Published on Business Times, AirAsia secures Barclays funding

I like Star Business version better AirAsia needs RM13bil funding because at least I do get see some numbers.

See at least I get to know that the deal is worth some US700 million (rm2.5 billion). I am puzzled here. With the USD so strong against the ringgit or the ringgit so weak against the USD, why do the deal in USD?

- PETALING JAYA: AirAsia Bhd yesterday sealed a deal in London mandating Barclays Capital to fund the purchase of 15 new A320-200 aircraft worth nearly US$700mil (RM2.5bil) for delivery largely in 2009 despite global banks clamping down on lending.

After yesterday’s deal, AirAsia needs another RM13bil to fund 104 aircraft orders it has placed from 2010 to 2014.

It is learnt that AirAsia is also in talks with BNP Paribas to secure more funding for 14 new A320 aircraft whose deliveries are in 2010.

But beyond that, can it secure all the funding it needs to take delivery of all the orders it has placed?

“We are thrilled to have secured the funding. It is not easy to raise money in (current times). The fact that we are able to do it shows the confidence of the financial community in our business model as it is the worst period for the credit market.

“This financing takes care of our 2009 and part of 2010 deliveries. Getting more guarantees for 2010 will not be an issue as our model is strong and it enables us to raise the money,’’ group chief executive officer Datuk Seri Tony Fernandes said in London yesterday evening.

He added that “this financing (via Barclays Capital) and the one (being negotiatied with BNP Paribas) will take us till end of 2010.”

“If people cannot get credit after that, i.e. in 2011, it would mean that the aviation sector will really be in difficult times.

“If by then we are not able to get credit, then we will have to cancel our aircraft orders but we hope we will not have to get to that stage. I think two years is a long time and we will cross the bridge when we get there.

“In the immediate horizon we have two years worth of financing (to see us through). We dare say we have achieved what not many airlines could have achieved in current times,’’ he said.

The signing ceremony was held in London to formalise the facility and it was attended by Fernandes, Barclays Capital, Airbus (the aircraft manufacturer) and BayernLB.

The funding via Barclays Capital – the investment banking division of Barclays PLC – comes three months after AirAsia secured a facility for US$336mil (RM1.21bil) to fund eight new A320 aircraft purchases.

The lead arrrangers for that earlier deal was BNP Paribas and Natixis Transport Finance.

The signing yesterday also confirmed a StarBiz report on Nov 13 that AirAsia was then close to securing a deal to purchase aircraft worth about US$1bil.

AirAsia has ordered 175 aircraft with an option of 50 more. Thus far, it has taken delivery of 56 aircraft and will take delivery of 14 and 24 aircraft this year and in 2010 respectively.

The budget airline is on an expansion trail even though many carriers globally including full service carriers are grounding aircraft on many of their routes in the current economic slowdown.

“We will continue to grow and launch new routes. Dhaka will be our next new launch route. We are also seeing growth from the corporate sector, a sector which is new to us,” Fernandes said.

Asked why AirAsia had a sale and leaseback arrangement with Doric for its last two aircraft deliveries and whether it would do similar arrangements for the current order of the 15 new Airbus A320-200 aircraft, Fernandes said: “Doric was a unique arrangement where there were clear tax advantages. Our aim is to own aircraft.’’

I am amazed. Bewildered.

Last month I wrote More Capital Borrowing For AirAsia????

Let me repeat the points.

- Take a look at this posting: AirAsia Posted Massive Losses!

I will just take out some important facts.

1. Cash balances is now only 774 million compared to 1.084 billion in its previous quarterly earnings!

2. In its previous quarter, I thought AirAsia borrowings were extremely high at 5.397 billion. AirAsia total debts is now 6.352 billion!!!!!

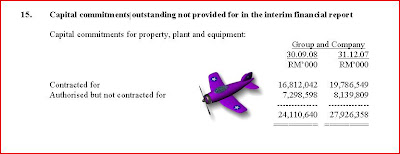

Now if you reckon that is bad, what about AirAsia's capital commitments? Have a look at the following screen shot. (source of data: Quarterly rpt on consolidated results for the financial period ended 30/9/2008 )

AA still has capital commitment totalling a whopping 24.1 billion!

So let's summarise. AA on its last quarterly earnings said that it has Cash balances of 774 million, total debts of 6.352 billion and a capital commitment of 24.1 billion.

So Barclays is giving AirAsia another 2.5 billion in loans!!!

Which means AirAsia loans could total a whopping 8.872 BILLION!

Holy cow!

Would you define this as debt bubble?

How?

2 comments:

As a consumer that like low air fare, i am happy with Air Asia. But as an investor, i am pretty scared about its near term prospect.

They have been giving out ALOT of advance travel booking that last until next year.

It used to be that the travel date were limited but now it has a bigger span.

Does this mean that AirAsia is literally rolling the cash flow with the free/low fares offers? They have so much debt that impossible to pay off in this type of environment.

I believe that you have it spot on too.

All I know that ALL debts need to be repayed and given the size of their debts and the insane size of their capital commitment, I doubt I will ever be a long term investor in such a company.

Come on United! :D

Post a Comment