I received some new comments in the following blog posting Move Over Who?: Part VIII

- I just downloaded the Q1/2006 report and noted that Karensoft had actually reported a Q1/2006 profit. Perhaps their strategy of focussing on ERP4Auto is paying off ?

- However, I am puzzled why you did not mention that Karensoft reported a Q1/2006 profit ?

I downloaded the Q1/2006 and the 2005 accounts and running through the GN3 Guidelines, I cannot understand why Karensoft was clasified as a GN 3 company as they pass all the tests as a Group and should not be classified GN 3.

The only thing that could hit them would be 2.1 (b) & (c) where the accounts of the listed company alone are considered. I noticed that there was an impairment loss of about 9 Million charged to the P/L of the holding company and not the group. As far as I know, FRS 136 on Impairment of Investments should only be efffective 1/1/06

Could it be that Karensoft has been penalsied for early compliance with FRS 136 ?

Yes, by not posting a new follow-up article on Karensoft probably might leave some readers thinking that I am truly biased against some stocks and more so biased against Karensoft since it did report a profit recently.

Anyway, I do hope very much that you do understand that this is a mere personal blog of mine, mumblings of my opinions and views on stocks from an investing point of view. It's really a general blog, hence unless there is an request, I do not feel I have the need and the obligation to follow-up on every issue of every stock I have mumbled on before. Some has even posted ugly comments that I sound like a broken tape recorder when I have kept repeating blog postings on a same stock.

Firstly, for some strange reason, I could not open the pdf file attachment from their latest quarterly earnings posted on Bursa website.

Could someone confirm if they can open the above pdf file attachment link?

Anyway, I will have to rely on Karensfot's Investion Relation (IR) website: here

Now Karensoft was listed back in 2003. Karensoft has been losing money each single year since it was listed. ( see here )

- FY 2003: Loss 0.595.17 million

- FY 2004: Loss 3.930 million

- FY 2005: Loss 10.809 million

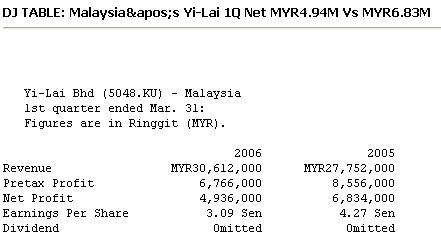

The latest earnings, 2006 Q1 saw Karensoft reported a profit. A new year, a new beginning. So how did Karensoft do?

- A sales revenue of 0.593 million.

- A net profit of 0.101 million.

A profit of 101 thousand from sales revenue of 593 thousand???

Hardly impressive at all!

Considering its past torrid history and also the incredible chain of events when Karensoft was proudly proclaimed by a local brokerage house that its Execsuite software could rival the mighty M'soft's Office Suite software and how the stock tumbled dramatically a couple of months after that recommendation, its performance wasn't too impressive, yes?

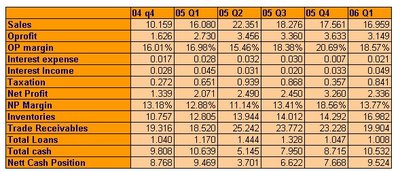

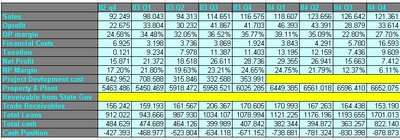

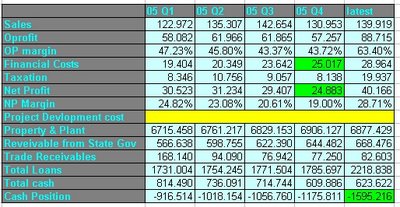

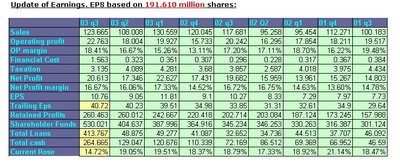

And the following issue is even more mind-boggling. Have a look at the following screen-shot of this webpage, http://ir.wallstraits.net/karenSoft/page.php?id=profit_loss

Simple exercise.

Add Karensoft total sales revenue since listing in 2003.

Add Karensoft's sales revenue since listing in 2003 and you will get total sales of 12.627 million.

Add Karensoft's total losses since listing in 2003 and you will get total losses of 15.334 million!!

And consider the fact that Karensoft stated that these losses were derived from provision of doubtful debts.

So how does a business accumulate so much doubtful debts?

Now I do reckon that this is one really interesting issue for all. Any conspiracy theories?

How?

Anyway, had you not request commentary on this stock, perhaps some might even accuse me for promoting the stock and making insinuation that perhaps Karensoft is on its way in turning around its business.

But of course, one can argue Karensoft has made a profit and no matter how small that profit is, a profit is still a profit. And since it has made a profit, there is a chance that this could very well be the start of a brand new Karensoft.

True, very true but surely one of question how sustainable is such earnings. A profit of 101 thousand from a sales revenue of 593 thousand is really peanuts and such performance is really shockingly poor considering the fact that Karensoft is a listed company!

And from its IR website, Karensoft's current balance sheet shows a cash balance of 2.943, while its total borrowing totals some 5.453 million (net debt 2.510 million) with accumulated losses of 15.371 million!

Isn't Karensoft in such an appalling state?

And consider this issue. Based on a quarterly profit of 101 thousand, it would require 152 quarters of similar earnings to erase that accumulated losses of 15.371 million in its balance sheet!!! And 152 quarters equates to some 38 years!!!!!!!

See why I had not made an effort in making a blog posting stating the fact that Karensoft reported a profit for its latest quarterly earnings? Should I make a positive blog posting? Or should I make yet another cynical posting on Karensoft? Well if I had made a positive posting on Karensoft based on these facts, perhaps some might get some wrong idea that perhaps I am trying to pull a funky stunt here and promote Karensoft based on some personal vested reason!! And on the other hand, if I was cynical again, some might even accuse that I have some real serious personal hatred against Karensoft!

How?

Regarding the GN3 thingy. Does it even matter? Say Karensoft has been wrongly classified as argued. Does Karensoft even have any investment merits at all?

* past blog postings can be found here:

Karensoft

Karensoft: Part II

Karensoft: Part III

Karensoft: Part IV

Karensoft: Part V

Karensoft: Part VI

Karensoft: Part VII

Karensoft: Part VIII