Firstly, do remember I am not a Sotong. Yes, I do not know what this stock will or will not do in the future. I simply cannot predict stock movements and neither do I know if you can lose money if you just follow this blog.

Ok?

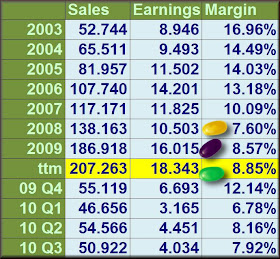

Now I usually view a company based upon a business perspective and the first question I would ask myself is the earnings track record.

1. Earnings Track Record.

What's your interpretation/opinion/view of the above track record?

My flawed view? Compared to 2003, earnings currently (ttm) and past fiscal yearnings has truly been much better.

However, it's not of a company which had shown consistent yearly earnings growth and in fact between 2005 to 2008, earnings had been rather poor and dismal because earnings was stagnant and I would also note that the profit margins had been declining since 2003.

So what's my overall view? A slightly average company? That's my flawed, personal view.

And needless to say, some would be appalled for me to base my conclusion of London Biscuit based on these set of numbers. Surely there's more to it than just looking at numbers like that!

Yes, that's absolutely correct but this is my basic initial scan of a company. If a company cannot get past this step and convince me that this could be a truly great company, what's the point of continuing?

See, I don't believe in trying to invest in every single company. I just try to invest in a couple of companies which I truly think has a wonderful set of business and what does a wonderful business have? A great profitable business, yes? I hope I am not wrong on this part because I truly believe that a great profitable business is extremely profitable and usually, it has an excellent growth record. And yes, the aim of course is to invest in these companies at cheap as possible. Yes, I am not the local 'bandaraya' and I do not believe in 'sapu-ing' every listed stock.

And for me, London Biscuit is looking mighty average only.

LOL!

I know, if it was me, I would stop here and move on but just to stop here and leave the review just like this, is rather.... err... tasteless.

LOL!

2. The FUNDAMENTALS of the COMPANY - Ze Balance Sheet

Yes, that's London Biscuit's balance sheet and seriously, from my flawed point of view, I really think it's awful!

That's no way how one would grow a business. I know I wouldn't if the business was mine!

And if it was me, I would have seriously walked away. There's not much reason to continue because London Biscuits does NOT look like a wonderful business to me. ;)

Sorry but this is my opinion and of course I could be wrong.

Anyway, if one have a brief look at the cash flow, one would be amazed to see what's happening in this company. (The below exercise, although rather tedious would allow one to gauge if my opinion that London Biscuit does NOT look like a wonderful business is wrong or not!)

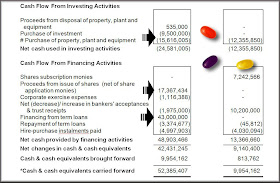

Aug 2004: Quarterly rpt on consolidated results for the financial period ended 30/6/2004

Ah... in fy 2004, London Biscuit's cash was boosted to 52.385 million. This was helped by the increase in long term loans by 43 million and a share placement issue of 6 million new shares at a price of rm1.60 and a rights issue helped raised some 17.367 million.

And note the 'purchase of investment' and purchase of 'property, plant and equipment' and the purchase of investment would have scored one big fat red flag for me. :P

Think about it for a moment.

Look at the balance sheet table again. London Biscuits for its fy 2003, had 10.215 million cash and 39.506 million in loans. It raised capital by doing a share placement of 10% and a rights issue. That raised 17.367 million. And they increased their long term borrowings by some 43 million! Ok, out of the money raised, the company 'invested' 15.616 million in plants, properties and equipment but it then spend some 9.5 million in 'investments'!!!!! Well, without the money raised, would London Biscuit be able to make that 9.5 million in 'investments'????

I mean, crudely put, part of the money raised from the rights issue, ultimately went into the investments!

Now surely this is NOT a company which is showing that it is managed prudently!

