Flashback.... 13 Nov 2004.

- Johor Port diversifies into property

November 13 2004

JOHOR Port Bhd, controlled by Tan Sri Syed Mokhtar Al-Bukhary, is diversifying into property development to broaden its earnings base.

The company has proposed to buy land in Pontian, Johor, for RM403 million cash.

The five parcels of leasehold land of about 890ha are designated for petrochemical and maritime industry use. The land is located opposite the Port of Tanjung Pelepas.

Johor Port is also buying the entire stake in Seaport Worldwide Sdn Bhd, which owns the land, from Indra Cita Sdn Bhd, also controlled by Syed Mokhtar.

“The development of the land into a petrochemical and maritime industry centre is expected to contribute positively to the existing business of the group as shipping, warehousing and other logistic and distribution activities are expected to rise in tandem with such development,” Johor Port announced on Wednesday.

However, the company said it has no operating history in property development.

“Therefore, there is uncertainty as to whether this new business would be successful or the cost of investment in Seaport would be recovered,” it added.

“Nevertheless, Seaport may leverage on Johor Port’s vast experience and skills in maritime-related activities, which are inherent in the existing business of the group,” it said.

Johor Port also said that it had entered a conditional subscription agreement with Indra Cita and Seaport to buy one million new shares of RM1 each in Seaport at RM403 per share.

Under the terms of the agreement, Johor Port will subscribe for the Seaport shares in three portions. It will pay RM141.05 million for the first two portions in the first quarter of next year and RM120.9 million for the third portion in the first quarter of 2006.

Johor Port said it will finance the acquisition with internally-generated funds.

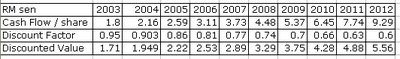

Upon completion of the proposed acquisition, Johor Port’s consolidated net earnings per share (EPS) will be reduced by about 4.48 sen per year arising from the settlement of the interest- bearing debt owed by Seaport Terminal and the reduction in interest income to the company due to the payment of the purchase consideration.

For the six months ended June 30 2004, Johor Port reported a net profit of RM44.9 million on the back of a revenue of RM160.2 million. EPS was at 13.62 sen.

Johor Port was trading at 2.49 then.

And Johor Port is what one would call a clean cash company, flush with cash and no debt.

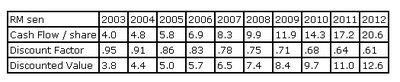

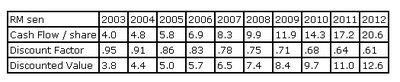

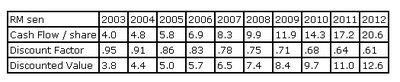

Now if one checked on the quarterly earnings (

note the importance of quarterly earnings) , one would note that Johor Port had 266 million net cash. BUT it also has an existing 178 million owing from holding company. (*cough*) How much is that worth? Well, 178 million would equate to around 53.9 sen cash per share. So instead of the holding company owing money to Johor Port, why can't Johor Port get the money back from the holding company and return the cash back to the minorities?

And out of the blue, Johor Port announces they are investing into property.

A business with they has no experience in. A business which one of the majority shareholder has vested interest in. The left hand sell to the right hand, the right hand sells to the public.

( Isn't this yet another highlight proving yet again one cannot rely SOLELY on cash per share yardstick. Yes, it is very good to know that the company u want to invest in is in a nett cash position BUT this should NOT be the main reason why one invest into the stock. Because the owner can just do anything they want with the cash!! )

The market wasn't impressed and RHB Research came out strongly opposing the deal.

-------------------------

17 November, 2004

RHB Highlights

Johor Port Bhd (RM2.46) : Acquiring 2,256 Acres Of Land From Controlling Shareholder For RM403m Downgrade to UNDERPERFORM

Johor Port has proposed to acquire from ultimate controlling shareholder Indra Cita Sdn Bhd (Indra Cita) five parcels of leasehold land measuring a total of 2,255.5 acres in Mukims of Serkat and Sungai Karang, Pontian District, Johor, at the south western tip of Peninsular Malaysia, for RM403m. Designated for petrochemical and maritime industry use, the land is located at the river mouth of Sungai Pulai and opposite of the Port of Tanjung Pelepas. The southern part of the land adjoins to the project site for the Tanjung Bin power plant.

