Posted on 28 Feb 2011: SAAG's Earnings

SAAG reported its earnings tonight.

Here's the updated numbers.

Some comments again.

1. The cash is diminishing again

2. The incredible debt increased again.

And as mentioned before, in its balance sheet, there's an entry called 'Amount due from customers for contract works'. That amount is now 279.267 million.

Tuesday, May 31, 2011

Quick Look At SAAG's Earnings

Posted by

Moolah

at

9:14 PM

0

comments

![]()

Labels: SAAG

Scholesy Retires!

Manchester United midfielder Paul Scholes has announced his retirement from football with immediate effect.

http://www.skysports.com/story/0,19528,12047_6960442,00.html- "I am not a man of many words but I can honestly say that playing football is all I have ever wanted to do and to have had such a long and successful career at Manchester United has been a real honour.

"This was not a decision that I have taken lightly but I feel now is the right time for me to stop playing.

"To have been part of the team that helped the Club reach that 19th title is a great privilege."

And I am privileged enough to watch him play so many times for Man United!

Posted by

Moolah

at

4:34 PM

1 comments

![]()

Labels: Man United

Monday, May 30, 2011

How Now Masterskill?

So we have the Green Packet boss and management who had contiuned talking about being EBITDA positive since Feb 2008. ( refer And Green Packet Says The Magic Word Once More )

And then we have the KNM boss and his MBO. (refer KNM: Are you IN it to win IT? Or are you IN it to LOSE IT??? )

Today I noted one of the big loser is MEGB. It's currently down some 4.1%.

The chart is coloured specially for a reason.

It represents the period since MEGB's boss gave an interview with Star biz: Masterskill CEO may raise his stake in company.

Friday February 18, 2011

Masterskill CEO may raise his stake in company

By LEONG HUNG YEE

KUALA LUMPUR: Masterskill Education Group Bhd group chief executive officer Datuk Seri Edmund Santhara is considering to up his stake in the group.

In a filing with Bursa Malaysia on Wednesday, the education-based Masterskill said Edmund, who owns some 90.6 million shares, or 22.1% stake in the company had announced his intention to deal in his securities in Masterskill.

“(I'm) looking at purchasing at this price,” Edmund said when contacted by StarBiz yesterday.

However, he said he could only buy the shares today as per Bursa Malaysia rules.

“Well, I need to wait and see. Perhaps, anything below RM2 doesn't justify keeping the company listed,” Edmund said when asked on the amount of shares he intended to purchase.

Last December, he told StarBiz that the share price then of RM2.22 was not “justifiable” for a firm that made about RM100mil in net profit annually.

He said that the company was fundamentally sound and that its Kuching campus was already in operation.

“The current share price weakness presents a great buying opportunity for Edmund to accumulate its shares,” an analyst said, adding that Edmund's move to purchase more shares may be a practical thing to do.

The analyst said most companies undertake share buybacks if they believe their shares are undervalued, or to send a signal of confidence in the company.

Masterskill, which raised RM771.3mil from its initial public offer (IPO) in May 2010, has succumbed to selling pressure yesterday.

The counter fell to a record low since its listing after Fidelity Management and Research (FMR) LLC, the parent of Fidelity Investment, sold 280,000 shares in the former.

The counter fell 8 sen, or 4.32%, to RM1.77, its lowest since its listing on May 18, 2010.

However, Edmund remains unperturbed by the divestment by FMR.

“It's a simple portfolio investment, so it's normal. The company fundamentals remain strong,” he said.

Edmund was confident its share price would stabilise soon. “As the company is good, the price will soon stabilise after the seller is gone, mainly Fidelity Investments,” he said.

FMR, one of Masterskill's substantial shareholders, has been trimming its stake in the education group since October. Following the disposal of 280,000 shares, FMR held a direct stake of 20.6 million shares, or 5.02% in Masterskill.

Dealers attributed the price slide the stock has fallen some 30 sen from its one-month high of RM2.34 on Jan 13 mainly to the recent selling pressure. However, they believed the selling might not be done as yet.

As at Sept 30, the nursing and allied health sciences education provider has 17,613 students. It posted a net profit of RM26.2mil for the third quarter ended Sept 30 on revenue of RM80.7mil.

The education group is due to announce its fourth quarter ending Dec 31, 2010 financial performance tentatively next Wednesday. Bloomberg's consensus estimates expect Masterskill to post RM104.6mil in net profit for the full financial year ended Dec 31, 2010.

--------------------------------

Let's look at that chart again.

The coloured area showed roughly the preiod when MEGB had been trading below 2.22 - remember 'Last December, he told StarBiz that the share price then of RM2.22 was not “justifiable” for a firm that made about RM100mil in net profit annually' and then on Feb 2011, he said 'anything below RM2 doesn't justify keeping the company listed,”

MEGB now trades at 1.85.

And if I am not mistaken, there's isn't a SINGLE buy transaction done by the boss.

Doesn't it makes you wonder?

Why did he on Feb 2011 tell out loud to the local investing public that he intends to purchase shares in MEGB?

Where are the share purchases since?

Is talk really so cheap?

Posted by

Moolah

at

1:58 PM

12

comments

![]()

Labels: Masterskill (MEGB)

Saturday, May 28, 2011

KNM: Are you IN it to win IT? Or are you IN it to LOSE IT???

I do not deny that falling stocks draws a lot of interest. For many, they think it represents a chance to buy a stock at a large discount and many a times, such strategy does works.

Now if you are not aware, KNM has fallen big time yesterday.

Here's a simple snapshot.

So the obvious question is KNM selldown an opportunity or what???

Are you IN it to win IT? Or are you IN it to LOSE it???

* Hehe.. where have you heard such a phrase before? *

Now if you are constant reaader of this blog (TQ!), you would realise that I offer NO direct answer to such a question. It's up to you to decide the issues highlighted in the postings.

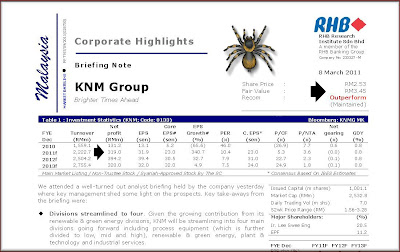

Now as you are aware, yesterday I posted two postings. How Is KNM's Earnings Guidance Faring? and History Repeats As KNM Tanks On Extremely Weak Earnings. From the comments posted, many research houses (except for RHB) still have an extremely high Target Price for KNM.

But Encik Market apparently is not liking KNM so much after its dismal earnings report and it send KNM crashing some 15%!

So who is correct? Encik Market or Encik Research?

Now one article I noted was this from Bernama: KNM Continues To Draw Investor Interest and I saw one extremely naughty line inside! Was it a typo or was there an intent to deceive?

Quote: KNM's order book is still strong at above RM50 billion. We understand that high-end products are expected to contribute between 50-60 per cent of the total," OSK Research said in a note today.

Eh? Eh? Eh? Harloooo! Since when on earth did KNM order book is above RM 50 Biillion??????

Tsk! Is this an innocent typo or what?

I wish I have a copy of that OSK report on KNM yesterday. Anyway here's a snapshot of OSK report dated March 2011.

Quote: Both its orderbook and tenderbook are robust at RM5.4bn and RM17.0bn respectively.

And here's an article on the Edge on 9th March: KNM back to earnings guidance mode (hehe - we come back to that article later).

Quote: KNM is confident of securing higher RM3 billion to RM3.5 billion new jobs per annum in 2011 to 2012 with higher quality (thus better margin) potentials. Order book backlog now stands at RM5.4 billion,” Maybank IB research noted in its report.

So we know that KNM's existing orderbook stands around 5.4 billion and I wonder how the Bernama article has OSK saying KNM's order book is worth 50 billion!

Perhaps it's a typo and for many investors, they know order books doesn't mean much because the company still needs to turn the order book into net profits. That's what's important for them.

But of course, for the conspiracy folks and of course the flying SMS that did its round yesterday urging investors to BUY, BUY, BUY would suggest that perhaps someone doesn't want the stock to die! Hence it could be an opportunity.

Perhaps.

But perhaps it also could be the handiwork of some trapped souls.

Anyway... I always feel that it's important to know a stock history.

