On the previous blog posting on eB Capital I wrote the following. Before I start, eB Capital announced its earnings yesterday.

EB CAPITAL BERHAD (MESDAQ Market)

Quarterly rpt on consolidated results for the financial period ended 30/6/2006

New comments will be in red font.

----------------------------------------------------------------------------------------------------------------

Boyplunger raised the following issue on eB Capital.

- I noted Redtone Technology Sdn Bhd has been accummulating EB Cap. Currently owning about 1.9m or 7% -8%.

Why is Redtone buying the shares of this company? That is interesting. Did i miss out something on the company's history.

Yes, I do understand that Redtone International has been buying shares into this company.

Why is RedTone buying shares into a company that has real problem in making a profit?

I have no idea.

And yes, I do understand your thinking rational. Because the justification is if RedTone International is willing to buy shares into the company, surely there must be something in the company that RedTone sees as value. And surely no sane company would want to buy a company if there is no profit to be made. Right?

Hence, the argument is of course, perhaps one should follow and mimmick what RedTone does!

But if that is the case, isn't one implying that when one company or one individual purchases a share of another company, the buyer(s) reasoning to buy the share is always correct?

Here is something interesing regarding is the buyer(s) always correct issue. This blog eB Capital II was written on May 18th 2006.

Look at the stock price chart of eB Capital during this period.

Stock last traded 1.23.

On May 18th 2006, the stock was trading as high as 1.70. Peaked at 2.00 on 5th June 2006.

But do we or would we ever know the true motives or intentions in such share purchases? Would we ever have the privilege to evaluate their reasonings in their share purchase? If no, then aren't we making one huge assumption, which is the buyer(s) of the share(s) is always deemed correct?

Can such strategy go wrong? Did one sell this stock when it hit 2.00?

Let me give some examples on what could go wrong.

Take the series of past postings on Karensoft. Well, the boss has always been constantly buying back shares in the company. So is the boss deemed correct in his actions? Well as everyone is well aware, Karensoft has just been re-classified as the first GN3 stock in the Messdaq listing. Which is rather dead serious since this classification states that Karensoft financial health is in a utter dire straits. So was there 'value' in the share purchase? Or perhaps the boss was buying for personal reasoning, which sadly is the 'value of being a listed stock'. So if one had followed Karensoft boss actions in the market, how then? See the danger?

Or how about the infamous purchase of a controlling stake in the huge congolomerate, DRB-Hiccom? How much was the share purchase back then? Wasn't it around 3.50 or so? Ahh.. I am sure that you are aware that some argued that because since the controlling stake was sold at such a high price valuation, then surely there must be value in the stock since the stock was selling around 2.00 back then. And what's the price of DRB-Hiccom today? Would a follow you, follow me strategy work in this case?

On the other hand, there were success stories in stocks like Transmile.

Ah, I am sure you understand what I am trying to say.

There's simply no gurantees in such strategy.

Sometimes it works but sometimes it can be dead wrong.

So how?

What's the best gauge?

Look at eB Capital.

eB Capital supposedly specialises in wireless broadband technology.

There'e 2 things one can gauge it on since it's listing. Look at these past compilations I had made on EB Capital .

The first news clip.

- With a current local market share of 0.54% in terms of broadband subscription, more efforts would be devoted to marketing its products and services to enlarge its share, he added.

Meanwhile, eB Capital's historical earnings demonstrate its strong growth.

The company registered a pre-tax profit of over RM1mil last year and an after-tax profit of RM560,000.

Revenue increased to RM8.3mil in 2004 from RM2.5mil in the preceding year

And the next article...

- Wireless Internet broadband provider eB Capital Bhd (eBCap) expects its subscriber base to grow in multiples of 10,000 over the next two to three years as it embarks on an aggressive recruitment drive after its listing on Mesdaq.

See how b4 listing, eB Capital boasted about its great potential and its track record.

After listing, eB Capital showed it true self.

How do you value such a company?

Secondly, take a look at eB Capital last reported earnings. Do you like what you see?

If you don't then... should you be bothered with what RedTone does?

And if I have to guess, perhaps RedTone wants to go into the wireless broadband industry.

By the way, based on current price of 1.70, do you reckon that eB Capital business is worth what the market is pricing it?

eB Capital reported a paltry sales revenue of only 2.730 million with a net loss of 236k, bringing half fiscal loss to 1.81 million.

So listed on 2nd Aug 2005. The company has yet to make a single sen of profit!!!

Now consider this, at the peak price of 2.00, eB Capital was valued at a mind-boggling 49.814 million!!!!!

Yes, the whole idea of creating MessDaq as a platform where small companies can raise capital for their business is a grand idea BUT companies like eB Capital is showing precisely the dark side.

Where on earth can such company be worth 49.814 million as eB Capital was worth back recently in June 2006?

Ah, the market has so far corrected eB capital insane pricing.

eB Capital last traded at 1.23.

Only 1.23.

Excuse me but this price is STILL INSANE!!!!!!!!!!!!!!!!!

Based on this price eB Capital is worth some 30.635 million!!!!!!!!!!!!

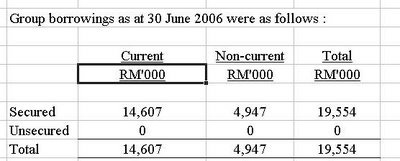

Look at the following snapshot of eB Capital's balance sheet obtained from its quarterly earnings yesterday.

See the piggy bank cash!!!

Think that is bad?

You haven't seen nothing yet babe!

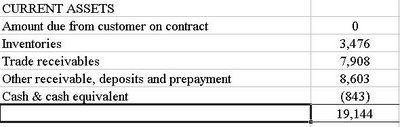

Look at the company's borrowings!

How?

See why I said that it's so insane that eB Capital is worth a whopping 30.6 million??????????????

2 comments:

This is insane! I really like your article, always show us the insane part of certain shares in Bursa. It is so ridiculous the pricing, I was shock till almost fall out from seat seeing the balance sheet you have presented. Really really eye opening !!!

Keep it up!

Your analysis of eB and Redtone is not complete without taking into account the hot topic vigorously discussed in the market over the past few months - the auction of the WIMAX radio spectrum by MCMC. Apparently, Redtone, having ravished by TM and other discounted call players, is desperately looking for alternate source of income. Their acquisition of eB shares is a strong indication of their intention to possibly acquire eB coz they do not have any industry expertise in wireless technology (not that eB have any either!) Also apparently, they decided that eB maybe too much of a risk, they have instead bought up CNX Solution (another small wireless player) at a significant lower price. Now, the question is, what are they going to do with the eB share they acquired. My guess is they will probably hold on to them until the WIMAX auction comes to a conclusion and they know what their next step will be. Until then, without the Redtone effect, eB prices will continue to spiral down, and not helping is the fact that eB directors and significant shareholders are fervently unloading thier holding. While at the meantime, eB is running out of cash, bank is unwilling to borrow money, product is not gaining any traction in the market. Only hope they have is the government project, which IMO will not help them short term even if they get any.... Very ugly scene ensue... st0rwing@kl

Post a Comment