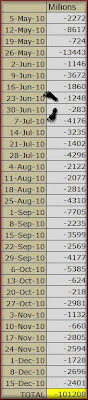

Now K-Star shares have been doing 'poorly' lately.

On the Edge Financial yesterday: http://www.theedgemalaysia.com/in-the-financial-daily/178118-k-star-tdr-listing-beneficial.html

- K-Star: TDR listing beneficial

Written by Kathy Fong

Monday, 06 December 2010 14:22

KUALA LUMPUR: The management of K-Star Sports Ltd is still puzzled by the big plunge in its share price as it soared to a record high only to tumble to its lowest ever in just a matter of one week.

“We are surprised with the selling on K-Star shares. We are not aware of any corporate development that will affect the share price movement, other than the proposed TDR (Taiwan Depository Receipts) programme that we had announced to the stock exchange,” K-Star’s chief financial officer Lim Yeow Eng told The Edge Financial Daily over a phone interview.

“We don’t want to speculate what the reason is behind the selldown,” he commented when asked about the heavy selling of K-Star shares recently.

Lim said the proposed TDR programme should be positive news to the company.

“Most companies’ share prices go up when they announce their plan to undertake the TDR programme,” he said. Lim also reiterated that the company’s operation was intact and was performing up to expectations.

The China-based sports shoemaker had on Nov 27 unveiled a proposal to seek a second listing in Taiwan. It is the second company on Bursa Malaysia to do this after XingQuan International Sports Holdings Ltd. K-Star intends to float 100 million shares, equivalent to 29.24% of its enlarged share capital, comprising 75.6 million new shares and 24.4 million existing shares, on the Taiwan Stock Exchange via the proposed TDR programme.

In Singapore, there are a growing number of companies seeking dual listing in Taiwan via the TDR programme, for instance Super Group Ltd, United Envirotech Ltd, Yangzijiang Shipbuilding (Holdings) Ltd and Osim International Ltd, the latest to jump on the bandwagon.

Share prices of these companies rallied after announcing the TDR listing. For instance, instant coffee manufacturer Super Group’s share price soared 40% after announcing its TDR programme.

Similarly, news on the dual listing exercise lifted United Envirotech’s share price by over 60%. Usually there is a price disparity between the shares that are listed in Taiwan and Singapore. Shares in Taiwan tend to trade higher than those listed in Singapore.

Lim said the proposed TDR programme is a positive move as the company could raise fresh capital for expansion at lower costs.

However, there have been concerns over shareholding and earnings dilution since K-Star will issue 75.6 million new shares, which are equivalent to 28.4% of its existing issued share capital, compared with XingQuan’s 15%. On this, Lim said with the new capital, raised at lower costs, would be invested to expand K-Star’s operations to enhance the company’s earnings in the future.

The latest results announcement showed that K-Star’s net profit rose 27% to RM14.3 million for 3QFY10 ended Sept 30 from RM11.3 million a year ago. Revenue grew 25% to RM88.36 million against RM70.4 million. For the nine-month period ended Sept 30, its accumulated net profit amounted to RM30.3 million or 0.39 sen per share compared with RM29.9 million or 0.5 sen per share previously.

Lim added that the dual listing in Taiwan would also help to increase the liquidity of the stock and raise the company’s profile and its brand name further. K-Star’s share price surged to a record intra-day high of RM1.21 on Nov 30 but the stock succumbed to intense selling, subsequently plunging to end at 45.5 sen last Friday — the lowest close since its debut on Bursa.

Trading volume surged to 27 million shares last Thursday. Over the last three trading days, some 70 million shares or 26.3% of K-Star’s issued capital changed hands.

According to Lim, the moratorium which was applicable to 83% of the company’s shareholding expired last Saturday. K-Star International Ltd is the major shareholder controlling a 58.4% equity stake. Some pre-initial public offering (IPO) investors hold the remaining 24%.

“The moratorium (on K-Star shares) is one of the highest on Bursa Malaysia,” said Lim.

However, under the proposed dual listing scheme, pre-IPO shareholders who have held shares in the company for over 12 months could sell part of their stakes via the TDR programme in Taiwan.