Now on one hand, let me say this first, knowing what has happened before would not guarantee you future success! But then history is important, no? Why do we study history in school? (ps I do not know this answer myself till this very day. I hated history. All I ever do is study dates. Why study dates? Go dating much fun, eh? :P )

Take stocks. If a stock has a long and troubled history, does it make sense to bet on it? Wouldn't the logical thing be is to find another better stock to bet on? Why force the issue?

Let's go back in time.

1 Sep 2010: Review Of KNM's Earnings

I wrote: KNM reported its earnings on 30th Aug 2010. And as expected, it wasn't nice at all.

LOL! 'And as expected'?

Well ... seriously what do you expect from the company when the management was more focused on trying to buyout the company? Yes, where is the company's focus? What's the company's priority?

Is the company focused on making more money?

Was it?

Apparently the company's management was more focused on its management buyout than its own business.

Now KNM stock is no stranger in selldowns!

The first one happened in July 2008. (sorry old Edge article. No link..)

- 22-07-2008: KNM down on financing concerns

by Jose Barrock

KUALA LUMPUR: Fast-expanding oil and gas player KNM Group Bhd continued to slide, shedding 25 sen yesterday to close at RM5.10 on concerns of its proposed exchangeable bond issue, in the current difficult period. At its lowest in intra-day trading, KNM fell to RM4.96.

The company’s shares were among the most active with 11.9 million shares traded. Since end- May this year, the company’s share has tumbled by about 27% and during the period in review, under-performed the sluggish Kuala Lumpur Composite Index by 13.5%.

According to Goldman Sachs, the dip in KNM’s shares is a result of fears as to whether the company’s proposed exchangeable bond issue will proceed, with the current weak market likely to be a dampener. KNM had taken a €350 million (RM1.8 billion) bridging loan to finance the acquisition of German-based Borsig Beteiligungsverwaltungsgeselschaft mbH, last month, and has since partially pared down some of these loans, by utilising proceeds from a RM1.1 billion one-for-four rights issue, which was completed end of last month

A month later

- 19-08-2008: KNM falls on foreign selling

by Chong Jin Hun & Jose Barrock

KUALA LUMPUR: Shares of KNM Group Bhd fell to their lowest in 10 months yesterday, on speculation that a foreign shareholder of the company is reducing its stake due to the higher political risk in the country.

This is despite the outlook of the oil and gas process equipment manufacturer being described by fund managers as bright considering that crude oil prices are expected to be sustainable in the long run.

"One of the major shareholders is selling down. It’s a portfolio change in terms of country risk," an analyst told The Edge Financial Daily yesterday.

A fund manager said KNM’s fundamentals remain intact in the long term because oil prices are expected to be sustainable, albeit at a lower level. KNM officials declined to comment when contacted.

Yesterday, shares of KNM dropped 11% or 18 sen to finish at RM1.46 with 32.99 million shares done. The stock traded at a daily high of RM1.64 at 9am, and sank as low as RM1.38 as at 2.44pm. Shares of KNM which have declined 37.74% this year, touched a one-year high of RM2.48 on Jan 2 this year, and hit its yearly low of RM1.23 on Aug 21 2007.

Volume has also increased significantly since last Friday. A total of 15.3 million shares were traded last Friday and another 33 million traded yesterday.

Filings to Bursa Malaysia show that US-based FMR LLC, and Bermuda-registered FIL Ltd (Fidelity International Ltd) have sold down their equity interest in KNM. Both FMR and FIL had disposed of 6.55 million shares in KNM between Aug 4 and 12 this year. According to filings, Fidelity still has another 407 million shares representing 10.29% of the company.

It could not be determined if Fidelity was a major seller of the shares yesterday...

A month later: KNM shares at 12-month low

- ... The company’s shares closed at RM1.24 yesterday.

Chong said although there was renewed concern surrounding the intangibles, there was “little risk of write-downs despite the current macro environment”.

“KNM is working with its auditors on how much they can revalue Borsig’s fixed assets and intellectual property,” he said.

He added that the current valuation of 2.33 million euros for plant and machinery did not include intellectual property.

Chong said the plants and intellectual property could be valued as much as 170 million euros (RM800mil) due to the latest robotic equipment and 19 different design patents that generated most of Borsig’s revenue.

“If Borsig’s fixed assets and patents are revalued upwards, this means that the RM1.6bil intangibles on KNM’s balance sheet will be reduced to RM800mil.

Let me paste the following here:

The following was most interesting

- Acquired 23/10/2008 11,376,000

Disposed 16/10/2008 72,271,600

Disposal was massive!

And did you see the point 2? Disposal of 72,271,600 shares - sold down by financier which is now resolved

And more interestingly, the company DID a share buyback during this same period! Notice of Shares Buy Back by a Company pursuant to Form 28A

Look at the details

Date of buy back from : 16/10/2008

Date of buy back to : 22/10/2008

Total number of shares purchased (units) : 22,190,200

Minimum price paid for each share purchased (RM) : 0.415

Maximum price paid for each share purchased (RM) : 0.690

Total amount paid for shares purchased (RM) : 13,544,216.13

Er how? The boss shares were sold down by his financier and during this exact same period, the company bought back shares!

Like this also can meh? (Of course the share bought back brought 'stability' to the share price. Look at the min and max price paid for the share buybacks!

But for some traders, they just love such stuff!

No joke!

Forward to 2009. On March 17th 2009, Management buyout of KNM hinges on funds

Massive privatisation talks via a MBO is been prmoted by the MD.

- A management buyout (MBO) will be considered for KNM Group Bhd but funding must be available, said managing director Lee Swee Eng.

“In the current environment, it will be very difficult to raise funds,” Lee told StarBiz in reference to a Bloomberg report on the possible privatisation of the company.

A Bloomberg report yesterday quoted Lee as saying he would consider leading an MBO as long as banks will the funds.“We are very undervalued. The opportunity for privatisation is a good opportunity but it’s the source of funding. There is no offer on the table,” he was quoted as saying.

Straight from the horse mouth. KNM is very much undervalued.

Wednesday, 10 June 2009, the Edge Financial Daily publishes the following. KNM’s MD sells 63.65m shares

- KUALA LUMPUR: KNM Group Bhd managing director Lee Swee Eng’s selling of a 1.6% stake recently has raised eyebrows and concerns about whether he would continue to pare his interest in the oil and gas player.

Replying to queries by The Edge Financial Daily via SMS yesterday, he said the selling of the shares was a strategic placement. “The proceeds from it will be used to degear and clear up all the margin taken up during the rights issue,” he said, but mum on whether he would be selling more shares.

According to a Bursa Malaysia filing on Monday, Lee sold a total of 63.65 million shares representing a 1.6% stake in KNM between June 1 and 4 at prices ranging from 97.5 sen to RM1.02 apiece.

Lee still holds a 23.74% stake in KNM as at June 8, via direct and indirect interests. While there were no new filings on Bursa regarding substantial shareholding changes in KNM yesterday, the company did see a block of 10 million shares change hands off-market yesterday in a block deal, at RM1.03 per share.

The stock had hit a six-month high of RM1.06 last Friday. It was the most actively traded stock yesterday with 82.64 million shares done, closing one sen lower at RM1.03.

“We believe that the share sale may help to raise funds to redeem part of Lee’s holdings under a share margin account,” said HwangDBS Vickers Research in a report yesterday.

The research firm pointed out that in October last year, Lee had been forced to sell a portion of his KNM shares by CIMB Bank. It was the fear of margin calls that had caused the company’s share price to drop during that period.

“We understand that the shares (the block sold in October 2008) was under share margin financing. This time around, the share sale is not under forced selling but Lee has raised around RM64 million and this could be used to redeem his holdings,” said HwangDBS.

Ahem.. see how KNM the stock had recovered? If you were a trader, wouldn't you love KNM so much?

But if you are a minority shareholder, think for a moment. Perhaps I am flawed in my way of thinking. Well acordingly the initial sell down was because of Lee's share margin financing.

And KNM the stock got hit big time!

Poor minority shareholders who had to suffer the selldown just because the MD's shares were sold down!

Come March, the MD starts to promote his shares stating KNM were very much undervalued.

So cheap that he wanted to do a privatisation via a MBO.

Then the markets rallied worldwide.

And KNM shares soared too.

