Monday, October 06, 2008: Anthony Bolton : Why Now's The Time To Buy!

- When he warned in November, 2006, that the bull market was long in the tooth and share prices seemed unsustainable, the FTSE 100 traded at around 6,000. It went on to top 6,600 before beginning the long decline to where we are today.

More importantly, for an army of investors who follow the "British Buffett", Mr Bolton added that he has been buying shares for the first time in two years because some valuations are the cheapest he has seen in a lifetime.

Speaking at his offices in the shadow of St Paul's Cathedral – where, incidentally, this multi-faceted man has had his choral compositions performed – he said: "Investors who sell now are making the great mistake of being shaken out when markets are low.

"They are probably the same people who bought when markets were high. If you are panicky by nature, you should not have invested in shares in the first place.

Sunday, April 12, 2009: 'We've hit the bottom' says Anthony Bolton

- Bears remain convinced the rally was little more than a "dead cat bounce" or bear market rally.

But Mr Bolton remains unfazed. His beliefs were underlined by a survey from his firm that found investing when consumer confidence is at a low point, such as now, can generate an average of 13pc more in annualised returns.

He did, however, concede that conditions would remain bumpy for the next few months. "The market recovery won't necessarily be in a straight line and we'll still see some ups and downs, the pattern we have seen recently."

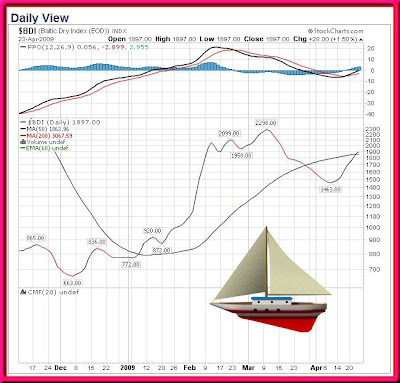

Thursday, April 30, 2009: All Things in Place’ for Bull Market

- April 30 (Bloomberg) -- Anthony Bolton, president of investments at Fidelity International, said a bull market in equities has already begun and financial shares are poised to drive recent gains higher.

Low valuations indicate advances that began in March are the start of a bull market, Bolton said. He favors financials, consumer cyclical, technology, and “value stocks,” such as retailers, automakers and construction-related shares.

“All the things are in place for the bear market to have ended,” Bolton said in an interview with Bloomberg Television in Hong Kong. “When there’s a strong consensus, a very negative one, and cash positions are very high, as they are at the moment, I’d like to bet against that.”

The MSCI World Index has dropped 3.2 percent this year, extending last year’s 42 percent slump, the worst annual performance since at least 1970. Shares plunged as a collapse in U.S. consumer spending and a freeze in credit markets sent the U.S., Europe and Japan into their first simultaneous recessions since World War II.

The declines dragged the gauge’s price-to-book value, or the ratio of stock prices to company assets, to 1.5, down from 2.4 at the beginning of 2008.

Bolton, who is based in London, said that in September he started putting money into Fidelity’s China-focused fund, which invests in Hong Kong-listed H shares of Chinese mainland companies, and into Japanese stocks.

Not Bear Rally

Investments in money market funds in the U.S. have reached a record and could fuel a bull market during the next two to three years, he said.

Bolton’s view contradicts that of Nouriel Roubini, the New York University professor who predicted the financial crisis. Roubini said last week he was “still bearish” and that an economic recovery is going to take “longer than expected.”

“Nearly all the broker research I read says ‘bear-market rally,’ that’s one of the other things that makes me think it’s the beginning of a bull market, not a bear-market rally,” Bolton said. “When everyone is extremely negative, I want to bet against that. If you wait for things to get better, you’ll miss the rally.”

Fidelity International managed about $157 billion as of January, according to Hong Kong-based spokeswoman Megan Aitken.