Comments on Texchem Resources?

I do have some archive news on this company. Perhaps it could offer you a different perspective on what kind of company you are looking at.

25th May 2007: Two Divisions to Drive Texchem

Big plans mentioned. I was more interested in the last line.

- For the first quarter ended March 31, the food division registered an operating loss of RM400,000, while its revenue of RM63.8mil was a 12.5% fall from the previous corresponding quarter.

Let's use that quarterly earnings as a marker.

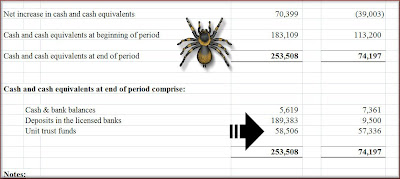

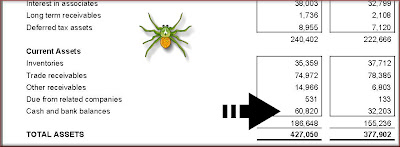

Quarterly rpt on consolidated results for the financial period ended 31/3/2007. Total losses were 889k. Cash 48.457 million. Total debts 304.463 million.

7th Aug 2007. Texchem Eyes Bigger Indonesian Mart Share

- TEXCHEM Resources Bhd wants to double its mosquito coil market share in Indonesia to 30 per cent in five years.

The company, which makes household insecticide products under the Fumakilla brand, wants to have a bigger slice of Indonesia's market, which is eight times bigger than Malaysia's

9th Aug 2007 Quarterly rpt on consolidated results for the financial period ended 30/6/2007. Company made 6.566 million from a revenue of 306.676 million.

Texchem Divisions¡¯ Reduced Sales with the Exception of Food

- PENANG: Texchem Resources Bhd’s net profit doubled to RM6.57 million in the second quarter ended June 30, 2007 from RM3.22 million a year earlier mainly due to an exceptional gain of RM6.2 million from the disposal of Texchem Consumers Sdn Bhd.

Revenue fell to RM306.08 million from RM323.03 million mainly due to the disposal of TCSB and lower sales volume achieved by the family care, packaging and industrial divisions, which were mitigated by higher sales from the food division...

If you minus out that exceptional gain of 6.2 million, there is not much profits left for the quarter.

27th December 2007, RHB Research iniated coverage.

- Texchem Resources

An Attractive Dividend Yielding Stock

Share price : RM1.29

Fair Value : RM1.37

Recom : Market Perform (Initiate Coverage)

...Initiate with Market Perform recommendation. We value Texchem at RM1.37/share, based on a target CY08 PER of 14.5x. Together with our projected 2008 dividend per share of 12 sen, this suggests a potential total shareholder’s return of 15.5%, which is roughly in line with our projected return for the market. Hence, we are initiating coverage on Texchem with a Market Perform recommendation.

Always felt unease with such a recommendation. Share price was rm1.29 and they felt fair value is around 1.37. Not much upside, yes? But they justify it by saying that this is a dividend play. Let's keep watch on this issue.

Jan 14th 2008: Texchem set to make strong recovery in earnings

- Texchem set to make strong recovery in earnings

By LEONG HUNG YEE

PETALING JAYA: Shares of Texchem Resources Bhd extended their gains on follow-through interest on Friday.

The counter closed marginally higher at RM1.28 and a breath away from its three-month high of RM1.32 recorded on Dec 27.

Analysts said the counter was clearly on the radar of investors as reflected in its price movement and trading volume over the past few months.

Rating agency Standard & Poor’s (S&P) has a buy call on the stock with a 12-month target price of RM1.45.

It said the company was poised for a recovery in earnings going into 2008 after overcoming operational difficulties that culminated in a net loss of RM900,000 in the first quarter (Q1’07), its first since Q1’04.

“We are forecasting Texchem to report net profits of RM13.1mil and RM11.2mil in 2007 and 2008, respectively, driven by a stronger performance at its packaging division coupled with the ongoing recovery at its food division.