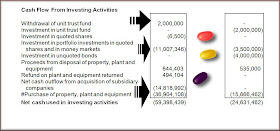

Aug 2005: Quarterly rpt on consolidated results for the financial period ended 30/6/2005

Now from the earlier balance sheet table, we know that for London Biscuit's fy 2005, it's loans increased from 78.3 million to 99.46 million.

And the above table shows where the bulk of money goes to!

Ok, it the unit trust fund was withdrawn but London Biscuit investment some 11.007 million and it purchased a company for 14.818 million ( here's one such announcement. see Acquisition of shares in Kinos Food Industries (M) Sdn Bhd (“KFI”) )and 36.9 million was spend in the purchase of plant, property and equipment.

London Biscuit now have 'spend' some 17.981 million in 'investments' and yes, it's mind boggling because the money 'spend' wasn't generated from London Biscuit's operations. It 'borrowed' the money!!!!

2006: Quarterly rpt on consolidated results for the financial period ended 30/6/2006

London Biscuit's fy 2006 total loans now stood at 108 million. In fy 2003, its total loans were just 39.506 million and the cash flow were telling another horror story yet again!

First they withdrew some 10.025 million from its portfolio investments but it during this period it also invested some 4.184 in quited shares.

But the last two lines paints a horrifc picture! It disposed some 6.305 million of 'property, plant and equipment' but at the same time, it also acquired some 23.362 million worth of 'property, plant and equipment'!!! Omigosh! What is it doing? Wheeling and dealing in these?????

Aug 2007: Quarterly rpt on consolidated results for the financial period ended 30/6/2007

London Biscuit's total loans now soared to 140 million!

And apparently, the management thinks what it is doing is correct as the wheeling and dealing continues!

On 17th Nov 2006, London Biscuits invested in Lay Hong! ( Damn! London Biscuit management thinks they are Warren Buffett or what???!!! ) ( see announcement on Bursa website here )

- As announced to Bursa Malaysia, on 17th November, 2006 and 29th November, 2006, the Company has acquired 20.0% of the issued and fully paid-up share capital of Lay Hong Berhad (“Lay Hong”), comprising 9,240,000 ordinary shares of RM1.00 each, for a total cash consideration of RM9,850,413.

Huhu!

London Biscuits is now buying stakes into listed companies!

Remember where and how London Biscuit is getting their money? :P

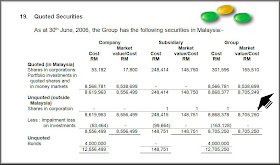

And their quoted securities for the year...

Aug 2008: Quarterly rpt on consolidated results for the financial period ended 30/6/2008

Huhu!!!! As per the balance sheet, London Biscuit's total loans now stood at 190 million for its fiscal year 2008!

So what did London Biscuit do with the extra money borrowed???

Yes, they wheeled and dealed yet again!

That 29.119 million acquisition is to be noted...

- The Board of Directors ("BOD") of LONBISC are pleased to announce that the Company had on 17 September 2007 signed a Sale & Purchase Agreement dated 17 September 2007 between KHEE SAN REALTY & HOLDINGS SDN BHD (“KSRH”) for the Proposed Acquisition of 18,420,300 ordinary shares of RM1.00 each in KHEESAN representing approximately 30.7% of the enlarged issued and paid-up share capital of KHEESAN (‘the said Sale Shares”) for a total cash consideration of RM27,630,450.00

Paid 27.630 million for 18.420 million shares in Khee San. (LOL! Have you even heard of this listed stock before? :P )

The purchase was announced on 17th Sep 2007.

This was Khee San earnings reported on Nov 2006. Quarterly rpt on consolidated results for the financial period ended 30/6/2006. Was Khee San such a profitable company that London Biscuit thought it was prudent to spend some 27.6 million of 'borrowed' money?

This was Khee San earnings reported on May 2007. Quarterly rpt on consolidated results for the financial period ended 31/3/2007. Khee San was losing money!

