Arrrghh....

I screwed up.

:P

KNM - Would Poor Corporate Governance Have A Negative Impact On The Stock?

That posting have one MASSIVE flaw.

What happened? Well, I relied on the little bells provided by RHB charting. I did not verify the data and if I did, I would realise that RHB missed out the events that happened on Aug 2004. Meaning to say there was a 1 into 2 share split ( see announcement:

| Entitlement - Others ) and after the share split, there was a bonus issue of 1 for 2 ( see announcement: Bonus Issue )

Which means my entire posting is beyond repair.

LOL!

Excuse? I was too lazy and incompetent to check my facts.

Ok... please line up and aim all the rotten eggs over here!

ps: pls be gentle.

ps: I am too lazy to recount. hehe. But if anyone is kind enough, I welcome them to do the entire calculations for me. :P

ps: It is Monday, isn't it?

******* EDIT 10/10/2011. The following posting is rather meaningless now because I realised that

I Screwed UP My Earlier KNM Posting ********

==========================================

Last month, I posted on the issue of the impact of corporate governance on a stock.

Do see Maybulk: Does poor corporate governance have a negative impact on a stock?

So this morning I was wondering about And KNM Directors Got Fined.... rm 25,000 Each!

( Yeah, tell me about it. A fine of rm 25,000 for a corporate director? I wonder who does the fine insult??? Really! )

Anyway, I was thinking about the impact of the poor corporate governance from KNM on its stock price.

I asked myself, what if an 'investor' bought KNM when it IPOed back in 2003 and held it till today.

Now that sounds like a fun exercise, no?

So, I opened up the chart of KNM from RHBInvest. This was KNM's chart since its listing in 2003.

Doesn't look too bad, yes?

But then I looked at all those little bells on the chart. And I made reference back to Bursa website and the result was rather interesting.

First, the IPO.

27 June 2003: PUBLIC ISSUE OF 6,680,000 NEW ORDINARY SHARES OF RM1.00 EACH AT AN ISSUE PRICE OF RM1.48 PER NEW ORDINARY SHARE PAYABLE IN FULL ON APPLICATION AND PLACEMENT OF 4,400,000 NEW ORDINARY SHARES OF RM1.00 EACH AT A PLACEMENT PRICE OF RM1.48 PER NEW ORDINARY SHARE PAYABLE IN FULL ON APPLICATION BY THE NOMINATED PLACEES

Ok, let's ass-u-me.... :)

IPO at 1.48 - 27 June 2003.

Assume 'investor' purchases 2,000 shares. This means an investment outlay of 2x1.48 = 2960.

(ps: if I do screw up with my calculations, please don't sue... just tell me and I will correct. :P )

A. 1 for 2 bonus issue Sep 2006 ( see announcement: Bonus Issue )

So total number shares becomes 3,000

B) 1 for 1 bonus issue and then share split 1 into 2 - June 2007. ( see announcement: Bonus Issue and Entitlement - Others )

Getting tricky. :P

Total number of shares held is now 3,000

After bonus issue, total number of shares becomes 6,000

After share split of 1 into 2, total number of shares becomes 12,000

Hope I have yet to screw up. :P

C) May 2008, rights issue of 1 for 4 at rm 4.00. ( see announcement: Rights Issue )

Getting even trickier. :P

(rights issue? LOL! Put more money in babe!)

With 12,000 shares, 'investor' will be eligible for 3,000 new shares at a price of 4.00 each.

Assuming 'investor' agrees and takes up the rights issue, 'investor' puts in extra outlay of rm 12,000.

Total outlay + original cost of investment = 12000 + 2960 = rm 14,960

Number of shares held becomes 15,000

( no screw yet, I hope! )

D) 2 for 1 bonus issue. July 2008 ( see announcement Bonus Issue )

Waaaahhh! so generous! 2 for one bonus issue woh!

So the number of shares held increases from 15,000 to 30,000

Aha! Made a mistake here. :P

Investor had 15,000 shares. A 2 for 1 bonus would see investor get 30,000 new shares.

So investor would now have 45,000 shares. ( Sorry.. sorry... and thanks for the correction!)

E) 4 into one share split!! ( see announcement: Entitlement - Others )

( Hehe... KNM back then... faced thunder, lightning woh! ... let's see there were ... forced selling on CEO shares, share buybacks, MBOs.... errr... such a happening stock.... and yeah KNM was a penny stock then! 4 into 1 .... would make KNM... appear more expensive. Hohoho! )

4 into 1 reverse share split...hmmm... 30,000 shares held would be consolidated into 7,500

45,000 shares would be consolidated into 11,250 shares. ( how did I pass my maths? :P )

Ok so far?

Remember original outlay + original cost of investment = rm14,960.00 and the number of shares held is 11,2500 shares.

KNM today is 1.23

If investor cashes out today, investor gets back 11.25 x 1230 = 13,837.50

But.... cost of investment = 14,960!!!!

Arrrrrrrrrrrrrrghhhhhhhhhhhhhhh!!!!

See the wonders of holding an investment in a stock that has poor corporate governance?

But.... but..... it looks like I have screwed up!!!

Oh.... no..... oh yeah!

I left out all dividends. *&^^:$%^#^%%#@@

hey but if you are interested to know how huge the dividends were... and lol.. if you think too huge... please skip the tedious counting below... :P

- June 2004: Final Dividend

- May 2005: First and Final Dividend

- June 2006: First and Final Dividend

- June 2007: First and Final Dividend

- Feb 2008: Interim Dividend

- Feb 2009: Interim Dividend

- March 2011: Interim Dividend ( I don't see any for 2010. :P )

Ok... 7 set of dividends.... should be fast and easy.

June 2004, 5 sen tax exempt. In this case, investor had 2000 shares then. This means 10 sen collected.

May 2005. 3 sen less tax of 28%. ( 3 sen also want to less tax? :P ) Investor had 2,000 shares. So dividend collected this year would be 4.32. Total dividend collected = 14.32 sen.

June 2006. 5 sen less tax of 28%. Still 2,000 shares. So dividend collected this year would be 7.2 sen. Total collected = 21.52 sen.

July 2007. 5 sen less tax of 28%. Now have 3,000 shares. So dividend collected this year would be 10.8 sen. Total collected = 32.32 sen.

Feb 2008. 4 sen less tax of 27%. Now have 12,000 shares.So dividend collected this year would be 35.04 sen. Total collected = 67.36 sen.

Feb 2009. 1 sen less income tax of 25% and 0.5 sen tax exempt. Now have 45,000 shares. So dividend collected this year would be 18.75 sen. 56.25 Total dividends collected = 123.61 sen.

March 2011. 3 sen tax exempt. Number of shares now held 7500. 11,250. So dividend collected this year would be 22.5 sen. 33.75 sen. Total dividends collected = 108.61 sen. 142.36

So total dividends collected (assuming me calculations is not screwed up) since 2003 is 108.61 142.36 sen.

Let's add this figure to the earlier calculations...

Cost of investment - 14,960

Shares worth today - 13.837.50 *** corrected figure ***

Dividends collected - 1423.60 ** corrected figure ***

How?

* hehe... got profit woh! *

Last April 2010, I wrote the following posting KNM's MBO Fails

Let me reproduce the entire posting:

......................

It was a laughing stock the day KNM's management announced its proposed management buyout.

It was noted in the postings KNM: Do Show Us The Money! and KNM: Should I Stay Or Should I Go?

Yesterday KNM announced what was simply expected.

