Wrote the following back in 2008: Should The Investor Take The Safer Approach?

Like to highlight the following passages..

===>>>

Now, present day, the Edge Weekly has an article on Fima Corp.

- Fima Corp Bhd is jumping on the plantation bandwagon by purchasing a slice of a small Indonesian palm oil outfit. In a statement on Jan 27, Fima said it will pay RM13 million for a 32.5% stake in PT Nunukan Jaya Lestari in East Kalimantan. This is part of a plan to diversify its earnings base. read more.... (link is broken. Can't help it)

How?

Ok, an investment of 13 million is not a lot... but... here is my cow question... don't you really think that this company management, after achieving its recent success, has started to think way too big? Don't you think the company is really starting to lose focus? Diversification into palm oil???

How? Is this the 'something wrong before it drops'? Or should we want to continue the wait-and-see approach?

or... ahem... should the investor take SAFER approach... ?

<===>

FimaCorp announced its earnings last night.

Before I clicked on the announcement, I was thinking out loud to myself. What do I expect? What do I want to expect from the company announcement?

I was sceptical about the diversification into palm oil. Did not like it and in fact, I always hate to see our local companies diversifying too much. For I had always preferred to see out companies concentrate on doing what they do best. FimaCorp was making great money in printing of security and confidential documents for the government. It was their niche. That's what they do best and to see them diversifying into palm oil (just because of a booming palm oil business in 2008) did not excite me too much.

Let's look at some 'recent' earnings.

Aug 2008: Quarterly rpt on consolidated results for the financial period ended 30/6/2008. FimaCorp made 14.006 million.

Nov 2008: Quarterly rpt on consolidated results for the financial period ended 30/9/2008. FimaCorp's earnings dropped to 7.952 million.

Feb 2009: Quarterly rpt on consolidated results for the financial period ended 31/12/2008. FimaCorp made 9.162 million.

May 2009: Quarterly rpt on consolidated results for the financial period ended 31/3/2009. FimaCorp made 26.010 million!

Aug 2009: Quarterly rpt on consolidated results for the financial period ended 30/6/2009. FimaCorp made 15.334 million.

Here's last night earnings.

Not as impressive but this FimaCorp is a different FimaCorp then what I was looking at when I wrote Should The Investor Take The Safer Approach?

Compare the quarterly tables posted here and do compare recent dividends paid.

Yet again, another post which I needed to make to put the record out straight. Yes, indeed the gamble for FimaCorp to venture into palm oil has paid off!

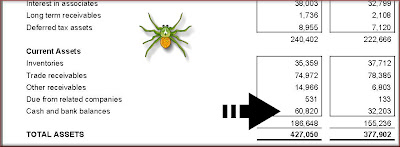

Here's screen shot of its balance sheet.

Ah yes, FimaCorp is no longer a net cash company with no debts and FimaCorp total borrowings amount to 43.144 million.

And here is the screen shot of FimaCorp's business segmentals.

Oh this again is not an early morning tipsy! Since I am no financial expert and since I am such a flawed one, I surely cannot guarantee that you will lose money if you decide to buy based on my posting and just for the record, FimaCorp last traded at 3.23.

0 comments:

Post a Comment