Aug 2007. Khee San reported losses for the fiscal year! Quarterly rpt on consolidated results for the financial period ended 30/6/2007

19th Sep 2007: London Biscuit explained thier purchase to Bursa: PROPOSED ACQUISITION OF 18,420,300 ORDINARY SHARES OF RM1.00 EACH IN KHEE SAN BERHAD ("KHEESAN") REPRESENTING APPROXIMATELY 30.7% OF THE ENLARGED ISSUED AND PAID-UP SHARE CAPITAL OF KHEESAN FOR A TOTAL CASH CONSIDERATION OF RM27,630,450.00 ("PROPOSED ACQUISITION") BY LONDON BISCUITS BERHAD ("LONBISC")

- The Board of LONBISC wishes to inform :-1) Basis of arriving at the consideration of RM27,630,450.

The consideration is arrived at on a "WILLING BUYER, WILLING SELLER" basis.

Willing buyer, willing seller? LOL! I wonder if Khee San was more than willing to dispose that chunk of shares for 27.6 million?

ps: 27.630 million paid for 18.420 million. How much per share cost?

London Biscuits quoted shares for the year...

Aug 2009: Quarterly rpt on consolidated results for the financial period ended 30/6/2009

And London Biscuit does the unthinkable! It supplied the minority shareholders with the following cash flow statement!

All we can see is that another 12.9 million was used in its 'investing' activities!!!!

Their quoted shares...

Time to look for its 2009 Annual report. :P

Aha! More wheeling and dealing in its 'property, plants and equipments'!!!

May 2010: Quarterly rpt on consolidated results for the financial period ended 31/3/2010

Total loans for London Biscuit is now 210 million.

So far, this fiscal year, some 42.809 million was spend by London Biscuit in its investing activities!

Seriously, mind boggling or what!

Ok, out of the 42.8 million spend, a chunk was spend on its 'investment' in TPC. ( See PROPOSED ACQUISITION OF 25,600,000 ORDINARY SHARES OF RM0.50 EACH IN TPC PLUS BERHAD ("TPC") REPRESENTING APPROXIMATELY 32% OF THE ISSUED AND PAID-UP SHARE CAPITAL OF TPC FOR A TOTAL CASH CONSIDERATION OF APPROXIMATELY RM7,680,000.00 ("PROPOSED ACQUISITION") BY LONDON BISCUITS BERHAD ("LONBISC") )

And here is TPC last reported earnings. Quarterly rpt on consolidated results for the financial period ended 31/3/2009 Yeah, TPC is losing money!!!

And this is Khee San last reported earnings. Quarterly rpt on consolidated results for the financial period ended 31/3/2009 Quarterly profit of only 207 thousand and a ytd profit of 1.104 million!!! (yeah London Biscuit paid some 27 million for this investment!)

And some 17.689 million new ESOS shares were listed recently.

Consider this, London Biscuit share base before the ESOS was 78.045 million. After ESOS, London Biscuit share base is now 95.734 million!!!!!!!!!!!

OMIGOSH!!!!!!!!!!!!!!!!

What a massive dilutive ESOS!!!!

To picture it more clearly, look at the TTM earnings of 18.343 million and for simplicity sake, assume London Biscuit to trade at a fair value based on 10x PE.

Based on 78.045 million shares and an earnings of 18.343 million, London Biscuit eps was 23.5 sen. 10x PE would means London Biscuit should trade at 2.35.

Based on 95.734 million shares and an earings of 18.343 million, London Biscuit eps is now 19.1 sen. 10x PE would means London Biscuit should trade at 1.91!

From 2.35 to 1.91!!!!

Honey dearest, London Biscuit has shrunk your eps via ESOS!!!!

And the dilution applies to dividends too! Unless London Biscuit figures a way out to pay more money back as dividends!

What a massive dilution!

How?

Does London Biscuit sound like an attractive and wonderful business?

And the most amazing thing is the 'property, plant and equipment' purchases and disposals each year!