- Further to the Company’s announcements dated 4 February 2010 and 22 March 2010 in relation to the above, the Board of Directors of KNM wishes to announce that after due deliberation, the Company and BlueFire Capital Group Ltd (“BlueFire”), including its partners GS Capital Partners VI Fund L.P and Mettiz Capital Limited, are unable to reach an agreement on the pricing of the Proposed Acquisition. Hence, the parties have mutually agreed that the proposal made by BlueFire on 4 February 2010 has lapsed.

Company and the bidders unable to agree on the pricing of the proposed acquisition? ( That announcement link: here )

That's all it can say? Is that all?

What a bloody disgrace!

Surely the company can be more transparent and shows the respect to the investing public how they failed to come into agreement on the pricing issue. What was BlueFire final bid? Was the proposal on 4th Feb 2010, the only proposal? Any newer proposal made by BlueFire? Was BlueFire even serious about the management buyout?

And who are the members of KNM management that are involved in the management buyout?

Last but not least, given what has transpired, and if the management that are involved in BlueFire's acquisition bid continues to remain in charge of the company, how should the minority shareholder view what has happened?

Biggest question that needed to be asked is, "Does the current management even has the interest of the minority shareholders in mind?"

What if the management and BlueFire returns with a much lower pricing? Not possible?

Exactly. How can the minority shareholders trust the current management now?

The current management involved with BlueFire, should look themselves in the mirror and ask themselves what have they been doing the past couple of months? Have they been focused on running and managing the company? Or are they only interested only in doing the management buyout for their own vested interest?

Stinks doesn't it?

In my flawed opinion, the board of directors should review the loyalty and the integrity of the current management involved in BlueFire. If there is no loyalty and no integrity, these management should simply go!

The Star Business carried a much detailed article: KNM deal falls through

- Thursday April 15, 2010

KNM deal falls throughBy RISEN JAYASEELAN

Offer lapses due to disagreement on pricing

PETALING JAYA: The deal to acquire the assets and liabilities of oil and gas company, KNM Group Bhd, has fallen through due to a disagreement on pricing.

The company said yesterday that the offer had lapsed by “mutual agreement of the parties,” as there was no agreement on the pricing.

It is understood that a meeting between the buyers and the board of directors of KNM had taken place yesterday afternoon, prior to the announcement.

StarBiz had three weeks ago highlighted the possibility of the buyers withdrawing the offer or lowering their price. Then, the buyers had completed their due diligence on the assets of KNM and yet, had not come up with any firm offer. The buyers had made a conditional offer to buy the assets of KNM on Feb 4, subject to a due diligence. The offer was at an indicative price of 90 sen per KNM share, totalling RM3.5bil.

It is not clear what price the buyers had offered yesterday but an analyst familiar with the situation said the board had asked the buyers for a price which was at a certain premium over the market price of KNM’s shares.

That, however, was more than what the buyers were willing to pay for KNM’s assets, the analyst said.

Maybank Investment Bank believed that the buyers had made a final offer of between 60 and 70 sen. In a note issued yesterday, Maybank Investment expected the market to react negatively over the deal falling through. Should the deal fall through, “we tactically downgrade KNM to a sell in the short term, ahead of this negative newsflow,” Maybank Investment wrote.

On the other hand, Kenanga Research head Yeonzon Yeow said that should KNM’s price dip below 60 sen a share, it would be a buying opportunity. Yeow has a fair value of 70 sen per KNM share, based on a price earnings multiple of 10 times the 2011 forecast earnings of KNM.

But some other research houses have a lower fair value of KNM, such as OSK Research, which has a fair value on KNM at 59 sen and TA Research at 62 sen. Both research houses said their fair values exclude considerations of the then indicative offer of 90 sen.

KNM founder and major shareholder Lee Swee Eng, a private equity firm called Mettiz Capital and a Goldman Sachs unit, are all part of the group seeking to buy KNM’s assets which include foreign companies in Germany and Italy.

The due diligence, which was conducted by foreign-based consultants including KPMG, is said to have cost the buyers a few million US dollars.

It is not surprising that the buyers are no longer keen to pay 90 sen a share for KNM’s assets as the latter posted an unexpected loss of RM31mil in its fourth quarter ended Dec 31, 2009. This dragged KNM’s full-year 2009 net profit to RM171mil, almost half the previous year’s RM336.4mil. The result was also significantly below analysts’ consensus forecast for FY2009 of RM288.7mil.

The poor fourth quarter results were due mainly to provisioning for foreseeable losses in its operations in Brazil, Canada and Indonesia, coupled with a revaluation of the group’s Canadian properties. Analysts said that due to the low price of oil and the general economic malaise, many of the projects that KNM was supposed to have participated in had failed to materialise.

Analysts said it was unlikely another offer for the assets of KNM could happen soon, considering that this group of buyers had already gone though a due diligence and yet could not agree on a price with the board.

The attempted KNM deal may also go down in corporate history as one of the last attempted mergers and acquisitions that had sought to use the assets and liabilities route that required only a simple majority of shareholders to approve. It would also have been the largest private equity deal ever done in the country.

The regulators are very likely to raise the shareholder approval threshold of such deals to 75% in the coming weeks.

.......................

And today 6 Oct 2011 'something' is finally done about such disgraceful behavior.

Bursa Securities raps KNM, fines directors RM200,000

Yeah.. that 'something' ... amounts to a WHOPPING rm 200,000..... :(

It's now Oct 2011 and the fine is only rm200,000?????

And to be precise that's just a shocking rm25,000 fine for each of its directors!!!

Sigh.... such a big fine... how will such fine deters others from pulling such disgraceful stunt in the future?

- Bursa Securities raps KNM, fines directors RM200,000 Written by Joseph Chin of theedgemalaysia.com

Thursday, 06 October 2011 19:07

KUALA LUMPUR: Bursa Malaysia Securities Bhd publicly reprimanded KNM GROUP BHD [] for breaching the Main Market Listing Requirements.

The regulator had on Thursday, Oct 6 also rapped and fined its directors a total of RM200,000 for not disclosing enough details about a proposed takeover in February 2010.

The regulator said KNM’s announcement was “not factual, unclear, inaccurate and lacked sufficient information and material facts to enable investors to make informed investment decisions”.

Bursa Securities fined managing director and major shareholder Lee Swee Eng and seven others RM25,000 each for breaching the listing requirements.

They were executive directors Gan Siew Liat, Chew Fook Sin and Ng Boon Su, independent non-executive directors Datuk Ab. Halim Mohyiddin and Lim Yu Tey.

Two former board members -- Dato’ Mohamad Idris Mansor (resigned April 28, 2010 as independent non-executive chairman) and Lee Hui Leong (resigned on April 8, 2010 as executive director) – were also fined.

Bursa Securities said the directors had breached paragraph 16.13(b) of the Main LR for permitting, knowingly or where they had reasonable means of obtaining such knowledge, KNM to commit the breach.

To recap, KNM had on Feb 4, 2010 announced BlueFire Capital Group Ltd (Bidco), a company controlled by Lee Swee Eng (who was a major KNM shareholder) about a proposal to acquire the KNM.

The proposed price was equivalent to RM0.90 per issued ordinary share of KNM.

However, Bursa Securities said the Fe 4, 2012 announcement did not disclose crucial facts which were contained in the Bidco offer letter.

Among them was that the proposed acquisition would be fully settled by redeemable convertible preference shares in a new entity and the RCPS can be converted into non-voting ordinary shares in Bidco or redeemed for cash.

Another condition which was not stated in the announcement to shareholders was there was not new shareholder holding 5% or more in KNM or existing shareholder increasing their shares by 5% or more; or more than 10 new shareholders holding 1% or more in KNM shares.

“The conditions which formed an integral part of the Proposal were clearly of interest and material to shareholders and investors to enable them to make an informed decision regarding the proposal,” it said.