“Excluding the exceptional gain recorded during Q2 '07, recurring net profit is expected to jump 62% year-on-year (y-o-y),” said the agency.

S&P said the company was attractive for its strong dividend track record and gross yield of 7.8%.

It added that Texchem had managed to bring its net gearing down to 112% at end-September 2007 from 140% at end-2006, although financing costs remained high and were a drag on profitability.

RHB Research projected Texchem’s earnings to rebound this year on account of better operating results from the family care and food divisions as well as lower finance costs as the company gradually pared down its borrowing levels.

The research house recommended a hold at RM1.29, valuing the share at RM1.37 based on a target calendar year 2007 price-earnings ratio of 14.5 times.

Eh? Eh? RHB coverage was a market perform, no?

22nd Jan 2008: Texchem to expand this year

- ... “By 2010, the food division could be expected to generate 30% of group revenue,” he said.

Texchem is also allocating RM7mil to set up seven Sushi King outlets this year in Kota Kinabalu, Miri, Bintulu and in the Klang Valley.

Two new Sushi King outlets were opened in Kuching earlier this month, bringing the total number of outlets in the country to 43....

Feb 2008: Quarterly rpt on consolidated results for the financial period ended 31/12/2007. Texchem made 8.601 million from a sales revenue of 327.192 million. The earnings margin are rather razor thin, yes? (some do prefer to invest in companies that have a profit margins above 20%)

On Business Times (link lost)

- Industrial, food units boost Texchem Res pre-tax

Published: 2008/02/22

TEXCHEM Resources Bhd saw its pre-tax profit rise to RM29.735 million in its financial year ended December 31, 2007 from RM22.537 million in 2006.

This, it said yesterday, was due to the improved performance of its industrial and food divisions, which offset the lower profits of the packaging and family care segment.

In a statement to Bursa Malaysia, the group said included in the higher pre-tax profit was an exceptional gain of RM6.2 million from the sale of Texchem Consumers Sdn Bhd (TCSB).

However, its full-year revenue dropped slightly to RM1.258 billion from RM1.267 billion before, due to the sale of TCSB and the lower revenue recorded by the packaging division.

Although the group remains optimistic for this year, it said it is mindful of a potential slowdown in the global economy which could have an impact on its performance.

In a separate note to the bourse, the group said it plans to buy a 21 per cent in PT Technopia Jakarta from Texchem Corp Sdn Bhd for RM5.903 million cash.

It felt this will enable the expansion of its family care division as well as consolidation of the future earnings of the Indonesian-based firm, and increase direct penetration into the mosquito coils market there.

“With a huge population of about 235 million people, Texchem Resources sees great potential in the mosquito coils and household insecticide products market in Indonesia.

“The proposed acquisition therefore represents further steps towards achieving the group’s vision to be the top player in the household insecticides industry in Asean by 2010,” it said. — Bernama

8th March 2008: Texchem targets RM3.2b revenue by 2013

Oo.. I always get sceptical when company boasts out loud to the local media about their revenue targets or revenue growth. Why? Most important is the bottom line, the net profit. One can have all the glittering revenue growth but if it is not accompanied by net profit growth, it all counts for nothing. Anyway as per the earlier quarterly earnings report, we saw that Texchem net earnings were 17.915 million for fy 2007. Note the figure is boosted by extraordinary gain of 6.2 million.

10th March 2008, on the Edge (link lost)

- 10-03-2008: Texchem confident of sustainable dividend payout till 2011

by Yantoultra Ngui Yichen

KUALA LUMPUR: Packaging, industrial, food and households products group Texchem Resources Bhd is confident of an annual 12% dividend payout until 2011 on the back of its aggressive expansion plans.

Texchem, which is controlled by Japanese businessman Tan Sri Fumihiko Konishi and was listed on the local bourse in 1993, paid dividends as high as 20% in 1999 and 2000.

