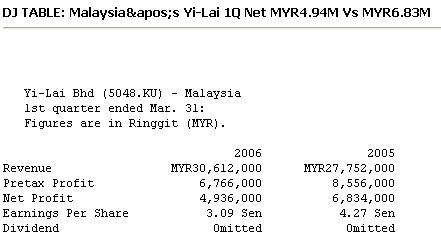

Yi-Lai just announced its 2006 Q1 earnings. (past blog postings on it can be found here: Part I , Part II , Part III , Part IV , Part V )

Yes, the net earnings were pretty low. And some would deem this as a huge disappointment. But then given the business economics of the industry during this earnings period, wasn't it expected? Two issues mentioned before (see : part-iii ), stiffer competition and higher cost of production stood out and it kept Yi-Lai's profits down. Oh yeah, I have to note that its sales revenue did increase.

And this was what the company management had to say in their earning notes.

- For the current quarter under review, the Group recorded a higher turnover of RM30.6 million compared to RM27.8 million for the corresponding quarter in 2005 whilst profit before tax was RM6.8 million compared to RM8.6 million for the corresponding quarter in 2005. The lower profit before tax for the current quarter despite higher sales was due mainly to lower selling price as a result of stiffer competition and higher cost of production

Now on the positive note, Yi-Lai's cash flow was extremely healthy. Cash grew by 5.415 million for the quarter, which is something like DIGI, after the adjustment for non-cash item, such as depreciation charges, the piggy bank cash grew more than the reported earnings. And in Yi-Lai's case, the positive cash flow was a huge relief because Yi-Lai's recent capital expansion saw drastic cash depletion in its piggy bank ( the depletion of piggy bank cash was mentioned in part-ii. )

Piggy bank cash is back up to 53.613 million (no debts) versus 48.198 million a quarter ago. ( Ze piggy bank cash grew 5.415 million - yeah some folks just loved to see ze piggy bank cash grow and grow and grow.).

So two clear and present issues.

Remember the issue of it's the business that counts?

Well, Yi-Lai's business is struggling in the current tough business environment. The tough business environment is hurting Yi-Lai's profits. Make no doubt about it.

How concern would you be on this issue? How worried are you that Yi-Lai's earnings is hurting?

However, the balance sheet is top draw. Another rarity since we are witnessing an extremely healthy growth in the cash flow despite the tough business environment. It's highly commendable what the management is achieving during current times..

How brown cow?

Oh, Yi-Lai's final dividend goes ex on 1st June 2006.

0 comments:

Post a Comment