Indra Cita holds a 100% stake in Johor Port’s parent Seaport Terminal (Johore) Sdn Bhd (Seaport Terminal) which in turn owns a 51.7% stake in Johor Port.

As the deal will be bundled together with the settlement of the RM182.1m inter-company loan owed by Seaport Terminal to Johor Port, Johor Port will effectively only fork out RM220.9m for the acquisition.

Independent valuer Henry Butcher puts a market value of RM540m to the land. After accounting for "estimated deferred taxation attributable to the fair value of the land" amounting to RM137m, the net value is assessed to be RM403m or about RM179,000/acre or RM4.10/sf. Indra Cita has invested or incurred a total sum of RM50.7m (including payment of land premium) in relation to the land.

This means Indra Cita will walk away with RM352.3m profits.

Rationale for the proposed acquisition, according to Johor Port, is to "diversify its business portfolio to include property development activities". Johor Port also believes its existing businesses, i.e. shipping, warehousing, and logistics and distribution activities will rise in tandem with the development of the land into a petrochemical and maritime industry centre. Johor Port estimates that the acquisition will erode its EPS by 4.5sen due to interest income foregone.

We find Johor Port’s rationale for the acquisition lame. We do not think the acquisition makes commercial sense to Johor Port based on the following reasons:

1. Given the defensive nature of the port business, we find it unnecessary for Johor Port to "diversify" its earnings base in order to counter sector-specific cyclical downturns, more so, to diversify into property development that is totally unrelated and provides no synergy to the port business;

2. While Johor Port did have cash balances of RM266m as at 30 June 2004 that it can spend, there are other top priorities. Johor Port Corporate Affairs Director Dr. Lim Meng Soon was quoted by the press on 7 October 2004 as saying that Johor Port has plans to invest RM200m over the next two years to build five new warehouses and upgrade wharfs, jetties, equipment, warehouse infrastructure and computerised systems, in anticipation of a significant rise in throughput. In addition, Johor Port’s outstanding long-term loans amounting to a total of RM200m are due for repayment by instalment from now to July 2008, including a bullet payment of RM70m in January 2006;

3.

The acquisition will turn Johor Port from an asset-light-cash-rich company into an asset-rich-cash-strapped company. In consideration for the land, Johor Port will not only forego some RM182m inter-company loan owed to it by Seaport Terminal, it will also part with some additional RM221m. This will almost deplete its cash balances of RM266m that are earmarked for capital expenditure over the next two years and loan repayment over the next four years. Johor Port will turn from a net cash of RM66m as at 30 June 2004, to a net debt of RM154m, translating into a net gearing of 0.2x after the acquisition;

4.

We doubt if the industrial plots/properties at the proposed "petrochemical industrial centre" on the land will be selling like hot cakes, given the already crowded playing field. There are now already three designated petrochemial centres in Malaysia, i.e. Kertih in Terengganu, Gebeng in Pahang, and closer to home, Pasir Gudang/Tanjung Langsat in Johor;

5. Assuming the petrochemical centre project on the land is indeed viable, Johor Port’s immediate upside potential is nonetheless fully exhausted. This is because the land will be acquired in its converted form and at the market rate for converted land in the Pontian area. Assuming an efficiency of 90%, i.e. 90% of the land area is saleable after providing for infrastructure, the adjusted cost of the land to Johor Port will be about RM198,500/acre or RM4.55/sf. Several small plots of industrial land of less than 10 acres in the Pontian area have changed hands at about RM200,000/acre or RM4.60/sf in recent years.

As an aspiring first-time property developer, we find Johor Port extraordinary gung-ho by committing itself to 2,255.5 acres of land (equivalent to the size of two self-contained townships that take at least 14 years to complete, even at Klang Valley’s pace) at the market rate for converted land. The annual holding cost alone will be RM12m (based on interest income foregone at 3% p.a.) to RM24m (based on borrowing cost of 6% p.a.) that will erode Johor Port’s FY12/05 pretax profit by 8-16%.

Seasoned conventional developers do it differently. They buy agriculture land at cheap prices, convert the land themselves and probably in phases in order to minimise cash outflow (payment of land premium). They do buy converted land sometimes, but only if they are confident of flipping it, i.e. launching and selling the property, almost immediately to manage cashflow.