Now if I add them up in a table, (the last couple of years, purchases were more than disposals, so the total amount represents the net purchases), this is what I get. (Now this is important, because some might try to value London Biscuit based on its NTA)

The last column is named PLANTS.

It represents the NET money, London Biscuits have spend each year on 'property, plant and equipment'.

In 2003, the property, plant and equipment was worth 79,573,688 million. NTA then was 1.56.

As per latest, the property, plant and equipment is worth a whopping 349.150 million!! NTA today as per it's last reported earnings in May is worth 2.04!

But... how much would you trust the value of the 'property, plant and equipment'???

Let's consider the 2009 annual report. London Biscuit purchases of such 'asset' was only some 32.395 million. London Biscuit disposal of such 'asset' was 19.107 million.

How?

Me? I have no idea and I wouldn't even dare invest in such a company based on its NTA. Now this is my personal opinion. Hey I am a chicken. I have no idea what on earth is happening! I have no idea why London Biscuit is purchasing and disposing so much property, plant and equipment each year!! And since I do not know, natutally I would not dare invest. And this is my flawed opinion and it's not an investment advice at all. :D

Ok?

Hi Moola,

ReplyDeleteAbsolutely love the way you analyse the quarterly numbers. Keep up the good work!

thank you.

ReplyDeleteCannot understand what you write.

ReplyDeleteasdf1234: TQ

ReplyDeleteChin: you are welcomed.

Loke: HUH?????? sigh.

An ugly balance sheet covered with nice PE ratio. I would give the management credit for its ability to raise funds investing in securities and bond. They have demonstrated a different set of professional skill. Sadly to say… it fails to beat the market like most investors.

ReplyDeleteMoolah, can you review Tomypak prospect?

If can... tomorrow. :P

ReplyDeleteMany thanks for sharing your hard work.

ReplyDeleteJust don't hate me if my comments does not suit you. :P

ReplyDeleteThere were some analysts bullish on the potential of ‘High Barrier Vacuum Metallized Laminates’ packing. Both Tomypak and Daibochi Plastic are benefited from their optimistic recommendation. Anyway, I am not shareholder of the company so no harm in listening different point of view. : D

ReplyDeleteSome have hated me before because my views clearly differed from theirs.

ReplyDeleteAnd the strange issue was I commented on the issue and not on the stock price but somehow they think I have strange magical powers, which seriously I don't. :P

I guess they were sizeable minority shareholders of the stock you commented. They thought you were sotong so your pessimitic comments might indirectly dumping the share price which might cause them to lose money.

ReplyDeleteLOL.

On the other hand, this company was praised as ... "A credible business model and a strong management team that executes well." See the posts below.

ReplyDeleteTuesday, January 19, 2010

Why I Like London Biscuits

http://malaysiafinance.blogspot.com/2010/01/why-i-like-london-biscuits.html

Tuesday, April 06, 2010

Possibly The Best Value Counter In Bursa

http://malaysiafinance.blogspot.com/2010/04/possibly-best-value-counter-in-bursa.html

Friday, July 16, 2010

Good Stocks On The Move

http://malaysiafinance.blogspot.com/2010/07/good-stocks-on-move.html

Thanks Moola for pointing out to us how gruesome the business of this company actually is ... having to borrow a lot of money just to grow.

tklaw: Missed this one sentence.

ReplyDelete"An ugly balance sheet covered with nice PE ratio".

LOL! What is a nice PE ratio?

Here are some opinions.

1. The PE ratio does NOT state if a company is nice or NOT. Yes, the PE ratio does NOT state indicate the quality of a company!!!

2. PE only indicates what the current traded price compared to the earnings. Sounds simple and understandable but there the factors involved, the P and the E, they are both not constand.

The Price changes and the E changes.

And the E is usuall an estimate earnings.

And then, if the share base increases, the E would also change.

So what's a nice PE ratio?

I know.. the PE is low.

LOL!

Granted that is the meaning.. but what's the suggestion? what's the interpretation?

Mine?

Take LonBis. Assume it is trading at an earnings multiple below 10 compared to its 2012 earnings estimates.

