LOL! 'And as expected'?

Well ... seriously what do you expect from the company when the management was more focused on trying to buyout the company? Yes, where is the company's focus? What's the company's priority?

Is the company focused on making more money?

Was it?

Apparently the company's management was more focused on its management buyout than its own business.

How unlucky for the investing public that the MBO had failed!

Yes... what do you expect? what did I expect?

:P

Posted one time too few....

- 24 June 2010: KNM: I Just Love The Way The Boss Talks!

- 26 May 2010: Oh KNM, Can You Please Buyout The Company At 90 Sen? ( How unlucky the minority shareholders the buyout failed! :P )

- 28 April 2010: I Just Like KNM So So So Much

- 22 April 2010: Why I Like KNM Even So Much More Today!

- 21 April 2010: Why I Also Like KNM A Whole Lot

- 15 April 2010: KNM's MBO Fails

- 23 March 2010: KNM: Should I Stay Or Should I Go?

- 23 March 2010: KNM: Do Show Us The Money!

- 22 June 2009: More On KNM

- 17 June 2009: Regarding KNM's MD Disposal Of Shares For A Cool RM64 Million ( Did you miss this? Did you? Did you? :P )

- 26 November 2008: KNM Q3 Earnings (where's the creation of wealth?)

- 27 Oct 2008: Regarding KNM's Sell Down! ( Did you also miss this? :P )

- 24 Oct 2008: KNM Comments About BTimes Article (LOL!)

So how poor was KNM's earnings?

Current fy 2010 ytd numbers indicate that 2010 would be another disappointing year and it should be even worse than 2009! Which would means two years of earnings decline!

And if memory does not fail me, KNM became a darling stock because of its spectacular earnings growth ( aha.. the 'engineered' growth via acquisitions and.... debt! :P )

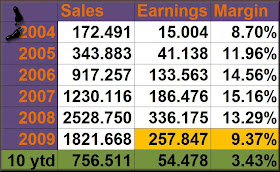

In 2004, it earned only 15 million. 2 years later it earned some 133.5 million. Yup! Spectacular earnings growth and the market loved what it saw and KNM became a darling stock.

And that's not all!

The earnings table above is 'distorted' because KNM's earnings was boosted by the "recognition of tax incentive granted for Borsig acquisition".

Now imagine if KNM did NOT get this tax incentive?

Can you picture how 'good' KNM's earnings was??????

Exactly!

Don't you wish for that so-called 90 sen MBO!!!! :P

Now apparently, MiB ( Maybank Investment Banking yo! And not Men In Black! :P ) disagrees! MiB reckons that KNM is 'recovering'! :P

And the statement that stood out the most was...

- KNM remains a Buy with a RM0.55 TP (9x 2011 EPS). We see limited downside, for most of the operating negatives have been priced in. Reputation rebuilding remains a work in progress.

Limited downside! The classical 'negatives all priced in'!

Huhu! Wiki wiki!

KNM currently down some 9.3%. It last traded at 44 sen. ( That MBO price... how muchie? :P :P )

Now the BUY TP.... based on 9x 2011 EPS.

Sounds reasonable at first sight but apparently stocks and recommendations is unlike love at first sight!

Time to check out KNM's estimates. :P

And MiB 'expected' earnings for KNM is 232.4 million for KNM's fy 2011!

Remember, KNM's ytd 2010 earnings is 54.478 million (which was boosted by some 45.474 million in tax benefits!).

How?

Do you like KNM or not?

:P

I guess its a clear sign of a shitty company when the CEO prefers to talk about the stock than his own business..

ReplyDeleteMr Lee and another joker; Mr Puan..

Everybody loves to talk, eh?

ReplyDelete:P

Seriously moolah...talk cxxxk!

ReplyDelete:-)

And those so called analysts buy their story, and make it even more rosy!

Makes you wonder what these jokers are analysing in the first place

- their coverage companies financial, or their own year end bonuses and salary increments!

most analysts are 'Value Creator", if they can't create value, what do you you thnik they worth what they been paid for? :-)

ReplyDeleteIf KNM is NOT a traded stock, and the valuer gives such a valuation... do you think they should be paid for giving you such 'valuable' report?