Bursa Securities said the conditions were material to assess the reasonableness of the offer and certainty of the acceptance by KNM of the proposal.

Bursa Securities noted that KNM’s share price and volume traded had increased following the announcement. KNM’s share price rose from 75 sen to 81.5 sen on Feb 5, 2010 and the volume traded on that day was 142 million (3.5% of KNM’s share capital) versus the past five-day average of 15.9 million shares traded.

The proposal subsequently lapsed on April 14, 2010.

From the posting: And So KNM Reported Its Earnings ..

- K C said...

KNM's ebitda for the half year 2011 is 78 m, and if annualized, 156 m. That EBITda amounts to less than half of the management guidance. KNM is a "big head devil". If you look at its earnings, 6 month pretax earnings is 8 m, or just 0.8% of the turnover. What is its ROE? 0.5%! Having more than a billion total debt, it just needs the interest rate to go up by 100 basis points to wipe out any profit! Some more the management keep on giving false hope to investors, just to do the wrong thing; to boost up share price. Do you want to invest in this type of company? KNM is too expensive at 50 sen is one of the most outrages investment understatements of the year

Some more the management keep on giving false hope to investors, just to do the wrong thing; to boost up share price

Flashback March 2008: Some Musings on KNM Reports

In that posting, I pointed out that in RHB's report, RHB mentioned the following:

- Management is giving guidance that FY08-09 net earnings to be around rm450million and rm700 million respectively.

Let's compare KNM's guidance versus actual performance.

- fy 2008, KNM made 336.175 million. (KNM guided 450 million)

- fy 2009, KNM made 257.847 million. (KMM guided 700 million)

And judging from this set of quarterly earnings it looks like KNM will come up very short against its own guidance.

And like K C said..." the management keep on giving false hope to investors, just to do the wrong thing; to boost up share price "

I totally agree!

Its simply shambolic that the management makes empty promises to the investing public!

And this is not the first time KNM had done this!

So let me ask the gatekeepers a simple question : "Does this represent good corporate governance that a company management makes empty promises to deliver profits to the investing public?"

Think about it..... seriously.

Do you want every single company to make bold statements that they will make XYZ profit but only to fall terribly, terribly short?

Company X will say in their profit guidance 'I will make 20 million' in a briefing to the investing public.. What do you expect the analysts in the briefing to do? Do you expect to come out and say... 'Nah, company X is totally BS!' or 'In your dreams! Those profits are not achievable!'

No you don't!

The analysts would be obliged to value company X based on that 20 million.

And since the 20 million is already a very extremely optimistic guidance, the share price of Company X will have to be upgraded!

But then ... when.... fiscal year comes... that 20 million is no where to be seen!

Now let me ask... has company X made a mockery of the market?

Isn't K C spot on by saying "the management keep on giving false hope to investors, just to do the wrong thing; to boost up share price "

Just to boost up the share price... the company management give the investing public false hope.

And so I ask... does this represent good corporate governance?

Or do you think KNM should be censored for making such wild profit guidance?

How?

I wonder if the gatekeepers are aware of what's happening.

And yeah the earnings again...

Can you see that the pretax profit is less than the after tax profit?

Why? KNM's got a nice fat tax benefit!!! ( Do read past postings )

And if we minus out the tax benefit, can we see how ridiculously small KNM's profits are????

( ps: K C, yeah the balance sheet is actually even weaker compared to its previous quarters. Loans increased, receivables increased a lot.... )

KNM reported its earnings.

A 6 months net earnings of just '29.8 million'?

Remember this posting on March 2011? What I Think Of KNM's Earnings Guidance

Let me highlight again:

- KNM’s management had met with analysts earlier in the week and guided earnings before interest, tax, depreciation and amortisation (Ebitda) of RM363 million for its FY11 (ending Dec 31, 2011), while the Ebitda for FY12 is targeted at RM564 million.

Yup, direct from the management own mouth...

KNM would have an EBITDA of rm 363 million for fy 2011.

And looks like the management is 'pretty good with its guidance' once more!

Yup! Strikes again!

Last posting on KNM was on May 2011: KNM: Are you IN it to win IT? Or are you IN it to LOSE IT???

I do not deny that falling stocks draws a lot of interest. For many, they think it represents a chance to buy a stock at a large discount and many a times, such strategy does works.

Now if you are not aware, KNM has fallen big time yesterday.

Here's a simple snapshot.

So the obvious question is KNM selldown an opportunity or what???

Are you IN it to win IT? Or are you IN it to LOSE it???

* Hehe.. where have you heard such a phrase before? *

Now if you are constant reaader of this blog (TQ!), you would realise that I offer NO direct answer to such a question. It's up to you to decide the issues highlighted in the postings.

Now as you are aware, yesterday I posted two postings. How Is KNM's Earnings Guidance Faring? and History Repeats As KNM Tanks On Extremely Weak Earnings. From the comments posted, many research houses (except for RHB) still have an extremely high Target Price for KNM.

But Encik Market apparently is not liking KNM so much after its dismal earnings report and it send KNM crashing some 15%!

So who is correct? Encik Market or Encik Research?

Now one article I noted was this from Bernama: KNM Continues To Draw Investor Interest and I saw one extremely naughty line inside! Was it a typo or was there an intent to deceive?

Quote: KNM's order book is still strong at above RM50 billion. We understand that high-end products are expected to contribute between 50-60 per cent of the total," OSK Research said in a note today.

Eh? Eh? Eh? Harloooo! Since when on earth did KNM order book is above RM 50 Biillion??????

Tsk! Is this an innocent typo or what?

I wish I have a copy of that OSK report on KNM yesterday. Anyway here's a snapshot of OSK report dated March 2011.

Quote: Both its orderbook and tenderbook are robust at RM5.4bn and RM17.0bn respectively.

And here's an article on the Edge on 9th March: KNM back to earnings guidance mode (hehe - we come back to that article later).

Quote: KNM is confident of securing higher RM3 billion to RM3.5 billion new jobs per annum in 2011 to 2012 with higher quality (thus better margin) potentials. Order book backlog now stands at RM5.4 billion,” Maybank IB research noted in its report.

So we know that KNM's existing orderbook stands around 5.4 billion and I wonder how the Bernama article has OSK saying KNM's order book is worth 50 billion!

Perhaps it's a typo and for many investors, they know order books doesn't mean much because the company still needs to turn the order book into net profits. That's what's important for them.

But of course, for the conspiracy folks and of course the flying SMS that did its round yesterday urging investors to BUY, BUY, BUY would suggest that perhaps someone doesn't want the stock to die! Hence it could be an opportunity.

Perhaps.

But perhaps it also could be the handiwork of some trapped souls.

Anyway... I always feel that it's important to know a stock history.

Now on one hand, let me say this first, knowing what has happened before would not guarantee you future success! But then history is important, no? Why do we study history in school? (ps I do not know this answer myself till this very day. I hated history. All I ever do is study dates. Why study dates? Go dating much fun, eh? :P )

Take stocks. If a stock has a long and troubled history, does it make sense to bet on it? Wouldn't the logical thing be is to find another better stock to bet on? Why force the issue?

Let's go back in time.

1 Sep 2010: Review Of KNM's Earnings

I wrote: KNM reported its earnings on 30th Aug 2010. And as expected, it wasn't nice at all.

LOL! 'And as expected'?

Well ... seriously what do you expect from the company when the management was more focused on trying to buyout the company? Yes, where is the company's focus? What's the company's priority?

Is the company focused on making more money?

Was it?

Apparently the company's management was more focused on its management buyout than its own business.

Now KNM stock is no stranger in selldowns!

