Blogged the other day, What Lah! Didn't AirAsia Said No More Oil Bets?. In it, Business Times carried a stronger header for AirAsia, Strong bookings to fuel AirAsia's revenue.

And I remarked then, "Record revenue? Since when did revenue ever counted for anything in the investing world? Strong revenue WILL NOT seduce any investors to invest in a stock! Strong net profits, yes! "

Today AirAsia reported its earnings. Wanna guess how it did?

Me? You should know where my bet was! Yup, earnings should be rather poor!

- AirAsia posts RM465.5m net loss

Published: 2008/11/28

AirAsia Bhd, Southeast Asia’s biggest discount airline, posted its first loss since it went public in 2004 after it took a one-time charge for contracts tied to fuel hedging and trades held by Lehman Brothers Holdings Inc.

The company reported a net loss of RM465.5 million (US$129 million) in the three months ended September, from a profit of RM180 million a year earlier, the Sepang, Malaysia-based airline said in a statement today. Sales climbed 43 per cent to RM658.5 million. Operating profit fell 37 per cent to RM91.6 million.

AirAsia had a charge of RM215 million in the third quarter after the company unwound hedging contracts and the likely non-recovery of a collateral for trades held by the now bankrupt Lehman Brothers. The carrier also filled fewer seats for a fourth consecutive quarter after chief executive officer Datuk Seri Tony Fernandes increased capacity while rivals including Malaysian Airline System Bhd scaled back operations.

“We see limited growth prospects for AirAsia,” said Christopher Eng, an analyst at OSK Research Sdn Bhd in Kuala Lumpur, who has a “neutral” rating for AirAsia. “This is not a time to aggressively invest in airline shares.”

AirAsia lost 1.8 per cent to close at RM1.11 today in Kuala Lumpur trading. The stock has fallen 31 per cent this year.

The company filled 75 per cent of seats in the last quarter compared with 79.3 per cent a year earlier, the statement said. The airline’s total passenger traffic increased to 3 million from 2.8 million, it said. - Bloomberg

Yup, sales rocketed but operating profits slumped!!!

But I was not interested in all these. I wanted to look at its balance sheet.

Back early this month, I wrote another posting on AirAsia, Tune Air Insists That It's Still In Midst Of Trying To Privatise AirAsia!

In that posting I had loaded some key balance sheet items.

Here are some shots of AirAsia balance sheet as reported in its quarterly earnings

Cash balances is now only 774 million compared to 1.084 billion in its previous quarterly earnings!

Cash balances is now only 774 million compared to 1.084 billion in its previous quarterly earnings!

And the horror part yet again...

Holy cow!

Yes Holy Cow!!!!!!!!!!

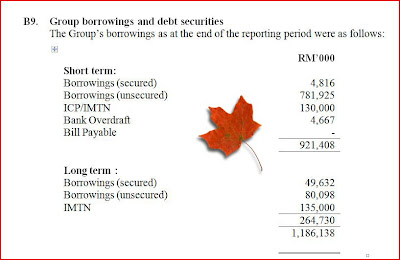

In its previous quarter, I thought AirAsia borrowings were extremely high at 5.397 billion.

AirAsia total debts is now 6.352 billion!!!!!

"Macam mana nak cari makan macam ni?"

And needless to say.. based on current quarter, one has to ask 'why it borrow so much but yet cannot make money?!'

And the following snapshot from its earnings notes shows exactly why such borrowings is a no-no.

And what's so wrong if the above, one may ask.

For starters, have a look at the below.

It's operating profit per quarter is only 91.559 million and when you add back its depreciation and amortisation figures, of 88.037 million its free cash from its operations is around 179.596 million.

Look again at the financial cost table. It's financial cost is 292.570 million!

How to make money when your financial cost is so much more than your operating profits

*The above comments were striked out because some readers felt it was misleading since the forex losses (or gains) are non cash flow items*

6.352 billion in debts?????

I guess no one has ever mentioned back to AirAsia that debts need to be paid one day!

And based on the current balance sheet, did Tune Air Insists That It's Still In Midst Of Trying To Privatise AirAsia!????

Does it even make business sense?