Hmm.... it seems that CIMB wrote a write-up on WorldWide today and with that write-up, it proved to be a catalyst itself, driving the stock by as much as 14 sen today!!!

And the Edge had an article based on that write-up...

- CIMB Investment Research reported that Worldwide has RM249 million net cash and equivalents and valuable stakes in the power and waste management businesses.

The research house said Worldwide shares are backed by RM1.45 cash per share.

"Based on our RM2.8 billion valuation for the 720MW Genting Sanyen IPP, Worldwide's 20% stake alone is worth a massive RM560m or RM3.27 per share, well above the share price," it said.

It said investors were getting the RM249 million net cash (RM1.45/share), property land bank and waste disposal businesses for free and more.

It estimated Worldwide's revised net asset value per share at RM6.09 more than triple its share price. It said the stock was also trading at a hefty discount to its NTA/share of RM4.23.

"Although Worldwide is cheap on discount to asset backing and P/E basis (6 times historical), the key problem is the lack of share price catalysts," it said.

Worldwide offers good value to long-term investors with the patience to wait for an eventual re-rating, it said.

But in today's CIMB write-up, CIMB is declaring that the Genting Sanyen stake is worth so much more.

- Based on our RM2.8bn valuation for the 720MW Genting Sanyen IPP, Worldwide’s 20% stake alone is worth a massive RM560m or RM3.27 per share, well above the share price.

Hmmm.... rm 560 million wor!

And then it mentioned that Worldwide has RM249 million net cash and equivalents..

Ah... I discovered something new today.

The following is a screenshot of Worldwide's balance sheet.

Ahh... as can seen, under current assets, Worldwide's cash, bank balances and deposits totals only 124.382 million.

And on the first line, you would see an entry of 'Investments' totalling some 124.554 million.. same period a year ago? Worldwide's such investment was only 69.075 million!!

And according to CIMB ( see a screenshot of their report below) these 'investments consist of unit trusts and bonds!)

Ahem... unit trusts and bonds!!!... and the obvious point of debate is why should a company like Worldwide (which had a poor history in investing... such as their theme park debacle recently) be dabbling in such investments??

Now if I check on Worldwide earnings notes, I could NOT find Worldwide's explaination on how and why such investment increased by so much. Lack of transparency???

What unit trusts did Worldwide buy?

What kind of bonds did Worldwide invest in?

And also... since such investments consist of unit trusts and bonds, how reliable is CIMB's value of rm249 million in cash and equivalents?

Ahh... anywayyyyyyyy.......remember me stating the issue of Worldwide's poor investment history?

Well... just for your information... Worldwide does dabble itself in the sharemarket too!!!

Yup!

And again, considering the issue of Worldwide's poor performance as a property developer, would the investor be faulted for questioning why Worldwide is dabbling in purchase and disposal of listed securities? Shouldn't the company management be more focused on their jobs? Would it be wrong to be so cynical? Well, consider the fact that Worldwide's value of investment in bonds and unit trusts totals some 124.544 million is more than Worldwide's sales revenue for its fiscal year 2005.

How?

anyway... do u wonder their performance in their purchase and disposal of quoted securities? Think they are good ah?

well the following table... err... u better have a look urself at those figures...

Err... how?

And another issue.. is the following statement from CIMB is not mentioned in the Edge article.

- Although Worldwide is cheap on discount to asset backing and P/E basis (6x historical), the key problem is the lack of share price catalysts. Earnings outlook for FY06 is flattish as contribution from waste management will likely dip temporarily due to relocation to a new site. Also, the group does not appear keen to unlock the value of its assets, including its stake in Genting Sanyen, unless it can put the

proceeds to good use.

See the points in red. Do you think that these two issues are rather important?

how? Should the Edge be omitting such issue?

(ps... and if consider the fact that Worldwide's management INCREASED their investment in bonds and unit trusts from 69.075 million to 124.382 million in their fiscal year 2005, does it appear that Worldwide is keen to unlock the value of their 'assets'?)

Anyway... what do you think?

Value Trap?

Or there is really VALUE as statetd by CIMB!

How?

Oh... some of the points made by hhc in part IV is worth noting now... :D

- 2)Small time trader or ikan bilis

Rule one to rule 9 are still attractive stories. They dont care what is it but as long as there is a renewed interest in this stock, they will swarm in. Most of them will be eaten by the ikan besar. Some of the nible one will managed to snatch the bait put out by big fish.

OK back to TA.

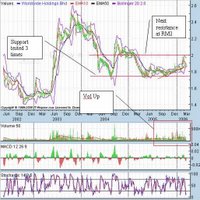

For the last whole year, Wldwide has been building base at around 1.8 region. IN the last 3 months, the vol is increasing and it's now trading close to its resistance area at 1.9 area and inside its mini uptrend established on Oct last year.

Its technical stand is interesting but i would pay attention if i can break and hold at above RM2 area. IN the mean time, i would say the bull and bear are fighting out. The outcome is still unclear. (chart pictures are contributed by hhc... many thanks!!)

nm,

ReplyDeleteOk for this worldwide, it finally run.

If u look at all those problematic property shares recently, u will notice that they flied without reason. Braya ran from 1.2 to 1.45.

Everything looks like a setup for me. Before the pro runs, all the pro shares are actively accumulated, can see its intra day chart esp for Braya, there was simply no seller. The bulls push it all the way to 1.4 and then paused. It's almost in a parabolic rise oredi.

Then yesterday, theedge or osk came out with the report that pro sector is resilent, bla bla bla. Then all pro stock flies with increasing volume (meaning ikan besar maybe finding the way out).

And how can we forget about Worldwide past price history. It was ramped up to almost 2.4++ last year or two and it showed ppl are quite eager to run it. Its numbers are impressive like what CIMB puts in (as long as not many thinks like nm). I bet there are many buyers waiting in the line to take the stock from those who got in earlier. BSKL is now like a GIANT casino with almost 2 Billion bet at 20Billion. what more can you ask?

I wont be surprise if our friend JB runs some articles on pro sector soon.

mark my word, the stories are getting interesting as the crowd now are crazy for idea. Anything will do...

Of course this is solely on TA point of view. But from past history, property sector is normally the last one to run and by that time, the party maybe over.....

pst..

ReplyDeleteQuote: " Its technical stand is interesting but i would pay attention if i can break and hold at above RM2 area. "

wonder which sifu said dat...

:)

Cheers!