Everyone was happy.

The MD Lee was even more happy and KNM did not seem undervalue no more, as he disposed a chunk of his shares and according to HwangDBS his disposal of shares helped rake in a tidy rm64 million ringgit!

How's that for cool?

And what about the MBO?

Guess what? On 15 April 2010: KNM's MBO Fails

Sorry but looking at it now, perhaps one would ask if there was any real intent to do the MBO.

And then there were many who simply wished that the MBO was real!!!

26 May 2010: Oh KNM, Can You Please Buyout The Company At 90 Sen?

With all these behind, KNM starts talking. The boss starts talking about 'swelling' orderbooks! It was unreal talk for those who had kept track of its orderbook. See posting: KNM: I Just Love The Way The Boss Talks!

And then the Boss continues to talk!

On 1 March 2011: KNM Says It Wants To Buy More Foreign Firms And Expand.. . And some were amazed by such talk because as per its balance sheet then, it did not appear that KNM was strong enough to buy more foreign firms.

A week later KNM started giving earnings guidance again. See What I Think Of KNM's Earnings Guidance

Now earnings guidance is important. It tells the local research house what to expect from the companies earnings. It's an indicating tool for the analyst and they use it as one of the basis on how they value the stock.

Naturally the higher the earnings guidance, the better for the stock.

Simplicity.

Higher earnings guidance means higher future earnings per share, which eventually means higher stock price.

And as mentioned before, in my usual flawed and wrong opinion, if a CEO or management opens its mouth and guides its earnings, I believe that the analyst/research reports have no choice and they have use that GUIDANCE number!

This is what the INSIDER, the CEO, the TAIKOR is telling them. The analyst cannot simply say, 'Oh no, dear Bossie, your GUIDANCE numbers are very rocket. There's no way your company can achieve those numbers!!!!'.

It's like telling the CEOs they are BS-ing! They simply cannot do that, can they?

And now that they do follow the guided numbers and when the actual earnings are way below estimates, the analysts would probbly feel silly.

Now the issue is with KNM's earnings guidance.

KNM did not have a good track record when they give earnings guidance.

Anyway as per the March posting: What I Think Of KNM's Earnings Guidance

Let's compare KNM's guidance previously and compare to what KNM actually earned.

Such comparison should be useful, yes? At least we get to know the quality of KNM's earnings guidance.

So how did KNM do?

fy 2008, KNM made 336.175 million. (KNM guided 450 million)

fy 2009, KNM made 257.847 million. (KMM guided 700 million)

Now on March 2011, earnings guidance, KNM said "KNM’s management had met with analysts earlier in the week and guided earnings before interest, tax, depreciation and amortisation (Ebitda) of RM363 million for its FY11 (ending Dec 31, 2011), while the Ebitda for FY12 is targeted at RM564 million."

And with such guidance, research house like RHB gave an earnings forecast of 319 million for FY 2011 for KNM. And naturally RHB gave it an OUTPERFORM rating.

How did KNM do for the first quarter? "The Group achieved revenue of RM413.00 million, profit after tax and minority interest of RM19.02 million and EBITDA (Earning Before Interest, Tax, Depreciation and Amortisation) of RM39.89 million for the period ended 31 March 2011.."

KNM's profit before tax for FY 2011 Q1 was only 6.267 million. ( I am ignoring the tax incentive ANGPOW given to KNM!) (ps: with such booming eps, how much do you think KNM can earn this year?)

And RHB was less than impressed too! "1QFY11 PBT of RM6.3m was significantly below expectations, accounting for only 2.3% and 3% of both our (RM277.5m) and consensus (RM208.9m) estimates respectively."

How?

And oh.. the goodwill issue. It's just some 832 million worth of goodwill sitting inside KNM's books. Why? I don't know.

So how lah?

Based on all these, do you want to bet on this stock or not?

I don't know Teochew music but I know some Hainan music. Can ah?

Posted by

Moolah

at

10:06 AM

1 comments

![]()

Labels: KNM

Friday, May 27, 2011

History Repeats As KNM Tanks On Extremely Weak Earnings

From the posting How Is KNM's Earnings Guidance Faring?

- Mun Wai said...

Moo,Quoted from your posting on 9 Mar : "Now because KNM's is telling all the research houses that it will earn so much, naturally the research houses have to base their fair value target projection for KNM based on these high numbers."

By sticking tothis unrealistic earnings guidance and consequently arrive at their earnings estimates (AmResearch even says 383m), won't the research houses are confusing many naive minds?

Good point.

Well, in my usually flawed and wrong opinion, if a CEO or management opens its mouth and guides its earnings, I believe that the analyst/research reports have no choice and they have use that GUIDANCE number!

This is what the INSIDER, the CEO, the TAIKOR is telling them. The analyst cannot simply say, 'Oh no, dear Bossie, your GUIDANCE numbers are very rocket. There's no way your company can achieve those numbers!!!!'.

It's like telling the CEOs they are BS-ing! They simply cannot do that, can they?

And now that they do follow the guided numbers and when the actual earnings are way below estimates, the analysts would probbly feel silly.

Anyway as per the March posting: What I Think Of KNM's Earnings Guidance

Let's compare KNM's guidance previously and compare to what KNM actually earned.

Such comparison should be useful, yes? At least we get to know the quality of KNM's earnings guidance.

So how did KNM do?

fy 2008, KNM made 336.175 million. (KNM guided 450 million)

fy 2009, KNM made 257.847 million. (KMM guided 700 million)

Yeah... naturally KNM tanked big time back then!!!

But the point is KNM's guidance back then was horrendous and way off target!

Posted by

Moolah

at

2:21 PM

6

comments

![]()

Labels: KNM

At Last Some Justice For Kosmo Fraud Case

Back on Oct 2009, I posted Kosmo's Directors Shocking Fine!!

Let me highlight some of the facts again.

Fact 1.

Company said it made 109 thousand in its unaudited account for its fiscal year.

Company actually had LOSSES totalling 141 million according to its audited accounts.

From 109 thousand to a LOSS of 1141 million!!!

Source: here

Blogged here: Kosmo Technology Shocking Deviation Of Accounts

See also : Unaudited and Audited Accounts: UnReal or Real?

What's the major cause of the massive deviation in the accounts? According to the company's own reasoning: here, two major items were 'Impairment Loss of 55.6 million and 'Provision for doubtful debt of 75.9 million' (ps: see the importance not to discount the trade receivables issue?)

Fact 2.

Company had problems in submitting its financial statements: KOSMO TECHNOLOGY INDUSTRIAL BERHAD ("KOSMO" or "the Company") Delay in issuance of 2007 Annual Report

Fact 3.

Back in 2006, it traded as high as 8.50.

It last traded at 1 sen

At the peak, KOSMO had a stock market value of around 1 Billion.

Fact 4.

Kosmo is now delisted!

And so on 30 Oct 2009, Bursa Securities publicly reprimanded and fined two directors of another delisted company, KOSMO TECHNOLOGY INDUSTRIAL Bhd, a total of RM257,300!

From Bursa website.

Paragraph 9.16(1)(a) of the LR requires a listed issuer to ensure that its announcement is factual, clear, unambiguous, accurate, succinct and contains sufficient information to enable investors to make informed investment decisions.

Pursuant to paragraph 9.22(1) of the LR, a listed issuer must give Bursa Securities for public release, an interim financial report that is prepared on a quarterly basis, as soon as the figures have been approved by the board of directors of the listed issuer, and in any event not later than 2 months after the end of each quarter of a financial year.

Paragraph 9.23 of the LR states that a listed issuer must ensure that the issuance of the annual audited accounts and annual report by a listed issuer shall be as follows :-

(a) the annual report shall be issued to the listed issuer’s shareholders and given to Bursa Securities within a period not exceeding 6 months from the close of the financial year of the listed issuer; and

(b) the annual audited accounts together with the auditors’ and directors’ reports shall, in any case, be given to Bursa Securities for public release, within a period not exceeding 4 months from the close of the financial year of the listed issuer unless the annual report is issued within a period of 4 months from the close of the financial year of the listed issuer.

Paragraph 16.11(b) of the LR states that a director of a listed issuer must not permit, either knowingly or where he had reasonable means of obtaining such knowledge, a listed issuer to commit a breach of the LR.

