I had a look at Lion Corp's earnings. Tonight Lion Corp reported its earnings. It wasn't good. Losses were huge. It lost some 400 million this quarter and losses this year totalled a massive one billion ringgit

I had a look at the balance sheet. It's inventories shrank. Worse still its cash balances fell to just 98 million compared to 141 million a quarter ago!

And their loans?

Ahh... there's one silver lining her. Loans declined to 'just' 2.989 billion.

ps.. the other Lion wasn't too good either.

Posted on the Edge Financialy Daily:

- LionDiv, Lion Corp sink further into the red

Written by Joseph Chin

Thursday, 27 August 2009 20:26

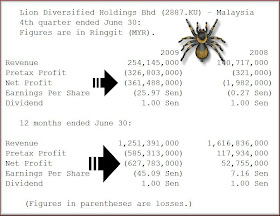

KUALA LUMPUR: LION DIVERSIFIED HOLDINGS BHD [] (LionDiv) sunk deeper into the red in the fourth quarter ended June 30, 2009 with a net loss of RM361.49 million compared with net loss of RM1.98 million a year earlier, due mainly to losses at its associates.

In its statement to Bursa Malaysia, Lion Diversified said its 4Q revenue rose to RM254.14 million from RM140.72 million. Loss per share widened to 25.97 sen from 0.27 sen.

LionDiv said it was impacted by losses of RM345.58 million from associates in the quarter, compared with gains of RM16.24 million a year earlier. However, there was an unrealised foreign exchange (forex) gain of RM17.83 million in the 4Q09.

For the FY09, net losses totalled RM627.78 million, compared with net profits of RM52.75 million for FY08. However, it registered a marginally higher profit from operations of RM204 million even though revenue fell to RM1.25 billion from RM1.61 billion.

The full-year contribution from the new direct reduced iron operation, which commenced in June 2008, had partially mitigated the dilution impact from the divestment of the retail business in the previous year.

"Our associates recorded substantial losses for the year as a result of the sudden and sharp drop in international steel prices. Demand weakened considerably as major economies begin to fall into recessionary conditions. After accounting for unrealised forex losses resulting from the translation of US dollar bonds, a loss before taxation of RM585 million was posted for the year under review," it said.

Meanwhile, its 59.04% owned subsidiary Lion Corp Bhd also posted higher net loss of RM406.38 million for its fourth quarter ended June 30, compared with a net loss of RM44.57 million a year earlier.

Its revenue plunged 74.5% to RM408.38 million from RM1.60 billion in the previous corresponding period.

"The results of the group continued to be affected by the global recession and uncertainties surrounding the global economic recovery. For the quarter under review, the group has further recognised a provision for diminution in value of its steel inventories amounting to RM159.3 million," Lion Corp said in notes to its quarterly results.

It anticipated results to be better in the next financial year on the back of an improved operating environment.

No comments:

Post a Comment