Hmm... more feedback on Worldwide

- The joint venture in the Sydney Theme Park is 40% indirectly owned by Worldwide and whatever loses incurred is more than cover for by its other profitable property ventures which means contribution from Genting Sanyen and waste disposal service continued to add on to the company's bank account. Look, even Warren dare not say he is always right! Meanwhile I don't see any problem with income from Genting.

==> Yes, there is nothing wrong with Genting Sanyen's money at all. In a nutshell, that's all there is in Worldwide. Which is the earnings derived from Worldwide's investment of a 20% stake in Genting Sanyen. If you take away Genting Sanyen, what has the management done since 2000?

The earlier argument was that Worldwide business is safe and protected and the management is conservative. And the counter argument was that the Sydney Theme Park venture did not paint a picture of Worldwide's management being conservative. And as argued one would be left scratching their heads wondering why Worldwide ventured in that theme park business.

- All IPP here are doing fine. They also sold off their Holiday Inn KL and made 17mil profit.With continous build up of cash in their a/c the current price will be deem undervalued! So what are they going to do with all this cash?

Yes, all IPP are making tons of money. Too much money in fact!

However, the point here is Worldwide merely has an investment stake in an IPP. A 20% stake. That's all.

Yes, again there is no denying that Worldwide has tons of cash... but what the very key is what are they going to do with it?

What are some possibilities that could happen with the cash ...

- They hoard the cash. (not possible? they can hoard like UAC and do nothing)

- They distribute most of the cash. (if so.. the investor speculating on this issue wins!)

- They distribute the cash but in small amounts per year.

- They keep the majority of the cash.. and embarks on 'new projects'... which is not a problem.. but given the issue of the theme park.. and the questionable Panorama Worldwide thingy... how safe is this option?

So how does one rate such speculation?

more comments..

- Great even directors of Mieco bought shares in their company so is Meico very "Geng"? If there is complete transparency in Worldwide and they are very good to minority shareholders Worldwide should be worth much more! Look there is no total transparency even in the good counters. What I am trying to point out is Worldwide will not SINK! period. I believe at its current price it is stable and should it fall below 1.80 great!

and more..

- Ah yes talk about GLC. Bursa gave out millions in ESOS at RM3.00.Suddenly they decide to give out 82sen per share in capital repayment. Before the payment price was around 4.50 now after payment it is at 4.60...Petgas?? Maybank??

err... the discussion was on Worldwide, wasn't it?

- Oh also some company gave little or no dividend. Liondiv, Farmbest. Wowww better still Berkshire Harthaway no dividend since 1971 and today it is worth ahemmm... around.... around I wonder how much...

and more....

- They know it is tough making a successful venture. Now guess whether they will "kill the goose that lay the golden egg" ie sell off their Genting Sanyen. Well run IPP from genting...

and more..

- Wldwide is risky investment but only if it's selling at revised NTA, say 4.50. But reservations about management's skills has already been fully discounted by all and sundry...why the hell you think it's selling 1.88.PKNS needs WLDwide's dividend...that's why it is paying a full 15.6 sen for the curremnt year....and probably more next year and the next since it has fat bank bal.

==> hmm.. let's be more accurate here on the issue of Worldwide dividend.

Worldwide paid a gross dividend of 10 sen for fy 2004. And for fy 2005, it had paid a gross interim dividend of 5.6 sen.

- If robert kuok should take over the management today, the price would shoot up to 5.00....wouldn't be far fetched. So with current management, the price is discounted to the extent it gives div yield 8.3% and the possibility of more in future. What more do you want...everything must be safe safe, then quit stock mkt, put money in FD with a lousy 3%. I would say, taking all into a/c, it's a safe buy at 1.88...in fact a good buy.

==> what has Mr.Kuok got to do with Worldwide Holdings???

Dividend of 8.3%???

The risk in the stock market is always there and should never ever be discounted. Hence, if an investor does not think the stock market is safe, then the investor should always, always opt for the FD.

more comments...

