Here's a simple question.

When the major shareholder, the big big bossie, sells down his shareholdings, what should the minority investor do? Should the minority investor continue to hold for the longer period, just because that's THE GOLDEN RULE in investing and more so, since the company has a strong 'reputation'.

Yes, this was a real life scenario and many would know which stock I am talking about.

Discipline is very important in long term investing and the ability to hold strongly to our reasoning is also very important. For as long as our reasoning is correct, we should ignore the view of others. Never be afraid if our reasoning is correct and yes, there will be plenty of times when the market disagree with our believes and reasoning.

Which means, in a crude manner, one needs to be stubborn with our investing.

But there's one crucial point and this, in my opinion, is the most trickiest part in investing.

How damn sure are we that we are correct?

Not possible that our reasoning is not flawed? Not possible that we could make an error? As George Soros famously said, "I am rich because I know I'm wrong!"

Flashback 25 Feb 2008, on the Edge.

- 25 Feb 2008: Cover Story: Lin drops a bombshell

By Jose Barrock

Who would have thought that Datuk Lin Yun Ling, who has helmed construction giant Gamuda Bhd as its managing director for the past 27 years, would reduce his effective holding in the company? Thus, the news came as a shock to the market when the gangling engineer reduced his already small interest of 5.23% in Gamuda to 1.73% last Thursday morning.

Quickly, the word out in the market was that the man responsible for the company's success was cashing out. This was despite an assurance that he would remain steadfast as the managing director. A quickly dispatched press release, an attempt to control the damage, clarified that Lin's disposal of 70 million shares in Gamuda was for "estate planning purposes". It failed to calm the nerves of investors. News that Lin had cashed out hit the market and at a conference call with several fund managers last Friday, Lin somewhat confirmed this belief.

According to one fund manager who attended the conference call, Lin stated that he had sold the shares and the proceeds are kept in a trust. He also maintained that he would continue to be at the helm of Gamuda.

In fact, in Gamuda's press release, Lin has committed to an 18-month lock-up period on his remaining shareholding — amounting to 1.73%. He also reiterates his commitment to his role as managing director of the company.

But the damage was grave. Gamuda's share price tumbled to RM3.92, its lowest since November last year, falling almost 25% over the past three trading days. Investors obviously did not like Lin's move, reading it as a signal that Gamuda had reached its peak.

Despite reassurances from the company, most research houses were quick to change their take on the company. Citigroup's report was perhaps the most telling with the tag line, "Sell: What are you waiting for?"

The report also highlights that other directors of Gamuda, such as Saw Wah Teng and Ng Kee Leen, have also been disposing of their equity. According to Bursa Malaysia filings, another director, Raja Datuk Seri Eleena Azlan Shah, has also been selling down her stake. In the middle of June last year, Raja Eleena had some 8.3% equity, but has since trimmed it to 7.8%. Most of this had gone unnoticed by the market and has only hogged the limelight since Lin's sale.

Lin's silent exit

"It is a matter of timing. It is bad. Why did he do it now? The sentiments are shaky and construction stocks have run up in the past year [due to projects announced by the government]. As the biggest construction firm, a selldown by a major shareholder certainly creates uncertainty among investors," an analyst says.

According to Inter-Pacific Research Sdn Bhd, Lin raised some RM322 million, selling off his 70 million shares at between RM4.60 and RM4.69. Eyebrows were raised over the pricing as it is at a discount of between 5.8% and 7.6% to Gamuda's close of RM4.98 on Wednesday. Gamuda's shares have fallen by about 21% since early January this year.

What does this mean? Is Lin sending the correct message? Does this mean that he feels that Gamuda is worth only between RM4.60 and RM4.69?

It is also noteworthy that Lin had increased his equity early this month, buying some three million shares under an employee share option scheme.

Nevertheless, CMS Dresdner Asset Management chief investment officer Scott Lim says, "No one can stop him from selling, even given that something may not be right… He's selling 75% of his total equity... the quantum is huge. So the expectation is that his commitment may not be there. People are going to be watching him for the next 18 months. We hope he delivers and lives up to the good picture painted."

The impact of Lin's selling can be seen in Gamuda's share price free falling, losing some 25% of its value from the time the word of Lin's selldown hit the market on Feb 19.