The first one happened in July 2008. (sorry old Edge article. No link..)

- 22-07-2008: KNM down on financing concerns

by Jose Barrock

KUALA LUMPUR: Fast-expanding oil and gas player KNM Group Bhd continued to slide, shedding 25 sen yesterday to close at RM5.10 on concerns of its proposed exchangeable bond issue, in the current difficult period. At its lowest in intra-day trading, KNM fell to RM4.96.

The company’s shares were among the most active with 11.9 million shares traded. Since end- May this year, the company’s share has tumbled by about 27% and during the period in review, under-performed the sluggish Kuala Lumpur Composite Index by 13.5%.

According to Goldman Sachs, the dip in KNM’s shares is a result of fears as to whether the company’s proposed exchangeable bond issue will proceed, with the current weak market likely to be a dampener. KNM had taken a €350 million (RM1.8 billion) bridging loan to finance the acquisition of German-based Borsig Beteiligungsverwaltungsgeselschaft mbH, last month, and has since partially pared down some of these loans, by utilising proceeds from a RM1.1 billion one-for-four rights issue, which was completed end of last month

A month later - 19-08-2008: KNM falls on foreign selling

by Chong Jin Hun & Jose Barrock

KUALA LUMPUR: Shares of KNM Group Bhd fell to their lowest in 10 months yesterday, on speculation that a foreign shareholder of the company is reducing its stake due to the higher political risk in the country.

This is despite the outlook of the oil and gas process equipment manufacturer being described by fund managers as bright considering that crude oil prices are expected to be sustainable in the long run.

"One of the major shareholders is selling down. It’s a portfolio change in terms of country risk," an analyst told The Edge Financial Daily yesterday.

A fund manager said KNM’s fundamentals remain intact in the long term because oil prices are expected to be sustainable, albeit at a lower level. KNM officials declined to comment when contacted.

Yesterday, shares of KNM dropped 11% or 18 sen to finish at RM1.46 with 32.99 million shares done. The stock traded at a daily high of RM1.64 at 9am, and sank as low as RM1.38 as at 2.44pm. Shares of KNM which have declined 37.74% this year, touched a one-year high of RM2.48 on Jan 2 this year, and hit its yearly low of RM1.23 on Aug 21 2007.

Volume has also increased significantly since last Friday. A total of 15.3 million shares were traded last Friday and another 33 million traded yesterday.

Filings to Bursa Malaysia show that US-based FMR LLC, and Bermuda-registered FIL Ltd (Fidelity International Ltd) have sold down their equity interest in KNM. Both FMR and FIL had disposed of 6.55 million shares in KNM between Aug 4 and 12 this year. According to filings, Fidelity still has another 407 million shares representing 10.29% of the company.

It could not be determined if Fidelity was a major seller of the shares yesterday...

A month later: KNM shares at 12-month low- ... The company’s shares closed at RM1.24 yesterday.

Chong said although there was renewed concern surrounding the intangibles, there was “little risk of write-downs despite the current macro environment”.

“KNM is working with its auditors on how much they can revalue Borsig’s fixed assets and intellectual property,” he said.

He added that the current valuation of 2.33 million euros for plant and machinery did not include intellectual property.

Chong said the plants and intellectual property could be valued as much as 170 million euros (RM800mil) due to the latest robotic equipment and 19 different design patents that generated most of Borsig’s revenue.

“If Borsig’s fixed assets and patents are revalued upwards, this means that the RM1.6bil intangibles on KNM’s balance sheet will be reduced to RM800mil.

Then came the big one on Oct 2008! The following was posted here: KNM Comments About BTimes ArticleLet me paste the following here: The following was most interesting - Acquired 23/10/2008 11,376,000

Disposed 16/10/2008 72,271,600

Disposal was massive! And did you see the point 2? Disposal of 72,271,600 shares - sold down by financier which is now resolved And more interestingly, the company DID a share buyback during this same period! Notice of Shares Buy Back by a Company pursuant to Form 28ALook at the details  Date of buy back from : 16/10/2008 Date of buy back from : 16/10/2008

Date of buy back to : 22/10/2008Total number of shares purchased (units) : 22,190,200 Minimum price paid for each share purchased (RM) : 0.415 Maximum price paid for each share purchased (RM) : 0.690 Total amount paid for shares purchased (RM) : 13,544,216.13 Er how? The boss shares were sold down by his financier and during this exact same period, the company bought back shares! Like this also can meh? (Of course the share bought back brought 'stability' to the share price. Look at the min and max price paid for the share buybacks! But for some traders, they just love such stuff! No joke! Forward to 2009. On March 17th 2009, Management buyout of KNM hinges on fundsMassive privatisation talks via a MBO is been prmoted by the MD. - A management buyout (MBO) will be considered for KNM Group Bhd but funding must be available, said managing director Lee Swee Eng.

“In the current environment, it will be very difficult to raise funds,” Lee told StarBiz in reference to a Bloomberg report on the possible privatisation of the company.

A Bloomberg report yesterday quoted Lee as saying he would consider leading an MBO as long as banks will the funds.“We are very undervalued. The opportunity for privatisation is a good opportunity but it’s the source of funding. There is no offer on the table,” he was quoted as saying.

Straight from the horse mouth. KNM is very much undervalued. Wednesday, 10 June 2009, the Edge Financial Daily publishes the following. KNM’s MD sells 63.65m shares

- KUALA LUMPUR: KNM Group Bhd managing director Lee Swee Eng’s selling of a 1.6% stake recently has raised eyebrows and concerns about whether he would continue to pare his interest in the oil and gas player.

Replying to queries by The Edge Financial Daily via SMS yesterday, he said the selling of the shares was a strategic placement. “The proceeds from it will be used to degear and clear up all the margin taken up during the rights issue,” he said, but mum on whether he would be selling more shares.

According to a Bursa Malaysia filing on Monday, Lee sold a total of 63.65 million shares representing a 1.6% stake in KNM between June 1 and 4 at prices ranging from 97.5 sen to RM1.02 apiece.

Lee still holds a 23.74% stake in KNM as at June 8, via direct and indirect interests. While there were no new filings on Bursa regarding substantial shareholding changes in KNM yesterday, the company did see a block of 10 million shares change hands off-market yesterday in a block deal, at RM1.03 per share.

The stock had hit a six-month high of RM1.06 last Friday. It was the most actively traded stock yesterday with 82.64 million shares done, closing one sen lower at RM1.03.

“We believe that the share sale may help to raise funds to redeem part of Lee’s holdings under a share margin account,” said HwangDBS Vickers Research in a report yesterday.

The research firm pointed out that in October last year, Lee had been forced to sell a portion of his KNM shares by CIMB Bank. It was the fear of margin calls that had caused the company’s share price to drop during that period.

“We understand that the shares (the block sold in October 2008) was under share margin financing. This time around, the share sale is not under forced selling but Lee has raised around RM64 million and this could be used to redeem his holdings,” said HwangDBS.