Among the pre-IPO shareholders who can dispose their shares in Taiwan are Skylitech Resources Sdn Bhd, A1 Capital Sdn Bhd (former Golden Eagle Resources Sdn Bhd), Yap Son On and Fortune United Investment Ltd.

This article appeared in The Edge Financial Daily, December 6, 2010.

Ah yes... K-Star the share SOARED recently before it's 'tumble'.

The bigger picture shows it...

The 1 for 3 stock split done at end Oct gave the share 'Kar Yau' factor!!

Posted on 7 Sep 2010: K-Star Wants To Split To Enhance Liquidity And Marketability. Let me reprooduce the entire posting in full here:

>>>

Posted on 25th Aug 2010. A Look At K-Star Sports

It was a simple posting, highlighting the rather optimistic earnings growth projection made by OSK.

What was also interesting was that K-Star appeared in the local news saying it wanted to raise more funds. I found it amusing and I wrote...

------------

According to that OSK report, K-Star raised some 32.9 million for its IPO and K-Star was listed on the 4th June (postponed from 31 May 2010).

It's now 24 Aug 2010 and on today's Star Biz, there was an article on K-Star: K-Star looks to raise funds

- It is looking at options such as rights issue, share placement and even a dual listing in Taiwan

K-Star wants to raise funds???????????????????????

Errr.... is the Malaysian investing public an atm machine?

------------------

Yesterday, K-Star made an announcement. Instead of the rights issue. share placement or dual listing talk mentioned earlier, K-Star said it wants to do a 1 into 3 stock split!

oO

It's reasoning... enhance liquidity and marketability....

- The Proposed Share Split is expected to enhance the liquidity and the marketability of the K-Star Shares on the Main Market of Bursa Securities and will indirectly encourage a wider spread of public shareholders, ranging from different and diverse type of investors. The Proposed Share Split will also enable the existing shareholders of K-Star to hold a larger number of ordinary shares in K-Star while maintaining their equity interest.

This means that K-Star number of shares would be enlarged from 88,800,000 to 265,400,000 shares.

This is how K-Star had performed since listing...

Yeah... the 'chart' shows that it's 'stock' performance had been rather lacking!

Can a stock split 'improve' and 'enhance' the stock?

LOL! LOL! LOL!

They cannot be serious can they?

Perhaps K-Star should ask some of Mr.Sotong's deep fried associates if they could comment a culinary chef.

Or perhaps K-Star should look at their own earnings performance for the clue why their shares lacks marketability!

As mentioned in the earlier blog posting:

A Look At K-Star Sports- Now K-Star reported its earnings on the 20th August 2010.

It was K-Star 2nd quarter earnings and K-Star only managed to make 5.94 million, giving it a half year earnings of only 16.467 million. ( see K-Star posts lower 2Q net profit at RM5.94m )

Yes, prior to the listing, K-Star made the following earnings announcement on 31 May 2010. Quarterly rpt on consolidated results for the financial period ended 31/3/2010

It said it earned some 10.542 million.

Then in Aug 2010, after being listed, K-Star's earnings came in at 5.94 million! ( See Quarterly rpt on consolidated results for the financial period ended 30/6/2010 )

Yup!

You said it WALOEHHHHH!!!

And best of all OSK's said in its IPO notes for K-Star listing was that K-Star is projected to earn some 52 million! Yup, OSK based its fair value for K-Star at rm 2.63 based ON that rather optimistic earnings projection!

Apparently, the market currently disagrees with such a valuation!

No wonder... K-Star 'feels' its shares lack marketability!

LOL!

-------------------------------------------------------

Yeah... thanks to the share split and of course the bubbly market, K-Star the share got all the marketability it wanted. It received the 'Kar Yau' factor and the stock soared up, up and away.

But the company was not 'satisfied'.

Perhaps it was aware that...

- Share prices of these companies rallied after announcing the TDR listing. For instance, instant coffee manufacturer Super Group’s share price soared 40% after announcing its TDR programme.

So it too, joined the bandwagon!

But K-Star's TDR involves a massive dilution in earnings!

- K-Star will issue 75.6 million new shares, which are equivalent to 28.4% of its existing issued share capital

Ahem... 28.4% dilution.

Err..... seriously!

What on earth are they even thinking about???? How could they ever possible come up with such a proposal?