Gamuda shed some RM2.5 billion in market capitalisation. Another fund manager says, "After a certain age, people have different priorities in life. As he is already thinking of estate planning, Lin is likely thinking about life after Gamuda… I am adopting a wait-and-see attitude to Lin's assurance and his commitment to Gamuda after the sale disposal… (There is) no clear successor in place. Construction companies need a strong leader who can spearhead efforts to secure new contracts. There is no one of the same stature as Lin in Gamuda," he says.

Without a doubt, the possibilities are aplenty as to why Lin could be selling. According to parties familiar with him, he could have decided to hold on to cash, considering the market volatility.

"Gamuda is his only concern, so there is nothing else distracting him. All in, he should still have about 2% in the company, including some shares held under trust and others," an insider familiar with Lin says.

Others speculate that he may have followed in the footsteps of Tan Sri Chua Hock Chin, who helmed Roadbuilder Holdings (M) Bhd for the longest time and hived off his company to IJM Corp.

Chua's exit was also a well-kept secret, and only took place after he had sold off his equity to a third party which later hived the equity to IJM Corp in late 2006.

It is not clear who the end buyer of Lin's equity is, but sources say funds from London and other parts of Europe are buying it off Credit Suisse (Hong Kong) Ltd, which was acting for Lin.

"It was well spread out. The only problem with the sale is the timing that bashed down the price," says a merchant banker.

Quickly, speculation cropped up as to who the purchasers were. Some were saying that Middle Eastern parties affiliated to Tan Sri Syed Mokhtar Al-Bukhary could be the ones taking up the shares. However, those in Syed Mokhtar's inner circle have denied this.

Undue pressure?

Another theory being bandied about is that Lin was prompted to reduce his stake following pressure after Gamuda, a non-bumiputera company, secured big jobs, including the northern portion of the RM12.5 billion double-tracking rail project.

The double-tracking job has seen its fair share of hurdles, and was shelved the first time after its award to MMC Corp and Gamuda.

The Malay Chamber of Commerce had been at loggerheads with Gamuda and its partner MMC on the awarding of contracts for the project — the chamber had hoped to secure several jobs under the contract, but failed. The friction could not have gone down well with Lin.

"For the first time, Gamuda came under pressure from an entity like the Malay Chamber of Commerce. It was awarded the job but came under pressure to share the cake with other contractors. It is unprecedented and certainly unhealthy. What makes anybody think that future mega projects will not get the same treatment?" asks a construction player.

Others say Lin is looking at cashing out to maybe invest in Vietnam. However, quarters close to him in Gamuda point out that he had been reluctant to venture into Vietnam in the first place.

"In fact, Lin was reluctant to go to Vietnam. But, at the behest of others, he explored and has some good projects there," says an official close to Gamuda.

Lin's move to sell down his stake has had far-reaching impact on other industry giants, such as IJM Corp Bhd, which was also feeling the heat.

A fund manager with a local firm, who spoke on condition of anonymity, says, "A construction company is only as good as its management. Can it still maintain the strong order book? Will the jobs keep rolling in? Will Gamuda's policies, laid down by Lin, still be maintained?" she asks. "The construction industry is sleazy and tough in the sense there are a lot of competitors. And a lot of opaque transactions. So management is important."

So many questions, no answers

Strangely, Lin and most of his top brass are away, some say in Australia, and this is what has upset most investors.

When such a material development takes place, naturally one would expect Lin, as the managing director, to hold a press conference, and inform investors what is going on and of his commitment to the future of the company.

None of the senior management personnel, normally contactable by the press, was available to clarify the position. The top brass are known to be among the most transparent, especially on developments relating to the company.

For instance, as soon as they were awarded the double-tracking rail job, Gamuda and MMC came out with detailed announcements on the award of the various packages by companies and shareholders. They particularly spelt out the jobs given to bumiputera companies, something that has not been practised by even government-linked companies (GLCs).

Citigroup points out that the last time Lin sold his shares was in April 2002. Then his disposal of 10 million shares saw the company share price take a beating as well. The research outfit adds, "What concerns us most is that Lin knows the company and the industry very well. The last time he sold his stock was when the last construction cycle peaked before tumbling."

Does this mean the industry is at the peak of an upcycle now?

Considering the slew of projects yet to be announced under the Ninth Malaysia Plan, that certainly is not the case. But in Gamuda's case particularly, it would be hard to maintain its order book of RM11 billion. It has a churn rate of about RM1.1 billion a year, based on its annual report for the financial year ended July 2007.