Ahem.. see how KNM the stock had recovered? If you were a trader, wouldn't you love KNM so much? But if you are a minority shareholder, think for a moment. Perhaps I am flawed in my way of thinking. Well acordingly the initial sell down was because of Lee's share margin financing. And KNM the stock got hit big time! Poor minority shareholders who had to suffer the selldown just because the MD's shares were sold down! Come March, the MD starts to promote his shares stating KNM were very much undervalued. So cheap that he wanted to do a privatisation via a MBO. Then the markets rallied worldwide. And KNM shares soared too. Everyone was happy. The MD Lee was even more happy and KNM did not seem undervalue no more, as he disposed a chunk of his shares and according to HwangDBS his disposal of shares helped rake in a tidy rm64 million ringgit!How's that for cool? And what about the MBO? Guess what? On 15 April 2010: KNM's MBO FailsSorry but looking at it now, perhaps one would ask if there was any real intent to do the MBO. And then there were many who simply wished that the MBO was real!!! 26 May 2010: Oh KNM, Can You Please Buyout The Company At 90 Sen?With all these behind, KNM starts talking. The boss starts talking about 'swelling' orderbooks! It was unreal talk for those who had kept track of its orderbook. See posting: KNM: I Just Love The Way The Boss Talks!And then the Boss continues to talk! On 1 March 2011: KNM Says It Wants To Buy More Foreign Firms And Expand.. . And some were amazed by such talk because as per its balance sheet then, it did not appear that KNM was strong enough to buy more foreign firms. A week later KNM started giving earnings guidance again. See What I Think Of KNM's Earnings GuidanceNow earnings guidance is important. It tells the local research house what to expect from the companies earnings. It's an indicating tool for the analyst and they use it as one of the basis on how they value the stock. Naturally the higher the earnings guidance, the better for the stock. Simplicity. Higher earnings guidance means higher future earnings per share, which eventually means higher stock price.

And as mentioned before, in my usual flawed and wrong opinion, if a CEO or management opens its mouth and guides its earnings, I believe that the analyst/research reports have no choice and they have use that GUIDANCE number! This is what the INSIDER, the CEO, the TAIKOR is telling them. The analyst cannot simply say, 'Oh no, dear Bossie, your GUIDANCE numbers are very rocket. There's no way your company can achieve those numbers!!!!'. It's like telling the CEOs they are BS-ing! They simply cannot do that, can they? And now that they do follow the guided numbers and when the actual earnings are way below estimates, the analysts would probbly feel silly. Now the issue is with KNM's earnings guidance. KNM did not have a good track record when they give earnings guidance. Anyway as per the March posting: What I Think Of KNM's Earnings Guidance Let's compare KNM's guidance previously and compare to what KNM actually earned. Such comparison should be useful, yes? At least we get to know the quality of KNM's earnings guidance. So how did KNM do? fy 2008, KNM made 336.175 million. (KNM guided 450 million)

fy 2009, KNM made 257.847 million. (KMM guided 700 million)

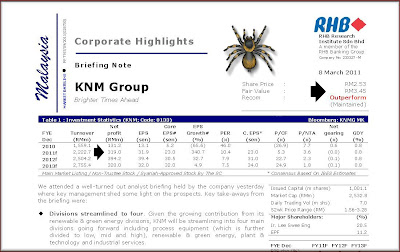

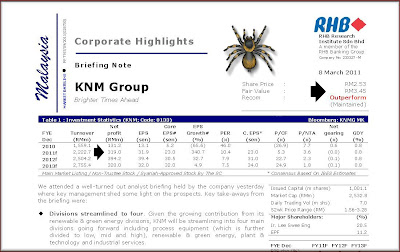

Now on March 2011, earnings guidance, KNM said "KNM’s management had met with analysts earlier in the week and guided earnings before interest, tax, depreciation and amortisation (Ebitda) of RM363 million for its FY11 (ending Dec 31, 2011), while the Ebitda for FY12 is targeted at RM564 million." And with such guidance, research house like RHB gave an earnings forecast of 319 million for FY 2011 for KNM. And naturally RHB gave it an OUTPERFORM rating.  How did KNM do for the first quarter? "The Group achieved revenue of RM413.00 million, profit after tax and minority interest of RM19.02 million and EBITDA (Earning Before Interest, Tax, Depreciation and Amortisation) of RM39.89 million for the period ended 31 March 2011.." KNM's profit before tax for FY 2011 Q1 was only 6.267 million. ( I am ignoring the tax incentive ANGPOW given to KNM!) (ps: with such booming eps, how much do you think KNM can earn this year?) And RHB was less than impressed too! "1QFY11 PBT of RM6.3m was significantly below expectations, accounting for only 2.3% and 3% of both our (RM277.5m) and consensus (RM208.9m) estimates respectively."  How? And oh.. the goodwill issue. It's just some 832 million worth of goodwill sitting inside KNM's books. Why? I don't know. So how lah? Based on all these, do you want to bet on this stock or not? I don't know Teochew music but I know some Hainan music. Can ah?

From the posting How Is KNM's Earnings Guidance Faring?

- Mun Wai said...

Moo,Quoted from your posting on 9 Mar : "Now because KNM's is telling all the research houses that it will earn so much, naturally the research houses have to base their fair value target projection for KNM based on these high numbers."

By sticking tothis unrealistic earnings guidance and consequently arrive at their earnings estimates (AmResearch even says 383m), won't the research houses are confusing many naive minds?

Good point. Well, in my usually flawed and wrong opinion, if a CEO or management opens its mouth and guides its earnings, I believe that the analyst/research reports have no choice and they have use that GUIDANCE number! This is what the INSIDER, the CEO, the TAIKOR is telling them. The analyst cannot simply say, 'Oh no, dear Bossie, your GUIDANCE numbers are very rocket. There's no way your company can achieve those numbers!!!!'. It's like telling the CEOs they are BS-ing! They simply cannot do that, can they? And now that they do follow the guided numbers and when the actual earnings are way below estimates, the analysts would probbly feel silly. Anyway as per the March posting: What I Think Of KNM's Earnings GuidanceLet's compare KNM's guidance previously and compare to what KNM actually earned. Such comparison should be useful, yes? At least we get to know the quality of KNM's earnings guidance.

So how did KNM do? fy 2008, KNM made 336.175 million. (KNM guided 450 million)

fy 2009, KNM made 257.847 million. (KMM guided 700 million) Yeah... naturally KNM tanked big time back then!!!

But the point is KNM's guidance back then was horrendous and way off target!

Posted on 9 March 2011 : What I Think Of KNM's Earnings Guidance

Let me repeat what KNM management said:

- KNM’s management had met with analysts earlier in the week and guided earnings before interest, tax, depreciation and amortisation (Ebitda) of RM363 million for its FY11 (ending Dec 31, 2011), while the Ebitda for FY12 is targeted at RM564 million

That was from the horsie own mouth and this wasn't no hot shot analyst estimates and this horsie, KNM, is TELLING everyone that it will earn some EBITDA of rm 363 million for fy 2011 and rm 564 million for fy 2012. And I remarked What I Think Of KNM's Earnings Guidance in that posting. So KNM reported its Q1 earnings. Here's the screenshot.  And here's what KNM has to say about their earnings. The Group achieved revenue of RM413.00 million, profit after tax and minority interest of RM19.02 million and EBITDA (Earning Before Interest, Tax, Depreciation and Amortisation) of RM39.89 million for the period ended 31 March 2011. Compared to the previous year, the higher performance for revenue and EBITDA in this year was due to higher revenue recognised and higher contribution margins, whereas profit after tax and minority interest in this year was lower due to lesser deferred taxation impact. Ok it's only the first quarter but remember KNM had said: - KNM’s management had met with analysts earlier in the week and guided earnings before interest, tax, depreciation and amortisation (Ebitda) of RM363 million for its FY11 (ending Dec 31, 2011), while the Ebitda for FY12 is targeted at RM564 million

How?

On the Edge Financial Daily: KNM back to earnings guidance mode

'Back' to earnings guidance mode. Yeah. KNM USED to give earnings guide but let's not talk about the past, just yet.

Let's focus on the main issue, which is 'How Much'.