We view the latest corporate move of Johor Port negatively. We are downgrading Johor Port to UNDERPERFORM from Outperform with a view to cease coverage altogether. While the minority shareholders of Johor Port may still stand a chance of defeating the proposal at the EGM (Seaport Terminal will abstain from voting as it is a related party), we believe irrespective of the outcome of the EGM, the damage is already done!

------------------

Yeah, with this RELATED PARTY TRANSACTION, Johor Port soon traded below 2.00! If not mistaken, Johor Port soon sank to a low of 1.90. ( Remember it was trading at 2.49 before this)

-------------------

Now the Edge Weekly came out with the following article.

Corporate: Johor Port's plan draws flak

By Lim Ai Leen

It reeks of a bailout."

This statement comes from one fund manager, but it seems to reflect what most of the investing community thinks of Johor Port Bhd's plan to pay RM403 million for 2,255.5 acres of land in Pontian, Johor.

On Nov 10, Johor Port announced that it had entered into a conditional agreement with Indra Cita Sdn Bhd (IC) and Seaport Worldwide Sdn Bhd (SW) to acquire the entire equity interest in SW for RM403 million. SW owns five parcels of 99-year leasehold land measuring 2,255 acres, which has been designated as a petrochemical centre and for the maritime industry. This land is located opposite the Port of Tanjung Pelepas.

Two factors irk these fund managers.

First, this is a related-party transaction. IC is the majority shareholder of Johor Port, via its wholly owned subsidiary Seaport Terminal (Johore) Sdn Bhd (ST). ST, in turn, has a 51.7% stake in Johor Port. SW is another of IC's wholly owned subsidiaries. Business tycoon Tan Sri Syed Mokhtar Al-Bukhary sits at the top of this hierarchy of companies, as the ultimate owner of IC.

ST also owes Johor Port RM182.1 million as at Oct 31, this year. This debt will be settled by IC from the RM403 million, hence the bailout allegations. It is understood that this inter-company advance was first given to ST in 1999, when Johor Port had hopes of buying a 30% stake in Pelabuhan Tanjung Pelepas Sdn Bhd (PTP), which operates Port of Tanjung Pelepas. This plan was aborted subsequently, but the money remained at ST. PTP is now controlled by Malaysia Mining Corp Bhd, Syed Mokhtar's flagship company.

David Ng, portfolio manager at Hwang-DBS Asset Management, says Johor Port has been in his portfolio of stocks for the last six months, due to its low valuations. "The stock has always traded at a discount because of the outstanding loan. So it's been priced in. But the company was earning good interest in the books and we were hoping that some resolution would come through. But this is not the way we expected [the loan to be resolved]," he says.

Second, the RM403 million price tag seems a tad high, especially when compared with the RM50.7 million SW incurred to settle the land premium and registration fees with the state government. "There are no hints on what value IC has added since its acquisition [less than seven months ago]," says Hwang-DBS Vickers' research report dated Nov 17.

According to Hwang-DBS Vickers, the buy works out to RM4.10 psf, which, says a professional valuer, is expensive.

"Much of the land is under water. So whether the price is fair depends on who's paying for the reclamation costs and how much earth is needed," he says. According to Johor Port's announcement,

there will be further capital expenditure required for the planning and development of the land such as soil reclamation and infrastructure works.

Which means that Johor Port will bear the cost.

"Reclamation will cost between RM6 to RM8 psf. Even assuming a conservative reclamation cost of RM6 psf, and assuming that only 50% of the land is used, this will translate into a net land value of RM20 psf [RM6 plus RM4, divided by half]," he estimates. He says this is double the net value for Tanjung Langsat, a petrochemical zone built on solid soil in Pasir Gudang, Johor.

However, Johor Port's independent valuation, conducted by property consultant, Henry Butcher Malaysia (Johor) Sdn Bhd, estimates the market value of the land at RM540 million. This means that at RM403 million, Johor Port is getting the land at 25% below market value.

Good cash flow

In any event, it appears that Johor Port is looking beyond the immediate horizon. It believes that the land is strategically positioned for the future. "Its location… is another added advantage in terms of its possible linkage to the transportation infrastructure put in place by the Johor state government in an attempt to make Senai Airport [a regional cargo centre], Port of Tanjung Pelepas and Johor Port [both to function as major international shipping cargo centres], into a regional transportation hub…", it states in the announcement.