- having said that, this stock is good for those seeking safe and good dividend income over the long term, definitely better than putting in FD. Its dividend payouts can only increase because parent co needs the cash. And remember, their power business is not run by them...and that is a very very good thing...LOL. If you are selling this stock, go ahead, meanwhile I stand at 1.87 and sapu whatever I can take....LOL...

hmmm.. 'power business is not run by them... and that is a good thing... LOL'

hmm... would it be wrong if I sense some concern over the trust of the management?

If that is the case... could the investor safely expect to receive safe and good dividends over the long term? What if the management decides to embark on a funky project again? Yes this is a speculation... but there is a chance it could happen. And since if it could happen... how safe is it to assume that the investor will receive good dividends?

- one hhc mention the directors not holding shares.....therefore implying company no good....LOL....really funny...what if I tell you there are holding millions of shares under various nominee accounts, then the company must be a really good company by your reasoning....hahaha.......directors say banyak susah, put under my name you ask where i get the money, don't put under my name you say company lousy....

If the director is not willing to own shares in the company... isn't this a valid reason to be concern? Remember the strategy in Worldwide is to invest in the share and expect to receive safe and good dividends over the long run. In the long run.. anything could happen... so is it wrong to think conservative?

- about edge article....about wldwide going through third party to get the contract...LOL...this edge journalist is very funny...doesn't he knows this is thwe way business is done, not only here but in other countries too. You simply can't take all the money for yourself, you must split it with others, else there is no contract to speak of.

How would one rate such business dealing? Wait ... what about the issue of being transparent?

If the management is not transparent.. then how could one trust? Could one dare to ass-u-me that one could expect to receive safe and good dividends over the long run?

Btw... please let's be more diplomatic.

Comments are most welcomed but at the end of the day, let's not forget that comments are mere opinions of each individual. In the stock market, no one will have the same exact view and opinions all the time. Opinions and views will always differ.

So.. if and when an opinion differ..

I would strongly ask everyone to refrain from resorting to making FUN of names.

Such childish actions is unwanted here.

~~~~~~~~~~~~~~~

Edit: 1.50 pm March 17th

Ok.. let me throw a new poser in..

Ahh... let me be put on my speculator suit... LOL!!

For Worldwide .. the main seduction is the cash in the piggy bank.

So what's Worldwide going to do about it? That for me, I think would be the main catalyst for other(s) to speculate also on the stock, thus creating the demand for the stock. Else no demand then how to expect the stock to a-go-go?

The other issues like low PE and discount to NTA simply isn't working! As mentioned earlier, these issues simply wasn't enough to attract investors to the stock.

For example on 27th June 2003, Insider wrote the following article, Worldwide Pt 2 – assured earnings, undervalued assets . Price of Worldwide was 1.95. That investment idea simply failed to seduce investors. And in Sept 18th 2004, SBB made the same suggestions at 2.04. Again the end result is for all to see.

So... as a speculator... what do I want to see?

Ahh... for me... LOL... just me mere opinions only... and if you do not agree... state your reasons lor... as a speculator... I would want Worldwide to Show ME the Moola!!!!

Simple as that. Make a concrete effort.. let the investing world know that you are willing to share! (Share market mah... if company got tons of cash.. surely Shirley you must share. tiok boh?)

So what's the best plan? Buy and wait for such an announcement? (What shold be my safety plan? Do I have one? If they do not share or announce another one silly project again.. surely Shirley the share price might take a big hit.... tiok boh?)

Or should I wait till they announce? (what if too late? cos when they announce the share price will rocket mah!)..

Or should I be the wise speculator and consult them trading sifus?

how?

~~~~~~~~~~~~~~~~~~~~~

more comments:

Such a hot topic which i think i will add some more comments

1):kingpin

"So if you oriiginally can make margin of 50%, but have to split with others 30%, you still get 20%. Does that mean you don't want the contract anymore?"

The issue here is integrity and honest business. Are Mr Kingpin recommends to get business by hook or by cook?

2)Mr Kingpin

"You simply can't take all the money for yourself, you must split it with others, else there is no contract to speak of."

Sharing contract and profit is nothing wrong per se. The problem is co-partner with some funny fly by night companies with directors in their 30s. The best part, they dont need to come out with cash. Risiko is bornt by Worldwide and profit they sama-sama enjoy. Is this kind of business model Mr Kingpin encourages?

