But before I get into that, let's review the past postings.

In Feb 2009, I highlighted the massive losses posted by CSC Steel: A Look At CSC Steel Latest Quarterly Earnings. Quarterly losses announced by CSC Steel were around some 42 million.

On 11th May 2009, CSC gave a profit warning saying that flat steel products used in cars and home appliances had deteriorated since the fourth quarter of last year and expects its profit downtrend to continue because of falling steel prices and production cuts arising from lower demand. ( LOL! As you know, sometimes in a hot market, anything can and will happen! That very same morning, CSC Steel Soars Despite Profit Warning! )

A week later, on 18th May 2009, CSC announced its 2009 Q1 earnings. It made some 5.709 million. A turnaround perhaps.

From the company earnings notes.

- B1. Review of performance

The Group achieved revenue and profit before tax for the current quarter of RM173.2 million and RM7.5 million respectively. This represents a reduction of RM169.8 million or 49.5% lower in revenue than that of its corresponding quarter. As a result of the revenue contraction, profit before tax of RM27.1 million in the corresponding quarter was reduced by RM19.6 million or 72.5% to RM7.5 million.

The significant drop in revenue is due to sales volume contraction and lower selling prices of our steel products. The lower profit before tax was mainly due to lower revenue achieved in the current quarter.

B2. Variation of results against preceding quarter

The Group’s revenue has decreased by 15.6%, from RM205.1 million in the preceding quarter to RM173.2 million in this quarter. The decrease in revenue is due to significant drop in the selling prices of our steel products.

Despite the decrease in revenue, the Group’s profit before tax increased by RM66 million from a loss of RM58.5 million in the preceding quarter to a profit of RM7.5 million this quarter due to the absence of charges made in respect of inventory write-down and impairment loss on plant and equipment totalling RM65.6 million during the previous quarter and the recovery of doubtful debts of RM4.9 million during the quarter.

13th November 2009, CSC announced its Q3 earnings. Most were impressed. The Edge Financial Daily had this article: CSC Steel 3Q net profit up 42% to RM39m

- CSC Steel 3Q net profit up 42% to RM39m

Written by Joseph Chin

Friday, 13 November 2009 19:57

KUALA LUMPUR: CSC Steel Holdings Bhd posted net profit of RM38.89 million in the third quarter ended Sept 30, an improvement of 42% from RM27.32 million a year, mainly due to the absence of the write-down in inventories.

It said on Friday, Nov 13 that revenue was RM261.48 million, down 31.4% from RM381.17 million a year ago. Earnings per share was 10.42 sen compared with 7.29 sen.

"The significant drop in revenue is due to lower selling prices of our steel products although sale volume improved marginally," it said.

"Despite the lower revenue, profit before tax increased by RM25.1 million or 88.2% to RM53.6 million. This is mainly due to the absence of the write-down of inventories to net realisable value amounted to RM30 million made in the corresponding quarter," it added.

When compared with the second quarter ended June 30, 2009, the group's revenue rose 61.9% from RM161.6 million to RM261.5 million in 3Q. Profit before tax increased by RM41.1 million or 328% from RM12.5 million in 2Q.

CSC Steel said the better performances in revenue and profit before tax were driven by both higher sales volume and favourable selling prices of its steel products.

"The improved sale volume was supported by the timely increase in supply of hot rolled steel (HRC) from our ultimate parent company, China Steel Corporation, to make up for the delay in local HRC supply," it added.

For the January-September period, net profit was RM54.03 million compared with RM100.85 million the previous corresponding period. Revenue also fell, down to RM596.19 million compared with RM1.167 billion a year ago.

On the current year prospects, it said the local steel market has slowed down since October 2009 after a series of price increases since second quarter 2009.

CSC Steel said overcapacity and high inventory which caused steel prices falling in China since August 2009 was the main factor that made local buyers cautious in re-stocking activities.

However, from mid October 2009, steel prices in China had begun to increase. CSC said the group expects steel market to recover by end of the year or beginning of 2010 as the stimulus packages introduced by many countries, especially China, with forecast GDP growth of above 8.0% this year, performed excellently.

