Tonight Lion Diversified announced its earnings. The earnings summary below shows just how horrendous it was.

However given the known shutdown in the steel sector, the losses weren't too much of a shocker to me.

Instead I was more interested in its balance sheet. Will we see the shrinking cash and exploding debts and the increasing receivables?

Mentioned in that blog posting. Lion Diversified Has Now Got Much More Earnings but.....

- 1. Cash balances is now 176.745 (compare to 215.439 million a quarter ago).

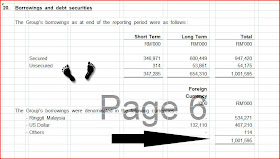

2. Total debts is now 986.542 million (compare to 864.774 million a quarter ago!!)

3. Trade receivables is now 511.587 million (compare to 392.027 million a quarter ago!!!)

Quarterly rpt on consolidated results for the financial period ended 31/12/2008

1. Cash balances increased to 302.428 million from 176.745 million three months ago. And if you look at the cash flow, the cash balance increased thanks to the fact that some 327 million was raised from the issuance of ICULS. Could you imagine the cash balances if this 327 million wasn't there?

2. Trade receivables exploded to 683.976 million! Three months ago it was only 511.587 million.(what on earth is happening??????)

3. Total loans is now 1.001 Billion versus 986.542 million reported in its previous quarterly earnings!

How?

I do see many around who brands Lion Diversified as a so-called fundamental stock.

I just do not understand such branding.

Lion Diversified did great as a stock a couple of years ago because of the Parkson success story.

However, do understand this Lion Diversified is now a totally different story. There is no retail business left in this stock!

Look at the basic numbers. What does one have? For me, in my flawed opinion, I see a company with massive losses and a terribly deteriorating balance sheet.

And look at the stock price. It last traded at 29 sen.

Can you see why it is trading so low?

Well, the receivables ballooning is of course due to the credit crunch... customers unable to pay on time, and such.

ReplyDeleteAs for the ICULS... yes, it's very obvious that the company was about to run out of money, and had to issue ICULS.