The fund managers, however, are not taken by the view.

"Investors are concerned because the company is buying land from a private entity belonging to a major shareholder. And they are wary because of the price that's being paid," surmises Ng.

He believes that this purchase, to be paid for from internal funds,

is not in the best interest of a company that currently trades at decent valuations and generates strong cash flows.

According to a shipping analyst,

Johor Port generates between RM90 million and RM100 million free cash flow per annum. It is also sitting on a RM266 million cash pile (as at June this year), which will be reduced once it forks out RM221 million (RM403 million less RM182 million loan set-off) for this venture.

"It is making good profits even though it charges the cheapest port rates in Malaysia. And now that there is talk that the tariffs will be revised upwards across the board, it stands to make even better profits," says Ng.

This won't happen, though, if the cash is sucked up in infrastructure and reclamation costs. And as yet, there is no indication of how long the project will take to give returns, or whether a port services company can turn itself into a successful property developer. Even Johor Port acknowledges the uncertainty.

It states in the announcement:

"The Johor Port group has no operating history in the property development business. Therefore, there is uncertainty as to whether this new business would be successful or the cost of investment in SW would be recovered. Nevertheless, SW may leverage on Johor Port's vast experience and skills in maritime-related activities, which is inherent in the existing business of the group which consists of shipping, warehousing and other logistics and distribution activities."

For the immediate term, the market is reacting negatively. The company stock fell from its six-month high of RM2.46 on Nov 10, to close at RM2.17 last Friday.

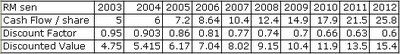

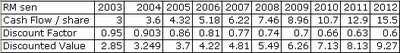

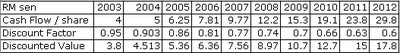

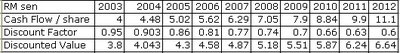

A local research house says its sensitivity analysis shows that earnings per share (EPS) for financial years ending Dec 31, 2004, to 2006, could fall by between 3% and 5% upon the completion of the deal. "This is mostly from the reduced inter-company loan interest and lower interest income from the net cash outflow," it states.

In the announcement, Johor Port states that the proposed acquisition is expected to decrease the consolidated net EPS of the company by approximately 4.48 sen.

It is early days yet, as Johor Port is still waiting for a feasibility study and due diligence review to be completed. Then the proposal has to pass muster with the regulatory authorities and the Minister of Finance Inc, who is Johor Port's special shareholder. On top of these approvals, the deal has to go before the 48.3% of shareholders who are not conflicted on the issue.

The dissenting voice is already getting louder. Ng believes that the minorities' ability to vote down the idea is "quite strong". He says: "The minority shareholders have to show that shareholder activism is growing in Malaysia. The days of minority shareholders just accepting their fate are gone."

The management of Johor Port declined to answer questions from The Edge, stating:

"We trust that the information as provided in the announcement will address all the queries…"

------------------------------

Ah... the minorities ability to vote down the idea.... let's see what happens next as time goes by.... hmm... is time the friend or enemy of mine?

------------------------------

Analysts: 'No' vote may boost Johor Port stock

By KANG SIEW LI

August 3 2005

JOHOR Port Bhd's share price will likely return to its previous record of RM2.49 last year if its shareholders vote against its proposal to buy Seaport Worldwide Sdn Bhd at the company's extraordinary general meeting on August 15, analysts say.

The share price has dropped 25 per cent since it announced plans to acquire Seaport Worldwide from Indra Citra Sdn Bhd for RM403 million last November.

The stock closed yesterday at RM1.90 per share, up 0.01 sen from Monday.

Seaport Worldwide owns five parcels of 99-year leasehold land measuring 913ha in Pontian, Johor, opposite Port of Tanjung Pelepas. The land is designated for petrochemical and maritime industry use.

Avenue Securities Sdn Bhd head of research Noor Azwa Mohammad Noor said analysts and investors did not like the deal and they made their feelings known through Johor Port's share price performance after announcement on the proposed deal was made.

"So, probably if the deal did not go through, the share price could even go back to the pre-announcement level which was between RM2.15 and RM2.50 per share," he told Business Times yesterday.

