Back in Ze High Life!!

CNN Market Report for May 2nd 2006 is titled Stocks back in the high life. It highlights the following point.

- The Dow Jones industrial average (up 73.16 to 11,416.45, Charts) added 0.6 percent, putting the blue-chip indicator at its highest level since Jan. 19, 2000. The broader Standard & Poor's 500 (up 8.02 to 1,313.21, Charts) index gained 0.6 percent to end the session at its highest point since May 21, 2001.The tech-heavy Nasdaq composite (up 5.05 to 2,309.84, Charts) rose 0.2 percent.

Wonderful.

Six years high.

So I decided to play around... and I went on a sight seeing on CNN charts... :D

And here is how the picture looks like..

Yup, that how a six year high Dow would look like.

Would it be wrong to say that it has take six long years for DJI to recover back what it lost back in 2000?

So doesn't it mean that the Dow has done absolutely nothing since 2000.

Check this out...

So I decided to look at some of Dow's 30 component stocks at CNN website.

Here are some of the pictures I took...

For startes, it was a no-brainer decision for me to check out Exxon Mobil. And it looks like I found a hot one! If one had bought in 2000, one was looking at money, money, money all ze way!

Next I decided to check the Coke bugger and see if it was really ze real thingy onot...

waaa.... not so happening eh? Buy and hold since 2000 wasn't too happening eh?

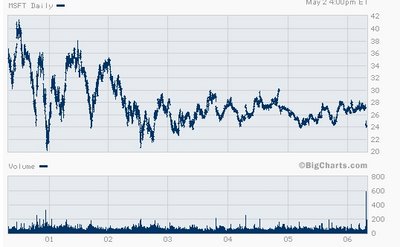

Then I thought about Bill Gates and his Microsoft. Hmm... if one bought Msft in 2000...

Ok... what about ze Wallmart? Hmmm... again not so happening, eh?

And what about Intel? Waaa....

Or what about ze big M.... MacDonalds?

And last but not least... this one I know is one horror story... ze General Motors...

Hmmm..... did you enjoy the tour as much as I did?

So the Dow is at its six year high... how?

Good ah?

ps... this reminds me of this blog posting: Is Ze Market for Suckers?

Hmm... let me reproduce what I wrote in that posting:

Wall Street has done an AMAZING job of creating conventional wisdom . “Buy and Hold ” is the 2nd most misleading marketing slogan ever, after the brilliant “rinse and repeat” message on every shampoo bottle. We as a country have fallen for it. Every message from every marketer of stocks tell us. Young or old, if you can hold for the long term, things will work out for you.

That is total bullshit. Its for suckers.

Totally agree!!

You cannot simply hold any shares! See this blog entry of mine: I wanna Hold your hand..

Simply put, If you buy and hold an investment gone bad, most likely than not, your investment would most likely go bad too!

So why do they want you to HOLD these shares gone bad?

Simple lor. They want you to be ze sucker!

If you are going to trade stocks, you just have to follow one rule and remember one thing. That rule is always have a definite knowledge advantage about the company you are trading, and always remember that every stock transaction has a sucker, and you have to know whether its you or the person on the other side of the trade. No one buys a stock from your, or sells one to you knowing they are leaving money on the table.

The bottom line is that unless you plan on making it a full time job to do your research and put yourself in a position to have an advantage, you are going to get your ass kicked at some point by someone who does. You just have to hope that it doesnt put a big financial hurt on you when it happens

Another good point, eh?

The same logic applies to funds. Funds are in the business of making money for themselves first. You 2nd.

Ahem! Funds are in the business of making money for themselves first.

Same rules applies here!

Repeat after me.... Funds are in the business of making money for themselves first. You 2nd!!!

Thats why I buy stock in public companies that relate to my other business entities. When i pick up the phone and call the CEO of a company i own shares in, they call me back very quickly. When I ask if there are business opportunities that make sense for the company and another company of mine to work together, I wont always get the business, but I will always get a meeting. If Im smart about the investments I make, the more important returns come from the relationships with the companies than the action of the stock.

Hmm... investing from a business perspective?

If the best you can do is buy shares that are going to be continuously diluted, then you are merely a sucker. There is a good chance that the shares you bought came from shares an insider who got stock options. You just helped dilute yourself with your first share purchase.

Ahhh.... beware very much of this issue. Private Placements, ESOS.... these stuff dilute earnings.

Very, very, very important issue hor.. Do NOT end up buying diluted earnings!

Such exercises are done at the very expense of the minority shareholder!

They make a sucker out of the minority shareholder!

Surely you do not want to be a sucker, rite?

:D

7 comments:

Ahh... perhaps I should have said 'Never Say I Ass-U-Me' that since Dow is at its six year high, everything is sooooooo rosy....

but then... since that bugger used that phrase for his book... i guess... i should watch me fingers...

:D

What about issuing a convertible bond

for shares by cos. ? Did it dilute any?

Convertible bond? As long as it can be converted into an ordinary share, the conversion increases the number of share in the company.

It's strange if u say to avoid those stock which tend to dilute earning, i

find there is a one particular super

growth stock i.e IOI that keep issuing

convertible bond but the price has an

explosive increase from RM 3(since 2000)until now RM 15.70 . How u would account and evaluate for this kind of share ?

Hi,

From the Bursa website, IOI Corp announced it made some 303.033 million for its fiscal year 2000.

Number of shares then is around 840 million.

Earnings per share based on 840 million = 36 sen.

For its fiscal year 2005, IOI Corp reported it made some 902.220 million.

Number of share is now 1186.844 million shares. (increased by some 40%!!)

Although the number of shares has increased by so much, its profits increased even more. Hence the earnings per share for IOI fy 2005 = 76 sen.

Now just imagine if IOI Corp's profits had NOT increased from 303.033 million to 902.220 million. Let's say IOI Corp remained stagnant.. say... it made only 350 million.

Based on 1186.844 million shares, although the earnings increased from 303 to 350 million, the earnings per share is now only 29.5 sen (compared to 36 sen).

See the dilution effect?

btw... my exact comments were:

----------------------

Ahhh.... beware very much of this issue. Private Placements, ESOS.... these stuff dilute earnings.

Very, very, very important issue hor.. Do NOT end up buying diluted earnings!

Such exercises are done at the very expense of the minority shareholder!

----------------------

As a minority shareholder, when a company issues placement shares and esos, the minority shareholder is not given an equal chance to particpate in these new shares. Which ultimately means new shares are being issued at their expense.

Warrants on the other hand.. is kinda bit more complicated. The shareholder has an option to participate in it. And if the investor choses to do so, the dilution effect is somewhat negated.

However... if the investor choses not to invest in the warrants although given the choice, then the investor should very well be aware of the dilution effect caused by the dilution of the warrants. Yup.. like i said.. in the case of warrants, it's more complicated.

Do u mean that by earning a supernormal profit is fairly justify for a company to issue ESOS, private placement .... that tend 2 dilute

earning ?

Post a Comment