This means the present order book will keep them busy for another 10 years or so, based on the churn rate. But then, the double-tracking rail project is expected to take off next year and the churn rate would be higher, hence it would only be a matter of another two years or so before they woud be under pressure to bag another major job.

Given that Gamuda is now under the scrutiny of not only competitors but also chambers of commerce, Lin had probably considered his options.

"He probably thought that doing business is going to be tough," says a banker.

But what's surprising is that Lin's exit comes at a time when a dividend policy has been put in place. In fact, the market is expecting a significant capital repayment from Gamuda's 45% unit Lingkaran Trans Kota Holdings Bhd (Litrak). As for Gamuda itself, it has set a target of paying out a base dividend of at least RM450 million a year.

All this adds to the puzzle of why Lin is reducing his interest.

Furthermore, the consolidation in the water sector is likely to see Gamuda benefiting. Under the exercise that has yet to take place, Gamuda would likely part with its 40% in Syarikat Pengeluar Air Sungai Selangor Sdn Bhd, the concessionaire for the Sungai Selangor Water Supply Scheme Phase 3, for cash. Market talk has it that Gamuda stands to walk away with anything from RM700 million to RM1 billion, which would come in handy to pay out dividends.

The company's prospects also seem bright with an all-important foray into Vietnam, nicking a job to build a RM3.5 billion integrated commercial complex in Hanoi, developing a five-star hotel, an international convention centre and luxury condominiums, among others.

In Laos, Gamuda has secured a RM2 billion contract to build, operate and transfer a dam as part of a hydroelectric project in late 2004.

Due to the bright prospects and strong management, Gamuda commands a better valuation than its peers. According to analysts, from the standpoint of price-earnings ratio, Gamuda is trading at high multiples of over 20 times, which brings us back to why Lin is reducing his interest.

"Of course, it makes monetary sense for him to sell shares when the price is high. The counter argument is that if there is upside, why not hold on? We have to wait for Gamuda's (financial) results to ascertain whether the selldown is ahead of negative development," the analyst says.

However, the valuation can be justified, considering projections of 70% earnings per share growth this year and 80% between 2008 and 2009 by analysts.

Nevertheless, there are many who view Lin's disposal with disdain. "In Genting (Bhd), the late (Tan Sri) Lim Goh Tong groomed (Tan Sri) Lim Kok Thay for years for the top position… Then he held an official retirement ceremony, which helped to ease the investing community's concerns over a new head in the company. If Lin had done that, the investing community would have been more prepared for his selldown. The market does not like uncertainty, especially during uncertain times," the analyst adds.

The statements in bold are worth reviewing now, yes?

Why did the boss sold down his shares by so much? Did he knew that the construction industry was peaking? And by selling down, it simply made monetary sense for him?

Yeah, Gamuda today is worth less than 2.70 and it pales in comparison to the prices that the bossie sold. (Oh, the following posting Credit Suisse has a target price of rm7.30 on Gamuda! makes good reading! :P)

And if the minority investor held on to the investing axiom that one should be holding for the longer period, the minority investor would have fared poorly today.

Now, I am not saying investing for the longer period does not work at all. Its just that the minority investor should realise that sometimes they should consider if they should discard the teaching and realise that there are fundamental reasonings that justify one to cash out of one's investment. Cashing out is no crime is it?

A more simplier and crude street sense reasoning would have been: "Big bossie also don't want his shares, why you still want? Why be a hero and hold long term?"

Now Gamuda reported its earnings last night.

I would like to compare what Gamuda earnings last night to the last quarterly announcement before the bossie sold.

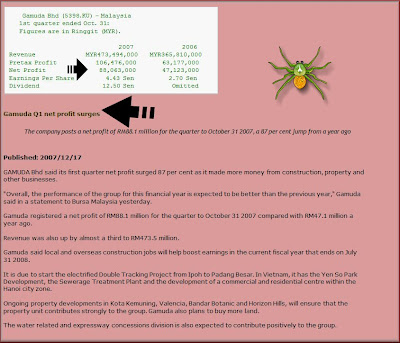

17th December 2007. This would be the last quarterly announcement made before the bossie sold his shares in Feb 2008.

Here's a clip.

And here's the link to its report: Quarterly rpt on consolidated results for the financial period ended 31/10/2007

Earnings is rather important but I am one who likes to see strength in a company's balance sheet too. That for me is important.