3)Mr Kingpin Again

"directors not holding shares.....therefore implying company no good....LOL....really funny...what if I tell you there are holding millions of shares under various nominee accounts, then the company must be a really good company by your reasoning....hahaha.......directors say banyak susah, put under my name you ask where i get the money, don't put under my name you say company lousy...."

The problem here is that worldwide has its ESOS and definitely its directors will entitled to it. If worldwide is such a fabulous company, why the director is not holding any share here. They definitely has better knowledge of how the company is doing. And we are not discussing the case of majority owner cum management case like megan. Just to put thing into perspective

Did anyone ask where RObert kuok or LimGoh Thong or Anand Krishna where they get their money? unless yr money is something from your share share business dealing......

4)Kingpin

"Its dividend payouts can only increase because parent co needs the cash. "

Are you sure? They are other faster and easier way for the mother co to get money. The simplest way is asset injection like land which PKNS got a lot. Another oversear venture is another possibility.

And i respect the way kingpin thinks but pls dont make fun on other ppl name. We all entitled to our own opinion. I ain't got pleasure in changing yr opinion to be like mind.

~~~~~~~~~~~~~~~~~~~~~~~~~

more comments:

Some of opinions

"Oh also some company gave little or no dividend. Liondiv, Farmbest.

Wowww better still Berkshire Harthaway no dividend since 1971 and today it is worth ahemmm... around.... around I wonder "

1)LionDiv

We ready has to see in the long run, how this LionDiv will become. Yes, it did make spectacular gain on Parkson listing. But, can it maintains its edge? Or will it succumb to competition. So, not much to comment here.

2)Farmbest

Is this really a run because of improving fundamental or syndicate play? The answer will be shown after a few months. If this is realy supported by syndicate, it wont hold out too long. So, let's keep our finger cross.

3)HB

Hah, do u know what is the big difference here? It is the MANAGEMENT integrity. Try to read those listed comp director report. Or doesnt Lion group owner has the track record which match HB?

I want to stress that Div Yield is not the most critical criteria for me. Just as a guideline

I found out that Mr Willy liked to use price increment to justify the stock quality. There is nothing wrong in this but dont you find that investing in a honorable management is safer? And in BSKL, we all know there are a few syndicates operating around.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

More comments....

Just my 2 sen Ok, let's put on as trader with TA skill.

There are 2 types of TA traders. If

1)Trader who can swing a big line.

Thing to consider

a)Liquidity

b)Free float

-->Wrldwide cap now 320M. Let's say 20% is floating, that means i need at least RM64M*7 to goreng. THis is liama rule. Dont ask me why use 7

c)Attractive story

-->not much at this moment. At least all those cash per share, NTA, project are OLD story.

d)Volatility in price

-->At least still in accumulating phase. If this indeed is the acc phase, then the syn has accumulated for almost 3 years.

2)Small time trader or ikan bilis

Rule one to rule 9 are still attractive stories. They dont care what is it but as long as there is a renewed interest in this stock, they will swarm in. Most of them will be eaten by the ikan besar. Some of the nible one will managed to snatch the bait put out by big fish.

OK back to TA.

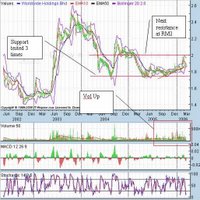

For the last whole year, Wldwide has been building base at around 1.8 region. IN the last 3 months, the vol is increasing and it's now trading close to its resistance area at 1.9 area and inside its mini uptrend established on Oct last year.

Its technical stand is interesting but i would pay attention if i can break and hold at above RM2 area. IN the mean time, i would say the bull and bear are fighting out. The outcome is still unclear.

===>>

pictures from hhc. (many thanks!!!)

------

9 comments:

nm,

Such a hot topic which i think i will add some more comments

1):kingpin

"So if you oriiginally can make margin of 50%, but have to split with others 30%, you still get 20%. Does that mean you don't want the contract anymore?"

The issue here is integrity and honest business. Are Mr Kingpin recommends to get business by hook or by cook?

2)Mr Kingping

"You simply can't take all the money for yourself, you must split it with others, else there is no contract to speak of."