KOSMO had breached :-

(a) paragraph 9.23(b) of the LR for failing to submit the Company’s annual audited accounts for the financial year ended 31 December 2007

("AAA 2007") on or before 30 April 2008. The AAA 2007 was only submitted on 30 June 2008;

(b) paragraph 9.23(a) of the LR for failing to submit the Company’s annual report for the financial year ended 31 December 2007 ("AR 2007") on or before 30 June 2008. The AR 2007 was only submitted on 6 August 2008;

(c) paragraph 9.22(1) of the LR for failing to submit the Company’s quarterly report for the financial period ended 31 March 2008 ("QR 1/2008") on or before 31 May 2008. The QR 1/2008 was only submitted on 30 June 2008;

(d) paragraph 9.16(1)(a) of the LR for failing to ensure the Company’s announcement dated 29 February 2008 on the fourth quarterly report for the financial year ended 31 December 2007 ("QR 4/2007") took into account the adjustments as stated in the Company’s announcement dated 30 June 2008, in particular the adjustments pertaining to additional provision for doubtful debts and impairment loss for development cost.

KOSMO had reported an unaudited profit after taxation and minority interest of RM109,000 for the financial year ended 31 December 2007 in the QR 4/2007. However, the Company had on 30 June 2008 reported an audited loss after taxation and minority interest of RM141,715,814 in the AAA 2007. The difference of RM141.824 million between the unaudited and audited results for the financial year ended 31 December 2007 represents a deviation of more than 100 times.

Dato’ Norhamzah bin Nordin and Encik Mohamad Nassir bin Mohd Kassim who were the directors of KOSMO at the material time were found to be in breach of paragraph 16.11(b) of the LR for permitting either knowingly or where they had reasonable means of obtaining such knowledge the Company to commit the aforesaid breaches.

They were informed of the audit concerns / issues to make provision for doubtful debt and possibility of impairment of development costs since August 2007 but have failed to demonstrate adequate efforts taken to discharge their duties to :-

(i) address the audit issues pertaining to impairment loss of development costs to enable timely submission of the financial statements in accordance with the LR; and

(ii) ensure that the QR 4/2007 made the necessary provision for doubtful debts and impairment loss on development cost to give a true and fair view of the state of affairs of the Company as at the financial year ended 31 December 2007 and in compliance with paragraph 9.16(1)(a) of the LR.

The finding of breach and imposition of the above penalties on KOSMO and the directors are made pursuant to paragraph 16.17 of the LR upon completion of due process and after taking into consideration all facts and circumstances of the matter including in relation to the directors, the roles and responsibilities of the directors in the Company particularly pertaining to the maintenance and preparation of financial statements.

So they were fined 257 thousand and their stock, which at one time was worth ONE Billion, disappeared into thin air with its delisting!

It's now May 2011.

On Star Biz: Kosmo director, accounts manager charged by SC

- Friday May 27, 2011

Kosmo director, accounts manager charged by SC

PETALING JAYA: The Securities Commission charged a director and an accounts manager of Kosmo Technology Industrial Bhd yesterday for providing false information to Bursa Malaysia Securities Bhd.

In a media statement, the regulator said six charges under section 122B(a)(bb) Securities Industry Act 1983 and two charges under section 369(a)(B) Capital Market and Services Act 2007 were preferred against Mohd Azham Mohd Noor and Helen Lim Hai Loon for false statements in the company’s eight quarterly unaudited results for financial years 2006 and 2007.

If convicted, they will be liable to a fine not exceeding RM3mil and imprisonment for a term not exceeding 10 years for each charge.

Azham and Lim were released on bail of RM150,000 with one surety each. Sessions Court Judge Rosenani Abd Rahman further ordered that their passports be surrendered to the court and fixed an application for their trial to be held jointly on June 22.

Finally some form of justice!

But is it enough?

According to the report, a fine not excedding rm3 million and imprisonment for a term not exceeding 10 years for each charge.

But the stock at its peak was worth 1 Billion. And I wonder how much was profited by that incredible stock price back then?

Posted by

Moolah

at

10:53 AM

0

comments

![]()

Labels: Bursa Stuff, Kosmo

Thursday, May 26, 2011

How Is KNM's Earnings Guidance Faring?

Posted on 9 March 2011 : What I Think Of KNM's Earnings Guidance

Let me repeat what KNM management said:

- KNM’s management had met with analysts earlier in the week and guided earnings before interest, tax, depreciation and amortisation (Ebitda) of RM363 million for its FY11 (ending Dec 31, 2011), while the Ebitda for FY12 is targeted at RM564 million

That was from the horsie own mouth and this wasn't no hot shot analyst estimates and this horsie, KNM, is TELLING everyone that it will earn some EBITDA of rm 363 million for fy 2011 and rm 564 million for fy 2012.

And I remarked What I Think Of KNM's Earnings Guidance in that posting.

So KNM reported its Q1 earnings.

Here's the screenshot.

And here's what KNM has to say about their earnings.

- The Group achieved revenue of RM413.00 million, profit after tax and minority interest of RM19.02 million and EBITDA (Earning Before Interest, Tax, Depreciation and Amortisation) of RM39.89 million for the period ended 31 March 2011. Compared to the previous year, the higher performance for revenue and EBITDA in this year was due to higher revenue recognised and higher contribution margins, whereas profit after tax and minority interest in this year was lower due to lesser deferred taxation impact.

Ok it's only the first quarter but remember KNM had said:

- KNM’s management had met with analysts earlier in the week and guided earnings before interest, tax, depreciation and amortisation (Ebitda) of RM363 million for its FY11 (ending Dec 31, 2011), while the Ebitda for FY12 is targeted at RM564 million

How?

Posted by

Moolah

at

8:53 PM

23

comments

![]()

Labels: KNM

Wednesday, May 25, 2011

And Green Packet Says The Magic Word Once More

Guess what article I saw on the Star Biz? Green Packet on track to achieve EBITDA target

EBITDA target again???

Quote from today's papers:

- Green Packet Bhd is on track to achieve its EBITDA (earnings before interest, taxes, depreciation and amortisation) break-even target by this year-end, according to the group's managing director and chief executive officer Puan Chan Cheong.

LOLOLOLOL!

Flashback: (refer posting dated 17 feb 2011: Green Packet Makes More Promises.... again. )

- Feb 2008: we expect the WiMAX business to be ebitda (earnings before interest, taxes, depreciation and amortisation ) break-even this year,"

- May 2008: we are targeting EBITDA positive by end of next year.

- May 2009: P1 will be EBITDA will break-even from next year.

- Feb 2010: concurred that will be EBITDA positive in the second half of this year.

- May 10: the company remained optimistic that it will be able to achieve an Ebitda break even

- June 2010: Green Packet Bhd’s target to turn earnings before interest, tax, depreciation and amortisation (Ebitda) positive by year-end may be delayed to next year

- Sep 2010: Puan added that Green Packet is maintaining that its Ebitda (earnings before interest, tax, depreciation and amortisation) will break even by the end of this year.

- Nov 2010: "We're confident of breaking even no later than the first quarter. Ebitda (earnings before interest, tax depreciation and amortisation) turnaround is really at the corner," chief executive officer C.C. Puan said at a press conference in Petaling Jaya, Selangor, yesterday.

- Feb 2011: defers its target of being EBITDA (earnings before interest, taxation, depreciation and amortisation) positive to end-2011.

- May 2011: Green Packet Bhd is on track to achieve its EBITDA (earnings before interest, taxes, depreciation and amortisation) break-even target by this year-end, according to the group's managing director and chief executive officer Puan Chan Cheong.

On Feb 2011, I posted Green Packet: 12th Consecutive Quarters Of Losses, 36 Month Of Losses And ...

I shall re-use that same template. ( Lazy lah)

Some facts. (new comments in black bold)

Fact. It lost some 100.112 million for the quarter. (It lost some 37.893 million for the current quarter)

Fact. This is the 12th consecutive quarter of losses. 36 months of losses. (13th consecutive quarter of losses. 40 months of losses)

Fact. Green Packet's total losses for last 36 months equals some 439.924 million! (Green Packet's total losses for last 40 months equals some 477.817 million!)

Fact. Green Packet raised some 98 million via rights issue last Aug. 2009.

