Now as mentioned in the blog posting, ROI on Fima Corporation, I mentioned that investor could ALWAYS take some precautionary steps. I still stick by this stance. For me, good companies could always turn bad. A change of management could easily disrupt the whole financial structure of a company and could easily turn a well managed company to a company without focus. A change in the business economics could also easily bring a company to its knees and yes, sometimes, we could also be wrong in our own reasoning and we could end up being a long term shareholder in a company which is littered with every possible financial shenanigans! Yes, instead of following all those investment thesis to the very dot, I strongly feel that one should be flexible and accept the very fact that we could easily err with our stock selection or our stock selection, through no fault of ours, could turn lemon.

And back then, one perhaps could use the following arguments to 'invest in Fima Corp'.

- Take for example Fima Corp.

Fima Corporation, is the manufacturing arm of Kumpulan Fima. Fima Corp's core business is printing and trading security and confidential documents such as travel documents, permits and licences.

Ok.. little bit background on Fima Corp.

Now, Fima Corp has an interesting track record and if one looks at the historical track record, one would note that this company is enjoying a tremendous turnaround in its fortunes since fy2003. (err.. some might define it as growth too!)

Secondly, since the turnaround of fy 2003, look at the start of 2004 Q1 quarter. It's piggy bank then was 12.106 million. A year later at the start of 2005 Q1, it's piggy bank has now grown to 32.494 million. And come end of fy 2005 q4, its piggy bank now stood at 56.775 million. This is what I think is desired in OUR business isn't it? We want to see our business piggy bank grow! (tiok boh?)

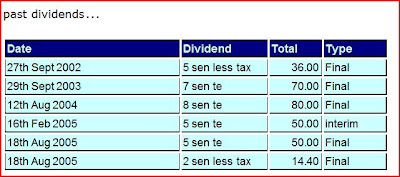

Thirdly, business profit margins is real decent, plus its dividend is on the drastic rise too!

These are some of the criteria that an investor wants, isn't it?

So we have a decent company making big bucks... dividends is on the rise.... and perhaps one could have considered Fima Corp as an investment, rite?

Now the 'tricky' part of the investment came when Fima Corp started to 'diversify'.

As argued in that blog posting:

- So since we had reasoned that this could be a good investment, we went and purchase this stock as an investment, hoping that this investment could grow forever and ever, right? But as mentioned before, the Review of Investment is an important integral of one's investment. We need to review our investment to make sure that the stocks we are holding is still a good stock. We need to review if the very reasons to invest in the stock remains valid. We need to check if that there is any tell-tale signs that something bad might happen.

In big corporations, when things get too rosy, sometimes it is possible that the company's management could get too big headed for its own good and starts embarking on questionable funky corporate exercises in an attempt to grow the company. Company get rich, starts to lose focus...

So besides looking at the financials, we also need to gauge them corporate exercises too. If it simply gets too funky, should we be dancing and playing that funky music with them ..... ?!! :p

Fima Corp then said...

- ... June 2005, Fima Corp announced that its subsidiary, Percetakan Keselamatan Nasional (PKN) is buying a property for some 15 million.

- ... Aug 2005 ... Security printing-based company, Fima Corporation Bhd, through its associated company, Giesecke & Devrient Malaysia Sdn Bhd, plans to invest about RM150 million to set up a new plant in Shah Alam, Selangor, next year. For the security printing segment, Roslan said Fima planned to spend RM20 million to replace the current machinery in order to increase its efficiency and production capacity

- ... 2006. ... Fima Corp Bhd is jumping on the plantation bandwagon by purchasing a slice of a small Indonesian palm oil outfit. In a statement on Jan 27, Fima said it will pay RM13 million for a 32.5% stake in PT Nunukan Jaya Lestari in East Kalimantan. This is part of a plan to diversify its earnings base.

From the core business of printing governmental securities, Fima Corp embarked on property, made 170 investment in new plant.. and also diversified into plam oil!