Konishi, 63, the group’s chairman and chief executive officer, said Texchem’s philosophy was to grow without asking any money from its shareholders, and only pay out dividend annually. It has not proposed any right issues since its listing.

Texchem, whose belt includes Sushi King and Fumakilla, aims to achieve a RM1.5 billion turnover and RM30 million pre-tax profit in its current fiscal year ending Dec 31, 2008 (FY08), riding on its new expansion plans, which might include some mergers and acquisitions (M&A).

Konishi said the group planned to expand its food division in the country as well as in Myammar via M&A as it had seen more sustainability in the food industry throughout its experience in the sector.

“There are about four (in talks on possible M&A) in the pipeline,” he told reporters after Texchem’s analysts briefing last Friday.

The group’s net profit for FY07 rose 8.95% to RM17.91 million from RM16.31 million in FY06 due to improvements in operational performance of its industrial, packaging and food divisions despite the disposal of its subsidiary Texchem Consumer Sdn Bhd. Its revenue hit RM1.26 billion while pre-tax profit was RM29.74 million.

Konishi said Texchem also aimed to expand the number of its Sushi King restaurants to 50 from 44 at present by the end of the year.

On its household division, he said the group planned to venture into new markets like Bangladesh and the Philippines by exploring the possibility of setting up household insecticide manufacturing plants in both countries.

“We will allocate some RM70 million for our expansion plan and expect our overseas revenue contribution to reach 50% (from 35% in FY07) soon (in the next five years),” he said.

Konishi added that Texchem expected its revenue to hit RM3.2 billion turnover and RM100 million in pre-tax profit in 2013 and it targeted to be a RM5 billion (revenue) company by 2020, with pre-tax profit of about RM200 million.

Meanwhile, Konishi said Texchem would increase investments in existing markets like Vietnam, Thailand and China as well as develop more venture businesses within each division.

Rather inaccurate the article. See the comments in red. It said "The group’s net profit for FY07 rose 8.95% to RM17.91 million from RM16.31 million in FY06". Well if one minus out the 6.2 million from rm17.91 million to the disposal, then Texchem fared much poorly in fy 2007 when compared to what it did in fy 2006.

May 2008: Quarterly rpt on consolidated results for the financial period ended 31/3/2008. Revenue did increase but Texchem net profits only 1.059 million!

5th July 2008, on Business Times. (link lost)

- Texchem: EU ban eating up revenue

By Marina Emmanuel Published: 2008/07/05

TEXCHEM Resources Bhd's (TRB) associate company Seapack Food Sdn Bhd has seen a 70 per cent production drop since the suspension of Malaysian seafood exports to the European Union (EU).

TRB chairman and chief executive officer Tan Sri Fumihiko Konishi said Seapack is expected to register monthly revenue losses of RM3 million until such time as the suspension is lifted.

"Our monthly production output now stands at 200 tonnes and we hope the authorities will act quickly in resolving the situation," he told reporters after an extraordinary general meeting in Penang yesterday.

Konishi said the EU accounts for 70 per cent of Seapack's exports and the company has been forced to restructure and reduce its workforce from 300 to 80 last month due to the drop in business.

"We are now concentrating on the domestic market and also regional ones," he said, adding that exports now include cleaned and re-sized squid and cuttlefish, along with value-added products such as sashimi squid and also surimi items.

Malaysia last month temporarily stopped seafood exports to the EU following threats of a total ban after checks on local fisheries revealed lacking health standards.

The EU has threatened a total ban on Malaysian seafood following random checks in April on nine companies exporting fishery products which were found lacking in health standards and practices.

Industry experts had predicted that Malaysia is set to lose more than RM11 billion during the three-month wait for the suspension to be lifted.

Konishi said the latest development will not affect the operations of TRB's seafood processing company Sea Master Trading company Sdn Bhd which has 280 people on its payroll.