Fact, Jan 2010. Green Packet raised some 69.176 million from a share placement.

Fact, Green Packet recently raised 322.910 million from issuance of Convertible Preference Share to SK Telekoms. ( see Sep 2010 posting: Update on Green Packet )

Fact. After tonight's earnings, Green Packet said it had some 171.962 million and some 238.190 million in borrowings. (After tonight's earnings, Green Packet said it had some 90.462 million - wow! where the money went? money heaven? And borrowings soared to 367.888 million!!!!)

Posted by

Moolah

at

11:00 AM

9

comments

![]()

Labels: Green Packet

Chat On Koon Yew Yin's Investment In Xingquan Again

Posted yesterday evening: Update On Koon Yew Yin's Investment In Xingquan

I received one great set of comments from xinzhang.

- You can check for yourself with Koon Yew Yin if he is still holding Xingquan at yewyin@gmail.com I have been informed that he transferred those shares to his daughter. This is an information which I got from himself. He is also holding Xingquan through his wife and other close relatives. The total holdings might be more than the 5.5% quoted. The point of him dumping Xingquan does not arise. However, the apparent dismal price movement of this counter had many riled up in anger.

I have read the comment posted by Gwyn Welsh on Xingquan in your blog recently. He had pointed out pertinent points which are of course facts. The management of Xingquan has to increase dividends to its shareholders in order to instil confidence among shareholders and potential investors. The confidence among investors now on Chinese stocks are very low.

Xingquan has to show that they are above the rest.

Now sending an email to Mr. Koon is probably a very good suggestion for those interested in FOLLOWING Mr.Koon Yew Yin's investment in Xingquan.

Point that I wanted to make is a rather simple fact that Mr.Koon by himself, his name, he is NO longer a substantial shareholder because he no longer holds the minimum amount required to be classified as a substantial shareholder.

Which means, he can either buy or sell his stake without the need to informing Bursa Malaysia.

Which puts investors who had adapted the follow Mr. Koon investing strategy in a dark.

Now the irony of Mr. Koon's transfer of shares is that Xingquan shares had declined rather sharply since then.

So how? Is Mr.Koon still holding these shares in Xingquan? Did he buy more for his family members? Or has he reduced his shareholdings?

And yes, I guess sending him an email might help.

Anyway, back in Nov 2010: on the posting More Balanced View On Xingquan, I highlight now again parts of your comments.

- ..... Xingquan is lacking on dividend as correctly pointed out by Mosea. Yes, for any investor, dividend is something that they are looking up to apart from price appreciation. But Xingquan has caveat this by presenting to all and sundery that they are paying from 10% to 20% of its PAT.

Xingquan should be paying up for the expansion completed recently. And the issue is how much business have they managed to get for this new plant.

And my last advise is will there be more funds interested in this counter apart from Mr. Koon Yew Yin. Having Koon Yew Yin on board is a good thing boosting investors' confidence.

Firstly the last statement. Sorry but not to be rude or arrogant but it's now May 2011. Despite the known fact that Mr. Koon is an investor of Xingquan, Xingquan shares have not fared well. So how?

On the issue of dividends again. You said today "The management of Xingquan has to increase dividends to its shareholders in order to instil confidence among shareholders and potential investors. "

On March 2011, CIMB had a report titled "Xingqian: Looking to plant a bigger footprint."

Here's a screen shot.

Apparently Xingquan is still holding very firm on its dividend payout at 10-20% of net profit, a point which you had already highlighted back in Nov 2010.

Now let's consider the updated tables again, from the posting recently, A Quick Look At Xingquan's Earnings

Now with profits not booming (compared on a yearly basis) and as mentioned in CIMB's latest reports, Xingquan, is hit by high material costs. One has to question where's the growth? Now the growth issue for Xingquan is extremely important because Xingquan had insisted it still wants to carry on with its TDR. Without growth and a future dilution of earnings caused by the issue of shares in the TDR programe, future eps will shrink.

Balance sheet cash. Cash is shrinking but most important thing is interest received. As mentioned several times by blogger snowball, why is the interest so low? Why is Xingquan getting so low value for its money? From the table above, we know that at the end of 4th Q FY2010, Xingquan had some 280 million cash. Nine months later, cash left is only RM 168.850 million. 168 million is a lot of money, yes? But from the cash flow, Xingquan said it's only getting some 563 thousand in interest. Err.. why so little value for their money?

And with cash depleting and the management hell bent on expanding and even rebranding everything, how to expect more dividends?

Having said that, yes, I really agree with you. If the management would show the investors the moolah, this stock could generate some investing interests!

Just my flawed opinions.

Posted by

Moolah

at

9:06 AM

1 comments

![]()

Labels: Koon Yew Yin, Xingquan

Update On AirAsia Earnings

Back in early Aug 2010, I gave AirAsia credit. Yeah I did. LOL!

In the posting Positive Move That AirAsia Defers Their AirBus Order, I said the following...

- However, let me say this, I have to give AirAsia some credit for eating the humble pie and for successfully persuading AirBus to allow them to defer the delivery of the air crafts and more so, this move really gives them a fighting chance to survive and to overcome their insanity of building a company which was clearly over burdened by the immense corporate debts they took upon to finance the building of their business.

Yeah.. AirAsia should be ok for the next one year or so... yeah.. this is a POSITIVE CORPORATE exercise... it's certainly extremely crucial that AirAsia made this postponement of delivery.... but... deferring is only a postponement.... and in regardless, these air crafts order still needs to be delivered!

(ps: you are welcome! :D )

And I continued to make reference on it.

On 4 Dec 2010: A Look At AirAsia Stellar Earnings. The positive moves from the deferment of the aircrafts was visible on the balance sheet. I made the following remarks.

- The cash/debt level, has it improved?

The c.c or capital commitment column 'improved'. Would I pay attention to the value? Or should I pay attention to the number of aircraft to be delivered?

On 24 Feb 2011: What Do You Thnk Of AirAsia's Earnings?

From that posting ::

Cash actually improved a lot compared to the previous quarter.

And debt increased slightly.

But the capital commitment... there was a huge improvement, yes?

And as mentioned before in August 2010, I thought it was a Positive Move That AirAsia Defers Their AirBus Order.

Seriously... it's giving AirAsia a fighting chance to survive!!!

And I still hold those remarks from that posting.

- However, let me say this, I have to give AirAsia some credit for eating the humble pie and for successfully persuading AirBus to allow them to defer the delivery of the air crafts and more so, this move really gives them a fighting chance to survive and to overcome their insanity of building a company which was clearly over burdened by the immense corporate debts they took upon to finance the building of their business.

Yeah.. AirAsia should be ok for the next one year or so... yeah.. this is a POSITIVE CORPORATE exercise... it's certainly extremely crucial that AirAsia made this postponement of delivery.... but... deferring is only a postponement.... and in regardless, these air crafts order still needs to be delivered! - Anyway... a postponement is a postponement is a postponement. Come 2014 (last August AirAsia deferred 8 AirBus to 2014) and 2015, these air crafts still needs to be delivered. Which means, from now till then, AirAsia still needs to ensure that it builds up its cash flow to ensure it can accept delivery of these air crafts that they had ordered. Unless of course, AirAsia can pull off another miracle by asking AirBus to allow them to defer yet once more. :P

ps: yeah, AirAsia X listing would indeed help AirAsia financials. It too is required. And it is the ONLY OTHER logical and sensible option for AirAsia to rescue its dire balance sheet.

Back in early 2009, I certainly thought AirAsia was doomed. I really thought there was a 90% chance it go into deep trouble but now I have changed my opinion. It's doing all the right things to survive.

They got their placement of shares. They deferred their aricraft order and their current plans to list AirAsia Thailand would help a lot!

But then the main issue or risk is... 2014 and 2015.

That's when AirAsia would have to take deliveries of all the aircrafts orders they have postponed. Will they survive? Or will they not?

ps: I have no idea what the stock would do. :/

<<<<<>>>>>

Last night AirAsia reported its earnings.

I believe the following updated table would speak for itself in regards to the much improvement in AirAsia balance sheet.

ps: And as usual I have no idea and have no interest to know how the stock will do.

