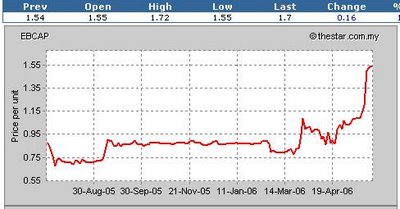

Firstly, I noted that this company had just received ze yellow card from the SC. Oops! Too much footie in me fried brain cellls! I meant EB Capital got ze UMA (Unusual Market Activity) from Bursa today, in which EB Capital replied in the following manner:

- There is no corporate development relating to the eB Capital Group's business and affairs that has not been previously announced that may account for the unusual market activity save for the appointment of Aseambankers Malaysia Bhd on 16 May 2006 for the Company's Proposed Bonus Issue of 12,453,500 New Ordinary Shares of RM0.10 each in eB Capital ("eB Capital Shares"), to be credited as fully paid-up, on the basis of one (1) new eB Capital Share for every two (2) existing eB Capital Shares ("Proposed Bonus Issue")

WoW!!!!

My oh my!

1.70??

Looks like this bugger has been stir-fried sunny side up!!!

Know why I am saying this? This is because I do remember that I had blogged on EB Capital b4.

In the blog posting, Oh Mess-Daq, I wrote the following on EB Capital:

<<==>>

Listed 2nd Aug 2005.

Yesterday I saw this bugger's quarterly earnings.

Sales Revenue: 1.802 million

Net loss: 1.064 million!!!

First quarterly earnings (reported on Nov 2005 ) after being listed and EB Capital reports a net loss!

Imagine a horsie horse in a cup race. The bell rings and the horse stumbles, throwing the jockey off the horsie. How? Out off the gates and already no hope liao!!

Disgusting or not?

You tell me lah.

And worse still, this EB Capital losses is at operating level and the company is net debt.

And lagi worse still for EB Capital, based on yesterday's closing price, EB Capital market capital is worth some 21.4 million.

And lagi, lagi worse still.. just imagine if the bossie owns 13% of this stock. This means the bossie is worth some 2.78 million based on his shares value in the market.

You tell me lah.... how come sky NO eyes one?

So, so easy to be a million hair ar?

So, so easy to be kaya raya!!

Sigh!

And lagi, lagi, lagi worse... just how did such company got listed?

Mana tu QC?

Well, i dunno but u guys and gals but muah is certainly pleased to read that SC is aware of this issue and is enforcing stricter rules.

Comeon... SC let's kick some butt!!!!!!

But there are some who are sceptical.

Will it really help?

I dunno... but... at least the very first small step is being made to rectify this issue.

I shall keep my faith... for now.

<==>

Has my opinion changed?

Heck NO!

Came Feb 2006, EB reported its earnings. Which it had to ammend and ammend. And finally on March 2nd 2006, it announced its final ammended quarterly earnings. And needless to say EB Capital states it loss 221k for that quarterly earnings. But somehow, it states it made 109k for its first fiscal year since listing.

But wait a minute.

Come 27th April, it boldly announced that there was a variance between audited and unaidted results. To cut it short, EB Capital actually lost 342k for the fiscal year!!

How could such a rotten stock be listed in a stock exchange????

So I am sure you are wondering why I am being so harsh on this bugger.

Take a look at the stock price and ze yellow card it got from Bursa.

So EB Capital states that it is proposing a 1 for 2 bonus issue and EB Capital states that:

- To the best of our knowledge, the Board of Directors of eB Capital are not aware of any particular circumstances contributing to the unusual market activity save as disclosed herein;

So does it make logical sense that they are not aware of anything?

So I am wondering, what is there to attract buyers to buy its share?

Is EB Capital bonus issue so seductive?

But then, which sane person would one to buy a share in a company which has yet to make a profit after being listed? And I wonder if the BOD of eB Capital is aware that they have yet to make a profit since listing?

Oh, how much is the price of EB Capital now?

1.70 wor!!!!!

now check this out...

See the Market Capital of EB Capital based on a price of 1.70?

42.341 million!!

Sooooo....

You tell me lah.... how come sky NO eyes one?

So, so easy to be a million hair ar?

So, so easy to be kaya raya kah??

Am I being too cynical?

But take a look at what is happening for EB Capital. Just form a company. Knowing how to make money is not a criteria, most important is to get the company listed on the Mess-Daq. And once it is listed, heck ze stock market might make you a million hair!!!

Oh, what a wonderful world!!

6 comments:

Hello Moola, I find your blog is interesting. However, as a foreigner in Malaysia I find it's not easy to read your blog as you write in "malaysian english". Do you mind to write in proper English so it could benefits other readers who are not Malaysia? Thanks.

Juan Carlos

Hi,

Thanks for your feedback... I will try to remind myself that.

Cheers!

Hi Moola,

I noted Redtone Technology Sdn Bhd has been accummulating EB Cap. Currently owning about 1.9m or 7% -8%.

Why is Redtone buying the shares of this company? That is interesting. Did i miss out something on the company's history.

Do share your thoughts. Cheers!

Boyplunger

Is it good to invest only in companies that pay dividend because dividend doesn't tell lies? Revenue and profit do. What is your opinion, please. Thanks.

Hi Dummy,

Generally getting dividends is always very good for the minority investor but sadly in the financial world, there are cases where some struggling companies continuing paying high dividends despite its poor financial health and despite its falling business. These management/oweners uses the dividends to entice buyers to buy or to refrain current investors from dumping their shares. Which works to be ok, as long as there is money to be distributed. But since their business is struggling and since their financial state is in poor health, what if the moolah run out? What if there isn't any money to be distributed? See the dangers in such assumption?

This is just one possibility but dividends is indeed a good indicator and as long as the investor is prudent enough, then the investor should be able to spot such financial shenanigans.

Cheers!

Thank you. I am great that you take the suggestion well.

Juan Carlos

Post a Comment