Take this real example of a stock, who is in a net cash position and pays about yearly dividend of 10 sen (tax exempt) per share. And with the stock trading at 1.52, would it be a good reason to buy and hold long term to the stock?

Let's have a look at what happened.

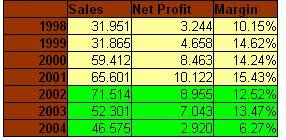

In which, one can easily argue that justification to invest in the stock is there...

1. company's net profits are growing yearly...

2. margins are decent

3. there is a 10% tax exempt dividend yearly.

4. net cash also.

When this stock announced its 2001 Q4 earnings back in Sept 2001. The traded prices then was 1.52. Based on a price of 1.52, the stock was trading on a trailing earnings multiple of 5.8x and with a dividend of 10 sen tax exempt, and giving a dividend yield of 6.6%.

Low PE and a good dividend yield.

This makes an investment case, right? Isn't this what one is taught to invest in?

Yes but sadly this is investing based on yardsticks and numbers.

What about the business?

Well, if one had bought the stock at 1.52, based on low PE and good dividend yields, without considering the business factors in the stock, the stock is now trading at 40 sen!

Yes 40 sen!

So what happened here? The stock in question is Multico.

If one got in Sept 2001, one would have done really well, considering that Multico did manage to edge past 3.00, one would have gained close to a 100% gain within the next six months. Yes, one could have bought the stock and came out smelling like roses.

But what if one decided to hold long term. Surely the thinking rational is if the stock could produce such fantastic gains in such a short period of time, the temptation, the greed to hold the stock for a longer period is there. This is just plain human nature.

However, from a business perspective, let's look at the chain of events and examine if one could have exited this investment in a much better manner.

Take a look at the quarterly earnings table below. Look at the 02 Q4 numbers and look at the one highlighted in lime-green. Could one see the drastic change in its quarterly earnings shown in 02 q4 earnings?

On a quarterly comparison, net profit margins slumped from 16.78% to 2.85. And net profits plunged to a mere 505 thousand.

Wasn't this the right time to get out?

Just from the quarterly earnings, we could sense that there was something drastic happened within Multico business.

Compare those earnings with the past historical earnings.

Wasn't it the right decision to make? To EXIT AFTER fy 2002?

And then early this year, there was 2 blog postings on this stock. Special audit on Multico accounts! and Multi-Code files suits..

Based on all logical reasoning, shouldn't one really exit the stock? Forget about the dividends it pays, the dividend yields, the stock fundamentals had deteriorated and the issue of trust and integrity within the company stood out like sore thumb!( See also Police report lodged by the Company )

Let's look at the end result of an investor who chooses not to accept reality and chooses to ignore all these issues and insist on holding on to the belief that one should buy and hold long term!

William O'Neil author of the best seller ' How To Make Money In Stocks ' wrote the following comments.

- One of my goals is to get you to question and change many of the faulty investment ideas, beliefs, and methods you have heard about or used in the past.

One of these is the very notion of what it means to invest. It's unbelievable how much erroneous information is out there about the stock market, how it works, and how to succeed at it. Learn to objectively analyze all the relevant facts about a stock and how the market is behaving. Stop listening to and being influenced by friends, associates and the continuos array of experts' personal opinions on daily TV shows.

It's also risky and possibly foolish to say to yourself, "I'm not worried about my stocks being down because they are good stocks, and I'm still getting my dividends." Good stocks bought at the wrong price can go down as much as poor stocks, and it's possible they might not be such good stocks in the first place. It may just be your personal opinion that they're good.

Furthermore, if a stock is down 35% in value, isn't it rather absurd to say you're all right because you are getting a 4% dividend yield? A 35% loss plus a 45 income gains equals a whopping 31% net loss.

To be a successful investor, you must face facts and stop rationalizing and hoping. No one emotionally wants to take losses, but to increase your chances of success in the stock market, you have to do many things you don't want to do. Develop precise rules and hard-nosed selling disciplines, and you'll gain a major advantage.

Consider one made an investment of 10,000 shares at 1.52 way back on Sept 2001 and yes, Multico had one Bonus Issue after the bonus issue, one would be left holding some 11,000 shares. Cost of investment would be around 15,200.

Now let's count the dividends received...

2001 10 sen (10 x 100 = 1000)

2002 10 sen (11 x 10 = 1100) (num shares increased due to bonus issue)

2003 10 sen (11 x 10 = 1100)

2004 7 sen ( 11 x 70 = 770)

2005 8 sen (11 x 80 = 880)

2006 7 sen (11 x 70 = 770)

2007 None! (No dividends! Why not sell? Another baffling reason not to sell, yes?)

So total dividends received after holding a stock for 6 years = 5620 but the current share price is now 0.40! So the current market value of the shares based at a price of 0.40 is 4,400.

And if you add up the current market value of the share with the dividend received, one's current value in this investment is: 4,400 + 5620 = 10,020!

Which means, from their original outlay of 15200, the investor is now holding to an investment worth 10,020!!!!

So holding a stock for so many years and after witnessing a grand bull run recently, how does this investment look? Is good or is it bad?

How?

Wasn't it better for the investor to acknowledge long ago that this stock is clearly good no more? Shouldn't one have sold much, much earlier? See how it's the business that counts.. ?

Anyway let's look back at what O'Neil wrote:

- It's also risky and possibly foolish to say to yourself, "I'm not worried about my stocks being down because they are good stocks, and I'm still getting my dividends." Good stocks bought at the wrong price can go down as much as poor stocks, and it's possible they might not be such good stocks in the first place. It may just be your personal opinion that they're good.

I do strongly believes that O'Neil is teaching something good here. Do not hold onto a stock just because of its dividends.

If the business performs poorly (Multico is in the dreaded automotive parts sector), the stock will STILL get hit.

Which means our investment in the stock will most likely perform rather poorly over the years as shown in this Multico example.

Now of course, do not misunderstand what I am saying here...

Dividends is indeed great, but for my personal choice, I want that something extra. I would want to see the business of the stocks doing great as well.

And the great business will most likely be the catalyst to drive the stock much higher.

Moola,

ReplyDeleteGood point. One should always look at the business side of things for indicative feedback on the potential of a company in the near future or long term.

[howshouse.com]

G' morning Moola,

ReplyDeleteI agree with your obvious point - invest based on fundamentals but if the fundamentals change as time goes on (in your example, EPS drops), then it's time to re-evaluate / cut-loss.

What I'd like to understand / know, if you can share your ideas / knowledge, is that, how would an amateur investor (not trader) like me know the operational aspects as to WHY the Company was doing well for past X years.

eg. Tongher - based on it's pass 3 years ROE + Growth of its Annual Sales, Shareholders' Equity, EPS, it was one of my filtered Companies to buy when it's price hit below $3.20. However, based on data from your findings on Tongher, they were doing well for the past few years due to their luck in accumulating/hoarding raw materials before commodity prices went really nuts.