Posted by

Moolah

at

7:44 AM

0

comments

![]()

Labels: AirAsia

Tuesday, May 24, 2011

Update On Koon Yew Yin's Investment In Xingquan

It's so understandable that many likes to follow the investing moves of their stock market heroes. If the stock guru buys, then they will buy.

That's how it is.

Now I am not here to argue whether this is correct or wrong but let's reconsider one popular example again.

Back in April 2011, I posted the following posting: Koon Yew Yin's Investment In Xingquan.

Why Xingquan again? Well Xingquan is one of them many Chinese listed stock selling at a cheap valuation and Koon Yew Yin is a famed local investor.

Now Koon Yew Yin's investment in Xingquan was first mentioned in the posting Regarding Xingquan's Cash And Dividends

- ch said...

Dear All,Yes, the issues brought up by Moolah, Mosea and Snowball are primary concern(s) if one is invested into Xingquan. The dynamics of Chinese stocks and business community are always tinged with mysterious circumstances. Be that as it may, the Chinese are rapidly becoming the world economic superpower. One thing I know about Xingquan is that a shrewd investor by the name of Koon Yew Yin is a minor majority shareholder. Please refer to Bursa Malaysia under change in shareholdings column. This is the same man who has years of experience in stock investing and the same person who pledged to donate RM30 million to UTAR (but was turned down by MCA for reason(s) best known to them. He is a smart share investor and invested a sizeable amount in Xingquan. Guess he should know something about Xingquan that we do

Date interest acquired : 27/09/2010

No of securities : 15,422,100

After the acquisition, KYY has

Direct (units) : 16,901,000

Direct (%) : 5.5

But there is no price stated. Shares were said to be purchased on Sep but the announcement was made on 19th Nov 2010.

From Star biz website: http://biz.thestar.com.my/marketwatch/charts/BizHistory.asp?submit=1&scode=5155, all we one can do is to make a guestimate of the acquired stock price. And if one use the average from Sep 15 to Sep 25, perhaps the average price is around 1.60.

Perhaps.

Is this correct? Or is this wrong? I do not know exactly but I would be flawed to use a guesstimate price of around 1.60+

Posted the next day on 20 Nov 2010: More Balanced View On Xingquan

And I mentioned ....

So much interest.

Well... for the record...

ps: how many quarterly earnings has Xingquan reported since listing?

ps/ps: how has Xingquan reallly fared?

ps/ps/ps: has Xingquan's perfomance so far being up to par? Has it beat 'expectations'? or has it grossly perform below expectations.

How? I just raised some simple questions.

On Jan 2011: Notice of Person Ceasing (29C) - Koon Yew Yin

Mr. Koon Yew Yin did a share transfer of 4,000,000 shares and with this share transfer he is no longer consider a substantial shareholder.

Which means he does not have to report to Bursa Malaysia anymore in regards to his shareholding in Xingquan. Has he sold some? Does anyone know? Or who has he transfer his shares to? Or did he top up more shares in this other account?

So how? If you are following KYY, how now?

And as everyone knows, Xingquan had fared rather poorly since Nov 2010.

So how?

Some even dare insinuate KYY called a buy call at 1.10. Rather dubious because since Nov 2010, the lowest Xingquan traded was 1.12.

ps: Do refer last month's posting: Koon Yew Yin's Investment In Xingquan.

Posted by

Moolah

at

5:22 PM

1 comments

![]()

Labels: Koon Yew Yin, Xingquan

Longtop Financial Technologies (LFT) : Yet Another Chinese Stock Hit With Fraud

From CNBC website: http://data.cnbc.com/quotes/LFT/tab/5

That's a pretty 'good looking stock' yes? Trading at a forward PE of 9.1x and a PEG of 0.54x, this 'could' be a decent stock pick, yes?

Check on finviz website: http://www.finviz.com/quote.ashx?t=lft

On CNBC news: China's Longtop Says Auditor, CFO Quit; SEC Probes

- The resignation on Sunday of the auditor, Deloitte Touche Tohmatsu CPA, came three days after Longtop [LFT 18.93 --- UNCH (0) ], which makes software for Chinese financial services companies, said its chief financial officer offered to resign.

Based in Xiamen, Longtop had a $1.08 billion market value before a May 17 trading halt in New York, though that value had fallen by more half since November.

It is among the largest of several Chinese companies — such as China MediaExpress — that were hit recently by accusations of accounting fraud, including from short-sellers or regulatory probes.

According to Longtop, Deloitte said its resignation stemmed in part from "recently identified falsity" in Longtop's financial records, as well as "deliberate interference" by Longtop management in the audit process.

Longtop also said Deloitte could no longer rely on its prior audit reports for the company.

Separately, Longtop said the U.S. Securities and Exchange Commission has opened an inquiry. It intends to cooperate, and has hired legal counsel and authorized the hiring of forensic accountants to examine matters raised by Deloitte.

Longtop said it is also considering whether to accept the resignation of CFO Derek Palaschuk, offered on May 19.

Palaschuk said he quit the board of Renren [RENN 12.40 -0.60 (-4.62%) ] three weeks ago, just before it went public on May 4, to protect the Chinese social networking company from any fallout from accounting fraud accusations at Longtop.

"It doesn't appear that Chinese companies have withstood the types of scrutiny by auditors that American companies have faced — for decades," said Richard Riley, an accounting professor at the West Virginia University College of Business & Economics in Morgantown, West Virginia.

"As these companies get bigger, they get more attention, and inconsistencies, anomalies or things that don't make sense may become more apparent," he said.

Neither Longtop nor Palaschuk returned requests for comment. Deloitte had no immediate comment. SEC spokesman John Nester declined to comment.....

Do click on CNBC other link: accusations of accounting fraud,

On Bloomberg: Deloitte Quits as Auditor of Hong Kong’s Longtop as U.S. SEC Probes Claims

- Longtop Financial Technologies Ltd. (LFT), a Hong Kong-based maker of financial software, said auditor Deloitte Touche Tohmatsu Ltd. resigned and a U.S. regulator started a probe of the company’s financial reports.

Longtop, whose 2007 U.S. initial public offering was underwritten by Goldman Sachs Group Inc. (GS) and Deutsche Bank AG (DBK), said Deloitte and Chief Financial Officer Derek Palaschuk resigned because of “falsity of the company’s financial records in relation to cash at bank and loan balances (and possibly in sales revenue)” among other issues, according to a press release today. The U.S. Securities and Exchange Commission informed Longtop that it is investigating matters related to Deloitte’s claims, the company said.

The probe of Longtop, which has been suspended in New York trading since May 17 as it delayed filing its annual report, represents an expansion of regulatory scrutiny beyond smaller Chinese companies listed in the U.S. by reverse mergers. The SEC launched an investigation last year into the use of reverse takeovers, in which a closely held firm acquires one that’s publicly traded, enabling it to sell shares without the regulatory and investor examination of an IPO.

“We learned that there’s no such thing as pedigree anymore in the Chinese market,” said Andrew Left, Los Angeles-based founder and owner of Citron Research, who wrote reports questioning Longtop’s financials. “This company had Goldman at their IPO, Deloitte as their auditor, and major firms as their investors. You couldn’t ask for a better structure.”

Now posted 27 April 2011: Want To Invest In Chinese Stocks Listed Overseas? Read This First!

Let me reproduce the entire article:

On the Financial Edge:

Lessons in handling S-chips for SGX

Written by Leu Siew Ying

Tuesday, 26 April 2011 10:46

Anne Stevenson-Yang wanders into a large conference room in between corporate presentations and meetings during a glitzy investment confab in Shanghai and finds rows of tables manned by representatives from small accounting firms and investor relations outfits hoping to snare Chinese companies seeking overseas listings as their clients. The event is the Rodman & Renshaw Annual China Investment Conference, which was held at Shanghai’s Le Royal Meridien Shanghai last month and was said to have featured 150 presenting companies, a live performance by 1990s R&B band En Vogue and drawn some 1,000 attendees.

US investment bank Rodman & Renshaw was looking to connect Chinese enterprises looking for cash with investors in the US and to facilitate introductions with the various providers of corporate services the enterprises will need as public listed entities in the US. And, despite a string of stories recently of egregious fraud and corporate governance scandals at US-listed Chinese companies that wouldn’t be unfamiliar to investors in Singapore’s S-chips, business was evidently booming.

