In the earlier post, YTL Cement, I wrote it in a rush and I forgot to highlight the current financial health of the company.

The very last quarter, 2003 Q2, YTL-C balance sheet showed the following.

Cash 129.047 million

Total borrowings 48.875 million.

versus

The last reported earnings, 2005 Q2, YTL-C's balance showed the following.

Cash 292.811 million

Total borrowings 860.200 million.

How? See how much things have changed in 2 years? Totally different company yes?

And then I did not mention the dividends issue. Did the enlarged share base had any impact on the dividends? The answer is NO. YTL-C has continued rewarding its shareholders yearly with a 20% gross dividend. Yup, the management had wisely kept its shareholders happy with the generous dividend payment each year.

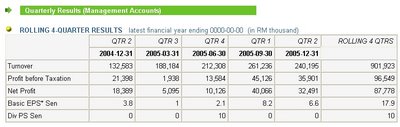

Btw.. look at the table above. Last year, things were not rosy at all for YTL-C. There was a cement price war and then there was the lack of construction jobs. Everything went haywire. And If look at their 2004 Q3 earnings in the table above, YTL only managed a net earnings of 5.095 million. And due to the enlarged share base, this works out to a mere 1 sen earnings per share! See how high the bar has been raised?

Anywayyyy... because of such factors in the economics of the cement industy, issues like price war and the dependance on the construction sector, which itself depends on the ruling govermental fiscal policy, for folks like UOB to project CAGR of 34.6%, I simply find it soooooooooo amusing.

No comments:

Post a Comment