Here's an example where a 'reputable' company, YTL Cement, issued new shares when it made an acquisition of another company. It's rather unique because in this example, there were several changes in the share base of the company and then there's the issue of dilutions caused by the conversion of warrants into ordinary shares.

Remember this mumbling of mine is only to highlight this issue and I am not here to lay judgement on the share or the company.. so do not simply ass-u-me hor!

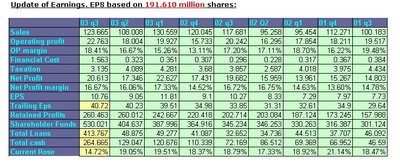

Back in May 2004, I made the following table after YTL-C had made its 2004 Q3 quarterly earnings announcement.

When YTL-C announced its 2004 Q3 quarterly earnings, YTL-C had just completed its purchase of Pahang Cement and in this acquisition of Pahang Cement, it stated that it will issue some 36.8 million new shares which works out to some 23.8% increment in the share base to 191.610 million shares and these shares were priced at 3.75 per share or at some 138 million.

Now here are some interesting notes.

Besides the dilution of earnings by some 23.8%, YTL-C also inherited Pahang's Cement's balance sheet in the acquisition.

Now check this out...

B4 the inclusion of Pahang Cement, YTL-C was in a net cash position of about 80 million...

After the inclusion, YTL-C turned into a company with a net debt of around 149 million.

And as can seen in the compiled table above, YTL-C debts balloned to over 413 million!

In terms of earnings per share. B4 the acquisition, YTL-C had a share base of 154.810 million shares.

The trailing earnings at that moment of time was 78.017 million.

Trailing eps based on 154.810 million shares was 50.4 sen.

But since the share base of 191.610 million shares, the trailing eps is now diluted only to 40.7 sen as seen in the compiled table.

How? Is the purchase of Pahang Cement worth the dilution in earnings?

Perhaps it was too early to lay judgement at that moment of time. Yes?

And then there was this complication made by this share split announced earlier on March 2004. A 1 into 2 share split (this share split was also applicable for its warrants too! )

And to make it even worse complicating, the warrants were always in the money and was due to mature in Dec. ( One can cnfirm by looking at this announcement )

And on the 8th Nov 2004, my live quotes showed the following info on the stock.

- YTL-C = 386,777,248 million shares

YTL-C Warrants = 92,829,508 million shares

So the new enlarged share base of YTL-C assuming FULL conversion of warrants = 479,606,756 million shares.

Now in Nov, YTL-C current/trailing net profit is now at 84.590 million. (yup, earnings improved )

EPS b4 full conversion of warrants = 84.590/386.777 = 21.9 sen.

EPS AFTER full conversion of warrants = 84.590/479.606 = 17.6 sen.

Now consider this issue... if one was holding 1000 shares in YTL-C in May 2004, the share split meant the investor would be holding 2000 shares of YTL-C after the share split. Which meant that the EPS AFTER full conversion of warrants is 17.6 sen x 2 or 35.2 sen per share. ( earnings per share was at 50.4 sen earlier before the purchase of Pahang Cement)

So is it wrong for one to consider the fact that their 'earnings shrank' despite the current/trailing earnings had increased from 78.017 million to 84.590 million?

Let's not pass judgement yet.

Last Sept 2005, YTL-C had a ICUL rights issue exercis. Pretty complicated (I had the whole exercise done b4 but to put it into this blog posting would make the posting extremely complicated) in which every YTL-C held was entitled to one ICUL and these ICUL can be converted to either 367, 490 or 549 ordinary shares depending on the time period when exercised.

Anyway, assuming full-conversion of these ICULS, YTL-C share base will potentially grow to 670 million shares or another dilution of 36%.

And it complicates matters more due to the fact that each individual investor would not think the same and probably most investors might not even hold this share for 10 years!

So perhaps it could be justifiable for some to consider that this whole ICUL exercise is a non-issue. But then some simply believe in buy and hold forever. How? Complex eh?

Anyway.. the reason I blogged this posting was because the Edge featured YTL Cement in their silly annual Top 100 exercise! ( did I say silly? Yup, I sure did. I could explain in details why I deem it as such but then it defeats the purpose of this posting. )

In the posting there were these interesting comments.

- “We expect YTL Cement’s three-year earnings CAGR [compound annual growth rate] at 34.6%, on the back of recovery in cement prices, rising demand and cost savings from rationalisation of operations after… [acquiring] Perak-Hanjoong in FY2005,” states UOB-Kay Hian. The research house pegs YTL’s net profit for FY2006 at RM100 million. Results for the first six months of FY2006 show the company is well on track — net profits came in at RM72.6 million. Cement prices are also on the mend. After being bashed down in a five-month price war — RM100 per tonne (below the average cost of production) last May — prices rebounded to RM180 per tonne the following month. A foreign research house believes that local cement prices will jump to RM192 per tonne this year. UOB, meanwhile, expects prices to only hit RM192 next year and RM198 in 2008.

CAGR of 34.6%???

Wahhhhhhhhhhhhh... so highly optimistic, isn't it?

Now what is so interesting is that if YTL-Cement hits a net profit of 100 million or more this fiscal year, it would mean that this is the best ever earnings in YTL-Cement history! ( yeah.. cement buggers are showing some good fortune lately.. )

Now say assume a net earnings of 100 million as projected by UOB-Kay Hian. Based on current share base of 489.731 million shares, this would equate to an EPS of only 20.41 sen! Which means at current price of 2.39, YTL-Cement is trading at earnings multiple of 11.7x.

Would this deem as attractive enough to seduce any new investor(s)?

Would it seduce you? Record profits woh, you want to invest in it or not?

Ahh... this is where you can pass your own judgement. Has all these new acquisitions of new companies funded by issuance of new shares help improve YTL-C as a company?

Ahh... if your answer is YES... then it is YES, eh? Such strategy has helped improved YTL-Cement prospects.

Ahh... but if your answer is NO.. then it is NO. Yes? And isn't it kind of ironic that a company might be recording its highest ever fiscal year earnings in its history and yet it fails to excite anyone. If it cannot seduce new investors, then how?

Yeah, how brown cow?

Is the cup half-full or half-empty?

LOL!!.. just being ze devil here!

No comments:

Post a Comment