Blogged yesterday: Green Packet Earnings

I wrote the following.

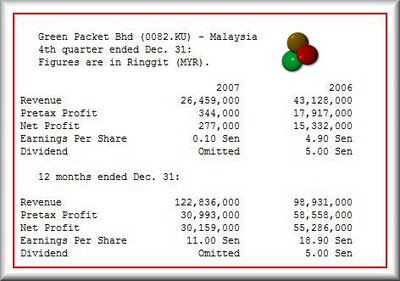

- A quarterly net earnings of only 277k???

Rather ironic if you look at the chain of events.

You have the stock collapsing.

And then you have the company buying back their shares aggressively.

And next you have the stock actively featured in the weekly financial news. ( 4 Feb 2008: Corporate: Taking a chance on Green Packet and 25 Feb 2008: Corporate: 'Transformation year' for Green Packet. )

And now... showtime! A net quarterly earnings of only 277k!

How?

This morning, I noted two huge articles on Green Packet.

On Business Times: Green Packet aims to regain sales momentum

- Higher operating cost at its WiMAX business shrinks Green Packet's full-year earnings by 45 per cent to RM30.2 million

TELECOMMUNICATIONS service provider Green Packet Bhd aims to regain its footing and at least double revenue this year, after posting weaker fourth quarter and full-year results.

The company's fourth quarter net profit shrank 98 per cent and full-year earnings fell 45 per cent to RM277,000 and RM30.2 million respectively, mainly because of higher operating cost at its local WiMAX business.

It has allocated capital expenditure of up to RM300 million this year, mainly for WiMAX infrastructure.

The company, through unit Packet One, will launch fast-speed wireless broadband services by mid-year. It hopes to sign up 100,000 WiMAX users by year-end.

Managing director Puan Chan Cheong said that in terms of profitability, the company's solution business ought to contribute "good double-digit" net profit growth this year, while its WiMAX business will still be in "investment mode".

"Nevertheless, we expect the WiMAX business to be ebitda (earnings before interest, taxes, depreciation and amortisation ) break-even this year," he told the media in Kuala Lumpur yesterday.

Green Packet's fourth quarter sales were 38.6 per cent lower at RM26.46 million compared with RM43.13 million a year ago.

Full-year sales, however, rose 24.2 per cent to RM122.84 million, a "sub-par" performance considering that the company is used to triple-digit revenue growth.

Weaker sales were caused mainly by China's delay in awarding a third-generation (3G) spectrum as Chinese phone companies do not want to spend heavily on infrastructure and solutions until the spectrum is awarded.

"We expect sales in China to be slow during the first half, and eventually to pick up in the second half once the 3G is awarded. The delay is only a temporary setback. We expect the 3G spectrum to be awarded before the Olympics.

"Should there be any further delays, we still can achieve triple-digit revenue growth; if not, very close," Puan said.

He added that this year's revenue growth would be contributed mainly by the Middle East and Malaysia.

The Middle East market, which contributed six per cent to revenue last year, is expected to represent 16 per cent of total sales this year as the company expands its sales network.

The Malaysian market, driven mainly by Packet One's WiMAX business, is expected to contribute 47 per cent to group sales. China will likely account for 26 per cent of total revenue.

Puan said the company is also considering selling entire or partial stakes in some of its non-performing investments.

"It depends on whether the investment brings strategic value to us. We should be able to make the decision by the first half of this year," he said.

Triple Digit growths?

On the Star Biz: Green Packet sees 100% growth in revenue this year

- Green Packet sees 100% growth in revenue this year

KUALA LUMPUR: Green Packet Bhd, which reported 24% higher revenue of RM122.84mil for the year ended Dec 31 (FY07), expects a 100% growth in revenue this year as its diversification plans start to bear fruit.

Group managing director and chief executive officer Puan Chan Cheong was confident of the “achievable” target, as the company had diversified its markets to cushion the impact of a slowdown in any one region.