- KNM’s management had met with analysts earlier in the week and guided earnings before interest, tax, depreciation and amortisation (Ebitda) of RM363 million for its FY11 (ending Dec 31, 2011), while the Ebitda for FY12 is targeted at RM564 million

From KNM's own words, KNM is TELLING everyone that it will earn some EBITDA of rm 363 million for fy 2011 and rm 564 million for fy 2012. Now because KNM's is telling all the research houses that it will earn so much, naturally the research houses have to base their fair value target projection for KNM based on these high numbers. Yeah what else can they do but base their reports based on such projections, yes? Now check this out. What we do know for now is KNM only earned some 131 million for its fy 2010. And if we do believe KNM's management, KNM can earn as high as 500 million for its fy 2012! Now tell me if that's rather optimistic. And consider the fact, the best KNM ever made was for its fy 2008 earnings. KNM had a net profit of rm 336 million. So KNM is telling us, the investing public that by 2 years KNM will bring in record profits. And consider the fact, fy 2010 Q3, KNM earned some 56 million. Its latest fy 2010 Q4, KNM earned some 20.6 million. Drastic drop on q-q earnings, yes? But it doesn't matter KNM says it CAN. Yes it can. It will earn some 500 million plus in 2 years time! Can ah? Now let's look at the BACK issue as mentioned at the start of the posting. See KNM used to give earnings guidance.Then it stopped.Aha... doesn't the inquiry mind wants to recall what happened? Let's use March 18, 2008. I wrote the following posting: Some Musings on KNM Reports. In that posting, I pointed out that in RHB's report, RHB mentioned the following: - Management is giving guidance that FY08-09 net earnings to be around rm450million and rm700 million respectively.

Ahaaaaaaaaaaaa..... Let's compare KNM's guidance previously and compare to what KNM actually earned. Such comparison should be useful, yes? At least we get to know the quality of KNM's earnings guidance. So how did KNM do? fy 2008, KNM made 336.175 million. (KNM guided 450 million) fy 2009, KNM made 257.847 million. (KMM guided 700 million) Yeah... naturally KNM tanked big time back then!!! But the point is KNM's guidance back then was horrendous and way off target! Yeah.. it doesn't take a genius to figure out why KNM stopped giving earnings guidance. And now... KNM is back at the game again. Giving very optimistic earnings guidance. How now brown cow?

I was reading the following article on today's Business Times:

- KNM wants to buy foreign firms, expand product line

By Sharen Kaur Published: 2011/03/01

Process equipment maker KNM Group Bhd (7164)aims to buy foreign firms and expand its product line in a bid to diversify and improve earnings, its chief said.

The group, which has RM300 million cash, is eyeing companies with investments in green technology, total solution and process, nuclear and environment, among others.

“There will be some major things happening within the next one year. The idea is to expand geographically and strengthen our product line,” KNM managing director Lee Swee Eng said.

Lee said the investment KNM made in 2008 to buy Borsig GmbH of Germany for e350 million (RM1.4 billion) has strengthened its belief that acquisitions are the right thing to do.

KNM’s German operations have been contributing 50 per cent to the group’s revenue and net profit.

Lee expects KNM to do better this year and growth to accelerate from 2012, driven by its order backlog of RM4.5 billion and business expansion.

KNM will start to see recognition from its RM680 million turnkey project in Uzbekistan and its RM2 billion biomass plant in the UK.

Last year, KNM posted a net profit of RM131.2 million on revenues of RM1.6 billion.

“Overall, we are profitable and on the road to recovery. Our existing order backlog is at an all time high compared to an average RM3.5 billion prior to the economic crisis.

“We are bidding for new projects worldwide,” Lee said at a luncheon in Kuala Lumpur yesterday.

Lee declined to comment on whether KNM will be taken private with its share price falling below fair market value.

Meanwhile, the luncheon, hosted by Germany Trade & Invest and Malaysian-German Chamber of Commerce and Industry, presented new opportunities for Malaysians to invests in all sectors in East Germany, backed by Europe’s largest airport project, Berlin Brandenburg International Airport (BBI).

BBI will have a capacity of 27 million passengers when it opens in early 2012.

Now since I had blogged several times on KNM, I was a bit familiar with the company. So on today's papers, the boss said it wants to expand and it wants to buy more foreign firms. Well, it's good to have ambition but let's have a reality check on KNM. KNM reported its earnings the other day. The earnings... was rather.... really smallish given the size of the company and as mentioned before I was less than impressed with KNM's balance sheet. From the posting made on 1 Sep 2010: Review Of KNM's Earnings  That was KNM's financial health!!! The classical GROWTH in debts. The classical shrinking cash. From KNM's earnings last week, KNM cash balance dropped to 296 million. Total debts stood at 1.045 BILLION. And with such a strong financial, the company tells the media it wants to buy more foreign companies! Err... are those foreign companies worth a dime a dozen? or what? Seriously! Nah... that is why .... - 24 June 2010: KNM: I Just Love The Way The Boss Talks!

- 26 May 2010: Oh KNM, Can You Please Buyout The Company At 90 Sen? ( How unlucky the minority shareholders the buyout failed! :P )

- 28 April 2010: I Just Like KNM So So So Much

- 22 April 2010: Why I Like KNM Even So Much More Today!

- 21 April 2010: Why I Also Like KNM A Whole Lot

Oh yeah.... - Last year, KNM posted a net profit of RM131.2 million on revenues of RM1.6 billion.

A net profit of 131 million? Should I be impressed? Or should I compare to KNM's financial history as posted in the Sep 2010 posting, Review Of KNM's Earnings  Yeah.. KNM's earnings has been declining since 2007!

KNM reported its earnings on 30th Aug 2010. And as expected, it wasn't nice at all.

LOL! 'And as expected'?

Well ... seriously what do you expect from the company when the management was more focused on trying to buyout the company? Yes, where is the company's focus? What's the company's priority?

Is the company focused on making more money?

Was it?

Apparently the company's management was more focused on its management buyout than its own business.

How unlucky for the investing public that the MBO had failed!

Yes... what do you expect? what did I expect?

:P

Posted one time too few....

- 24 June 2010: KNM: I Just Love The Way The Boss Talks!

- 26 May 2010: Oh KNM, Can You Please Buyout The Company At 90 Sen? ( How unlucky the minority shareholders the buyout failed! :P )

- 28 April 2010: I Just Like KNM So So So Much

- 22 April 2010: Why I Like KNM Even So Much More Today!

- 21 April 2010: Why I Also Like KNM A Whole Lot

- 15 April 2010: KNM's MBO Fails

- 23 March 2010: KNM: Should I Stay Or Should I Go?

- 23 March 2010: KNM: Do Show Us The Money!

- 22 June 2009: More On KNM

- 17 June 2009: Regarding KNM's MD Disposal Of Shares For A Cool RM64 Million ( Did you miss this? Did you? Did you? :P )

- 26 November 2008: KNM Q3 Earnings (where's the creation of wealth?)

- 27 Oct 2008: Regarding KNM's Sell Down! ( Did you also miss this? :P )

- 24 Oct 2008: KNM Comments About BTimes Article (LOL!)

So how poor was KNM's earnings?

Current fy 2010 ytd numbers indicate that 2010 would be another disappointing year and it should be even worse than 2009! Which would means two years of earnings decline!

And if memory does not fail me, KNM became a darling stock because of its spectacular earnings growth ( aha.. the 'engineered' growth via acquisitions and.... debt! :P )

In 2004, it earned only 15 million. 2 years later it earned some 133.5 million. Yup! Spectacular earnings growth and the market loved what it saw and KNM became a darling stock.

And that's not all! The earnings table above is 'distorted' because KNM's earnings was boosted by the "recognition of tax incentive granted for Borsig acquisition".

Now imagine if KNM did NOT get this tax incentive?

