I first wrote on Malaysia AE Model (MaeMode) on Wed 25 April 2007. Here's the posting: MaeMode.

Despite the impressive numbers mentioned back then (in April 2007), I said the following: "I see the classical debt built-up again....Sigh!... I guess I will call this a pass."

Here is how the stock had fared since...

Ahh... as you can CLEARLY see.. that sometimes we can call PASS on a stock based on our own simple and flawed reasoning and in Maemode case in 2007, I DID NOT LIKE the classical debt built up! But yet the stock moved up after I passed on it.

How? Did I feel like a loser? Did I feel frustrated over the missed opportunity?

No. Not me.

For me the stock exchange is always there. It's a casino (sorry but this is how I feel about it. It's my flawed opinion about stock exchanges!) and it's open all year, except on weekends and holidays. And every day, there will be winners and losers in the casino. Now, do I feel silly not to win in the casino on a given day? Do I have to gamble in the casino everyday? Must I?

But that's just me. That's just my flawed way of thinking.

Fast forward... made couple of postings of MaeMode in between... and on Jan 2010, I made the following posting, MaeMode And Its Receivables Again!

In which I made a reply to a comment in a new posting The Receivables Issue, MaeMode, Mems And Megan

I actually feel that it's difficult to predict if any company would be the next company 'like' LCL. Nothing in life is ever truly certain and in the corporate anything that might happen could happen. And the unexpected could certainly happen too.

So would MaeMode turn into a LCL?

The issue of trade receivables is so simple for me. Company makes sales, company should collect them sales. All of it. A sale is never a sale until ALL the money is collected.

Which is why when I look at a company's balance sheet, I would not like to see high receivables increasing.

Obviously this would suggest to me that 'most likely' the management is either lousy because the company is not able to collect the money due to them. (yes, I would not complicate things here by suggesting fake sales - so for simplicity sake, let's assume all sales and receivables are legit).

And to make matters even illogical is when I see the company's debts increasing at the same time too.

It just does not make sense.

Why borrow more from the bankers when there are already so much money owed to the company?

Why can't the company collect these money instead of borrowing more?

And from a business point of view, if one is offered to be a co-owner of such a business, would such a business proposition appeal? Won't the logical answer be NO? Why would one want to be a co-owner in a business which requires more and more funding when it cannot collect the money owed to them?

And since I equate investing to owning a business, I would always, always shy away from such business opportunity. No matter what future prospect the company says it could achieve because in the long run, for me, without collection, such a business would most likely go no where.

Of course, having said that, I understand I could miss out on one or two opportunities! Such mindset is never 100% fool proof because because sometimes the wheel of fortune could really turn for such a company but this is something I would not want to bet on it because I am merely speculating that changes out of the blue could happen. I would rather forgo such an opportunity and invest in a company which has no such risks.

And sometimes, being safe, does work. Ok, I am not bringing out the goats from the farmville and let them gloat all over this posting but let me show an incident where investing using such a mindset did work out. It did prevent the investor from losing their money.

That was 30th Jan 2010.

I have not made any updates on MaeMode since then, so here's one today. :D

In 2002, MaeMode had sales of over 107.830 million and a profit of 8.259 million.

Today? It's last 4 quarters earnings, MaeMode had sales of 402.742 million and a profit of 2.322 million.

Errr... compare 2002 and most recent 4 quarters earnings. what's your interpretation? Clearly the company did not progressed at all, right? Sales almost increased 4 times. 4 times! But yet earnings decline from 8.2 million to just 2.3 million.

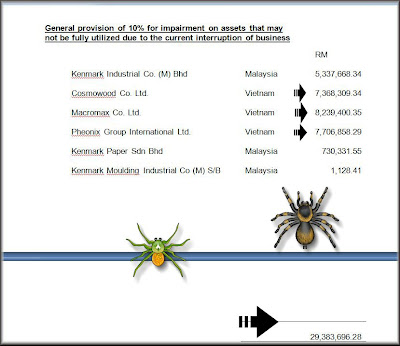

And the following table, I zoom in and highlight the balance sheet item, like cash, loans and receivables.

How? In 2002, MaeMode had loans of 75.267 million. Today? It owns their bankers some 341.111 million!

Is this progress?

And then receivables again.

Look at the size of it. 341.319 million!

Receivables are what is owed to the company and hey, if Maemode can collect this 341 million, then it wouldn't need that 341.111 million in loans yes?

So why can't MaeMode collect its debts?

And from the table, these receivables have most likely grown roots in MaeMode's balance sheet! It's so clear these receivables are in there for so long already! Why? Why? Why? What's wrong?

And needless to say, if MaeMode cannot collect these debts, MaeMode will have to write these debts off!

Yes?

And when it does, I won't be surprise to see MaeMode get hit by huge loss provision!

And yes I would dearly love to see the debtor aging list!

Oh... if I were a minority shareholder, and given such a business fundamentals, I would check to see if any major shareholders thinks the same too! Yeah, have any major shareholders have been disposing their shares.

And oh... in April and May 2010, I noted the following disposals...

- MALAYSIAN AE MODELS HOLDINGS BERHAD ("MAE") - Disposal of Entire Equity Interest in Matromatic Manufacturing (M) Sdn Bhd by Matromatic Handling Systems (M) Sdn Bhd

- MALAYSIAN AE MODELS HOLDINGS BERHAD (“MAE”) - Disposal of Equity Interest in Technibuilt (M) Sdn Bhd by Technamation (M) Sdn Bhd

- MALAYSIAN AE MODELS HOLDINGS BERHAD ("MAE or the Company") - Disposal of Equity Interest in Indusmech Engineering (M) Sdn Bhd

Hmmm... how would you interpret such disposals?

MaeMode last traded at 50 sen.

How? What do you think of MaeMode's prospects?

---------------

Edit... some extra food for thought.

2005, MaeMode had a rights issue. That raised some 31.7 million.

2008, MaeMode had a 10% placement. That raised some 13.245 million.