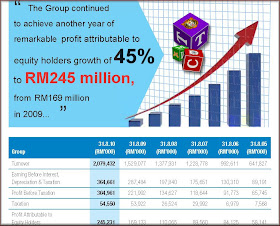

Now Top Glove earnings track record had been incredible. Here's a snapshot from their recent annual report.

With such impressive track record, the stock market and its investors simply loved the stock for it simply rewarded its investors handsomely.

However, growth is not forever, especially not for extreme high growth.

The industry was growing at rapid pace and with such rapid pace, huge capex was required. Last year the following were posted.

- 25 June 2010, Would You Be Concerned With All The Capex In The Rubber Glove Industry

- 16 Sep 2010. Bargain Hunting For Rubber Glove Stocks?

I raised the simple question:

- But in regards to the glove sector, perhaps one should consider if the fundamental reasonings is unjust?

Remember if the reasoning is indeed justifiable, ie, strong USD would see lower revenue and higher latex prices would mean higher costs and overcapacity could lead to price wars, then won't it be possible that future earnings could be much 'lower'?

How?

And we did see some lower earnings.

From Top Glove's earnings report last night:

Look at the two numbers highlighted by the arrows. (All images can be clicked for a larger view)

Perhaps that's a bit not so clear.

How about this set of summarised data?

As can be seen clearly, since Top Glove's 10 Q2, earnings had been declining quite drastically and if one needs to keep count, that's FOUR consecutive quarters of decline.

And if one is an investor, perhaps one should check out the financial health. Compare the cash/debt balances. Are they improving or are they declining? ( LOL! Sorry babe, I am too lazy to do everything in one single post and more so I am not the financial advisor!)

However, shareholders of the company would be quick to point out that Top Glove had been a rather extremely good dividend stock! (aha.. how many knew this fact?)

From Top Glove's earnings notes..

That's impressive, yes?

Now I do not have the complete comparison data, so I dare not claim Top Glove is the best dividend stock but I have to admit that I am simply impress by Top Glove's track record of paying more dividends each year back to its shareholders, as seen by the data above. (I normally view the total monetary value paid by the company and not based on dividend yield. Why not dividend yield? Well the dividend yield equation is based on the price one invests on a stock and this price is not equal for everyone. Some might buy at 2.00, some might buy at 3, so the dividend yield is out of whack for me.)

Now why is the financial balance sheet an important issue? Well remember the posting highlighting the rubber gloves industry intense capex? Well if cash is getting lower, then this would put a huge strain on Top Glove's ability to pay more dividends this year. Ah, some layman would use the common sense thinking and say if earnings is falling then naturally the dividends would fall too. Heck it's a no brainer!

So how?

Me? I still think the few issues that are important for Top Glove is the USD factor, the price of latex and the industry over capacity issue.

And if one is still an investor, one needs to give these factors a serious consideration.

No comments:

Post a Comment