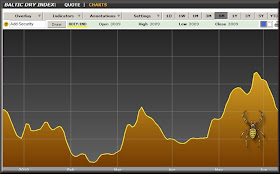

Yes, I am aware the possibility that one of causes of the steep decline could be caused by the surge in the supply of vessels but what I am concerned about is the slowdown of China's purchase of commodities.

The following news clip posted on Reuters offers many suggestions.. China commodities demand slows despite export pickup

- By Polly Yam and Ruby Lian

Business Economy

HONG KONG/SHANGHAI (Reuters) - China's imports of industrial commodities slowed in May despite a leap of almost 50 percent in the country's overall export figures, which global markets took as an encouraging signal about the state of the global economy.

China's total exports rose 48.5 percent in May from a year earlier and imports were up 48.3 percent, China's customs office said on Thursday, giving China a trade surplus of $19.5 billion, up from just $1.7 billion in April.

Imports of crude oil, refined fuel, copper, iron ore and rubber all slumped compared with April, giving little evidence of Chinese export strength feeding through into commodity demand.

Crude oil exports slid 16 percent, copper shipments fell 9 percent, and rubber exports fell 36 percent compared with the previous month. Aluminium imports were flat on the month, but 72 percent down from May last year.

However, China's commodity exports did benefit from the jump in exports overall, with net exports of steel products rising by more than a quarter to almost 5 million tonnes, a reversal of China's unusual position as a net importer a year ago.

Within China, many commodity traders are nervous of demand falling off because of a slowing property market and cooling growth in car sales, as well as oversupply of materials imported in vast quantities when prices fell after the financial crisis.

China's buying power was boosted throughout 2009 by the relative weakness of most other economies, enabling it to snap up sought-after supplies with little competition. That honeymoon has now ended.

"Chinese copper firms reduced their copper buys in May after international copper prices fell, despite running rates at copper smelters remaining at high levels. This means they were using their inventories," said Fang Junfeng, an analyst at Shanghai Cifco.

"June copper imports are expected to remain at the same level as May. But imports could fall by about 10 percent in July when the peak demand season ends."

SLUGGISH DEMAND, TOUGH EXPORTS

China's huge steel sector, which produced almost half the world's steel output last year, is now facing rising costs and production cuts in the third quarter of the year.

Citi analysts said in a research note that despite a long period of destocking, current trader inventory levels were still 35 percent higher than the 2009 average.

"We believe steel prices have no way to go but to fall off in the third quarter. Weak seasonality, sluggish demand from downstream and tough exports are all driving prices downwards," they said.

Exports of coke, used by steelmakers, almost doubled to more than 20 times the volume shipped a year ago, despite a 40 percent export tax, implying a lack of domestic demand. Imports of iron ore also fell by 6.2 percent from April.

"Most of the deals were signed in March or early April when prices were still high and buying was active, but orders have dramatically fallen in May after prices plummeted," said an iron ore trader based in Ningbo.

Imports of soybeans also rose on the month, to 4.37 million tonnes, but some buyers are cancelling cargoes after overbooking imports, leaving ports swamped with supplies.

"We have not booked anything for August. There are too many supplies at home and crushing margins were negative, which could last for two months," said an official at a soy crushing firm in Dalian.

No comments:

Post a Comment