My Dearest Moo Moo Cow,

Saw this business article posted on the Star, Toyochem earnings look promising

- Saturday April 21, 2007

Toyochem earnings look promising

By Yeow Pooi Ling

PETALING JAYA: With main board counters having touched new highs, it is just a matter of time that second board-listed companies follow suit.

However, as with the main board, not all second board stocks would see a re-rating in their prices. Only companies with strong fundamentals, attractive valuation and healthy cashflow would attract investors.

Toyochem Corp Bhd seems to fit the above criteria. The company has continued to post high earnings with earnings per share at 27.5 sen for fiscal year (FY) ended Dec 31, 2006, despite facing rising raw material prices.

Its balance sheet remains healthy. Net cash per share of RM1.25 is one of the highest on the second board. Net tangible asset stood at RM3.64 a share as at end-December 2006. Based on yesterday’s closing price of RM2.78, Toyochem was trading at a discount of 24%.

Toyochem is involved in the manufacture and trading of printing ink, as well as services the graphic art industry. It is the largest ink player in the country with a market share of 40%.

Toyochem is 51% owned by Toyo Ink Asia Ltd, Hong Kong, which is a wholly- owned unit of Toyo Ink Manufacturing Co Ltd of Japan (TIJ).

Listed on the Japan Stock Exchange since 1965, TIJ is one of the most established printing ink manufacturers in the world with over 60 subsidiaries worldwide.

This close association has enabled Toyochem to enjoy easy access to the most advanced technological developments.

The costs of raw materials make up a significant bulk of Toyochem’s operating expenses. The raw materials include pigments, resin and additives, which are oil-derivative products.

Nonetheless, while crude oil prices remained high, operating profit margins improved to 10.4% in the second half of FY06 from 8.2% in the first six months.

Earnings per share recorded in the fourth quarter was the strongest at 9.1 sen; indicating that efficiencies had improved and Toyochem was able to pass on costs to its customers.

The impact of crude oil prices on earnings is usually reflected three to four months later.

Given that crude oil prices have weakened and hovering between US$60 and US$69 per barrel since the last quarter of 2006, the ink maker’s earnings, going forward, could be stronger.

Furthermore, raw materials are purchased in US dollar denomination and Japanese yen so the strengthening of the ringgit would have translated into lower raw material costs for Toyochem and higher earnings.

Based on FY06 results, about 58% of sales came from Malaysia, 22% from Singapore, 9.3% from the Middle East and 9.7% from East Asia.

The company has indicated that export prospects to the Middle East are “improving” and the Indian market looks “promising.”

Toyochem also plans to introduce vegetable oil-based ink to cater to customers that prefer environmental-friendly products.

On Thursday, Toyochem announced a final net dividend for FY06 of 11 sen, translating into a decent yield of 4.0%. For FY05, it paid a gross final dividend of 11 sen per share. The net dividend payment for FY06 implied an improvement from FY05.

It is learnt that the company intends to increase dividend payout to 50% of net profits in two years. With net cash of RM51mil and steadily growing earnings, there is a high chance that Toyochem can achieve the 50% payout. Reserves ballooned to RM106.5mil as at end-December 2006. If it decides to reward shareholders further, it could also declare a two-for-one bonus issue. This would also help it meet the requirement for a transfer to the main board.

Given its solid fundamentals, Toyochem has attracted strong institutional investors like Skim Amanah Saham Bumiputra and Lembaga Tabung Haji, which held 11.35% and 4.16% respectively as at April 28, 2006.

Wah, my dearest Moo Moo Cow, this reporter is making Toyochem looks like one must-buy kind of stock investment.

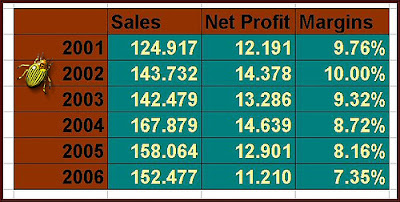

Let's have a look at the company's track record.

How my dearest Moo Moo Cow? Despite having a solid balance sheet, Toyochem's earning is simply not that exciting at all, for there is simply no growth!

rgds

0 comments:

Post a Comment