They say that there is a reason for everything. And when one purchases a stock for an investment purpose, shouldn't there be a valid reason to justify the investment? For some, as long as their reasons to invest in the stock are still valid and justifiable, they would consider this as a valid reason to stay invested in the stock. Fair reasoning?

Let's try it out and review the reasons to invest in this stock. For simplicity sake, I would ass-u-me that perhaps one made the investment in ... say... May 2005. (Why May 2005? LOL! I had discussed this stock with some friends in a private site before, hence all my old notes are still around) (the ROI will be made in red font)

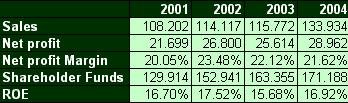

The above table represents the available financial track record for Yi-Lai back in May 2005.

This is Yi-Lai's track record since listing.

- net profit margin since listing: 20%, 23%, 22%, 21.6%

ROE since listing: 16.7%, 17.52%, 15.68%, 16.9%

Well.... as it is... Yi-Lai had a slightly disappointing fy 2003... it was really lacklustre in which its net profit dropping slightly. But overall if one compare from 2001 to 2004 numbers, Yi-Lai's performance has been fairly good, hasn't it?

So what would be the fair assessment of Yilai's financial performance? Has it been consistently good?

since Yilai has only 4 years financial record since listing, there is no point running any CAGR computations.... (err... if one uses 2001 as its starting base, Yilai's cagr since 2001 is around 9.6% ) (Yi-Lai's current net earnings dropped by 4% compared to its previous fiscal year)

Does Yi-Lai pass the initial test? (how? net earnings margin improved.. roe dropped slightly, while total net earnings dropped by 4%)

From a business perspective....

Yilai has been performing steadily since listing in 2001. The steady performance is even more impressive because Yilai's products not only survived but even manage to improve despite the initial Afta concerns of cheaper Chinese tiles. Much of this could be contributed to the robust housing growth since 2002.

What about Yilai's product?

Does it have a brand-name? (A good exercise to do is to visit some tile shops and check on the Alpha tiles, ask about their price and the comparisons with other tiles)

http://ir.wallstraits.net/yilai/page.php?id=corporate_info

http://www.alpha-tiles.org/company.html

You probably could get tons of info from those two links... and from Alpha-tiles website, there is a page on Alpha tiles projects. From here, u get an indication that Alpha tiles could be strong in housing projects (which can be found here ) and check the type of projects Yilai had achieved...

another strength is that one could argue that tiles have a slight advantage and one could argue that it could survive tough economic environment cos home renovations always exist.... and when folks renovate... there is a chance that tiles are needed.... (however... this one is pretty subjective hor.... so u might wanna consider this issue first)

Weakness

I believe Yilai cannot compete with Whitehorse on the higher-end quality tiles. This is where Yilai loses out... (is this point still valid? has Yi-Lai's product improved? or perhaps there is new competitors?)

And of course.... the economy.... the economy..... !!!

When the economy hurts.... sooner or later..... the housing/property market will hurt too.... and when the slowdowns happen..... sales would slow down! (how? property market has been sluggish wor!)

Opportunities

Ahh... this one... u have to understand Balance Sheets issue... Now Yilai has been a strong debt free company throughout its history. Hence the opportunity for future growth is there cos Yilai could easily embark on a capex to challenge for the higher-end quality tiles.... but.... one shud realise that such opportunities itself is speculative..... and as it is.... i believe there is no evidence of Yilai doing so.

And then perhaps u cud throw in the export opportunity (ahh... due to its location, Yilai does supply to certain Spore projects). (how would you evaluate the capex now? Would you consider as an opportunity? or would you consider it as a burden?)

So how is your assessment of Yilai's business? Would it be hurting if there is a slow in housing/development projects? Do you think it has a strong consistent business? Is this what u are looking for in a business?

what about the company's outlook?

let's take a step back... the following comments was made by Wallstraits following a company visit.

- Yi-Lai’s ceramic tiles manufacturing operations commenced in 1990 with its first production line generating an annual output of 1.4 million sq meters of tiles. The production line remains at the present factory in Kulai, Johor. The Group has since added 5 more lines to boost the annual capacity to 8.9 million sq meter on a twenty-acre land to manufacture a wider range of tiles. It is understood that Yi-Lai is one of the three factories in Malaysia that have installed the production line with advanced technology. (Slowdown is happening isn't it? Earnings dropped by some 4%)

- The six production lines currently manufacture ceramic and homogenous tiles for the Malaysian and overseas markets. The main export market is , which contributed about 10 percent of the Group’s sales. Yi-Lai has been marketing its tiles locally and internationally under the brand name of ‘ALPHA Tiles’ since 1991.

To further add to its product range, Yi-Lai has started manufacturing and marketing full-bodied homogenous tiles (multi-effect homogenous tiles) last year with the purchase of new machinery. Full-bodied homogenous tiles are the higher end products that have the natural stone effect on the surface finishing. Part of the IPO proceeds was used to finance the two machines, Dry Powder Mixer and Spot-Feeder, to manufacture this new variety of tiles.

Point to note... since listing..... Yilai has not purchased any more machinery... hence we have a company that had performed pretty well since listing. (this issue NOT valid anymore!)

Now the following were some comments from RHB (back in 2005)...

- OUTLOOK

1QFY12/05 outlook remains positive. 1QFY12/05 demand outlook for ceramic tiles remains bright, supported by renovation activities and on-going property constructions. In the medium term, Yi Lai’s efforts to expand its product range and to beef up its marketing strength will continue to enhance its market position. Essentially, the company’s strong production efficiency places it on a strong foothold to defend its market position.