Noor Azwa reiterates an "outperform" rating on Johor Port's stock as he feels the negative news with regards to the controversial deal has been reflected in the share price given current undemanding valuation, which is even below historical lows.

"But if the deal goes through, I see no impact (on the company's earnings) for the financial years ending December 31 2005 and 2006," he added.

( Moolah: huh? No impact? But what about all the cash? Where will it go if the deal goes thru? )

Hwang-DBS Vickers Research Sdn Bhd senior analyst Wong Ming Tek also predicts that Johor Port's share price will return to pre-announcement price levels if shareholders were to reject the proposal.

He said the near-term earnings dilution and long-term uncertainty make it difficult to justify the acquisition cost of RM403 million over Seaport Worldwide's original cost of the land of RM51 million incurred seven months before Johor Port's proposal. The premium over Seaport Worldwide's cost is 18 times the dividend Johor Port will pay for 2004.

"Until there is new information, we maintain our view that the proposed acquisition of Seaport Worldwide will result in near-term earnings deterioration (for Johor Port). In the longer term, there is too much uncertainty for us to be convinced of the acquisition's feasibility," Wong said, maintaining a "fully valued" recommendation on the stock with a RM2 price target, based on six times the financial year 2006 earnings per share of 32 sen.

OSK Research Sdn Bhd manager Chris Eng said he remains positive of the company's management and operational capability, but views the proposed acquisition negatively.

"If the deal is voted out, we expect Johor Port's share price to move," he said, maintaining a "buy" rating and fair value of RM2.50 for the stock

-------------------------------

And then... comes the shocker....

-------------------------------

Watchdog group now advises minorities to approve Johor Port proposal

August 9 2005

THE Minority Shareholder Watchdog Group (MSWG), in an about- turn, is advising minority shareholders of Johor Port Bhd to vote for its proposal to buy Seaport Worldwide Sdn Bhd for RM403 million.

"Although there are risks associated with venturing into port-related property development, the proposed acquisition would present good potential for enhancing Johor Port's profitability, hence shareholder value," MSWG chief executive officer Abdul Wahab Jaafar Sidek said in a statement yesterday.

He said its latest view was derived from Johor Port's recent circular to its shareholders as well as the watchdog's observation during a site visit to the port and Johor Port's management representations last Wednesday.

"We learnt that Johor Port is unable to expand its activities as there is no additional space for expansion in its current site in Pasir Gudang. In this regard, the proposed acquisition will provide an alternative site for Johor Port's future expansion," said Abdul Wahab.

In late February, the MSWG urged Johor Port's minority shareholders to vote against the proposal as it saw the plan as an attempt to settle an interest-bearing inter-company loan amounting to RM182.1 million as at October 31 2004.

-----------------------

No additional space to expand? So expand at the cost of the minorities? And we are talking about UNDER WATER land! Oh my! And that was MSWG sole reasoning to flip its earlier objection?

Let's read what MSWG said on Feb 2005!

---------------------

New Watchdog showing its teeth again!

’No’ to JPort

By Yap Lih Huey

Minority shareholders of Johor Port Bhd have been urged to vote against the company’s proposal to diversify into property development at a shareholders’ meeting to be convened later.

In making the call, the Minority Shareholders Watchdog Group (MSWG) sees Johor Port’s plan as an attempt to settle an interest-bearing inter-company loan amounting to RM182.1 million as at Oct 31, 2004.

“MSWG would like to advise minority shareholders that the proposed acquisition is not in their best interests and in that they are encouraged to vote against the proposed acquisition,” its chief executive officer Abdul Wahab Jaafar Sidek tells FinancialDaily.

“The proposed acquisition is a scheme to settle in full the inter-company loans owed by Seaport Terminal (Johor) Sdn Bhd (ST) to Johor Port,” he adds.

MSWG says the proposed acquisition is expected to reduce Johor Port’s free cash flow, its capacity to maintain an average dividend payout of 5% to 6% per annum, and reduce its earnings per share.

Johor Port has performed profitably, generating free cash flows of between RM90 million and RM110 million per annum and is cash rich, having fixed deposits totalling over RM231.2 million as of Sept 30, 2004.

Besides its consistent dividend, it posted an earnings per share of 21.39 sen for the nine months to Sept 30, 2004. The counter closed at RM1.99 on Feb 24.

