand, while it is always good to have an ambition and setting goal and targets to achieve BUT would you consider that this current project is simply way too big for their head?

Or perhaps... one should adopt the wait and see approach?

Ok. Not a problem. Now when Fima Corp announced their earnings back in Aug 2005... huge question marks began appearing.

- 1. Increase in Receivables... 12.087 million

2. Increase in Inventories.... 6.1 million

3. Net decrease in cash .... 7.123 million

How?

Another wait and see?

Now, present day, the Edge Weekly has an article on Fima Corp.

- Fima Corp Bhd is jumping on the plantation bandwagon by purchasing a slice of a small Indonesian palm oil outfit. In a statement on Jan 27, Fima said it will pay RM13 million for a 32.5% stake in PT Nunukan Jaya Lestari in East Kalimantan. This is part of a plan to diversify its earnings base. read more....

How?

Ok, an investment of 13 million is not a lot... but... here is my cow question... don't you really think that this company management, after achieving its recent success, has started to think way too big? Don't you think the company is really starting to lose focus? Diversification into palm oil???

How? Is this the 'something wrong before it drops'? Or should we want to continue the wait-and-see approach?

or... ahem... should the investor take SAFER approach... ?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Ever wonder the long term consequences of holding on to such a stock? Have a look at how the stock performed since March 8th 2006.

Ok, the stock did not fall off the cliff but if you look on the top left corner of the chart, FimaCorp on March 8th 2006 was trading at 2.37. On June 12th the stock closed at 2.25.

How?

Moola,

ReplyDeleteYou've got one of the more informative and functional blogs around.

Do appreciate your insight and ideas portrayed within.

I look forward to more informative readings.

Thanks.

Hi Moola,

ReplyDeleteThanks again for the article. With your guidance, maybe one day I could write like this in my blog. Lets see how.

Check out my blog n you'll know then.

Cheers!

Dear Valuelife,

ReplyDeleteWhy do you want to write like me?

Don't you want to be an investor that you will be proud of?

:)

Maybe he's proud of you

ReplyDelete:)

(I know I am hehe)