The undergoing expansion programme will be funded by internal funds. Total capex budgeted under the expansion programme is estimated at RM25m, which includes the spending of RM18m for a new line and another RM7.0m for the acquisition of a show house cum warehouse in PJ. The capex will be financed by its internal funds, which include its operating cash flow of RM37.7m p.a. in FY12/04-05 and its cash reserve of around RM60m after the latest interim dividend payment in Feb 04 and the pending total dividend payment of RM6.9m (final plus special).

Capacity expansion is to raise production mix of high-end tiles and to improve efficiency. Management plans to add another new line to cater to demand growth and to further expand its capacity for the high-end products (homogeneous tiles and multi-effect tiles). The new line is able to produce up to 6,500 square meters (sq m) of tiles per day or 2.3m sq m yearly and is projected to raise its total capacity by 26%. The benefits of the new line are 1) to raise the generation mix of the high-end products (homogeneous and multi-effect tiles) from 40% currently to 52%; and 2) to improve production efficiency.

Installation works for the new line is expected in June 2005 and commercial operation to commence in July 2005.

==>>

Soo.... what's your view on Yilai's outlook? Promising?

(How? What's your outlook on Yi-Lai now? So Yi-Lai has made their expansion program. New line, new warehouse cum showroom in PJ (hmm.. it can still be argued that Yi-Lai which is stronger in the Johor/Spore region is trying to expand its reach, rite?) but as mentioned earlier the new line has been left idle)

Now the ownership/trust issue...

now let me say one thing... except for some minor shareholder changes... I rate highly of Yilai.

There has been absolutely no hanky panky stuff!!!!!!!!!!! (is this issue still valid?)

no rights issue... no bonus issue... no placement.... no funky corporate exercises and most important no ESOS!

Clean!!! Fantastico!!!!!!

These are the type of companies whose owners are very much focused on the company's business and not on the company's share price!!

So how? Do you want to own such a business?? Do you want to be part owner of such business? Do you think the management has been competent or not? (How valid are these points now?)

That's the most important question. Do you want to own such business? Cos if the business ain't good, no point talking no more!!! (How? From a business perspective, does Yi-Lai still looks like a good business to own?)

In Yi-Lai's wallstraits site, there is a news archieve page and this article in the Smart Investor magazine is worth a read. Compare the points then and now.

Logically we want to invest in companies at a cheap price but more logically we only want to invest in good companies, rite?

There is absolutely no point in talking price when the quality of the business is in doubt. Don't you see that happening so often? Folks talk about investing in this and that company just because the price is cheap. But if the company is poor, in a tough industry, has a very poor financial history (most of da time losing money), then there is no point talking price, is there?

Yup... b4 we talk how much... we better talk quality first, rite? (is the quality still there?)

In real life... if a company has a poor habit of losing money, owing lots of money, why on earth, and if one is given an opportunity to be part owner of such business at a supposedly cheap price? Should we? well some of the commonsense things to ask are like.... Are we in a management position to turn it around? Or are we just a part owner with no say in the management? So is it a wise decision to invest in such company?

Now if in real life we say no.... how can one say yes in the stock market?

think about it hor....

So.... how? What would you evaluate YiLai as a business?

What's your evaluation? (how's your evaluation now? Is Yi-Lai still a good business?)

Is it a good business with clear sustainable earnings? Or is it an average company? Or is it a poor business?

How? Are the reasons still valid to justify one to stay invested in the stock?

Oh.. and some invested in the stock because of the dividend issue. And how would one evaluate their reasoning to stay invested in Yi-Lai since Yi-Lai has decreased their dividend payout this year?

2 comments:

nm,

A very nice and informatic articles on YILAI. Hopefully u can reproduce more of this kind of analysis. Some of my points...

1)Management integrity

Best. As we know, Yilai is operating in mainly low tech sector. SO not much incentive is needed to motivate staff (So no ESOS). Management is so far very honest and fair to all shareholders.

2)Inventory

Just calcute that Yilai inven currently match to 1Q sales. IN Tile industry, this might not be high consider u need to have ready stock for housing project. SOmetimes, big project requires big amount of stock. Once again, Wthorse is bad in this criteria

3)Expansion.

Neutral. Remember Kimhin which used to have lot of cash and didnt know how to expand in good time. See what is facing KimHIm now. Tile industry is improving every year. If u read those housing magazine, u know know that the mecca of tile if Italy. Then taiwanese will try to copy Italian new tech and then other asian countries. If Yilai doesn't expand upstream, it will lose out to Thai and other maker. I treat this as kind of hedging against market up turn.

3)Dividen.

Yilai is the star here but not as bad as BAT or BJtoto which borrowed in order to pay dividen. At least Yilai knows that since it has no use of the cash, just return it to the shareholder. It can always raise cash if it needs to. Assuming a 80% payout, this amounts to around Rm0.14. MOre than 10% yield on current price.

4)Is there a value there @ current price?

This is pretty subjective. but if u survey all the comps in BSKL, YILAI will definetely ranks one of the best in the mid-cap stocks considering its track record and div yield. I considering current property downturn as a hiccup and an opportunity to further increase my partnership with this comp.

P/S: I had position in this Yilai long time ago after being introduced by NoMore around RM0.8. SOld part of my holding when it fell from RM2 to RM1.7. Currently, i m looking to increase my holding.

dude... the subject of review/buying/selling is pretty much subjective too.. and worse still it also depends on one's own method and strategy...

right or not?

sooo... on the matter of buying/selling/staying... me can't really say too much... :P

cheers!

Post a Comment