Here's the screen shot of the balance sheet back in 2007.

And this is the bank borrowings then.

How? Back in December 2007, the fundamental weakness in the stock can be seen! The cash balances weakened tremendously compared to its previous year, same quarter. The receivables were up, indicating that despite its 'strong' earnings, Gamuda wasn't able to collect 'promptly' from its customers. Yes, Gamuda had collection difficulties. (As a business man or a business woman, don't you wonder, what good is the sales if the monies cannot be collected promptly?). The the borrowings increased. 889.959 million in loans is no small change, yes? (ps: given these fundamental weakness and given the fact the boss disposed so much of his shareholdings, wouldn't it made logical sense that the minority shareholder would have been much better off disposing their investment back in Feb 2008 also?)

And given the fact, that the construction industry had really boomed for so many years, perhaps the bossie sold his shares because he reckoned that the boom cycle is over.

Back then, the market was expecting some 380million to 420 million in net earnings for Gamuda.

Fast forward present day, last night, Gamuda reported its earnings. It was decent (ah, for some it pales in comparison to what it did during its peak years!).

Again I more interested in its balance sheet.

First up, its loans!

WOW! Total loans now stands at a whopping 1.614 billion!

Now that's NO small change! Considering the fact that Gamuda ONLY had some 889.959 million in loans back in December 2007!

Look at the size of the receivables today! Adding the receivables and amount due from construction contracts, the amount is a whopping 1.4 billion! Two years ago, in December 2007, it was some 993 million. (so much progress, eh?)

And then we have marketable securities at some 100 million! Errr.. don't you wish Gamuda could be more transparent by stating clearly what these marketable securities represent?

And yes, Gamuda cash balance has increased.

How? Which do you prefer? Gamuda today or Gamuda two years ago?

And what do you think of the bossie selling down his shares back in Feb 2008? Don't you think he was so smart to sell?

Yeah, good for him but what about his minority shareholders, shareholders who held on believing that in the longer term, they should be rewarded handsomely?

And yes, there's another development yesterday. held on believing that in the longer term, they should be rewarded handsomely?

And interestingly, there was another development yesterday. Gamuda makes cash call; 1Q net profit up 14.5%

- KUALA LUMPUR: GAMUDA BHD is seeking fresh capital from its shareholders via a renounceable rights issue of up to 267.7 million warrants.

The exercise, on the basis of one warrant for every eight existing shares held, may raise up to RM714.8 million for the infrastructure builder and property developer.

The RM714.8 million assumes full exercise of the warrants at an indicative exercise price of RM2.67 each, Gamuda told the exchange today.

Gamuda said the proceeds would finance its capital expenditure needs and potential investments related to the company's existing businesses, besides the repayment of borrowings.

"The exercise of the warrants will allow the company to obtain proceeds without incurring additional interest expenses and minimise any potential cash outflow in respect of interest servicing.

"In addition, the exercise of the warrants will increase Gamuda's shareholders' funds/capital base and hence improve its gearing level for a more optimal capital structure," said Gamuda, which also owns infrastructure concessions.

Existing shareholders of the company will be given the option to further increase their equity participation at a pre-determined price over the five-year tenure of the warrants.

The proposed rights issue is expected to be completed by the first half of next year....

Yet another cash call from one of the local listed companies. (ps: see MAS to raise RM2.7b from rights issue oO )

I wonder... I really do wonder... do these companies really think that the local stock market is a bottom-less piggy bank, where anyone can simply raise cash as per their wimps and fancy? How rich is the local investing community??? How long and how much can our local listed companies continue to make these cash calls? Don't they understand that it's paramount that they manage their companies in a more efficient manner than continue to ask the market to support their cash calls? How?

oh... ps. I have no idea how Gamuda the share would perform in the future. ok?

2 comments:

A sharp view on the operation of gamuda.the nature of construction business always finance the clients.If economy turns bad,they will not be paid.during good times,margin will be small as developer dictate the terms.Most of contractor will turn to developer as they grow.never have long term view on them.

When the horsie ran off from the turf, it means she cannot endure the races. If the same principle applied on the bossie, it should not far off ya Moolah?

Mr. Koon, one of the former founders had indicated some structural issues in construction. If this is not overcome, I think the industry would not as efficient as we thought down the road.

If I am Mr L, the company is not a family biz like Lim's Genting, I will do the same thing....sorry minority shareholders.

Post a Comment