As for Malaysia, it said domestic steel demand was increasing as projects under the stimulus packages, are being gradually implemented.

"Coupled with the current low inventory level, we expect greater re-ordering activities to take place once international steel market starts to recover," it said.

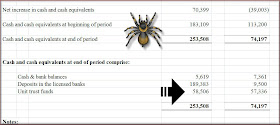

From the company's earnings notes. The cash balance.

It's impressive, no?

Its total borrowings were 13.705 million.

How can I not say it's impressive?

However, nothing is perfect. Such is life. LOL!

Posted a year ago, November 2008 Regarding CSC Steel'sCurrent Earnings And Its Investments In Marketable Securities. Some of the issues mentioned were:

- Ah. The marketable securities appears to be Unit Trust Funds! Now don't you want to know what kind of funds these are? What if there are commodity-linked funds?

4. But look at the size of their investment in these Unit Trust Funds. CSC has cash balances of 7.361 million and bank deposits of 9.5 million but it's Unit Trust Funds investments totals a whopping 57.336 million!!!! Surely, one has the rights to question if CSC Steel management has got their priorities correct or not! Is CSC an investment company or is it a steel manufacturer?Why is CSC investing such a big portion of their total cash into Unit Trusts given the current global credit crisis? Why?

5. The current quarterly earnings is for quarter ending 30th Sept 2008. Most Unit Trust Funds are down since then. As mentioned earlier, what if there are commodity-linked funds?

The following screen shot was taken from CSC latest Cash Flow statement from its latest quarterly earnings.

CSC Steel has some 58.506 million in Unit Trust Funds!

Is it too much?

Me? My answer is an astounding YES!

CSC Steel should realise that some investors simply DO NOT like to see such practice. If CSC has ample cash in its piggy bank, it would create more shareholder value if it returns more back to its shareholders! Yes, pay more back to the shareholders in the form of dividends and stop SCREWING around trying to make money in the Unit Trust markets. Stop dabbling in the market!

Of course, you might not argee but that above is my flawed opinion.

The following screen shot is taken from CSC earnings notes.

As can be seen, CSC is not losing making money but the money it is making is rather smallish, no? And if I were a shareholder, surely I would ask where is the justification in investing so much money in these Unit Trust funds?

Got extra moolah, share with the shareholders would certainly be a much viable option, no?

How?

ps: this is not your weekend tipsy la.

Hi, could u pls write some review on LIONFIB that belong to the same industry.

ReplyDeleteAs I have highlighted before, The investment in unit trust is most likely be Cash park in Amcash, which is a money market fund, a cash management plan by most company which have extra cash to earn better interest rather than placement in FD.

ReplyDeleteCash is King, CSC now has more financial resorces to undertake major CAPEX or other options to increse shareholder value if opportunity arise.

I see it as a pluc point for CSC (the better quality on it's balance sheets).

KC,

ReplyDeleteLOL!

You seem so annouyed that I have pointed out the fact that CSC had invested a massive amount in unit trust funds.

Yes, I remember what you had said before. And like before, your exact words were 'most likely'. And most likely is most likely. Nothing more, nothing less. It's not 100 percent certain, yes?

Don't you think CSC Steel should publish it clearly in its earnings notes which unit trust? So difficult to be more transparent meh?

And if it's AmCash, why AmCash? What not others? No other better fund? And what exactly was the investment?

58 million invested in unit trust is no small change.

But... if you think it's ok, then it's certainly OK for you.

I have no right to argue with you.

Seriously.. it's no problem with me at all. :D

But there are others who think it's NOT ok.

Put it this way, if I wanted ato invest in a unit trust fund, I would just go do it and invest in a unit trust. Why should I invest in a stock only to see it invest in 'dunno what unit trust fund'?

And about shareholder value. Like I said many times before, if company have excess money, I would rather see it give it back to the shareholders.

That's my view and you do not have to accept it.

:D