- It’s ALL about the money, money, money

We just need your money, money, money

We just wanna make our world dance

It's all about the Price Tag

Now here's an article published on Aug 2004 by Bernama news.

- August 02, 2004 21:28 PM

Malaysia's Directors Paid More Money In 2003

KUALA LUMPUR, Aug 2 (Bernama) -- Directors of Malaysian public-listed companies are generally paid more money in 2003, given the improving economy and rising profits, according to a survey on directors' remuneration carried out by Malaysian Business magazine.

The survey finds that there were more millionaire directors last year compared with 2002 as more top executives earned bigger bucks, Malaysian Business said.

Top executive directors of companies such as Safeguards Corporation, IJM Corporation, Malaysia Airlines and Choo Bee Metal saw their pay packages hitting seven-digit figures.

Meanwhile, their counterparts in IOI Corporation, Star Publications, Hwang DBS and Maxis Communications also enjoyed hefty hikes, as these companies enjoyed increasing profits, Malaysian Business said.

The survey, which entered its third year, studied 548 companies which paid RM300,000 and more per annum to their highest paid directors.

In total, these companies paid out a whopping RM1.13 billion to their directors in 2003.

Malaysian Business said that Corporate Malaysia's highest-paid director is from Genting Bhd (Genting's chairman/president and chief executive officer (CEO), Tan Sri Lim Kok Thay who gets between RM40.15 million-RM40.20 million).

"His remuneration package within the RM40.15 million-RM40.20 million band makes him possibly one of the very few, if not the only Malaysian director, to take home an eight-digit figure compensation," it said.

The second highest paid director is from Resorts World, a subsidiary of Genting Bhd, whose compensation is in the RM16.65 million-RM16.70 million band. (Resorts World chairman, president cum CEO, Tan Sri Lim Koy Thay (RM16.65 million and RM16.70 million),

These payouts, however, might have been paid to the same person taking into consideration the possibility of double counting.

Ranking third is an executive from Berjaya Sports Toto, who earned a compensation package in the RM8.15 million-RM8.20 million band (Berjaya Sports Toto CEO, Tan Sri Vincent Tan gets between RM8.15 million-RM8.2 million).

IOI Corporation dished out between RM6.90 million-RM6.95 million to its top executive putting him in fourth place (IOI Corporation executive chairman, Tan Sri Lee Shin Cheng (RM6.90 million-RM6.95 million).

The fifth spot is taken by a director of IOI Properties, a subsidiary of IOI Corporation, with a remuneration of RM6.90 million-RM6.95 million (IOI Properties' executive chairman Tan Sri Lee Shin Cheng (RM6.90 million-RM6.95 million).

Again this payout may have been paid to the same person, the magazine said.

Malaysian Business also said that while the mountain of wealth got larger for some, there were also directors who took sizeable pay cuts in 2003.

But more peculiar were the instances of directors being paid top dollar although the companies they helm fell further into the red or are in the Practice Note 4 category, which groups companies with negative shareholder funds, it said.

The magazine said this phenomenon highlights a troubling issue about directors' remuneration in Malaysia -- that there is generally an absence of a link between company performance and directors' remuneration --.

Nevertheless, it said that more companies have displayed good transparency standards by going beyond the minimum requirement to disclose the exact amount paid to each of their directors last year, but these companies still remain in the minority.

"Strangely a handful of companies, which took that extra disclosure step in 2002, regressed to the minimum requirement of `band-width' disclosure in 2003," Malaysian Business said.

Others in the list are:

Star Publications (Malaysia), group managing director and CEO, Datuk Steven Tan Kok Hiang (RM6.35 million-RM6.4 million), Hwang-DBS (Malaysia), executive chairman and managing director Datuk Seri Hwang Sing Lue (RM4.42 million) Rashid Hussain executive chairman, Datuk Sri Sulaiman Abdul Rahman Taib (RM4.3 million- RM4.35 million).

RHB Capital executive chairman, Datuk Sri Sulaiman Abdul Rahman Taib (RM4.3 million-RM4.35 million), MK Land executive chairman, Tan Sri Mustapha Kamal (RM3.652 million), Public Bank non-executive chairman Tan Sri Teh Hong Piow (RM3.65 million-RM3.7 million).

Yu Neh Huat executive chairman, Datuk Dr Yu Kuan Chon (RM3.6 million-RM3.65 million), Landmarks managing director, Mohamad Abdul Halim Ahmad (RM3.1 million- RM3.15 million), PPB Group executive chairman, Ong Le Cheong (RM3.1 million- RM3.2 million), Edaran Digital Systems executive director, Mohd Shu'aib Ishak (RM3.05 million-RM3.1 million), Malayan United Industries chairman cum CEO, Tan Sri Khoo Kay Peng (RM2.9 million-RM2.95 million).

Berjaya Group chairman cum CEO, Tan Sri Vincent Tan Chee Yioun (RM2.85 million-RM2.9 million), British American Tobacco (M) executive director, Russell Scott Cameron (RM2.812 milion), Berjaya Land CEO, Datuk Robin Tan Yeong Ching (RM2.8 million-RM2.85 million) and DRB-HICOM group chairman, Tan Sri Mohd Saleh Sulong (RM2.60 milllion-RM2.65 million).

Malaysian Business, the country's premier business magazine published by Berita Publishing Sdn Bhd, also features every year the country's 40 Richest Malaysians and the MB100 list, comprising the choicest companies on Bursa Malaysia.

- Top ringgit for head honchos

By Roziana Hamsawi Published: 2011/08/17

The top 20 companies on Bursa Malaysia forked out RM455.6 million to directors last year in terms of total payout, up 22 per cent from 2009.

KUALA LUMPUR: Directors in public-listed companies got paid more last year compared to the year before.

Malaysian Business, in an annual survey of the "highest paid directors" published in its August 16 issue, said the top 20 companies on Bursa Malaysia forked out RM455.6 million last year in terms of total payout, up 22 per cent from 2009.

Out of more than 600 companies surveyed, close to 270 directors raked in more than RM1 million in remuneration in 2010.

The survey lists a total of 630 companies with remuneration band of RM300,000 and above as stated in their respective annual reports.

Malaysian Business noted that only a handful of the companies were transparent in stating the exact remuneration of their top executives.

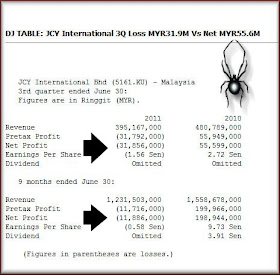

"Interestingly, several companies with huge losses still rewarded their directors with huge payouts," it said in a press release yesterday.

Genting Bhd topped the list with a big payout of RM111.48 million to its board, 21 per cent higher from the previous year.

IOI Corp Bhd came in second with a total payout of RM56.29 million, 71 per cent more from the year before.

Genting also had the highest remuneration band of RM106.65 million to RM106.7 million for a single director but did not name who the director was. The top executive listed is its executive chairman/chief executive officer Tan Sri Lim Kok Thay.

Other companies with the highest remuneration band for a single director were IOI Corp, which paid out a remuneration band of RM53.05 million to RM53.1 million to its highest ranking director. This was higher compared to RM25 million to RM30 million it paid out in 2009, presumably to its director and founder Tan Sri Lee Shin Cheng.

Genting's subsidiary, Genting Malaysia Bhd, which paid out more than RM42 million to its top executive, took the third spot.