“We are pleased with our diversification strategy in terms of markets, customer base and solution offerings.

“As a result, the dip in our solutions business in China has been substantially offset by strong growth in both the Middle East and North Africa (MENA) and Asia-Pacific regions,” he said in a briefing on the company's FY07 results yesterday.

According to Puan, the China market is projected to contribute 26% to group revenue this year against 41% last year, while revenue contribution from the Middle East and South-East Asia is expected to increase to 16% and 10% from 5% and 5% respectively.

He said the commercial launch of WiMAX services by June would boost the company’s revenue.

Despite the higher revenue in FY07, Green Packet's pre-tax profit fell almost 90% to RM30.99mil against RM58.56mil in FY06.

Puan said the drop in earnings towards the second half of last year was due to a slowdown in sales in China and continued heavy investment to build the converged telecommunications business of its unit, Packet One Networks (M) Sdn Bhd.

It was also attributed to share of losses from non-core businesses via associated companies and higher provision of costs made in the discounted telephony subsidiaries.

On reports that the company’s revenue is affected by slower sales to China due to regulatory delays on the award of 3G spectrum, Puan said China would remain an important market for Green Packet due to the sheer size and high growth potential of its telecommunications sector.

“Solution sales from China are expected to regain momentum in the second half. We see this slowdown as no more than a hiccup due to external risk factors.

“However, plans have been in place since early 2006 to mitigate the risks associated with over-dependency on any single market,” he said.

Puan also said Green Packet would further rationalise its business operations to pursue opportunities in two major growth regions – Asia-Pacific and MENA.

“We are looking at divesting our interest in non-core, loss-making associates that do not contribute strategic value to the company,” he said.

He said Green Packet planned to break into the Singapore market and would finalise a partnership with a prominent telco there next month.

How?

At least you have the give this company credit for despite their poor earnings, they certainly know how to market themselves to the news media!

2 comments:

None of you need to listen to me but for my friends who did in 2007would have avoided the massive loss caused by the drop of share price of Green Packet and Mtouche. Both were listed and invested by OSK.

While I cannot produce concrete evidence - suffice to say that a risk averse investor should stay away from any tech companies that were invested by OSK before. You can do your own analysis.

Just don't get anywhere near them and you will avoid speculative losses.

Now MTouche is about 40c from RM4. Guys - the mastermind have already exited the stocks . Game over ! [for those who are still following them - Never too late to cut.]

And last word - dont believe anything they say in the papers!

This Greenpacket is a money-laundry machine for one of our political party!! to raise fund. Two biggest share holder is CCPuan,Dato'Kok Onn (from Gadang Holdings) and one very funny thing is direct shareholding company is GHPL which incorporate in British Virgin Island; as who is behind this GPHL~ no idea who?? CCPuan were link with Gerakan Leader through Dato'Kok Onn. Deal is you get me the dough; i give you the license; got it? how to raise proper money? stock legilimate windfall. So Keng Yaik step down, GP downtrend started. Now how to link Keng Yaik with Dato' Kok Onn? Gadang Holdings core business is in property development, construction and engineering; BUT Gadang other business in manufacturing, AND water concession, small portion derive from water concession. So Dato' Kok Onn from old-economy block; while CCPuan is a new economy greenhorn; how do they met? This is the missing link i am trying to establish. This stock clearly lack fundamental and how could it rally way over their stock to earning ratio!?

and...WIMAX is NOT a recession proof "service", what product does GP has that is "must-have" for SME or corporate? clearly they don't have a niche or solid business model. They didn't release their WIMAX customer acquisition performance after 6 months? total subscriber they have right now? so called 6,000; now they don't even have 600!! and spend 71million USD to built a mere 200 station towers? And spend RM40m to acquire the current green building. Transmission average per tower only reach 1km in radius? you do the math, and do you still have hopes the stock can rally back to their prime RM4 plus? except Maxis, Digi, Celcom declare bankruptcy, they might stand a chance.

Post a Comment