Stevenson-Yang was at the Shanghai investment conference for a somewhat different reason, though. The managing partner of J Capital Research provides independent research on Chinese companies, which she says are often poorly understood in developed markets. Just weeks before the Shanghai conference, J Capital Research had published a report alleging that Xian-based fertiliser maker China Green Agriculture had been inflating its revenue. Among other things, the report cited discrepancies in revenues reported by the company in the US versus revenues reported by its key operating unit in its filings with China’s authorities. That sparked a steep sell-off in its US-listed shares.

China Green Agriculture, which is already under investigation by the US Securities and Exchange Commission (SEC), later issued a letter to its shareholders, responding point-by-point to the J Capital Research report. Among other things, it said that there are differences in accounting standards in China and the US, and that companies do not reveal all their financial information to China’s authorities for fear of losing their competitive edge if the information were to become public.

Whatever the case, accounting irregularities and corporate governance issues at US-listed China companies are now making investors there as nervous as investors in Singapore are about S-chips. In fact, the spate of bad news prompted SEC commissioner Luis Aguilar to remark that the number of Chinese companies with accounting deficiencies or that are “outright vessels of fraud” seems to be growing.

That’s spurring business for the likes of Stevenson-Yang and J Capital Research, as hedge funds and bear raiders scramble for information about US-listed Chinese companies to take short positions in their shares. Another company benefiting from this negative interest in Chinese companies is Hong Kong-based Muddy Waters Research, a firm founded by US lawyer Carson Block. In November, Muddy Waters published a report on Rino International Corp, alleging that the accounts of the water treatment equipment supplier based in Dalian had “serious flaws”. That sparked an investigation by the SEC and eventually led to the suspension of trading in the company’s shares on April 11.

Then, there is OLP Global LLC, which bills itself as an “alternative” research and consulting firm with a track record of “bridging the information and research gap” between companies and investors. Earlier this year, OLP alleged there were questionable dealings at US-listed ChinaCast Education Corp, but no action has been taken on the company so far. Interestingly, ChinaCast Education was originally listed in Singapore as ChinaCast Communication Holdings. In 2007, it was delisted following its acquisition by a US-listed company called Great Wall Acquisition Corp.

Not all of these firms confine themselves to producing “negative” research on Chinese companies, though. In fact, J Capital Research says it began examining China Green Agriculture because it was initially excited about its prospects. It was only after it looked closely at its business that it discovered what it believes to be evidence of inflated reported revenues. Yet, demand for such negative research is clearly growing, says Stevenson-Yang, because of a “clash of civilisations” when Chinese companies are listed in developed markets.

According to her, analysts and investors in developed markets are incapable of examining Chinese companies properly. Besides differences in accounting and financial reporting standards, companies in China just don’t work the same way as in developed markets. “And, if they list overseas, [China’s] attitude is that what happens there is none of its business as they are regulated by the overseas regulator,” Stevenson-Yang says. That creates a “black hole” that enables unscrupulous promoters to take dodgy Chinese companies public overseas, supported by a host of fly-by-night accounting firms and investor relations outfits, she adds.

To be sure, not all Chinese companies that seek overseas listings are fraudulent. Yet, the methods that analysts and regulators in developed markets use often aren’t sufficient to separate the ones that are from the ones that aren’t. “Investment bankers and research analysts do not begin with the point of view that the [financial] reports are incorrect,” Stevenson-Yang tells The Edge Singapore. “You don’t assume that people are lying to you.”

Even when Chinese companies are genuine, investors don’t always understand the business ethos in China and they underestimate the potential for things to go wrong after the company is listed. “To a Chinese entrepreneur, IPO capital is just revenue. It’s for the taking and not for building the company,” says Stevenson-Yang. And, if the business performs poorly or begins to fail, some companies have little compunction in fabricating their financial accounts to keep their share prices up and continue raising cash, she adds.

Benefit of ‘negative’ research

Such views might seem fanatically negative in a market like Singapore, where analysts tend to express deeply unenthusiastic sentiment on a stock by simply dropping it from their coverage. Yet, the absence of “negative” research in the local market hasn’t left S-chips any better off than China stocks listed in the US. On the contrary, in recent months, S-chips like China Gaoxian Fibre Fabric Holdings, Hongwei Technology and China Hongxing Sports have crashed and then been quickly suspended after giving investors only scant explanation of what exactly has gone wrong.

Peter Choo, who organised the listing of several S-chips over the past decade, first at DBS Bank and later at Westcomb Securities, a boutique investment bank he founded, says the Singapore market would be better off if the negative research and shorting activity promoted by firms like Muddy Waters and J Capital were more widespread here.

“They are superior to analysts,” he says, noting that some of these firms not only provide information to short-sellers but also take short positions themselves. “They spend a lot of money and time investigating a particular company and they put their money there to short the stock. If they make money, well and good. We must have this kind of community.”

Besides alerting investors to trouble brewing at companies, such firms might also help uncover questionable behaviour by investment banks, accounting companies and investor relations firms. In her report on China Green Agriculture, Stevenson-Yang says the company is surrounded by a cluster of US-based promoters “whose record at best presents weak judgment and at worst could suggest a cross-border collaboration to defraud”.

These US promoters, she says, have worked closely with a group of investors in Shaanxi, one of whom was jailed for four years in China for securities fraud and indicted in the US. Roth Capital, the underwriter of an issue of US$25 million worth of new shares for China Green Agriculture in July 2009, also has a pattern of backing problematic companies, Stevenson-Yang claims. Its clients include Orient Paper, ChinaCast Education, Fuqi International and Harbin Electric, which are alleged to have misrepresented their results.

Stevenson-Yang says the SEC ought to bar reverse takeovers, which appears to be the route that many troubled Chinese companies took to obtain their US listings, and start prosecuting the investment banks, accounting companies and investor relations firms that are colluding with these companies. “It’s not going to get rid of fraudulent companies, but it will reduce their numbers,” she says.

That already seems to be happening now. The SEC established a special unit late last year to investigate reverse takeovers. The probe is reportedly targeting Chinese companies and a web of small investment banks, accounting firms, law firms and investor relations advisers.

Obtaining negative and even incriminating information from a company and its promoters to support a bearish call on its stock is no easy task for an independent analyst, though. Stevenson-Yang says she and her team often rack up costs in the region of US$100,000 (RM299,000) for research on a single company.

With the lack of short-selling activity in Singapore, can analysts who specialise in negative research make money in the local market? How can local investors tell a good S-chip from a bad one? What can the Singapore Exchange do to prevent the slew of accounting irregularities and corporate governance problems at S-chips from poisoning sentiment towards the whole sector and derailing its efforts to turn itself into a capital-raising hub for promising young companies?

Inherently risky

Stock exchanges in the US, UK and across Asia, including SGX, have worked hard over the last few years to attract Chinese companies. Now, shares in these companies trade alongside shares in well-established companies in those markets. Yet, Stevenson-Yang says Chinese companies listed overseas are inherently risky and unsuitable for many investors. In her view, pension funds and mutual funds looking for steady returns should avoid them, because of the high chance of fraud or corporate governance failures.

Indeed, the victims in these cases haven’t just been small mom-and-pop investors but major institutions with the resources to do extensive due diligence. For instance, private equity firm The Carlyle Group held a 10.9% stake in China Forestry Holdings and a 16.5% stake in China Agritech. Hong Kong regulators suspended trading in China Forestry after its CEO sold a huge block of shares and its auditors uncovered “possible irregularities” in its FY2010 accounts. China Agritech received a delisting notification from Nasdaq on April 12 after a self-professed short-seller, LM Research, called the company a scam and said its factories were all idle.

Even so, few exchanges, bankers and investors are likely to completely avoid Chinese companies because of the tremendous opportunity for growth they offer. “Despite the troubles, we must continue to engage China businesses for obvious reasons,” says Choo. “The benefits of having S-chips outweigh the negatives. No one ever gets full marks or 100% success.”

Investors with the stomach for such risk ought to size up their targets from first principles, rather than rely entirely on their financial reports. As Stevenson-Yang sees it, investors should simply avoid a Chinese company if they have never heard of the products it sells, or if their products have no comparables. She also recommends being wary of companies that keep raising funds, even when their books show they are flush with cash. “If a company wants to prove it’s for real, then if they have cash, they have to pay dividends,” she says. Also, watch out for small companies that provide precise earnings forecasts that they then meet without fail, she adds, especially if those companies are using the services of second- or third-tier auditors, investment banks and investor relations firms.