"Fortunately, we moved fast enough to step up our exports to China and Japan since we are unable to do so to EU countries for now," he said.

South Korea and Taiwan are also the company's other export markets where prawns, squid, cuttlefish, deboned fish and processed jellyfish are sold.

TRB's food division currently contributes 29 per cent to group revenue.

"Since our food division is viewed by TRB as its rising star," Konishi said, "we will continue to invest in this division. For this year, we will invest RM15 million to upgrade our facilities for the food division locally and overseas".

Konishi also said that several new projects for the division are currently in the pipeline to expand the food business in Malaysia and abroad.

31st July 2008: Quarterly rpt on consolidated results for the financial period ended 30/6/2008. Net earnings only 468k!

Oh the dividends issue.

31st July 2008: Interim Dividend. Interim Dividend of 6% less 26% Malaysian tax

15th December 2008: Second interim dividend Second Interim Dividend of 4% less 25% Malaysian tax

On 17th December 2008:

- RAM downgrades Texchem debt issue

Published: 2008/12/17

RAM Ratings has revised the outlook on the long-term rating of Texchem Resources Bhd's RM100 million Commercial Papers/Medium Term Notes Programme (2005/2012) (CP/MTN) from stable to negative.

The CP/MTN is currently rated "A3/P2".

In a statement, Rating Agency Malaysia Bhd (RAM) said the negative outlook reflects concerns about the increased prospects of lower sales and profit margins for Texchem amid the difficult operating environment.

"Texchem's overall performance during the nine-month period ended September 30 2008 was below expectations, with narrower profit margins following the distribution issues faced by its family-care division and also the weaker showing of its packaging segment, which had been affected by stiff competition and pricing pressures," it said.

Despite higher revenue, the group's operating profit margin eased to 1.4 per cent for the nine months, from 1.72 per cent previously.

Feb 2009. Quarterly rpt on consolidated results for the financial period ended 31/12/2008. Texchem lost 3.98 million!

May 2009: Quarterly rpt on consolidated results for the financial period ended 31/3/2009. Texchem lost 9.232 million!!!!

- Texchem records RM9.2m net loss in 1Q

Written by Financial Daily

Wednesday, 06 May 2009 10:50

KUALA LIMPUR: Texchem Resources Bhd recorded a net loss of RM9.2 million in the first quarter ended March 31, 2009 (1QFY09), compared with a net profit of RM1.1 million a year earlier, mainly due to the impact of the global economic downturn.

Revenue fell 30% to RM242.8 million from RM347.1 million mainly due to a drop in demand for industrial, packaging and food products, despite its family care division having achieved higher sales via its Indonesian subsidiary that was acquired on April 18 last year. No dividend was declared.

Texchem said yesterday the diversified group expected its business environment to remain challenging, and would continue to adopt a prudent approach towards capital expenditure while focusing on managing its trade receivables, inventories and operating cash flows to improve liquidity during this difficult period.

This article appeared in The Edge Financial Daily, May 6, 2009.

July 2009: Interim Dividend Interim Dividend of 3% less 25% Malaysian tax

Ooo... interim dividend halved! This is what one has to be extremely careful. Dividends are not constant. Yes, they can increase in time (and this usually co-incides with better earnings performances) but they also can be decreased!

Oct 2009: Quarterly rpt on consolidated results for the financial period ended 30/9/2009. Texchem made 1.05 million. Recovery?Not much clues given in its earnings notes.

- The Group’s revenue for the current quarter was RM318.4 million, a decrease of 22% compared to RM406.2 million reported in corresponding quarter last year. The lower revenue was mainly due to the on-going global recession which had adversely affected turnover in the Industrial, Packaging and Food Divisions.

As a result, the Group generated a slightly lower pre-tax profit of RM2.7 million against the corresponding quarter of RM3.0 million.

Texchem today trades at 96 sen.