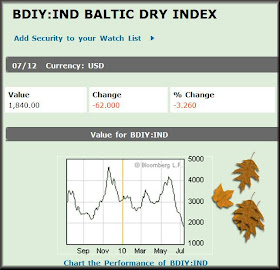

The Baltic Dry Index has continued its free fall.

Here's the closing Baltic Indices.

- Baltic Indices

Baltic Dry 1,840 (-3.26%)

Baltic Capesize 1,949 (-7.28%)

Baltic Panamax 1,941 (-0.15%)

Baltic Supramax 1,789 (-1.54%)

Baltic Handysize 988 (-1.50%)

As of 07/12/10

Baltic Dirty Tanker 789 (-0.88%)

Baltic Clean Tanker 812 (-0.12%)

As of 07/12/10

The lack of demand for iron core and coal is clearly highlighted by the massive plunge in the Baltic Capesize Index. ( Capesizes usually haul the 150,000 tonne cargo such as iron core and coal)

The comparison YTD performance between Capesize and Dry Index.

No demand for iron core equals no demand for shipping!

- Commodity Shipping Slumps for Longest in 9 Years on China Steel

The Baltic Dry Index, a measure of commodity shipping costs, fell for the longest period in almost nine years as declining Chinese steel prices erode the nation’s iron ore demand.

The index of freight rates on international trade routes fell 38 points, or 2 percent, to 1,902 points today, according to the London-based Baltic Exchange. Today’s drop was the 31st straight decline. That’s the longest since the 34 sessions to Aug. 15, 2001, according to Baltic Exchange prices. Charter rates for all types of ships tracked by the exchange fell.

“We don’t see anything in the next two to three weeks that’s going to turn the market around,” Guy Campbell, head of dry bulk at Clarkson Plc, the world’s largest shipbroker, said by phone. “Everything is centered on China. We are still watching China in terms of where the steel price is going.”

The price of hot-rolled steel in China has declined 17 percent to 3,909 yuan ($577) a metric ton since rising to a 2010 high of 4,698 yuan on April 15, according to prices from Antaike Information Development. Some of the nation’s mills are shuttering blast furnaces for maintenance and others are relying on existing stockpiles instead of imports, Michael Gaylard, strategic director at Freight Investor Services Ltd., said by phone from Shanghai today.

Iron ore creates the single-biggest source of demand for dry-bulk shipping, according to data from Clarkson’s research unit. Trade in the steelmaking ingredient will total 996 million tons this year. Coal is second-largest at 865 million tons of seaborne trade. Grains are 315 million tons. ( source: here )

Recent postings on the current plunge..

- Baltic Dry Index Plunges But Container Rates Soars!

- Baltic Dirty Tanker Index And Baltic Dry Index Plunging.. What Does It Mean?

- Baltic Dry Index Continues To Plunge

- Time To Panic? BDI Down Over 40% In 20 Days! (June 24th )

- Baltic Dry Index Continues To Plunge! Are You Worried About the Possible Implications?

- Plunging Baltic Dry Index Reflects The Slowing China Commodity Demand

If we take Guy Campbell, head of dry bulk at Clarkson Plc, the world’s largest shipbroker, comments into consideration, that is, “We don’t see anything in the next two to three weeks that’s going to turn the market around,” then shouldn't we be concerned with the impact on the shippers. Surely idle ships for the next two to three weeks will not do any dry bulk shipper any good.

Posted on 13th May 2010, Baltic Dry Index Recovers An Impressive 45% And Offers A Ray Of Hope To The Greek Economy?

Now according to this Bloomberg news article, Greek Shipowners Waiting for Prices to Drop, RBS Says, Greece shipowners accounts for more vassels orders! And the longer the plunge its most likely RBS could be hurt also!

- The ratio of losses on RBS’s shipping loans has averaged 2 basis points, or 0.02 percent, in the past 20 years, according to Varnavides, who joined the bank’s shipping department in August 1974. He said he expects that trend to continue for the next several years. The bank’s shipping department is expanding lending, while the unit’s so-called non-core shipping lending has dropped, he said.

RBS has provided about $23 billion of credit to shippers, of which $20 billion has actually been borrowed, he said. In January last year, it had provided $25 billion of credit.

And the biggest Greece shipowner is Dryship and the strange thing was Dryship was downgraded last month, DryShips Stock Earns Downgrade and the downgrade was not based on dry bulk shipping but was based on its offshore oil deepwater drilling rigs!

Here's how Dryships is doing.

Not a bad or scary looking chart if you look at it from a 6 month's perspective but take a look at how Dryships had performed the past 3 years. It's a shocker...

Yup this stock once traded above 110. It's now less than 4 bucks! ( Blogged on Dryships back in 2008: Dryships, Maybulk and Dry Baltic Index (BDI) )

ps: Here's a screenshot of summary of ship sales...

Moola, I used google finance to have alook at shipping companies. DRYS is the biggest caps among them and when i looked at the 2nd & 3rd biggest caps companies in the sector, all their stock prices took a beating in this last 3 years!!..

ReplyDeleteNever though that the global shipping industry can be that badly hit.!!