Does this indicate LonBis is a great business?

No it doesn't. Not for me.

What it tells is that the market is ignoring the potential of LonBis earnings. That's all.

Why?

Well for starters, the balance sheet, which is a great indicator on how well a company is managed, is simply a horror show. It's crazy and the recent ESOS is even more absurb.

Now if the market hates this fact, doesn't it explain why the stock is trding so low compared to whatever earnings potential it has?

:D

I agreed what you said. What I meant of ‘nice’ PE ratio is low PE. Some prefer to make a quick decision to buy a stock by simply referring to its earnings without going thru the fundamental.

ReplyDeleteAnyway, Londbis is not my appetite because it is too risky…a biscuit company borrows money to invest in securities, unit trust or bond…as what you said they thought they were Warren Buffett. LOL

Hi Moolah,

ReplyDeleteI think one can learn a lot by just reading your write up. Keep it going and I absolutely agree with your quote : "I don't believe in trying to invest in every single company. I just try to invest in a couple of companies which I truly think has a wonderful set of business".

Thank you. Keep it going.

What I can see is EGGs(TPC) and Confectionaries(Kheesan) that London Biscuit is after?

ReplyDeleteBut that two companies are also not making a lot of monies? Strange yet strange..not for profit and dividend, is it for strategic stakes? Very much doubtful....

There are merits in Dali's writing (Malaysiafinance)...the timing of entry. if one have bought some by the time he wrotes, now you should be happy with 20% return. I think Moolah is trying to prewarn whether this stock is worth to hold for longer view which nobody could predict the up and down....

I think we are quite blessed of having 2 great minds for us and free.

WOW!

ReplyDeleteI make and give NO advice. :D

Cause I am lousy! LOL!

ps: to ass_u_me is to make an ASS out of U and ME.

:D

Me too, I am charlie charlie chickedee....purely for education and learning purpose.

ReplyDeleteEither we stay put with ear muff, or we progress with fact??

LOL! LOL! LOL!

ReplyDeleteYou are not going to let a sleeping cow lie, eh? :P :P

ok.. take Khee San acquisition.

How much did LonBis pay? 27.630 million.

How many shares did LonBis get? 18.420 million.

What does this suggest to you?

And look at what LonBis had done since fy 2004?

It raised money and it borrowed money and what did it do? It invested and bought some 'property, plant and equipment' (do I know eaxctly what the property, plant and equipment were? No i don't. Do you?)

And it repested this process each year.

Wash, rinse and repeat.

Now compare now and back in 2003.

London Biscuits for its fy 2003, had 10.215 million cash and 39.506 million in loans.

Today? London Biscuits has 15.5068 million cash and 218.004 million in loans.

Does this look like a truly wonderful business to you?

:D

hi dude,

ReplyDeleteGreat work. maybe this UK biscuit is too complex for me to understand,so much so i never put my money into it.

Most of the local foods companies like to deal with other investment. Sign...

Moolah,

ReplyDeleteAn excellent and detail analysis of London Biscuit. This should give valuable reference to those who think LB is an excellent buy because of its seemingly low PE ratio. I agree with all things written by you (not trying to 'bodek' you). Just to add some of my observations. LB borrows heavily for its business and what is the return of the invested capital and return of equity? A poor 7% and 9.8% respectively. I would say ROIC and ROE should be at least 12% and 15% respectively for LB kind of leverage of 2.6. Look at the times interest earned at 2.4. This means more than 40% of what it earns goes to paying interest alone. what about tax authority and shareholders? If one cares to look more closely, there is hardly any free cash flows for the past few years. No wonder it is trading so 'cheaply'.

hhc: LOL! You are getting too humble. :P

ReplyDeleteK C: Thanks! :)

Another good anlysis on London Bis.

ReplyDeleteHey bro, can we have ur analysis on Insas.

Tks

Companies make capital expenditure all the time. Care to explain your fuss over the plants and machinery issue?

ReplyDeleteTQ