Sharing contract and profit is nothing wrong per se. The problem is co-partner with some funny fly by night companies with directors in their 30s. The best part, they dont need to come out with cash. Risiko is bornt by Worldwide and profit they sama-sama enjoy. Is this kind of business model Mr Kingpin encourages?

3)Mr Kingpin Again

"directors not holding shares.....therefore implying company no good....LOL....really funny...what if I tell you there are holding millions of shares under various nominee accounts, then the company must be a really good company by your reasoning....hahaha.......directors say banyak susah, put under my name you ask where i get the money, don't put under my name you say company lousy...."

The problem here is that worldwide has its ESOS and definitely its directors will entitled to it. If worldwide is such a fabulous company, why the director is not holding any share here. They definitely has better knowledge of how the company is doing. And we are not discussing the case of majority owner cum management case like megan. Just to put thing into perspective

Did anyone ask where RObert kuok or LimGoh Thong or Anand Krishna where they get their money? unless yr money is something from your share share business dealing......

4)Kingping

"Its dividend payouts can only increase because parent co needs the cash. "

Are you sure? They are other faster and easier way for the mother co to get money. The simplest way is asset injection like land which PKNS got a lot. Another oversear venture is another possibility.

And i respect the way kingpin thinks but pls dont make fun on other ppl name. We all entitled to our own opinion. I ain't got pleasure in changing yr opinion to be like mind.

Some of opinions

"Oh also some company gave little or no dividend. Liondiv, Farmbest.

Wowww better still Berkshire Harthaway no dividend since 1971 and today it is worth ahemmm... around.... around I wonder "

1)LionDiv

We ready has to see in the long run, how this LionDiv will become. Yes, it did make spectacular gain on Parkson listing. But, can it maintains its edge? Or will it succumb to competition. So, not much to comment here.

2)Farmbest

Is this really a run because of improving fundamental or syndicate play? The answer will be shown after a few months. If this is realy supported by syndicate, it wont hold out too long. So, let's keep our finger cross.

3)HB

Hah, do u know what is the big difference here? It is the MANAGEMENT integrity. Try to read those listed comp director report. Or doesnt Lion group owner has the track record which match HB?

I want to stress that Div Yield is not the most critical criteria for me. Just as a guideline

I found out that Mr Willy liked to use price increment to justify the stock quality. There is nothing wrong in this but dont you find that investing in a honorable management is safer? And in BSKL, we all know there are a few syndicates operating around.

Just my 2 sen

Thanks for adding more comments.. and thanks also for not reacting!

:)

Cheers dude!

nm,

Ok, let's put on as trader with TA skill.

There are 2 types of TA traders. If

1)Trader who can swing a big line.

Thing to consider

a)Liquidity

b)Free float

-->Wrldwide cap now 320M. Let's say 20% is floating, that means i need at least RM64M*7 to goreng. THis is liama rule. Dont ask me why use 7

c)Attractive story

-->not much at this moment. At least all those cash per share, NTA, project are OLD story.

d)Volatility in price

-->At least still in accumulating phase. If this indeed is the acc phase, then the syn has accumulated for almost 3 years.

2)Small time trader or ikan bilis

Rule one to rule 9 are still attractive stories. They dont care what is it but as long as there is a renewed interest in this stock, they will swarm in. Most of them will be eaten by the ikan besar. Some of the nible one will managed to snatch the bait put out by big fish.

OK back to TA.

For the last whole year, Wldwide has been building base at around 1.8 region. IN the last 3 months, the vol is increasing and it's now trading close to its resistance area at 1.9 area and inside its mini uptrend established on Oct last year.

Its technical stand is interesting but i would pay attention if i can break and hold at above RM2 area. IN the mean time, i would say the bull and bear are fighting out. The outcome is still unclear.

keke... thanks for putting in ur views.. :D

interesting point... if this is the accumulation phase... then syn has accumulated for 3 years!

pst... got chart picture onot? if have... send to my_moolah@yahoo.com

thanks!

nm,

typo mistake. not 3 years but last 2 years.

The pic has been sent to you

ic...ic....

many thanks... me load ur pix up... ok?

:D

nm,

it is not my pic. I took it from the web service. Dont know ok or not?

Err... the picture looks ok ...

and i guess it's up to one's own interpretation lor...

:D

Post a Comment