On Nov 10, 2004, Johor Port announced that it had entered into a conditional agreement with Indra Cita Sdn Bhd and Seaport Worldwide Sdn Bhd (SW) to acquire the entire interest in SW for RM403 million to diversify into property development as an objective to broaden its earnings base.

SW has five parcels of leasehold land measuring 902ha at the river mouth of Sungai Pulai and opposite Port of Tanjung Pelepas, which are designated for petrochemical and maritime industry use.

Johor Port’s proposed acquisition is a related-party transaction. Indra Cita is the majority shareholder of Johor Port, via its wholly owned subsidiary, Seaport Terminal (Johore) Sdn Bhd, which in turn has a 51% stake in Johor Port. SW is Indra Cita’s subsidiary.

Tan Sri Syed Mokhtar Al-Bukhary is the ultimate owner of these companies via his ownership in Indra Cita.

Abdul Wahab says although the land is acquired at 25% below market value of RM540 million, the additional capital and

reclamation expenditure of between RM6 and RM8 per square feet will likely make the land more expensive.

“Taking these costs into account, the total cash consideration for the proposed acquisition would amount to more than RM20 per square foot. The market sentiment is going to be negative in view of the above factors,” he adds.

MSWG expects Johor Port to register an improved performance due to higher revenue for its financial year ended Dec 31, 2004.

Last year, Johor Port was given the certification by London Metal Exchange, which allows the port operator to handle more non-ferrous metal containers and consignments passing through its port.

------------

Sigh! First he say NO giving all the valid reasoning and then he changed it by saying YES!

Needless to say.... guess the outcome of the voting?

Do you reckon the minorities stand a chance with the MWSG changing its opinion just like that?

-------------------

Johor Port gets 5% discount for SWW acquisition

By Tamimi Omar

Johor Port Bhd has

successfully negotiated for a

5% discount to the RM403 million purchase price for its proposed acquisition of Seaport Worldwide Sdn Bhd (SWW) through the subscription of new shares in SWW.

“In addition, the payment terms for the consideration are proposed to be staggered over two years” Johor Port said on Aug 15.

On Nov 10, 2004, Johor Port entered into a conditional subscription agreement with Indra Cita Sdn Bhd (IC) and SWW to effectively acquire the entire equity interest in SWW.

It said the acquisition would enable JPB to diversify its business portfolio to include property development activities in order to broaden the future earnings sources of the group.

-----------------------

SUCCESSFULLY? :(

a 5% discount for underwater land????? :(

And RHB had this to say.....

---------------------

16 August, 2005

RHB Highlights

Johor Port Berhad (rm1.89) : EGM Approves Controversial Land Deal, FY12/06-07 Earnings Downgraded UNDERPERFORM

Johor Port’s minority shareholders at yesterday’s EGM gave the company go-ahead to acquire from ultimate controlling shareholder Indra Cita Sdn Bhd (Indra Cita) five parcels of leasehold mangrove land measuring a total of 2,255.5 acres in Pontian, Johor. Johor Port also announced that it has successfully negotiated for a 5% reduction in price from RM403m to RM382.9m and that the payment will be staggered over two years. Indra Cita holds a 100% stake in Johor Port’s parent Seaport Terminal (Johore) Sdn Bhd (Seaport Terminal) which in turn owns a 51.7% stake in Johor Port.

Recall, we are against the deal due to the steep pricing which means Johor Port’s upside is exhausted. The land will be acquired in its converted form and at the market rate for converted land in the Pontian area. Assuming an efficiency of 90%, i.e. 90% of the land area is saleable after providing for infrastructure, the adjusted cost of the land to Johor Port will be about RM188,600/acre or RM4.35/sf (after accounting for the latest 5% discount in price). Several small plots of industrial land of less than ten acres in the Pontian area changed hands at about RM200,000/acre or RM4.60/sf in recent years.

We are also against the deal because we do not think the acquisition makes commercial sense to Johor Port. Given the defensive nature of the port business, we find it unnecessary for Johor Port to “diversify” its earnings base in order to counter sector-specific cyclical downturns, more so, to diversify into property development that is totally unrelated and provides little synergy to the port business.

