Posted the following yesterday, "AirAsia Reported Massive Losses Again!!"

Received a set of interesting comments which I felt I should reply in detail. I do hope and ask that you spare your precious time with me in this rather long reply!

Ah said...

- Actually... I think revenue is relevant to stock analysis.. it shows the growth potential of a company. I personally wouldn't want to invest in a company with shrinking revenue, which could be telling that the company is losing market share? If you look at airasia's operating data or presentation, they did record some encouraging passenger growth. Of course, higher revenue should translate to higher net profit, i do agree that net profit is more important.

Ah, just for your information, when I blogged the posting What Lah! Didn't AirAsia Said No More Oil Bets?, I focused on one Business Times article titled Strong bookings to fuel AirAsia's revenue (link is removed - probably due to Business Time's own managment of its web space)

I felt the title was misleading.

Yes market share of course it's extremely important but this is where it would be subjective. In my own opinion, I would never run my business just for the sake of market share.

Market share is like a popularity contest where rewards is never fully guaranteed.

I would choose the net earnings over being popular.

And that's my flawed opinion.

And this is why I do NOT like companies goating on their record revenue.

Look at AirAsia.

It got it's dream record revenue. What about profitability? Where?

- But in AirAsia's case, the huge loss was very much due to the "exceptional item" of >rm400million. If you exclude this and the deferred tax, core net profit is still quite decent. However, on whether to treat the lumpy RM426 million as "exceptional" or "one-off" is disputable. Who knows whether there will be another RM400million exceptional items next year?

One thing first. The deferred tax 'ADDS' to AirAsia profit.

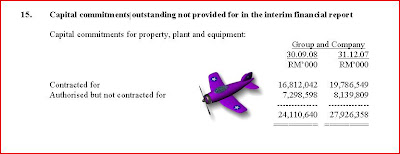

See how some 44.530 million was added back to AirAsia profits?

I am sure you understand that these deferred taxes are taxes in which AirAsia was supposed to pay the local government as taxes from their aircraft purchases.

Last blogged in December 2008, Again On AirAsia's Deferred Tax Issue and the earnings reported last night showed that AirAsia deferred tax is at 672.501 million!!

( see also AirAsia's deferred taxes issue and More on AirAsia's Deferred Tax Issue. And I would note from the first posting "We believe that AirAsia has a strong case for its non-provision of deferred taxes. With capital allowances and investment allowances likely to come to RM18bn in total, the company will not have to pay cash taxes for decades." )

Now let's look at AirAsia exceptional item mentioned in its books.

- The exceptional amount of RM426 million in the quarter relates to the cost of the unwinding our fuel derivative contracts and interest rate swaps. For the full year accounted, the Company has incurred a total of RM1,069 million which includes our collateral held by the now defunct Lehman Brothers. The allocation of the cost borne by the respective business unit is as follows; AirAsia Berhad is RM641 million, Thai AirAsia is RM222 million and Indonesia AirAsia is RM207 million.

The cause of the exceptional amount of rm426 million as stated by AirAsia was due to unwinding of fuel derivative contracts and interest rate swaps.

And how would you define such losses?

For me, in my flawed opinion as usual, these are PLAIN SIMPLE MANAGEMENT MISTAKES.

No one asked AirAsia to hedge on oil and no one asked them to fiddle with complex stuff as interest rate swaps.

Now they lost big money!!!!

rm426 million!

And I would simply declare and state this as HORRENDOUS management.

And I do believe you have hit it spot on when you said "Who knows whether there will be another RM400million exceptional items next year?"

I for one would NOT DISCOUNT THIS from happening!

And let me state why!

November 2008, I wrote the following What Lah! Didn't AirAsia Said No More Oil Bets?

I started that posting by highlighting that on 11 January 2008 AirAsia publicly stated the following on our Business Times.

- AirAsia: No more bets on oil price

AIRASIA Bhd, Asia's biggest discount carrier by fleet size, will stop making bets on the price of oil, after incorrect forecasts contributed to a 16 per cent slide in shares over the last month.

"It's a nightmare because the volatility is crazy," chief executive officer Datuk Tony Fernandes said in a Bloomberg Television interview on Thursday. "We took a bet that oil won't go above US$90 a barrel and it has and it's staying there."

November 2008. Business Time published Strong bookings to fuel AirAsia's revenue (link not working)

The boss pre-warns on fuel hedging losses and at the same time gloats on record revenues!

- Fernandes, however, expects the airline to remain profitable this year, despite provisions and costs which will be incurred.

AirAsia will make provision for losses from the collapse of Lehman Brothers investment bank.

"We had a trade (on fuel) with them (Lehman Brothers) and some money outstanding, I don't think we are going to get it back, but we would have paid for it anyway," he said.

That, together with hedging losses, which even Fernandes admits will be heavy, will be quite a sum. However, he declined to reveal any figures.

Few days later, I blogged AirAsia Posted Massive Losses!

- AirAsia had a charge of RM215 million in the third quarter after the company unwound hedging contracts and the likely non-recovery of a collateral for trades held by the now bankrupt Lehman Brothers. (quoted from Business Times AirAsia posts RM465.5m net loss )

How??

January 2008 AirAsia siad no more bets on oil prices. November it took a rm218 million charges in losses. And yesterday it took another rm426 million hit!

How?

The losses are rather incredible, yes?

How can the investor trust that this will not happen again?

Would you trust?

- All in, my view is that AirAsia is doing some sort of bloodbath this year.. and charging all the shit to FY08 since it's already a bad year (stock mkt collapse, record high jetfuel cost). So in FY09, they are basically unhedged and could take advantage of the lower fuel cost, as well as the lower finance cost (part of the RM426 million was due to unwinding of interest rate swap) I do believe that they can deliver some nice profit in FY09! BUT BUT BUT... i also agreed with you on the issue of high gearing.. hehe :)

Lower financial cost?

I seriously wonder how low the cost of financing their debts can get when its total debts so far is more than rm6 billion (discounting the newer 2.5 billion loan from Barclays)

This is what the company is saying in its earning notes.

- (i) Forward Foreign Exchange Contracts

The Group has hedged 65% of its dollar liabilities pertaining to its aircraft, engine and simulator loans into Ringgit by using long dated foreign exchange.

(ii) Interest Rate Swaps

The Group entered into interest rate swaps (some of which are capped) to hedge against fluctuations in the US-LIBOR on its existing and future aircraft financing for deliveries between Year 2005 and 2009. The effect of this transaction enables the Group to pay fixed interest rate of between 3.25% to 5.20% over a period of 12 to 14 years.

(iii) Fuel Hedging

As at 31 December 2008, following the unprecedented, near collapse of the US financial system and the collapse of WTI prices from $147 to $31 per barrel during the year, had subsequently liquidated its positions to take opportunity of the lower spot prices.

Changed 65% of its dollar liabilities to Ringgit. Interest rate swap? I do hope it knows what it is doing here.

Fuel hedging.

I can't help being evil here. Yes crude oil is down for now but what if it rises to say $45 or $50 of $60? Dare we say not possible? And what would AirAsia do again? Start hedging again?