Can you picture how 'good' KNM's earnings was??????

Exactly!

Don't you wish for that so-called 90 sen MBO!!!! :P

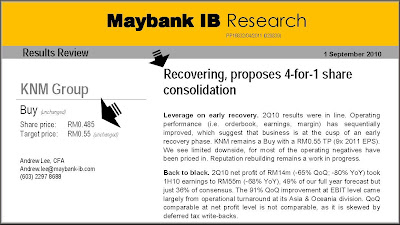

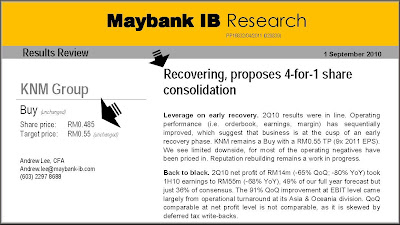

Now apparently, MiB ( Maybank Investment Banking yo! And not Men In Black! :P ) disagrees! MiB reckons that KNM is 'recovering'! :P  And the statement that stood out the most was... - KNM remains a Buy with a RM0.55 TP (9x 2011 EPS). We see limited downside, for most of the operating negatives have been priced in. Reputation rebuilding remains a work in progress.

Limited downside! The classical 'negatives all priced in'! Huhu! Wiki wiki! KNM currently down some 9.3%. It last traded at 44 sen. ( That MBO price... how muchie? :P :P ) Now the BUY TP.... based on 9x 2011 EPS. Sounds reasonable at first sight but apparently stocks and recommendations is unlike love at first sight! Time to check out KNM's estimates. :P

And MiB 'expected' earnings for KNM is 232.4 million for KNM's fy 2011!

Remember, KNM's ytd 2010 earnings is 54.478 million (which was boosted by some 45.474 million in tax benefits!). How? Do you like KNM or not? :P

I just love how the boss talk.

Which boss? This one.

And yeah... talk is always free when supply is more than demand. :P

- KNM order backlog may swell to RM3b

By Zuraimi Abdullah Published: 2010/06/24

KNM Group Bhd (7164), an export-oriented process equipment manufacturer, has hinted that its order backlog will swell to more than RM3 billion this year from RM2.1 billion currently.

"Our (order) replenishment will be higher in 2010. We now have an order backlog of RM2.1 billion. In 2009, the market was very bearish, but we were still able to get an order intake of RM1.5 billion," managing director Lee Swee Eng said.

MAY is such a nice three little word. Wait I have to declare the following postings.. - Oh KNM, Can You Please Buyout The Company At 90 Sen?

- I Just Like KNM So So So Much

- Why I Like KNM Even So Much More Today!

- Why I Also Like KNM A Whole Lot

Anyway.. bottom line is KNM current order book stands at 2.1 Billion and he hopes to get it to 3 Billion. Now as it is... it does look like a simple clean statement but...but... but... if you do simple search.. you will see... clearly... why I LOVE the way he talks! 29 June 2007: KNM to ramp up capacity - Lee said the group's current order book stood to RM1.74bil, pushing its factory average utilisation rate to more than 80%. Most of these jobs would be completed within 18 months

7 Dec 2007: KNM to buy rival for RM2bil - KNM told the analysts that the group’s current order book value had expanded 19% from end-September to RM2.5bil currently. The jobs usually take an average 18 months to complete. Oil and gas made up 47% of its order book, followed by petrochemicals 28% and minerals 17%, while the rest were from various sources.

5 Feb 2008: KNM to raise RM2.2bil - Meanwhile, Lee also told StarBiz that KNM's current order book stood at about RM2.8bil, while bids valued at RM11bil had been submitted. “So, prospects are looking very bright for us,” he said.

31 Mar 2008: KNM sees Borsig as a jewel in the crown - The German manufacturer will bring in an order book of RM1.5bil to KNM's existing RM2.4bil.

hmm... 1.5 bil + 2.4 bil = 3.9 Bil hor. 7 Aug 2008: KNM gets overseas orders worth RM463mil - KNM has an outstanding order book of about RM4.2bil and is bidding for RM20bil worth of projects.

13 Oct 2008: KNM sticks to target despite slowdown - “We’re confident of servicing our interest payments and paring down debts,” he told StarBiz, adding that its order book was some RM4.7bil.

Yeah... despite the slowdown.. boss talks... and talks... of being confident.. 30 Jan 2009: Job orders to slow for KNM - KNM Group Bhd expects the replenishment of its order book to slow down due to the weaker economic conditions.According to managing director Lee Swee Eng, customers are re-evaluating their budgets, including the value of tenders, due to the slump in raw material and commodity prices.“They want the effect of lower raw material prices to flow back into the contracts. The normal conversion cycle was three to six months but it is now slowing down to six to nine months,” he told StarBiz in an interview.

errr... long article... but KNM .... the boss... he talk... I like... just say expect order book to slow down... but if my eyes not faulty, I don't think I saw boss say current order book then how much! I wonder why. 20th Feb 2009: 20-02-2009: KNM: Order book stands at RM3.9b - KUALA LUMPUR: KNM Group Bhd’s total order book secured to date is about RM3.9 billion while it had received compensation for the cancellation of two supply contracts, the company said. In reply to a query from Bursa Malaysia, KNM said its unit, KNM Process Equipment Inc was compensated by Petro-Canada Oil Sands Inc over the cancellation of a contract to supply columns and pressure vessels totalling RM18.78 million. KNM also said its unit FBM Hudson Italiana SpA — whose supply of feed and effluent heat exchangers amounting to RM58.28 million was also cancelled by Petro-Canada Oil Sands — had also been compensated...

ok.. they got compensated... but order book is now only 3.9 billion. Oct 2008 it was 4.7 billion! I wonder if this cancellation of contracts was known in Jan 2009 or even earlier. 28 May 2009: KNM Sees Signs of Contract Pickup After Crude Rally (Update2 ... - “Our guys are becoming very busy again,” managing director Lee Swee Eng said in a phone interview yesterday. “Not busy taking orders, but busy starting to discuss. Customers are starting to restart their projects.”Exploration projects become more commercially viable the higher oil prices climb, bringing in business for contractors. A 40% jump in crude prices this year has helped KNM shares more than double in the same period, reversing a tumble in 2008.It’s not clear now long it will take for these new oil and gas exploration proposals to translate into new contracts, Lee said. He declined to disclose the value of KNM’s order book, which in March was RM3.9 billion. The company will release first-quarter results this week, he said.

Huhu... his guys are busy again... hmm... they were very free earlier? :P But... the key sentence... he DECLINED to disclose the value of KNM order book. LOL! Why ah? 10 June 2009: KNM's MD sells 63.65m shares - The Edge Malaysia Huhu.... my hero dumps 63.65 million worth of shares.... no wonder... new reports had continued to say that he declined to disclose KNM current order book! 1 Sep 2009: KNM Group 1H09 within expectations but analysts' views still mixed - Also, as at June 2009, its order book and tender book were a robust RM2.8 billion and RM14 billion respectively, it said.

Huhu....KNM order book is now only 2.8 billion. No wonder... all the silence from the boss! See he's so smart (that's why he my hero) and sold 63 million shares.... btw.. that one line comment was from my favourite research house comments. OSK Research. See they so clever paint the nice picture to the investing market and said KNM's order book were a robust 2.8 Billion. See it doesn't matter. 2.8 Billion is 2.8 Billion. It certainly doesn't matter that less than a year ago, the order book was at 4.7 Billion. it doesn't matter. OSK said it was robust. 11 Jan 2010: source: here - Order book is down to RM2.2 billion (previously RM2.7 billion), mainly due to project completion while tender book is maintained at RM14 billion thus far. At their historical burn rate of RM500 million per quarter, existing contracts will still last them throughout the year; good enough to tie them down for 2010, as they await contract flows to improve.

