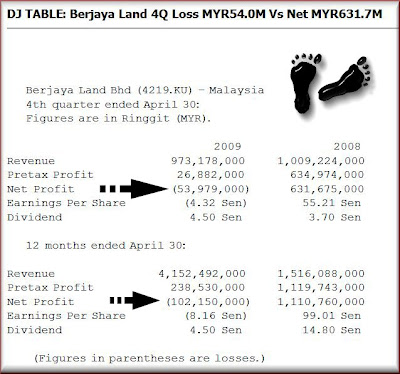

On the Edge yesterday: Berjaya Land sinks into red with 4Q net loss

- KUALA LUMPUR: BERJAYA LAND BHD [] went into the red in the fourth quarter ended April 30, 2011 with net losses of RM4.68 million compared with net profit of RM72.07 million a year ago due various factors including impairments and loss on disposal of certain quoted investments.

It said on Monday, June 27 that revenue fell 5.83% to RM1.062 billion from RM1.128 billion mainly due to the lower property sales from the property development business.

Pre-tax profit was RM105.1 million compared with RM161.2 million a year ago. Loss per share was 0.09 sen compared with earnings per share of 1.44 sen.

“The drop in pre-tax profit for the quarter under review was mainly due to the impairment in value of certain property, plant and equipment and quoted investments coupled with loss on partial disposal of equity interest in a subsidiary company and certain quoted investments, as well as share of losses from jointly controlled entities,” it explained.

The board recommended a final dividend of 1.0 sen per ordinary share of 50 sen each less 25% income tax.

For the financial year ended April 30, 2011, its earnings fell 28.1% to RM80.44 million from RM111.96 million. Pre-tax profit dipped to RM458.57 million from RM465.79 million. Revenue was marginally higher at RM4.06 billion versus RM4.05 billion.

The lower pre-tax profit was mainly due to lower profit contribution from BERJAYA SPORTS TOTO BHD [] as its principal subsidiary, Sports Toto (Malaysia) Sdn Bhd, was adversely affected by the increase in Pool Betting Duty from 6% to 8% effective June 1, 2010 and higher prize payout.

This impact was mitigated by the reduction in the 4D Big Special Prize effective Dec 15, 2010. In addition, certain resorts of the group which are upgrading certain category of rooms incurred higher charge out of room refurbishment expenditure this year.

The SunBiz today, carried this version: BLand posts pre-tax profit of RM458m in FY11

- BLand posts pre-tax profit of RM458m in FY11

Posted on 28 June 2011 - 05:41am

PETALING JAYA (June 27, 2011): Berjaya Land Bhd (BLand) posted a slightly lower pre-tax profit of RM458.57 million for the financial year ended April 30, 2011 (FY11) from RM465.79 million a year ago on lower profit contribution from the gaming business due to the impact from the increase in pool betting duty from 6% to 8% in June last year and higher prize payout.

However, the impact was mitigated by the reduction in the 4D Big Special Prize last December.

In addition, certain resorts of the group, which are upgrading certain category of rooms, incurred higher charge out of room refurbishment expenditure in FY11.

The impact on the earnings was partly mitigated by the gain on disposal of an associated company and favourable fair value changes of certain of the group's quoted investments, BLand said on Monday.

Revenue in FY11 was marginally higher at RM4.06 billion against RM4.05 billion a year ago.

On a quarterly basis, BLand's pre-tax profit for the three months ended April 30, 2011 (Q4) was lower at RM105.14 million against RM161.24 million mainly due to the impairment in value of certain property, plant and equipment and quoted investments coupled with loss on partial disposal of equity interest in a subsidiary company and certain quoted investments, as well as share of losses from jointly-controlled entities.

Revenue in Q4 was RM1.06 billion compared with RM1.13 billion a year ago.

"Barring unforeseen circumstances, the directors are of the view that the group's performance for the financial year ending April 30, 2012 will remain satisfactory," BLand said in a statement.

BLand has recommended a final dividend of one sen a share less tax.

The Star Biz and Business Times did not report on BLand's earnings.

Hmmm... interesting?

Are we playing spot the difference or what?

Both articles appears to be correct with its facts but .... aren't they .... different?

How?

How is our local stock exchange going to attract more 'investors' when the local media publish rather 'different' set of news?

I mean, which set of news, should the 'reader' trust?

I understand that investors should know what they are buying and investors should do some form of research before investing but what chances do they stand if the local media spins out news like this?

And then Bland earnings itself.

They, the media, focus on 'pre-tax' profit but isn't 'pre-tax' meaningless to the investor?

Think about it.

At the end, doesn't the company, Bland, still have to pay tax? Or tax is free?

If not, why is the SunBiz making such meaningless comparison?

- On a quarterly basis, BLand's pre-tax profit for the three months ended April 30, 2011 (Q4) was lower at RM105.14 million against RM161.24 million....

- BERJAYA LAND BHD [] went into the red in the fourth quarter ended April 30, 2011 with net losses of RM4.68 million compared with net profit of RM72.07 million a year ago due various factors including impairments and loss on disposal of certain quoted investments..

Now surely the inquiry mind would want to know what the impairments were and what the certain quoted investments were?

And here's the Edge or is it Bland explanation..

- “The drop in pre-tax profit for the quarter under review was mainly due to the impairment in value of certain property, plant and equipment and quoted investments coupled with loss on partial disposal of equity interest in a subsidiary company and certain quoted investments, as well as share of losses from jointly controlled entities,” it explained