Surely that was too much, yes? And the clear question to be begs to be answered in 2006 was Fima Corp losing its business focus?

Do we want to be a long term investor in a company that could potentially turn into a lemon? Yes, this was the ROI question that was needed to be addressed back then.

That blog posting was brought back to life in 2008. :D

Should The Investor Take The Safer Approach?

And as clearly shown in the example, if one had taken the safer approach, it would appear that one would have missed out because Fima Corp, the stock had done fairly well since the posting in 2008.

But... on the other hand.... if one had diligently followed the developments, one easily have the option to be an investor again, yes? Surely this is an option, yes? We do need the sensible and flexible approach, yes?

November 2009: A New Look At Fima Corporation and LOL that posting was followed by one of my shortest posting Fima Corporation Again!.

It's now August 2010.

Fima Corp announced its earnings last night.

Yes there was a clear blip in earnings in fy 2007 and fy 2008. ( Did it or did it not pay off for an investor to take a safer approach then?)

But since then, Fima Corp's earnings have been rather impressive, yes?

The balance sheet...

Couple of notes...

1. The dwindling cash. ( remember back then when I wrote in Delphi, Fima Corp had no debts)

2. The receivables ... ah... it has grown substantially, yes? Is it acceptable, given the size of the turnover?

3. LOL! It's back! It has returned. Yeah... the cash is now back to a very healthy 125.063 million.

How? Could we put on our negative and pessimistic hat on and suggest that Fima Corp management could get cocky and start spending silly again? Can we? :P

Ah... this is where it's important for a couple of reasons.

Remember, the issue was on how Fima Corp diversified into properties and the palm oil business?

So it's very important to have a look at Fima Corp's segmental. Take a good look. See what's the driving factor, the catalyst that is causing Fima Corp's earnings to improve so drastically. Now if one is lazy and refuse to understand what's happening, then how would one know if the earnings from Fima Corp are sustainable or not?

Make sense ah? Or am I totally wrong?

Fima Corp's Business Segmental.

How?

1. Its printing business shown great improvement last fiscal year. Current first quarter earnings, the printing of security documents business is showing great potential with earnings of 19.804 million.

2. Others - this should be flushed into the toilet!

3, Property. How? Remember in June 2005, Fima Corp announced that its subsidiary, Percetakan Keselamatan Nasional (PKN) is buying a property for some 15 million. Now I am not aware if Fima Corp did pump in more money into this division but since fy 2005, Fima Corp's property division did not do too bad because it has generated some 3.895 million ( I got this total from adding the sum in that column) in profits.

4. Palm Oil. Now this is clearly the big earnings booster for Fima Corp and it does appear that Fima Corp had made a wise decision to venture into the palm oil business.

ps: I DON"T INDULGE IN STOCK PRICE MOVEMENTS. So please spare me those comments saying how high or how low a stock could go.

ps: And I am not a Sotong, so I am not liable for your winnings and losings. LOL!

hi moolah,

ReplyDeletesince you review fimacorp, why don't you also review how is kfima is doing?

Kfima has not announced its earnings yet.

ReplyDeleteFor reference, you can refer to this posting made on March 2010: A Look At Kumpulan Fima's Earnings

As a conclusion,u are "over thinking" about fimacorp, and u are not familiar with the chairman of fimacorp, ahmand bin basir. U not clearing about background of Ahmad.surely u not attend the AGM of fimacorp.And u already pass by a opportunity since 2006 u wrote the blog.If u attend the AGM, u will not a lot from chairman. Tell u lah, fimacorp is plan to develop 4000 more hectare oil palm,that is why the cash is remain high level(125M)and now all the prepare job are already done but only waiting for the approval from INDO government.

ReplyDeleteMy humble apologies for forgetting that people like you exist.

ReplyDeletedear molah, dun say "apologize" lah..U are very expert in viewing one listing company..good job

ReplyDelete