And yeah, it made money, some 13 million in net profit. I had to make sure I made this posting this morning - I have to give credit else there will be the usual complains from the usual suspect. ( Do I Not Give Credit Where Credit Is Due? )

Company said the following.

- The Group recorded revenue of RM409.6 million in the current quarter under review, a slight decrease of 5.2% or RM22.7 million from RM432.3 million recorded in the immediate preceding quarter. However, the Group recorded a pre-tax profit of RM13.1 million as compared to preceding quarter pre-tax loss of RM94.9 million. This is mainly due to higher selling prices of steel products and improvement margins for the Group.

And here is the stats from DJ.

- Margins improving

- On the first step towards recovery. Turnaround theme yo!

- Just imagine... if Perwaja net earnings recover to 302 million. (What's that commonly used expression again? 'Wahlaueh ho sey liao'! Hope I am not using the expression wrongly. )

The.. the ... the .. 'nothing good to say' would say the following...

Yes, Perwaja did not lose money for the quarter but look at 'same quarter previous year' comparison. Last year same period, sales revenue was around 977 million. Perwaja current revenue is only some 409 million.

Hence, isn't there justifications that Perwaja is far away from full recovery?

And if this is the case, what does it say for Perwaja the stock?

Perwaja was trading as low as 59 sen in March. Perhaps it was the peak of pessimism and perhaps the market had priced Perwaja for total annihilation. Yeah, in the short term, anything can and will happen in the market.

But how unjustifiable was the market?

How weak was Perwaja fundamentally?

In the posting, OSK's Recommendation On Perwaja Holdings, Perwaja's balance sheet was captured: here.

Did the balance sheet reflected how weak Perwaja was fundamentally?

It's cash balances was a mere 17 million and total company loans amounted a whopping 867 million. Wasn't it scary? No? And not to mention Perwaja's earnings were deteriorating each quarter. Year-to-date (half year) losses were more than 56 million.

Anyway, Perwaja today is at 1.37.

In March it was 0.59 sen.

How?

Before one talk if the recent rally in the stock price is justifiable or not, have a look at Perwaja's current balance sheet.

What I have done is that I have overlayed Perwaja's LATEST balance sheet on the RIGHT. On the left was what I was looking at back in May 2009. (see posting OSK's Recommendation On Perwaja Holdings )

Cash continued to weaken!

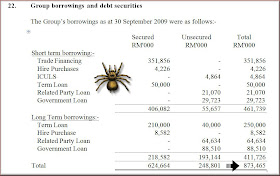

Now let's divert attention to Perwaja's borrowings.

Total borrowings is now at 873 million!

Cash is only at some 15 million!

And not helping is that trade payables is more than 500 million.

How?

Given the fact that Perwaja stock HAD ALREADY rallied strongly, would you, as an investor, be interested in this Perwaja 'turnaround' story?

Or would you not say that whatever turnaround had already been priced into the stock?

No comments:

Post a Comment