I was most eager to read Mega First earnings because this was a stock I had expressed some negative views earlier.

Here are the links to the past postings:

- Comments On Mega First Insane Trading

- What Do You Seriously Think Of Mega First's Insane Trading Of Quoted Securities?

- What Is Mega First Doing?

Here is the link to Mega First 2010 Q1 earnings reported last night. pdf file attachment

The cash flow statement showed Mega First purchase and disposal of quoted securities.

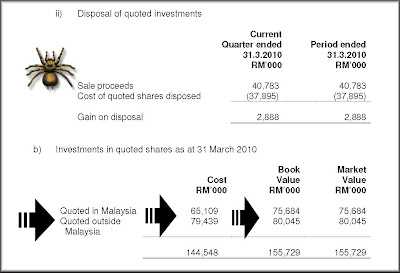

And there.. it disposed some 40.783 million worth of shares and it also purchased some 44.880 million worth of shares!

Yes, holy cow!!!!!!!!!!

Pure insanity!

What on earth is this company doing?????

Here's the simple maths.

A quarter is 3 months and each month has about 20 trading days. Which means a quarter has about 60 trading days (give or take a couple of days).

Disposed 40.783 million. Purchased 44.880 million. Well that's ONLY a mere 85.663 million worth of quoted securities Mega First had traded in the first quarter. And since a quarter has about 60 trading days, this meant that Mega First are trading on the average of 1.42 million worth of quoted securities per trading day.

1.42 million worth of quoted securities traded per trading day.

.

Exactly!

Insanity!

For the record, last fiscal year, it purchased 162.658 million worth of quoted securities and disposed some 272.274 million! Which works to some 434.932 million worth of quoted securities purchased and disposed!

And do they describe in full detail what these quoted securities are? Nope. This is all they mentioned ( see B7)

So what quoted shares outside Malaysia have Mega First being actively trading?

Yes, the inquiry mind wants to know.

Sigh!

=========================================

Anyway, I was reading MFCB's annual report...

- Mr Goh N an Kioh, age 56, joined the Board on 1 February 2003 as a Non-Independent and Non-Executive Director. He was appointed as Chairman of the Board on 29 July 2003. Mr Goh holds a Bachelor of Economics (Honours) degree from the University of Malaya. He has wide and varied business investments in many countries. He is presently the Chief Executive Officer of Cambrew Group of companies, a brewery and soft drinks company, and Chairman of Pearl River Tyre (Holdings) Limited, a tyre manufacturing company listed on the Hong Kong Stock Exchange.

So I decided to check out Pearl River.

From hkex.com.hk website

Nice to see Mr. Goh buying more of his company shares in Hong Kong.

I then searched for Pearl River Tyre list of current shareholders:

http://www.hkexnews.hk/sdw/search/search_sdw.asp

Hello OSK! :D

ps: IINM OSK does NOT do coverage on Mega First.

4 comments:

Yes, they trade, which they should have not but focusing on their core biz. A big no no.

Their disclosure of their HK trading at Bursa nonetheless is applauded. Hope this could be followed by the pack too.

You gotta bet that OSK is covering the stock in HK!

I dont understand why local companies like to dip their hands into the stock market. It is like they are going to get a portion of the profit as bonuses from the investments. They dont have the discipline to stay still. Shall I call the head of the company a CEO, a CIO or a Fund Manager?

I wish to see these companies which sit on these stock market investments get obliterated in the next bear market so they could focus on the business for the well-being of their shareholders. They will never learn when they never get bitten.

Solomon: The size of their trading simply blows my mind.

85.6 million traded in one quarter?????

Ps: Those info on Pearl River are mostly taken from Hong Kong stock exchange website.

:D

JP: Not sure if OSK does or not... so I rather not say. LOL!

Seriously. What on earth are these people doing?

I pray that their minority shareholders realise the gravity of the situation here with Mega First excessive trading!

Post a Comment