- RM1b worth of new jobs in FY10 for Mudajaya

Written by Financial Daily

Thursday, 05 August 2010 11:23

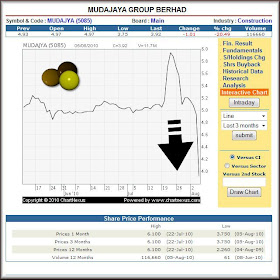

Mudajaya Group Bhd

(Aug 4, RM4.93)

Maintain buy at RM5.08 with a target price of RM7.33: Based on our estimates, Phase 1 (RM762 million) hit 41.9% completion as of June versus 23.2% in January. We understand that deliveries for the key plant components are slightly delayed to August from June as scheduled earlier due to minor specification changes. Nonetheless, management reaffirms that the entire project is on track for completion by end-2012.

We expect the bulk of the revenue recognition for Phase 1 to take effect this year. There are also plans to expand capacity by another 2x360MW when the existing four plants near completion.

This means Mudajaya could land another EP contract estimated to be worth RM1.7 billion.

The Indian government intends to set up nine Ultra Mega Power Plants (UMPPs), three of which have been awarded. The next two up for grabs are located in Chhattisgarh and Orissa, for which the prequalification of tenders will be conducted by end-August.

Evaluation is expected to take two to three months before the final tenders are called, which could then take another six to seven months before the results are known. Each UMPP will have a capacity of 4,000MW and cost about US$5 billion. Mudajaya intends to bid for both UMPPs via a consortium.

During its AGM, Tanjong said it intends to bid for the UMPPs together with Mudajaya. We gather that an Indian-listed contractor, IRB Infrastructure, could potentially be the consortium’s local partner.

Management did not provide details on the shareholding structure, but we think Mudajaya may take up a 20% to 25% stake. We believe that if successful at the bid, Mudajaya could grab a slice of the EPCC contract, expected to be worth US$3.75 billion.

Locally, Mudajaya will be submitting its tender for the civil works portion of the LRT extension, which will close by month-end. Recall that Mudajaya constructed some stations for the existing line.

The company is also looking at the seven highway projects planned under the Public Private Partnership (PPP).

However, it intends to participate in those jobs as a pure contractor instead of a concessionaire.

It is also eyeing some PFI projects comprising education facilities and power plants. Overall, management is guiding for RM1 billion worth of new jobs for FY10. — OSK Investment Research , Aug 4

This article appeared in The Edge Financial Daily, August 5, 2010.

As you know, Mudajaya shares plunged!

And OSK had a report with a recommendation of "Maintain buy at RM5.08 with a target price of RM7.33".

The next day stock plunges 20%!!

Ouch!!!

If OSK has sotong vision of very accurate prediction, why they need

ReplyDeletedesperately to promote it ? Just

keep 4 themselves lah until the money

fill up all their building space !!!!

true.. i do agree that osk always produce substandard report...

ReplyDeleteand i also had done research on their report, most of time, their prediction is wrong

The wonderful thing is that our beloved SC is doing what it calls an 'informal review' of Mudajaya's affairs....all this while fierce speculation is going on, and the company's shares roller-coast wildly. Methinks the greatest culprit is the SC...There is no such thing as 'informal review'. This is not a black market!!!

ReplyDeleteTHERE IS CONSPIRACY GOIN ON IN OSK.. WHAT IS THE MOTIVE TO COME THE REPORT AND THE SHARES PRICES PLUNGE THE NEXT DAY>

ReplyDeleteTHERE IS CONSPIRACY GOIN ON IN OSK.. WHAT IS THE MOTIVE TO COME THE REPORT AND THE SHARES PRICES PLUNGE THE NEXT DAY>

ReplyDeleteBe careful when reading OSK's report. Verify, verify and verify again lest you regret later!

ReplyDelete