Also, in consideration for the land, Johor Port will not only forego some RM186.9m inter-company loan owed to it by Seaport Terminal, it will also part with some additional RM196m cash. This will almost deplete its cash balances of RM242.2m that are earmarked for capital expenditure such as for the construction of five new warehouses and upgrading of other port facilities over the next two years.

The consultants hired by Johor Port, IPC Island Property Consultants Sdn Bhd, is projecting an IRR of 12% from the investment, based on fairly aggressive assumptions, namely: (1) The land will be fully developed and sold in seven years; and (2) The land will be sold as industrial plots priced at an average of RM19psf, against a total cost of RM12psf consisting of the land cost of about RM4psf and land development costs (i.e. infrastructure and land reclamation costs) of RM8psf.

We find it hard to visualise a property project in excess of 2,000 acres in size to be fully developed and sold within seven years (translating to about 300 acres per annum), especially, under the current economic conditions. While not strictly comparable, a mixed property project measuring about 1,000 acres in the Klang Valley, for instance, will take at least seven years to be fully completed. We also find the projected average selling price of the land of RM19psf unrealistic given that industrial land in the Pontian area changed hands at below RM5psf in recent years.

While the Board of Directors of Johor Port supposedly approved the land deal based on the favourable outcome of the feasibility study done by the consultants, i.e. an IRR of 12% that is in excess of Johor Port’s historical average ROE of 10.6% by developing the land into reclaimed industrial land, Johor Port has a different plan for the land. Johor Port intends to dispose of a substantial portion of the land as bare land or on a “as is where is” basis. The rationale is to cap Johor Port’s cash outflow at the purchase price with no further investment in land reclamation (Based on the consultants’ model, Johor Port is supposed to fork out RM1.1bn in land reclamation cost over the 7-year period).

Logically, by selling a substantial portion of the land in its bare form (as against reclaimed and developed), it will result in a lower overall IRR that makes Johor Port’s investment in the land less worthwhile.

The 5% discount in price does little to mitigate Johor Port’s risks in relation to this huge investment, so is the payment that will now be staggered over two years. We are downgrading Johor Port’s FY12/06-07 net profit forecasts by 6% and 12% largely to account for the holding cost of the land. Until and unless Johor Port starts to register sales from the land, the annual holding cost alone will be RM9.4m in FY12/06 and RM18.8m in FY12/07 based on our estimate.

Meanwhile, Johor Port independent director Ooi Teik Huat who chaired yesterday’s EGM was quoted by the press as saying that only minority shareholders who owned 74.5m shares or 54% of the total shares held by minority shareholders who turned up yesterday voted in favour of the deal. As such, it could be deduced that “disgruntled minority shareholders” out there hold a total of at least 63.5m shares.

We expect a new wave of selling from some of these “disgruntled minority shareholders” over the next few days or weeks.

Maintain UNDERPEROFM. Indicative fair value of RM1.61 based on 5x FY12/06 EPS. The low PER rating is to reflect Johor Port’s vulnerability

------------------

Now Johor Port story did not end here, not on Aug 2005.

Dec 2005....... came the privatisation issue!

-----------------------------------

MMC Plans to Buy 52 Percent of Johor Port, Take It Private

(Bloomberg) -- MMC Corp., a Malaysian builder and engineering group controlled by Syed Mokhtar Al-Bukhary, agreed to buy his 52 percent stake in Johor Port Bhd. for 427 million ringgit ($113 million), expanding its port business.

MMC is buying 170.8 million Johor Port shares at 2.50 ringgit apiece from his Seaport Terminal (Johore) Sdn Bhd., it said today in a statement. MMC will later offer to buy the rest of Johor Port and delist it. The takeover values the company at 825 million ringgit.

Acquiring Johor Port, the country's second-biggest port, will help Syed Mokhtar consolidate his port operations under MMC, which owns half of the Port of Tanjung Pelepas, and diversify its transport and logistics divisions.

---------------------------

Now this is where.... I will say....

think about it!

Yes.. just think about what had happened.

Look at the chain of events.

Nov 2004, Johor Port ( cash rich, trading at a price of 2.49) announced it's RELATED PARTY TRANSACTION underwater land deal.

Johor Port of course tanked big time...

A year later.... MMC says wants to take Johor Port private.... at 2.50.

And yeah... just think about it.

How?