Attorneys at US law firm Robbins Umeda, which is helping shareholders of China Century Dragon Media file a class action suit against the company, advise investors to scrutinise a company’s corporate governance record. That includes its policies and practices on insider trading and related-party transactions. “Good corporate governance, although not foolproof, tends to decrease the likelihood that fraud or insider misconduct will damage a company,” the firm’s attorneys Brian Robbins and Gregory del Gaizo say, in an email response to questions from The Edge Singapore. Large investors can also have their investments monitored by a law firm in order to alert them to corporate misconduct or fraud, they add.

Robbins Umeda says it has handled a dozen cases of irregularities at US-listed Chinese companies so far, and that number is likely to keep rising. “It feels like almost every day that there is an announcement of irregularity at a Chinese company listed on an American exchange,” its attorneys say in their email.

Regulation versus liberalisation

In Singapore, regulators have responded to the surge in reports of irregularities and corporate governance failures over the last few years by demanding higher levels of compliance with the rules. Earlier this year, SGX directed S-chips to beef up their controls and ordered their audit committees to conduct an internal review and file a report by May 31. Bankers and officials at S-chips say SGX has been sending out such notices quietly from time to time, since 2009, when auditors for Fibrechem Technologies found the company was reporting inaccurate cash balances and receivables.

Investment bankers also say that SGX has asked them use private investigators to check the backgrounds of companies they bring to market, and this has now become standard practice. SGX maintains a list of errant directors and it also requests for information on consultants who refer IPO deals. In addition, it requires the professionals involved in an IPO to sign off on the prospectus to ensure they have done thorough due diligence.

What is the result of all these efforts? “There is no gross negligence. I am speaking for everybody, because I have worked with all of them,” says Choo, referring to IPO managers and bankers who are licensed to operate in Singapore. “I think they are all up to the mark. But how can you tell when a boss is unscrupulous?”

Indeed, even as instances of irregularities and corporate governance failures continue to come to light, obtaining and maintaining a listing in Singapore is getting tougher for promising young companies, some market watchers say. A comparison of the thickness of listing prospectuses filed in Singapore versus markets such as London’s AIM and the Australian Securities Exchange is telling.

The latest Catalist prospectuses are 200 to 300 pages long, whereas recent prospectuses lodged with ASX vary from 64 to 220 pages. Meanwhile, companies seeking a listing on AIM only have to submit a form providing rudimentary information that covers not even a dozen pages. AIM’s listing regulations run into a mere 137 pages, while Catalist’s listing rules are contained in 14 chapters with several sections each, not to mention appendices and practice notes.

With the ease of listing, AIM has attracted more than 3,000 companies since it was set up 16 years ago. The companies listed on the market don’t attract much analyst coverage and they don’t stay forever. Yet, it is vibrant enough to keep attracting investors as well as companies looking for capital from around the globe. Some 450 of the 1,174 companies now listed on AIM operate outside the UK, in more than 100 countries. How does AIM regulate these companies? A spokesman for the exchange says companies that flout listing regulations are fined or publicly or privately censured. At worst, they are booted off the board. Cases of fraud are referred to the authorities, the spokesman says.

In Australia, early-stage mining companies are able to obtain listings on ASX with ease, even though they are highly risky and many ultimately fail. Yet, the market has an investor base that accepts such risks. “They intuitively understand the business and they have gone through the learning curve,” says an analyst who covers SGX. That makes ASX a vibrant market for junior mining and natural-resource companies.

“SGX is doing a lot, but I’m not sure more regulation is the answer,” the analyst adds. According to Choo, for a company to obtain and maintain a listing on Catalist is now no less onerous than on the Mainboard. Moreover, the sponsorship system and listing requirements make listing fees expensive on Catalist relative to other exchanges that also target start-up companies, he adds.

Now, some market watchers are suggesting that SGX simply set basic rules to ensure that companies are what they hold themselves out to be, and then spare them the cost of tough regulation.

While that won’t reduce the number of companies failing, it would increase the number of listing aspirants willing to take a chance on a Singapore listing.

Choo says there is a big pool of investors in the region willing to take high risks for potentially high returns and that Singapore now has a window of opportunity to turn itself into the AIM of Asia. “That is the strength of Singapore, but it takes courage to do it. It takes a different mindset.”

Such a mindset might also see the value of having short-sellers and research firms like Muddy Waters and J Capital Research hunting for companies that might not be what they claim and taking them down. Meanwhile, Stevenson-Yang says she is unmoved by the point-by-point rebuttal of her report on China Green Agriculture by the company’s CEO.

“I read his letter and did not see any substantive points.” She insists that she had tried to engage the company while working on her report, but did not get adequate responses to her questions. “I gave them ample time and details to respond to my report and they did not respond. The letter was just hot air,” she says. — The Edge Singapore

This article appeared in The Edge Financial Daily, April 26, 2011.

http://www.theedgemalaysia.com/in-the-financial-daily/185646-lessons-in-handling-s-chips-for-sgx.html

Also posted 17 March 2011: Featured Posting: China Integrated Energy (CBEH): The Latest Alleged Chinese Fraud

Posted by

Moolah

at

12:01 PM

2

comments

![]()

Labels: Accounting Fraud, Longtop Financial Technologies (LFT)

Flashback: 2009 Champions League Final

Flashback:

27 May 2009: Champions League 2009 Final: Barcelona Vs Manchester United

It's been a long time since I wrote a preview.

Tonight's match would be special, I hope.

The best team, the current champions from La Liga, Barcelona, plays the best team, the current champions from Premier League, Manchester United, in Rome.

It should be fun, I reckon.

From an injury perspective or the availability of the first team players, Manchester United is probably the firm favourite.

Let's look at who is missing from Barcelona. Milito and Marquez are out with injury, while Alves and Abidal are both suspended. Alves will be sorely missed! Everyone who watches Barcelona knows so well that Alves offers so much to this Barcelona. And this is very much Barcelona's back four.

And then there is doubt on Iniesta and Henry too.

However, as of now, current indications are both could very likely feature since they both trained. I have a strange feeling that Iniesta would play but not Henry. If Iniesta do not play, Busquest would most likely take his place and sorry, I do not rate Busquet too highly.

United's main doubt is only Rio, although Rio has declared himself fit to play.

So when one talks about strength, it's clear that United has the edge and I do seriously reckon that United should win this.

Here's my reasoning. Both sides attacking options are superb. Both team can score. This is a fact. But when we add in the old adage that defence wins championship, which back four would you choose? Barcelona's back four who are missing all their key players versus United's backfour who could be missing Rio? I would choose United. Which means I believe that United has a better chance to stop Barcelona's attack over Barcelona's ability to stop United's attack. And not forgetting, United had shown that it can use the 4-5-1 formation to do another smash-and-grab job over Barcelona! Can Barcelona do this? I reckon not. Which goes to say, I also do not think Barcelona can defend a lead as well as United. This is simply because this is not Barcelona's style of play.

Yes, I reckon that United should win! :D

As usual, I do hope that I am not flawed.

Anyway, this is the line-up I hope Ferguson would field.

VDS

JoS, RioO, Vidic, Evra,

Carrick Anderson

Park Giggs Rooney

Ronaldo.

It's still very much a 4-5-1 formation with Ronaldo playing the role of lone forward. Parks and Rooney to play on the wings with Giggs sitting in front of Carrick and Anderson. And Anderson to give extra protection for Evra. This is needed for Messi is indeed one great ball player. He is good.

Score prediction: 2-1 United. :D

Man of the match? Wayne Rooney.

:p2

=============================================

Sadly Man United just did not show up for the game! Yes it was utterly disappointing as we did not compete!

Barcelona 2 Manchester United 0

Barcelona is the 2009 Champions League Champions.

They truly deserved it.United played well below par. United DID NOT challenge Barcelona as there were simply too many missed passes made throughout the game. What a shame.

Congratulations to all Barcelona fans.

Posted by

Moolah

at

10:00 AM

0

comments

![]()