So today, KNM finally declared to the investing public and me... that it's order book is only 2.1 Billion. And oh... it MAY swell to 3 Billion. Question is..... are you impressed? ---------------- update: 2:17 pm. I just realised the Edge carried the following article: KNM open to possibility of another privatisation ROFLMAO! Taukeh lang... how muchie? Yaloh.. this time how muchie you want to offer us? :p3

I looked at KNM's earnings reported last night.

Less anyone forget I wrote Why I Also Like KNM A Whole Lot and Why I Like KNM Even So Much More Today! and I Just Like KNM So So So Much just last month.

So what was I going to expect I asked myself. Here we have a company who is run and managed by a person, who is also the Managing Director and Chairman of the company, who had been busy attempting to buyout the rest of the company. Yeah, what can we expect, he has been rather busy. How nice. What a caring owner we have here. The minority shareholders should be so pleased.

Before I look into it's earnings, there was one interesting side note. On Feb 2010, KNM reported its 2009 Q4 earnings. Quarterly rpt on consolidated results for the financial period ended 31/12/2009. It was said KNM lost some 31 million.

But end April this figure was adjusted due to tax incentive. Deviation Between Announced Unaudited Financial Statements And Audited Financial Statements For the Year Ended 31 December 2009. KNM's profits were adjusted higher by 94.6 million, thanks to the "recognition of tax incentive granted for Borsig acquisition".

Earlier this month, KNM had a feature article on Business Times. ( Sometimes, it's good to read these comments and then compare it to the company's earnings. Hey we need to know if the article is trying to scare the investors away, yes? :D )

- KNM Group expects to perform better this year

Published: 2010/05/04

PROCESS equipment manufacturer KNM Group Bhd (7164) expects to perform better this year on lower tax rates and higher exploration and production activities.

Moolah: Ok... KNM is given a huge helping hand from taxes. - "We recently spoke to the management of KNM following the breakdown of its proposed takeover offer. We believe that investors have overlooked the business aspect in the last few months after the takeover news first broke off back in February 2010," wrote HWANGDBS Vickers Research Sdn Bhd (HDBSVR) analyst Lee Wee Keat in a note to clients yesterday.

Moolah: Excuse me, Mr. Lee Wee Keat. What can the investors do? Should we watch the business aspect? Should we? We are not even sure if the management is busy watching the business aspect themselves since they are so busy trying to buyout the minority shareholders. Some naughty and bad investors are saying 'why bother'. Mr. Lee, you should drill some sense into them. - KNM's substantial shareholder and group managing director Lee Swee Eng had recently aborted his proposed offer via Bluefire Capital Group to buy KNM's entire business at RM0.90 per share.

Moolah: KNM now so cheap. Its only 48 sen. Here's a tip to KNM management. In my flawed opinion, if you do a proper takeover at RM0.90 per share, I believe many minority shareholders and funds would be soooooooooooo happy to sell to you now. How? - Last year was a bad year for KNM as oil majors held back spending in view of low and volatile oil prices.

Moolah: OOoooo... oil prices now even lower. How? - "We understand that KNM managed to secure only RM1.5 billion worth of jobs last year, and capacity utilisation was only 65 per cent compared with 80 per cent in 2008.

Moolah: Mr. Lee, as an analyst, do not understand la. Why don't you get proper confirmation before you make such statement? If not, if the management denies such statement, then how? Yaloh, what if KNM says they got more contracts, then how? - "(Profit) margins for the jobs secured were also slimmer as intense competition over the modest number of jobs available led competitors to cut prices," he said.

Lee expects margins for the next few quarters to remain sluggish as the company completes jobs secured last year. He estimated that the average completion ranges from 15 to 18 months per project.

"We gather that margins have improved since, but have yet to recover to previous levels."

Lee also said concerns over KNM's orderbook replenishment persists.

"KNM has a RM2.4 billion orderbook, with RM400 million of new contracts secured thus far. This is slow, but we foresee a rise in exploration and production activities in the second half of this year to trigger contract flows."

The group currently has a RM11 billion tender book comprising jobs mostly in the Middle East and Europe.

However, Lee has cut his new wins assumption for KNM to RM1.7 billion from RM1.8 billion previously for the financial year ended December 31 2010 (FY10), based on current tender book and historical hit rate of 15 per cent.

KNM's FY09 audited net profit stood at RM260.6 million after adjusting for the tax incentive, which was granted by the Finance Ministry on April 7 2010 to its subsidiary KNM Process Systems Sdn Bhd for the acquisition of Borsig.

Totalling RM1.4 billion, the tax incentive will apply for a period of four years from 2009.

"We expect a lower tax rate going forward as local operations will be spared from paying taxes. Also, there was no impairment charge for Borsig. Borsig contributed about 45 per cent of total FY09 earnings," said Lee.

The research firms has upgraded KNM to "hold" from "fully valued", but lowered its target price to RM0.60 from RM0.65.

"We expect some overhang in the share price given the EPF's recent heavy selling, but at the current price level, we believe that most of the negatives have been priced in. KNM has also started to buy back its shares.

"We believe KNM's strong RM571.7 million cash balance should support more buyback on share price weakness," said Lee.

Strange. This was basically an article based on HWANGDBS Vickers Research Sdn Bhd (HDBSVR) analyst Lee Wee Keat notes. Why the article titled 'KNM Group expects to perform better this year'? Why ah?So how?Time to take a guess.KNM has got huge tax benefit. 1.4 billion woh. No play-play, yes? With so much incentive, I am going to guess that its net earnings should easily be more than 100 million. That was my guess. And I was wrong. LOL! Yeah, wrong again. Last night, KNM's earnings before tax fell to just a mere 245 thousand but its final net profit came in at 40.334 million many thanks to deferred taxes.

How? Is this very happening set of earnings or what?

On the Edge Financial : KNM's 1Q net profit falls 60%

- KUALA LUMPUR: KNM GROUP BHD []'s net profits for the first quarter (1Q) ended March 31, 2010 fell by 59% to RM40.33 million from RM98.45 million a year earlier as revenue declined nearly 30% to RM373.3 million on the back of lower utilisation of capacity.

Meanwhile, profit before tax fell to RM249,000 in 1QFY10 from RM124.9 million a year ago. It recorded basic earnings per share of 1.02 sen from 2.51 a year ago.

Compared to the preceding quarter, revenue is lower by 10.38% compared to 4QFY09's revenue of RM416.52 million. However, its profit before tax and minority interest at RM249,000 is better than the 4Q loss before taxation and minority interest of RM80.9 million.

In a filing to Bursa Malaysia, KNM said the difference in the profitability was due to one off foreseeable losses provided in the previous quarter.

KNM's board maintained that it is confident that the group will “continue to be profitable” for FY2010.

At its close on Tuesday, May 25, the stock fell two sen to 48 sen and was the second most actively traded counter on the local bourse.

RM 249 thousand profit before tax is better.... better??? Nice that KNM Group decided to make a comparison when their profit before tax is only rm 249 thousand. Anyway, I was looking at company's balance sheet. KNM cash is at 496 million. Lots of money eh? ( Oops... Mr. Lee from HWANGDBS Vickers Research Sdn Bhd noted in early May that KNM had some 571 million!) Of course some would argue that despite the drop, KNM is very rich. Cash rich. But what about debts? Oh KNM only has some total debts of 1.157 Billion. How? Oh KNM, can you please, please, please, please buyout the company at 90 sen???? Pretty please?

|