ReplyDeletethat's i said 'Value Creator"! Have to create value out of nothing baru consider great! Whether it is for the company or for the public is another issue. Sad to say that this market world is made up of "speculate for the future" movement.

ReplyDeleteA thousand apologies.

ReplyDeleteMy reply did sounded terrible.

ps: In my humbled flawed opinion, creating value out of nothing is not considered great because at the end of the day, nothing is nothing is nothing.

:D

just like the way u 'pen' down those analyst. anyway , most of them r young graduate , so ....follow ' instruction' ...lah!!!

ReplyDeleteQuote: most of them r young graduate , so ....follow ' instruction' ...lah!!!

ReplyDeleteA thousand apologies too! I am also young and getting younger every year too!

ps: What instruction(s) do I need to follow?

The truth is the research analyst

ReplyDeleteseldom issue SELL recommendations

otherwise they lose their job or being demoted or having their bonuses dramatically cut. It seem there is a conflict of interest such that all this punishment have related to the analyst's employer typically has a business relationship with that stock

company that the analyst is covering could directly affected by the analyst's commentary.

Back to KNM.

ReplyDelete54.478 million profit and 45.474 million came from tax benefits?

??????

???

:P

aduhai mabuhai

ReplyDeletenow reverse stock split to shore up the stock price?

if Mr Lee will focus on his core biz, he wouldn't need to worry about the stock price

IF.... IF .... IF .... I am a shareholder...

ReplyDelete1. I would demand to know why that MBO failed.

2. What was Lee's exact price?

3. Ask him now... if he thought 90 sen was so-called 'value'... ask him to do a MBO at 70 sen la. At 70 sen he saved a lot compared to his BIG 90 sen offer. Shareholders happy. He not happy meh?

Yeah... so busy... thinking of how to buyout the company.... where got time and motivation to run the company's business?

ps: Like I said previously... most managers that attempts to do a MBO and fails... the BOD usually kick them out of the door immediately. Why? These managers don't have the company at heart. So dumb question nos is why is he still managing the company?

Look at current result. Half ytd earnings only 54.478 million! And 45.474 million was derived from tax benefits!

Yeah.. the manager is toooooooooooooo busy thinking of how to buyout the company and no time to manage the company.

Analyst or an investment banker are self-serving. The most important point to take home is that the MAIN job of an analyst is not to analyse!!! It never was and neither is even today.

ReplyDeletehttp://myinvestingnotes.blogspot.com/2010/08/never-trust-analyst-or-investment.html

oO

ReplyDeleteWOW!

Strong words from BB! :-)

How about the IIA? ( Indepen... Inv.... Advi..... )

*Cabutzzzzzzzzzz*

Moolah,

ReplyDeleteClick the link and you will find my answer to your question there. ;-)

Is your left leg longer now from my pulling?

ReplyDelete:P

I think it is the sectoral issue rather than KNM earning. Some O&G companies even shows losses....margin are not getting exciting with intense competition.

ReplyDeletesolomon: the better 'ones' still showed great promise and real earnings yes?

ReplyDeleteKNM story? you tell me... how did they build their so-called empire?

:P

ps: Seriously... it all bolis down to their failed MBO. What the management tried to do... is unforgivable! And that they are still running the company speaks huge volume on why their company is performing sooooooooooo poorly.

my flaweed views. :P

I am a very young graduate, my flawed opinion is that O&G operates like a cartel in real world.

ReplyDeleteLike any part of the world, without the right connection, I don't think the better one could survive. Our O&G has not reached world class, except maybe for certain asset in SAPCREST.

For KNM case, not much to say like u. I suspect the failed MBO is also because of the TAX reason.

I have not seen a stock that plummeted from orbit could fly up to the orbit again, not sure KNM can do this miracle?? Not for me to say but the Minds to trick.

LOL!

ReplyDeleteDamn! So cryptic! :P

Well... I believe any stock on their given days... they can do wonders.

But wait...........

I am not sure what exactly is their wonder act! Perhaps it's flying. No wait! Perhaps it's diving. No waitt! Maybe it's pole dancing!

hehe