The Sugar Bun had finally melted. The following is a report from Business Times.

- November 7 2006

SHARES and warrants of Sugar Bun Corp Bhd hit limit down yesterday.

Sugar Bun shares declined 36.73 per cent or RM1.08 while its warrants fell by 41.25 per cent (99 sen), with 22.41 million and 1 million shares done respectively.

The decline also marks Sugar Bun's lowest closing in four weeks. However, on a year-to-date basis, its stocks are still trading at 163 per cent higher.

At the close, the Kuala Lumpur Composite Index was 0.47 per cent or 4.72 points lower at 993.30.

Sugar Bun shares and warrants gave up 29.9 per cent and 30 per cent to RM2.06 and RM1.68 respectively during the first half of the trading session, before sliding further in the second half. Shares and warrants were down to as low as RM1.45 and RM1.18 before closing at RM1.86 and RM1.41 respectively.

Early last week, Sugar Bun was queried by the Bursa Malaysia Bhd for unusual market activity.

Last Friday, the firm officially announced plans to venture into the oil, gas and energy sector. Its unit, Borneo Energy Sdn Bhd, entered into agreements with three firms in Thailand to provide management and technical services. The service pacts are with Suntech Palm Oil Co Ltd, Siam Gulf Petrochemical Co Ltd and Transtech Energy Company Ltd.

"The agreements are expected to contribute positively to the financial performance of the group in the future," the company told Bursa Malaysia.

Sugar Bun posted a net loss of RM2.15 million during the second quarter ended July 31 2006, an improvement of 11.18 per cent compared against its net loss of RM2.42 million a year ago. Revenue declined by 25.17 per cent to RM4.48 million.

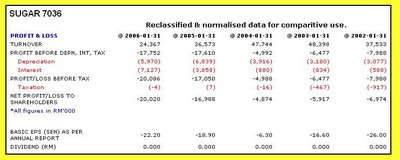

For its full year ended January 31 2006, it posted a higher net loss at RM17.23 million, against a net loss of RM16.99 million a year ago. Revenue also fell by 36 per cent to RM23.32 million.

The firm has been posting net loss every financial year end since January 31 2001, when it recorded a net loss of RM13.38 million.

Flasback. I wrote this Sugar is TOO Sweet!!

Incredible. Sugar Bun paid RM15,000 for a USD1.00 company. And after that a news story where Sugar Bun, a company which had losses since 2001, reported to be targeting rm300 million worth of oil and gas contracts. A company which had NO prior expertise in the oil and gas industry. A company which is in real, deep, deep financial troubles, losing money since 2001. Sometimes I wonder, do Petronas hands out contracts for charity. I really wonder.

But yet the stock price rocketed UP.

Take a good look again at Sugar as posted here

1.

That's losses since fy 2001.

2. Any improvement lately?

3. Cash piggy bank.

4. How about this?

How?

Sugar Bun CLOSED YESTERDAY at 1.86!!!!!!!!!!!!

Again I asked .. how high should Sugar Pie Honey Bunch fly?

2.00?

1.00?

or 0.50?

0 comments:

Post a Comment