This morning I posted How Now AirAsia? Oil Prices At Highest This Year and I got an interesting set of comments from Maverick.

- In the 3rd quarter Air Asia booked a loss of 215m exceptional item. In Note 16 there is no mentioning of cost for Thai AirAsia or PT Indonesia AirAsia on this matter. Amount due from these two companies in the balance sheet are 101m and 143m.

This is AirAsia's Q3 earnings. Quarterly rpt on consolidated results for the financial period ended 30/9/2008

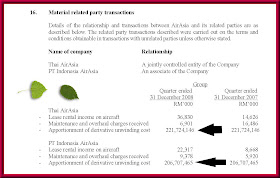

Here is a screen shot of Note 16.

- In the 4th quarter Air Asia had an exceptional item of 426m. In note 16 suddenly there are amounts of 222m and 207m "apportionment of derivative unwinding cost". The amount due from the two daughter companies in the balance sheet increased to 313m and 332m.

This is AirAsia's Q4 earnings. Quarterly rpt on consolidated results for the financial period ended 31/12/2008

The following shows what Maverick is talking about.

And the balance sheet showing how amount due from associates jumped!

Maverick then continues.

- It looks like "suddenly" Air Asia realized that the losses from their hedging activities were getting too high, and they decided to shift parts of it to their two daughter companies.

The way they account for these daughters is that they dont equity account any more losses there, since their initial investment has been written off. So what is increasing is the amount due from these companies

I find this all rather fishy, this whole way of accounting for the two daughter companies.

By the way, from their 2008 annual report, interview with Tony:

==============================

Q: Has your appetite for risk changed as a result of a more challenging economic climate and higher fuel price?

A : The definitive answer is “no.” AirAsia has long pursued a disciplined, consistent and prudent approach to business risk management. This means our risk appetite remains consistent whether the economy is growing or slowing. It’s an approach that delivers better and more predictable returns for our shareholders.

=============================

Dude, are you sure? Better and more predictable returns to the shareholders?

How?

I feel that there is indeed justifications in what's highlighted by Maverick here.

What say you?

No comments:

Post a Comment